Sovereign Wealth Fund

From Handwiki

From Handwiki | Public finance |

|---|

|

|

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank.

Some sovereign wealth funds may be held by a central bank, which accumulates the funds in the course of its management of a nation's banking system; this type of fund is usually of major economic and fiscal importance. Other sovereign wealth funds are simply the state savings that are invested by various entities for investment return, and that may not have a significant role in fiscal management.

The accumulated funds may have their origin in, or may represent, foreign currency deposits, gold, special drawing rights (SDRs) and International Monetary Fund (IMF) reserve positions held by central banks and monetary authorities, along with other national assets such as pension investments, oil funds, or other industrial and financial holdings. These are assets of the sovereign nations that are typically held in domestic and different reserve currencies (such as the United States dollar , euro, pound, and yen). Such investment management entities may be set up as official investment companies, state pension funds, or sovereign funds, among others.

There have been attempts to distinguish funds held by sovereign entities from foreign-exchange reserves held by central banks. Sovereign wealth funds can be characterized as maximizing long-term return, with foreign exchange reserves serving short-term "currency stabilization", and liquidity management. Many central banks in recent years possess reserves massively in excess of needs for liquidity or foreign exchange management. Moreover, it is widely believed most have diversified hugely into assets other than short-term, highly liquid monetary ones, though almost no data is publicly available to back up this assertion.

History

The term "sovereign wealth fund" was first used in 2005 by Andrew Rozanov in an article entitled, "Who holds the wealth of nations?" in the Central Banking Journal.[1] The previous edition of the journal described the shift from traditional reserve management to sovereign wealth management; subsequently the term gained widespread use as the spending power of global officialdom has rocketed upward.[citation needed]

China's sovereign wealth funds entered global markets in 2007.[2](p4) Since then, their scale and scope have expanded significantly.[2](p4)

SWFs were the first institutions to use sovereign capital in an effort to contain the financial damage in the early stages of the 2007-2008 global financial crisis.[2](pp1-2) SWFs are able to react quickly in such circumstances because unlike regulators, SWFs actively participate in the market.[2](p2)

SWFs grew rapidly between 2008 and 2021, with global assets under management by these funds increasing from approximately $4 trillion to more than $10 trillion.[2](p3)

SWFs invest in a variety of asset classes such as stocks, bonds, real estate, private equity and hedge funds. Many sovereign funds are directly investing in institutional real estate. According to the Sovereign Wealth Fund Institute's transaction database around US$9.26 billion in direct sovereign wealth fund transactions were recorded in institutional real estate for the last half of 2012.[3] In the first half of 2014, global sovereign wealth fund direct deals amounted to $50.02 billion according to the SWFI.[4]

Early SWFs

Sovereign wealth funds have existed for more than a century, but since 2000, the number of sovereign wealth funds has increased dramatically. The first SWFs were non-federal U.S. state funds established in the mid-19th century to fund specific public services.[5] The U.S. state of Texas was thus the first to establish such a scheme, to fund public education. The Permanent School Fund (PSF) was created in 1854 to benefit primary and secondary schools, with the Permanent University Fund (PUF) following in 1876 to benefit universities. The PUF was endowed with public lands, the ownership of which the state retained by terms of the 1845 annexation treaty between the Republic of Texas and the United States. While the PSF was first funded by an appropriation from the state legislature, it also received public lands at the same time that the PUF was created. The first SWF established for a sovereign state is the Kuwait Investment Authority, a commodity SWF created in 1953 from oil revenues before Kuwait gained independence from the United Kingdom. As of July 2023, Kuwait's Sovereign Wealth Fund, or locally known as Ajyal Fund, is now worth $853 billion[6]

Another early registered SWFs is the Revenue Equalization Reserve Fund of Kiribati. Created in 1956, when the British administration of the Gilbert Islands in Micronesia put a levy on the export of phosphates used in fertilizer, the fund has since then grown to $520 million.[7]

Nature and purpose

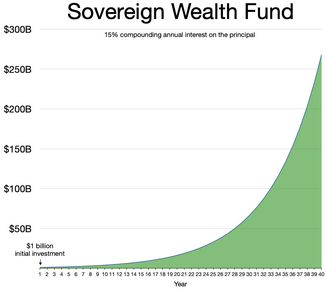

15% compounding interest annually

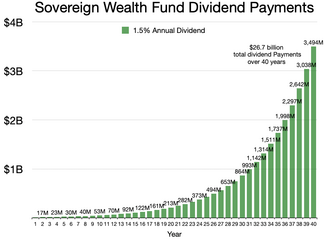

$26.7 billion in total dividend payments over 40 years.

Dividends were not reinvested and can be used as revenue for the government.

SWFs are typically created when governments have budgetary surpluses and have little or no international debt.[dubious ] It is not always possible or desirable to hold this excess liquidity as money or to channel it into immediate consumption. This is especially the case when a nation depends on raw material exports like oil, copper or diamonds. In such countries, the main reason for creating a SWF is because of the properties of resource revenue: high volatility of resource prices, unpredictability of extraction, and exhaustibility of resources.

SWFs are primarily commodity-based and many have been established by oil-rich states.[2](p5) SWFs of China are a notable exception to this more typical model.[2](p5)

Stabilization SWFs are created to reduce the volatility of government revenues, to counter the boom-bust cycles' adverse effect on government spending and the national economy.

Savings SWFs build up savings for future generations. One such fund is the Government Pension Fund of Norway. It is believed that SWFs in resource-rich countries can help avoid resource curse, but the literature on this question is controversial. Governments may be able to spend the money immediately, but risk causing the economy to overheat, e.g., in Hugo Chávez's Venezuela or Shah-era Iran. In such circumstances, saving money to spend during a period of low inflation is often desirable.

Other reasons for creating SWFs may be economic, or strategic, such as war chests for uncertain times. For example, the Kuwait Investment Authority during the Gulf War managed excess reserves above the level needed for currency reserves (although many central banks do that now). The Government of Singapore Investment Corporation and Temasek Holdings are partially the expression of a desire to bolster Singapore's standing as an international financial centre. The Korea Investment Corporation has since been similarly managed. Sovereign wealth funds invest in all types of companies and assets, including startups like Xiaomi and renewable energy companies like Bloom Energy.[8]

According to a 2014 study, SWFs are not created for reasons related to reserve accumulation and commodity-export specialization. Rather, the diffusion of SWF can best be understood as a fad whereby certain governments consider it fashionable to create SWFs and are influenced by what their peers are doing.[9]

As market participants, SWFs influence other institutional investors, who may see investments made alongside SWFs as inherently safer.[2](p9) This effect can be seen with increasing frequency, especially with regard to investments made by the Government Pension Fund of Norway, Abu Dhabi Investment Authority, and Temasek Holdings, and China Investment Corporation.[2](p9) SLFs help facilitate a state's ability to use its selective equity investments to promote its industrial policies and strategic interests.[2](p9)

Concerns about SWFs

The growth of sovereign wealth funds is attracting close attention because:

- As this asset pool continues to expand in size and importance, so does its potential impact on various asset markets.

- Some countries, like the United States, which passed the Foreign Investment and National Security Act of 2007, worry that foreign investment by SWFs raises national security concerns because the purpose of the investment might be to secure control of strategically important industries for political rather than financial gain.

- Former U.S. Secretary of the Treasury Lawrence Summers has argued that the U.S. could potentially lose control of assets to wealthier foreign funds whose emergence "shake[s] [the] capitalist logic".[5] These concerns have led the European Union (EU) to reconsider whether to allow its members to use "golden shares" to block certain foreign acquisitions.[10] This strategy has largely been excluded as a viable option by the EU, for fear it would give rise to a resurgence in international protectionism. In the United States, these concerns are addressed by the Exon–Florio Amendment to the Omnibus Trade and Competitiveness Act of 1988, Pub. L. No. 100-418, § 5021, 102 Stat. 1107, 1426 (codified as amended at 50 U.S.C. app. § 2170 (2000)), as administered by the Committee on Foreign Investment in the United States (CFIUS).[further explanation needed]

- Their inadequate transparency is a concern for investors and regulators: for example, size and source of funds, investment goals, internal checks and balances, disclosure of relationships, and holdings in private equity funds.

- SWFs are not nearly as homogeneous as central banks or public pension funds.

- A lack of transparency and hence an increase in risk to the financial system, perhaps becoming the "new hedge funds".[11]

The governments of SWFs commit to follow certain rules:

- Accumulation rule (what portion of revenue can be spent/saved)

- Withdraw rule (when the Government can withdraw from the fund)

- Investment (where revenue can be invested in foreign or domestic assets)[12]

Governmental interest in 2008

- On 5 March 2008, a joint sub-committee of the U.S. House Financial Services Committee held a hearing to discuss the role of "Foreign Government Investment in the U.S. Economy and Financial Sector". The hearing was attended by representatives of the U.S. Department of Treasury, the U.S. Securities and Exchange Commission, the Federal Reserve Board, Norway's Ministry of Finance, Singapore's Temasek Holdings, and the Canada Pension Plan Investment Board.

- On 20 August 2008, Germany approved a law that requires parliamentary approval for foreign investments that endanger national interests. Specifically, it affects acquisitions of more than 25% of a German company's voting shares by non-European investors—but the economics minister Michael Glos has pledged that investment reviews would be "extremely rare". The legislation is loosely modeled on a similar one by the U.S. Committee on Foreign Investments. Sovereign wealth funds are also increasing their spending. In fact, the Qatar wealth fund plans to spend $35 billion in the US in the next five years.[timeframe?][13][14]

Santiago Principles

A number of transparency indices sprang up before the Santiago Principles, some more stringent than others.[citation needed] To address these concerns, some of the world's main SWFs came together in a summit in Santiago, Chile, on 2–3 September 2008. Under the leadership of the IMF, they formed a temporary International Working Group of Sovereign Wealth Funds. This working group then drafted the 24 Santiago Principles, to set out a common global set of international standards regarding transparency, independence, and accountability in the way that SWFs operate.[15][16] These were published after being presented to the IMF International Monetary Financial Committee on 11 October 2008.[16] They also considered a standing committee to represent them, and so a new organisation, the International Forum of Sovereign Wealth Funds (IFSWF) was set up to maintain the new standards going forward and represent them in international policy debates.[17]

As of 2016, 30 funds[18] have formally signed up to the Principles, representing collectively 80% of the assets managed by sovereign funds globally or US$5.5 trillion.[19]

Size of SWFs

Assets under management of SWFs amounted to $7.94 trillion as of 24 December 2020.[20]

Countries with SWFs funded by oil and gas exports, totaled $5.4 trillion as of 2020.[21] Non-commodity SWFs are typically funded by transfer of assets from official foreign exchange reserves, and in some cases from government budget surpluses and privatization revenues. Middle Eastern and Asian countries account for 77% of all SWFs.

Depletion of SWFs

Numerous SWFs have gone bust throughout history. The most notable ones have been Algeria's FRR, Brazil's FSB, Ecuador's numerous SWF arrangements, Papua New Guinea's MRSF, and Venezuela's FIEM and FONDEN. The main reason why these funds have been exhausted is due to political instability, while economic determinants generally play a less important role.[22] SWFs in unstable countries may provoke risks for recipient states of SWF investments, given that the instability in SWF-sponsor countries makes those investments uncertain and likely to be disinvested to weather political risk in the short-term.

Highly stable countries, such as Denmark, Qatar, China, or Australia are less likely to experience SWF depletion precisely because of their political stability.

Largest sovereign wealth funds

|

See also

- Boutique investment bank

- Fund of funds

- Global financial system

- Government Pension Fund of Norway

- Investment management

- List of exchange-traded funds

- List of hedge funds

- List of investment banks

- List of private-equity firms

- National wealth

References

- ↑ "Who holds the wealth of nations?". Central Banking Journal 15 (4). May 2005. http://www.ssga.com/library/esps/Who_Holds_Wealth_of_Nations_Andrew_Rozanov_8.15.05REVCCRI1145995576.pdf. Retrieved 2 September 2008.

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9 Liu, Zongyuan Zoe (2023). Sovereign Funds: How the Communist Party of China Finances its Global Ambitions. The Belknap Press of Harvard University Press. ISBN 9780674271913.

- ↑ "Sovereign Funds Embrace Direct Real Asset Deals". SWF Institute. 1 August 2013. https://www.swfinstitute.org/news/11593/sovereign-funds-embrace-direct-real-asset-deals.

- ↑ Dunkley, Dan (7 August 2014). "Sovereign-Wealth Funds Pump Near Record Amount of Cash in Deals". The Wall Street Journal. https://blogs.wsj.com/privateequity/2014/08/07/sovereign-wealth-funds-pump-near-record-amount-of-cash-in-deals/.

- ↑ 5.0 5.1 M. Nicolas J. Firzli and Joshua Franzel: 'Non-Federal Sovereign Wealth Funds in the United States and Canada', Revue Analyse Financière, Q3 2014

- ↑ "Kuwait Sovereign Fund Ranks Fifth in World, 2nd Regionally - ARAB TIMES - KUWAIT NEWS". 15 July 2023. https://www.arabtimesonline.com/news/kuwait-sovereign-fund-ranks-fifth-in-world-2nd-regionally/.

- ↑ "The world's most expensive club". The Economist. 24 May 2007. http://www.economist.com/finance/displaystory.cfm?story_id=9230598.

- ↑ "Sovereign-Wealth Funds Went Full Steam Ahead Direct Investing in 2014". The Wall Street Journal. 6 January 2015. https://blogs.wsj.com/privateequity/2015/01/06/sovereign-wealth-funds-went-full-steam-ahead-direct-investing-in-2014/.

- ↑ Chwieroth, Jeffrey M. (1 December 2014). "Fashions and Fads in Finance: The Political Foundations of Sovereign Wealth Fund Creation" (in en). International Studies Quarterly 58 (4): 752–763. doi:10.1111/isqu.12140. ISSN 0020-8833.

- ↑ "Sovereign Wealth Funds: The New Hedge Fund?". The New York Times. 1 August 2007. http://dealbook.blogs.nytimes.com/2007/08/01/sovereign-wealth-funds-the-new-hedge-fund/.

- ↑ Duncan, Gary (27 June 2007). "IMF concern over 'black box' funds of reserve rich nations". The Times (London). http://business.timesonline.co.uk/tol/business/economics/article1991137.ece.

- ↑ "Rebuilding America: The Role of Foreign Capital and Global Public Investors | Brookings Institution". Brookings.edu. 11 March 2011. http://www.brookings.edu/research/papers/2011/03/11-sovereign-wealth-funds.

- ↑ Global, IndraStra. "How Are Sovereign Wealth Fund Decisions Made?". IndraStra. ISSN 2381-3652. https://www.indrastra.com/2017/12/How-are-sovereign-wealth-fund-decisions-made-003-12-2017-0022.html. Retrieved 25 December 2017.

- ↑ "Qatar to invest $35bn in U.S. over 5 years". The WorldFolio. http://www.theworldfolio.com/news/qatar-to-invest-35bn-in-us-over-5-years/4186/.

- ↑ Sovereign Wealth Funds: Generally Accepted Principles and Practices (Santiago Principles) , International Working Group of Sovereign Wealth Funds, October 2008

- ↑ 16.0 16.1 International Forum of Sovereign Wealth Funds. "Santiago Principles". http://www.ifswf.org/santiago-principles.

- ↑ International Forum of Sovereign Wealth Funds. "About us". http://www.ifswf.org/about-us.

- ↑ International Forum of Sovereign Wealth Funds. "Our Members". http://www.ifswf.org/our-members.

- ↑ "International Forum of Sovereign Wealth Funds (IFSWF) and Hedge Fund Standards Board (HFSB) establish Mutual Observer relationship". Hedge Fund Standards Board. 4 April 2016. http://www.hedgeweek.com/2016/04/04/238050/international-forum-sovereign-wealth-funds-ifswf-and-hedge-fund-standards-board-hf.

- ↑ "Sovereign Wealth Fund Rankings. Retrieved 2020-12-24". swfinstitute.org. https://www.swfinstitute.org/fund-rankings/sovereign-wealth-fund.

- ↑ "Sovereign Wealth Fund Rankings". swfinstitute.org. https://www.swfinstitute.org/fund-rankings/sovereign-wealth-fund.

- ↑ The demise of sovereign wealth funds." Leonardo Di Bonaventura Altuve. Retrieved 2023-04-04. doi:10.1080/09692290.2023.2190601. https://www.tandfonline.com/doi/abs/10.1080/09692290.2023.2190601?journalCode=rrip20. Retrieved 5 April 2023.

- ↑ "SWFI". https://www.swfinstitute.org/fund-rankings/sovereign-wealth-fund.

- ↑ "Norway Government Pension Fund Global (Norway GPFG) - Sovereign Wealth Fund, Norway - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05b9af.

- ↑ "Rapport financier 2022 - Groupe Caisse des Dépôts". https://www.caissedesdepots.fr/sites/default/files/2023-04/230426_CDC_RAFI_FR_2022_PDF_MEL.pdf.

- ↑ "China Investment Corporation (CIC) - Sovereign Wealth Fund, China - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05ac89.

- ↑ 27.0 27.1 "SAFE Investment Company (SAFE Investment Company) - Sovereign Wealth Fund, China - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05bd9b.

- ↑ "Ranking - SWFs and PPFs -" (in en). https://globalswf.com/ranking.

- ↑ "Kuwait Investment Authority (KIA) - Sovereign Wealth Fund, Kuwait - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b5f2.

- ↑ "Public Investment Fund (PIF) - Sovereign Wealth Fund, Saudi Arabia - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05bc3b.

- ↑ "GIC Private Limited (GIC) - Sovereign Wealth Fund, Singapore - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b242.

- ↑ "Hong Kong Monetary Authority Investment Portfolio (HKMA IP) - Sovereign Wealth Fund, Hong Kong - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b3a7.

- ↑ "Hong Kong Monetary Authority Investment Portfolio (HKMA IP) - Sovereign Wealth Fund, Hong Kong - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b3a7.

- ↑ "Portfolio Performance" (in en). https://www.temasek.com.sg/content/temasek-corporate/en/our-financials/portfolio-performance.

- ↑ "Temasek Holdings (Temasek) - Sovereign Wealth Fund, Singapore - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05c04a.

- ↑ "Qatar Investment Authority (QIA) - Sovereign Wealth Fund, Qatar - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05bc5a.

- ↑ "Central Provident Fund (CPF) - Public Pension, Singapore - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05ac13.

- ↑ "2021 Annual Report - CDPQ". 11 April 2022. https://www.cdpq.com/en/performance/annual-reports/2021.

- ↑ "Investment Corporation of Dubai (ICD) - Sovereign Wealth Fund, United Arab Emirates - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b49f.

- ↑ "Mubadala Investment Company (Mubadala) - Sovereign Wealth Fund, United Arab Emirates - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05b883.

- ↑ "Turkey Wealth Fund (Turkey Wealth Fund) - Sovereign Wealth Fund, Turkey - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05c184.

- ↑ "Korea Investment Corporation (KIC) - Sovereign Wealth Fund, South Korea - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b5cb.

- ↑ "Abu Dhabi Developmental Holding Company (ADQ) - Sovereign Wealth Fund, United Arab Emirates - SWFI". https://www.swfinstitute.org/profile/5d0c7854d5ad707266741fc3.

- ↑ "Russia's National Wealth Fund at $148 billion at Jan 1 - Finance Ministry" (in en). euronews. 19 January 2023. https://www.euronews.com/next/2023/01/19/russia-reserves-national-wealth-fund.

- ↑ "Russia | National Wealth Fund: Total Amount | CEIC". https://www.ceicdata.com/en/russia/national-wealth-fund-total-amount.

- ↑ "Future Fund (Future Fund) - Sovereign Wealth Fund, Australia - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b1ad.

- ↑ "Emirates Investment Authority (EIA) - Sovereign Wealth Fund, United Arab Emirates - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05afc6.

- ↑ "Alaska Permanent Fund Corporation (APFC) - Sovereign Wealth Fund, United States - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05a804.

- ↑ "Brunei Investment Agency (BIA) - Sovereign Wealth Fund, Brunei - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05aadd.

- ↑ "Financial Statements and Independent Auditors' Report". https://www.utimco.org/media/3438/2020-puf-financial-statements-final-pw.pdf.

- ↑ "Samruk-Kazyna (Samruk Kazyna) - Sovereign Wealth Fund, Kazakhstan - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05bdc0.

- ↑ "Libyan Investment Authority (LIA) - Sovereign Wealth Fund, Libya - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b66a.

- ↑ "Kazakhstan National Fund (Kazakhstan National Fund) - Sovereign Wealth Fund, Kazakhstan - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b556.

- ↑ "Dubai World (UAE - Dubai) - Fund Profile -" (in en). https://globalswf.com/fund/DUB-WRD.

- ↑ "ARDNF – Azərbaycan Respublikası Dövlət Neft Fondu – Home". http://www.oilfund.az/.

- ↑ "Portfolio". https://www.oebag.gv.at/en/organisation/portfolio/.

- ↑ "Khazanah Nasional (Khazanah) - Sovereign Wealth Fund, Malaysia - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b58c.

- ↑ "New Zealand Superannuation Fund (NZ Super Fund) - Sovereign Wealth Fund, New Zealand - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05b948.

- ↑ "Home" (in en-US). https://www.sic.state.nm.us/.

- ↑ "New Mexico State Investment Council (NMSIC) - Sovereign Wealth Fund, United States - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05b92a.

- ↑ "Bpifrance (Bpifrance) - Development Bank, France - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05aa99.

- ↑ "Russian Direct Investment Fund (RDIF) - Sovereign Wealth Fund, Russia - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05bd89.

- ↑ "Nuclear Waste Disposal Fund (Kenfo) - Sovereign Wealth Fund, Germany - SWFI". https://www.swfinstitute.org/profile/5ac240adce6eca492d272cb5.

- ↑ "Mumtalakat Holding (Mumtalakat) - Sovereign Wealth Fund, Bahrain - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05b88b.

- ↑ "Timor-Leste Petroleum Fund (Timor-Leste Petroleum Fund) - Sovereign Wealth Fund, East Timor - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05c12c.

- ↑ "Homepage | ISIF" (in en). https://isif.ie/.

- ↑ "Ireland Strategic Investment Fund (ISIF) - Sovereign Wealth Fund, Ireland - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b4b3.

- ↑ Alberta Heritage Savings Trust Fund Annual Report 2021-22 (Report). Heritage Fund. June 2022. p. 5. ISBN 978-1-4601-5445-8. https://open.alberta.ca/dataset/3675e470-646e-4f8a-86a7-c36c6f45471a/resource/a70d648a-4001-4293-a3a0-7fd98aedfd5a/download/2021-22-heritage-fund-annual-report.pdf. Retrieved 18 February 2023. "the net financial assets of the Fund are valued at [CAD]$18,715 million as of March 31, 2022"

- ↑ "Daily exchange rates: Lookup tool". Bank of Canada. 2022-03-31. https://www.bankofcanada.ca/rates/exchange/daily-exchange-rates-lookup/?lookupPage=lookup_daily_exchange_rates_2017.php&startRange=2017-01-01&series[]=FXUSDCAD&lookupPage=lookup_daily_exchange_rates_2017.php&startRange=2017-01-01&rangeType=range&rangeValue=&dFrom=2022-03-31&dTo=&submit_button=Submit. "Date: 2022-03-31 | CAD → USD: 0.8003"

- ↑ "Economic and Social Stabilization Fund (2 contenidos)" (in en). http://www.hacienda.cl/english/investor-relations-office/reports/sovereign-wealth-funds-reports/economic-and-social-stabilization-fund.

- ↑ "National Development Fund of Iran (NDFI) - Sovereign Wealth Fund, Iran - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05b8d2.

- ↑ "North Dakota Legacy Fund (North Dakota Legacy Fund) - Sovereign Wealth Fund, United States - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05b98a.

- ↑ "Heritage and Stabilization Fund – Ministry of Finance" (in en-US). https://www.finance.gov.tt/category/heritage-and-stabilization-fund/.

- ↑ "Heritage and Stabilization Fund (Heritage and Stabilization Fund) - Sovereign Wealth Fund, Trinidad and Tobago - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b364.

- ↑ "Indonesia Investment Authority (Indonesia Investment Authority) - Sovereign Wealth Fund, Indonesia - SWFI". https://www.swfinstitute.org/profile/5f7dde9916e98059cc6f024e.

- ↑ "National Investment and Infrastructure Fund (NIIF) - Government Fund, India - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05b8df.

- ↑ "China-Africa Development Fund (CAD Fund) - Government Fund, China - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05acbc.

- ↑ "State Fiscal Stabilization Fund | U.S. Department of Education". https://www.ed.gov/category/program/state-fiscal-stabilization-fund.

- ↑ "CDP Equity" (in it). https://www.cdpequity.it/cdp-equity/it/home.page.

- ↑ "1H 2023" (in it). https://www.cdp.it/sitointernet/it/bilancio_2023.page.

- ↑ "Pula Fund (Pula Fund) - Sovereign Wealth Fund, Botswana - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05bc49.

- ↑ "Alabama Trust Fund (ATF) - Sovereign Wealth Fund, United States - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05a800.

- ↑ Idaho, Access. "Home" (in EN). https://efib.idaho.gov/.

- ↑ "Idaho Endowment Fund Investment Board (Idaho EFIB)". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b40f.

- ↑ "SITFO". https://sitfo.utah.gov/.

- ↑ "State Capital Investment Corporation (SCIC) - Sovereign Wealth Fund, Vietnam - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05bf53.

- ↑ "Nigeria Sovereign Investment Authority (NSIA) - Sovereign Wealth Fund, Nigeria - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05b968.

- ↑ "Fundo Soberano de Angola (FSDEA) - Sovereign Wealth Fund, Angola - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b1a8.

- ↑ "Sharjah Asset Management (Sharjah Asset Management) - Sovereign Wealth Fund, United Arab Emirates - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05be47.

- ↑ SAMH. "Sharjah Asset Management – The Investment Arm of the Government of Sharjah" (in en-US). https://sam.ae/.

- ↑ "إلى 150 مليون دينار خسارة محفظة الأوقاف". https://alqabas.com/article/114139-100-إلى-150-مليون-دينار-خسارة-محفظة-الأوقاف.

- ↑ "Fondo de Ahorro de Panama" (in es-PA). https://www.fondoahorropanama.com/.

- ↑ "Fondo de Ahorro de Panama (FAP) - Sovereign Wealth Fund, Panama - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b136.

- ↑ "Investments | Louisiana State Treasurer | Louisiana" (in en). https://www.treasury.la.gov/investments.

- ↑ "Louisiana Education Quality Trust Fund (LEQTF) - Sovereign Wealth Fund, United States - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05b6ba.

- ↑ "Palestine Investment Fund (Palestine Investment Fund) - Sovereign Wealth Fund, Palestine - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05ba86.

- ↑ "Western Australian Future Fund (WAFF) - Sovereign Wealth Fund, Australia - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05c326.

- ↑ "Ley del Fondo para la Revolución Industrial Productiva (FINPRO),..." (in en). https://www.bivica.org/file/view/id/838.

- ↑ "Agaciro Development Fund". 24 November 2018. http://agaciro.rw/index.php?id=2.

- ↑ "Agaciro Development Fund (Agaciro) - Sovereign Wealth Fund, Rwanda - SWFI". https://www.swfinstitute.org/profile/598cdaa50124e9fd2d05a7da.

- ↑ "West Virginia Future Fund - Sovereign Wealth Fund, United States - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05c31e.

- ↑ "West Virginia Code 11-13A-5b" (in en-US). https://code.wvlegislature.gov/11-13A-5b.

- ↑ "National Fund for Hydrocarbon Reserves (FNRH) - Sovereign Wealth Fund, Mauritania - SWFI". https://www.swfinstitute.org/profile/598cdaa60124e9fd2d05b8d7.

- ↑ "Монгол Улсын Сангийн яам" (in en). https://mof.gov.mn/en.

- ↑ "Fonds Souverain d'Investissements Stratégiques (FONSIS)". https://www.fonsis.org/fr.

Further reading

| Library resources about Sovereign wealth fund |

|

- Sovereign Wealth Fund Institute – What is a SWF? What is a Sovereign Wealth Fund? - SWFI

- Natural Resource Governance Institute & Columbia Center for Sustainable Investment "Managing the Public Trust: How to make natural resource funds work for citizens", 2014. [1]

- Castelli Massimiliano and Fabio Scacciavillani "The New Economics of Sovereign Wealth Funds", John Wiley & Sons, 2012

- Saleem H. Ali and Gary Flomenhoft. "Innovating Sovereign Wealth Funds" . Policy Innovations, 17 February 2011.

- M. Nicolas J. Firzli World Pensions Council (WPC) Asset Owners Report: “Infrastructure Investments in an Age of Austerity: The Pension and Sovereign Funds Perspective”, USAK/JTW 30 July 2011 and Revue Analyse Financière, Q4 2011

- M. Nicolas J. Firzli and Joshua Franzel. "Non-Federal Sovereign Wealth Funds in the United States and Canada". Revue Analyse Financière, Q3 2014

- Xu Yi-chong and Gawdat Bahgat, eds. The Political Economy of Sovereign Wealth Funds (Palgrave Macmillan; 2011) 272 pages; case studies of SWFs in China, Kuwait, Russia, the United Arab Emirates, and other countries.

- Lixia, Loh. "Sovereign Wealth Funds: States Buying the World" (Global Professional Publishing: 2010).

{{Navbox

| name = Private equity and venture capital

| state = autocollapse | title = [[Finance:Private equitPrivate equity and venture capital

| image =| bodyclass = hlist

| group1 = Basic investment types | list1 =

- Buyout

- Venture

- Mezzanine

- Growth

- Secondaries

- Equity co-investment

| group2 = History | list2 =

- History of private equity and venture capital

- Early history of private equity

- Private equity in the 1980s

- Private equity in the 1990s

- Private equity in the 2000s

| group3 = Terms and concepts

| list3 =

| Buyout |

|

|---|---|

| Venture |

|

| Structure |

|

| group4 = Investors | list4 =

- Corporations

- Institutional investors

- Pension funds

- Insurance companies

- Fund of funds

- Endowments

- Foundations

- Investment banks

- Merchant banks

- Commercial banks

- High-net-worth individuals

- Family offices

- Sovereign wealth funds

- Crowdfunding

| group5 = Related financial terms | list5 =

- AUM

- Cap table

- Capital call

- Capital commitment

- Capital structure

- Distribution waterfall

- EBITDA

- Envy ratio

- High-yield debt

- IPO

- IRR

- Leverage

- Liquidation preference

- M&A

- PME

- Taxation of private equity and hedge funds

- Undercapitalization

- Vintage year

| below =

- Private equity and venture capital investors

- Private equity firms

- Venture capital firms

- Angel investors

- Portfolio companies

}}

|

Categories: [Foreign direct investment] [Investment funds] [International finance]

↧ Download as ZWI file | Last modified: 08/07/2024 13:03:44 | 4 views

☰ Source: https://handwiki.org/wiki/Finance:Sovereign_wealth_fund | License: CC BY-SA 3.0

KSF

KSF