Maine Water Quality, Question 5 (June 2010)

From Ballotpedia - Reading time: 7 min

From Ballotpedia - Reading time: 7 min

|

|

|

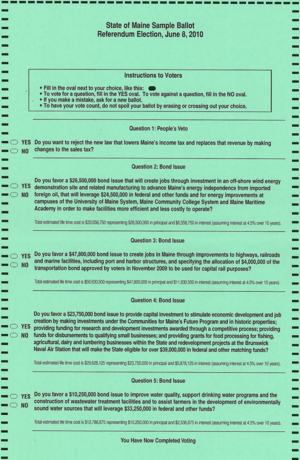

The Maine Water Quality Bonds Issue, also known as Question 5, was on the June 8, 2010 ballot in Maine as a legislatively referred bond question, where it was approved. The measure issued $10.25 million in bonds to fund water quality improvements, drinking water programs, construction of wastewater treatment facilities and development of environmentally sound water sources by farmers.[1][2][3][4]

Election results[edit]

| Maine Question 5 (June 2010) | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 175,165 | 55.50% | |||

| No | 140,442 | 44.50% | ||

Election results via: Maine Secretary of State, Elections Division, Referendum Election Tabulations, June 8, 2010

Text of measure[edit]

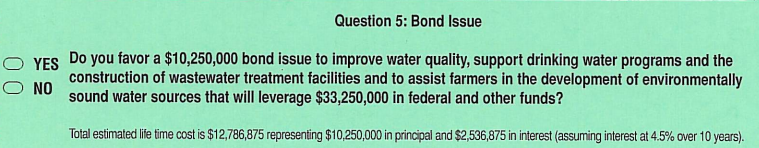

The language appeared on the ballot as:[3]

| “ | ” |

Summary[edit]

The following description of the intent and content of this ballot measure was provided in the Maine Citizen's Guide to the Referendum Election:

| “ |

This Act would authorize the State to issue bonds in an amount not to exceed $10,250,000 for the activities described below.

The bonds would run for a period not longer than 10 years from the date of issue and would be backed by the full faith and credit of the State. If approved, the bond authorization would take effect 30 days after the Governor’s proclamation of the vote. A “YES” vote favors authorizing the $10,250,000 bond issue to finance the above activities. A “NO” vote opposes the bond issue in its entirety. [5] |

” |

| —Office of the Attorney General | ||

Fiscal note[edit]

The following debt service description for these bonds was provided in the Maine Citizen's Guide to the Referendum Election:

| “ |

Total estimated life time cost is $12,786,875 representing $10,250,000 in principal and $2,536,875 in interest (assuming interest at 4.5% over 10 years). [5] |

” |

| —Office of the Treasurer | ||

The following fiscal impact statement was provided in the Maine Citizen's Guide to the Referendum Election:

| “ |

This bond issue has no significant fiscal impact other than the debt service costs identified above. [5] |

” |

| —Maine Office of Fiscal and Program Review | ||

Support[edit]

Officials[edit]

- Rep. Hannah Pingree (D-36), sponsor

- Rep. Seth Berry (D-67), cosponsor

- Rep. Emily Ann Cain (D-19), cosponsor

- Rep. John Piotti (D-45), cosponsor

- Sen. Bill Diamond (D-12), cosponsor

- Senate President Elizabeth Mitchell (D-24), cosponsor

The Bangor Region Chamber of Commerce voted May 20, 2010 to endorse the four bond measures that appeared on the statewide ballot. According to board Chair Michael Ballesteros the bonds were in line with the chamber's interest's of the state's business community. The Portland Chamber of Commerce also supported the bond measures.[6]

Gov. John Baldacci supported the four June 2010 bond measures. In his weekly radio address he said the bonds would help boost the economy, help small businesses and support energy independence. Baldacci noted that he understood the reluctance to vote in favor of the measures but argued that Maine was conservative with borrowing and paid its debt in less than half the time it takes most states.[7][8]

Tactics and strategies[edit]

In May 2010 Dana Connors, president of the Maine State Chamber of Commerce (dead link), said a coalition was being formed to launch an advertising campaign in support of the bond proposals. According to Connors they were planning to do some "advertising." Connors argued that the bonds would help create jobs.

Some supporters said that although they did support the proposed bonds on the June 8, 2010 ballot, they worried that voters wouldn't readily approve them, particularly because the state and the country were coming out of a recession. Chris Hall, vice president of the Greater Portland Chamber of Commerce said that supporters had to work hard to convince voters. "We did have some members on our board that opposed our endorsement because of those same concerns. But most, more than 60 percent, supported all of the bond package," he said.[9]

Opposition[edit]

The Maine Heritage Policy Center was opposed to the bonds scheduled to appear on the June 2010 ballot. Center President Tarren Bragdon said that while bonds were appropriate for some state needs, Maine had too much debt. "It’s our hope that the voters will reject some of these and send a strong message to the politicians in Augusta that if you are not going to be responsible with our credit card, then we will take matters into our own hands and vote no. We are going to say no more debt, not now."[9][10]

Scott Moody, an economist for the center, wrote a study which ultimately concluded that Maine's debt would leave lawmakers with two options: reduce spending or raise taxes. "Before any new debt is approved, Mainers should insist that legislators deal with these ballooning, unfunded retirement liabilities first and foremost," said Moody.[11]

Media editorial positions[edit]

- Main article: Endorsements of Maine ballot measures, 2010

Support[edit]

- The Bangor Daily News supported Bond Questions 2, 3, 4 and 5, saying

| “ |

States, unlike the federal government, are unable to spend into the red. That’s a good thing. But with interest rates at historic lows, these bonds are a bargain for building and rebuilding Maine. They should be passed. [5] |

” |

| —Bangor Daily News editorial board | ||

- The Journal Tribune said,

| “ |

Last week the Journal Tribune endorsed the four bond issues on Maine’s June 8 ballot. We recommended “Yes” votes on Questions 2-5, proposed bond issues that serve the interests of Maine’s people. [5] |

” |

| —Journal Tribune editorial board | ||

Path to the ballot[edit]

To place the measure on the ballot, the measure was required to receive at least a two-thirds vote in both the House and Senate.

See also[edit]

- Maine 2010 ballot measures

- 2010 ballot measures

- List of Maine ballot measures

- History of Initiative & Referendum in Maine

Similar measures[edit]

- Maine Energy Efficiency Bonds Issue, Question 2 (2010)

- Maine Jobs Bond Issue, Question 3 (2010)

- Maine Economic Development and Job Bonds Issue, Question 4 (2010)

Articles[edit]

- Early results reveal approval of most Maine measures including a tax reform veto

- Mainers cast their ballots on tax reform and bond measures

- Maine ballot measure order set for June 8 ballot

External links[edit]

- Summary of LD 913: "An Act To Authorize Bond Issues for Ratification by the Voters for the November 2009 and June 2010 Elections"

- LD 913 full text

Additional reading[edit]

- Associated Press, "Maine's Voter Turnout Appears To Be Low," June 8, 2010

- Sanford News, "State's primary is this Tuesday; ballot to include referendum questions and school budget validation," June 3, 2010

- Associated Press, "Maine Voters To Decide Bond Questions," May 16, 2010

- The Free Press, "June Statewide Ballot Questions," May 13, 2010

- WCSH6, "Lawmakers debate jobs bond proposals," March 29, 2010

Footnotes[edit]

- ↑ Maine Legislature, "LD 913 full text," accessed February 9, 2010

- ↑ Morning Sentinel, "Mainers approve all 4 bonds on ballot," June 9, 2010

- ↑ 3.0 3.1 3.2 3.3 3.4 Maine Secretary of State, Division of Elections, "Maine Citizen's Guide to the Referendum Election, Tuesday, June 8, 2010," accessed May 14, 2014

- ↑ Maine Secretary of State, Elections Division, "Referendum Election Tabulations, June 8, 2010," accessed May 14, 2014

- ↑ 5.0 5.1 5.2 5.3 5.4 5.5 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

- ↑ Associated Press, "Regional Chamber of Commerce endorses Maine bonds," May 20, 2010

- ↑ The Portland Press Herald, "Baldacci asks voters to support bond issues," May 22, 2010

- ↑ Associated Press, "Gov Urges Mainers To Vote For Bond Proposals," June 5, 2010

- ↑ 9.0 9.1 Bangor Daily News, "Bond backers fear rejection at the polls," May 20, 2010

- ↑ Maine Public Broadcasting Network, "Bond Package: Desperately Needed, or Dragging Maine into Sea of Debt?" May 18, 2010

- ↑ Bangor Daily News, "Bond question advocates getting word out," June 2, 2010

- ↑ Bangor Daily News, "Bonds Will Boost Maine," May 26, 2010

- ↑ The Journal Tribune, "An investment in harnessing offshore wind energy," May 28, 2010

|

State of Maine Augusta (capital) |

|---|---|

| Elections |

What's on my ballot? | Elections in 2024 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |

KSF

KSF