Medicaid spending in New Hampshire

From Ballotpedia - Reading time: 17 min

From Ballotpedia - Reading time: 17 min

This page covering Medicaid spending by state last received a comprehensive update in 2017. If you would like to help our coverage grow, consider donating to Ballotpedia. Please contact us with any updates.

![]() This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Medicaid spending in New Hampshire | ||||||

| Overview | ||||||

| Number of enrollees: 186,9411 | ||||||

| Total spending: $2 billion3 | ||||||

| Spending per enrollee: $8,5604 | ||||||

| Percent of state budget: 29.7%4 | ||||||

| Medicaid eligibility limit: 318% FPL3 | ||||||

| Expansion?: Yes2 | ||||||

| CHIP spending: $29 million4 | ||||||

| CHIP eligibility limit: 323% FPL2 | ||||||

Data years

| ||||||

| Medicaid spending in the U.S. • Medicare • Medicaid • Obamacare overview | ||||||

New Hampshire's Medicaid program provides medical insurance to groups of low-income people and individuals with disabilities. Medicaid is a nationwide program jointly funded by the federal government and the states. Medicaid eligibility, benefits, and administration are managed by the states within federal guidelines. A program related to Medicaid is the Children's Health Insurance Program (CHIP), which covers low-income children above the poverty line and is sometimes operated in conjunction with a state's Medicaid program. Medicaid is a separate program from Medicare, which provides health coverage for the elderly.

This page provides information about Medicaid in New Hampshire, including eligibility limits, total spending and spending details, and CHIP. Each section provides a general overview before detailing the state-specific data.

Background[edit]

Established in 1965, Medicaid is the primary source of health insurance coverage for low-income and disabled individuals and the largest source of financing for the healthcare services they need. In 2014, about 80 million individuals were enrolled in Medicaid, or 25.9 percent of the total United States population. According to the Kaiser Family Foundation, Medicaid accounted for one-sixth of healthcare spending in the United States during that year.[4][5][6]

The federal Centers for Medicare and Medicaid Services (CMS) monitors state Medicaid programs and establishes requirements for service delivery, quality, funding, and eligibility standards. Medicaid does not provide healthcare directly. Instead, it pays hospitals, physicians, nursing homes, health plans, and other healthcare providers for covered services that they deliver to eligible patients.[6][7]

The Patient Protection and Affordable Care Act of 2010, also known as Obamacare, provided for the expansion of Medicaid to cover all individuals earning incomes up to 138 percent of the federal poverty level, which amounted to $16,643 for individuals and $33,948 for a family of four in 2017. A 2012 United States Supreme Court decision made the Medicaid expansion voluntary on the part of the states.[8][9]

Eligibility[edit]

Eligibility for each state's Medicaid program is subject to minimum federal standards, both in the population groups states must cover and the maximum amount of income enrollees can make. States are required to cover the following population groups and income levels:[9][10]

- states must cover pregnant women up to at least 138 percent of the federal poverty level ($16,643 for an individual, $33,948 for a family of four in 2017)

- states must cover preschool-age children up to at least 138 percent of the federal poverty level ($16,643 for an individual, $33,948 for a family of four in 2017)

- states must cover school-age children up to at least 100 percent of the federal poverty level ($12,060 for an individual, $24,600 for a family of four in 2017)

- states must cover elderly and disabled individuals up to at least 75 percent of the federal poverty level ($9,045 for an individual, $18,450 for a family of four in 2017)

- states must cover working parents up to at least 28 percent of the federal poverty level ($3,376 for an individual, $6,888 for a family of four in 2017)

The Affordable Care Act authorized states to expand their Medicaid programs to offer coverage to childless adults up to 138 percent of the federal poverty level, though they were not required to do so. As of November 2018, a total of 36 states and Washington, D.C., had expanded or voted to expand their Medicaid programs.New Hampshire opted to fully expand its Medicaid program, covering childless adults earning incomes up to 138 percent FPL. Full details on Medicaid eligibility for New Hampshire and three of its neighboring states are provided in the table below.[11]

| Medicaid eligibility by population category, 2016 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| State | Children | Pregnant women | Adults | ||||||||

| Medicaid ages 0-1 | Medicaid ages 1-5 | Medicaid ages 6-18 | Separate CHIP | Medicaid | CHIP | Parent | Childless adults | ||||

| New Hampshire | 318% | 318% | 318% | N/A | 196% | N/A | 68% | 138% | |||

| Maine | 191% | 157% | 157% | 208% | 209% | N/A | 100% | No | |||

| Massachusetts | 200% | 150% | 150% | 300% | 200% | N/A | 133% | 138% | |||

| Vermont | 312% | 312% | 312% | N/A | 208% | N/A | 53% | 138% | |||

| Note: Figures represent household income as a percentage of the federal poverty level. | |||||||||||

Expansion under the Affordable Care Act[edit]

The Affordable Care Act (ACA) provided for the expansion of Medicaid to cover childless adults whose income is 138 percent of the federal poverty level (FPL) or below. The provision for expanding Medicaid went into effect nationwide in 2014. As of November 2018, a total of 36 states and Washington, D.C., had expanded or voted to expand Medicaid.

New Hampshire expanded Medicaid under the Affordable Care Act in 2014 via an alternative system of assisting enrollees with purchasing private insurance. Former Governor Maggie Hassan (D) supported Medicaid expansion, calling it a "positive step forward" in her 2014 State of the State address. Governor Chris Sununu (R) said in a February 2017 interview, "There's no doubt it's been helpful. ... It was a price tag of somewhere between $400 and $500 million. We've been able to do it to date without a single New Hampshire taxpayer dollar."[1][2][3]

Support[edit]

Arguing in support of the expansion of Medicaid eligibility in an April 2013 article, the Center for American Progress states that the expansion helps increase the number of people with health insurance and benefits states economically. The organization argues that by providing health insurance to those who would otherwise be uninsured, Medicaid expansion allows low-income families to spend more money on food and housing:[12]

| “ | Medicaid coverage translates into financial flexibility for families and individuals, allowing limited dollars to be spent on basic needs, including breakfast for the majority of the month or a new pair of shoes for a job interview.[13] | ” |

| —Center for American Progress | ||

Regarding financial costs for states, the organization argues that "states that expand their Medicaid coverage will not incur unsustainable costs," citing a Congressional Budget Office report that estimated an increase in spending of 2.8 percent. The organization also argues that states will offset these costs with increased revenues and other financial gains:

| “ | Sources of increased revenues include state sales taxes, insurance taxes, and prescription-drug rebates. States will also incur savings, as the federal government will be paying a much higher share of the cost for populations that were previously ineligible and therefore solely paid for by states. This will free up billions of dollars from state budgets.[13] | ” |

| —Center for American Progress | ||

Marilyn Tavenner, President and CEO of the health insurance trade association America's Health Insurance Plans, also spoke in support of Medicaid expansion in September 2016, saying she would like to see all states expand the program. "Medicaid is going to become the bigger issue [from the] affordability perspective," Tavenner said, arguing that Medicaid expansion would pressure the country to address rising health costs.[14]

Opposition[edit]

Arguing against Medicaid expansion in a February 2014 article, Michael Tanner, a fellow at the Cato Institute, states that Medicaid expansion is costly for states and does not provide better access to healthcare for low income individuals. Tanner argues that although states are required to pay at most 10 percent of costs for enrollees who became eligible under expanded programs, this still represents a significant cost increase for states. Tanner also argues that states will see greater costs than predicted as previously unenrolled individuals discover they are eligible under the traditional eligibility limits.[15]

Regarding healthcare access, Tanner cites a study from the Oregon Health Insurance Exchange, which "concluded that 'Medicaid coverage generated no significant improvements in measured physical-health outcomes.'" Tanner also states that "Other studies show that, in some cases, Medicaid patients actually wait longer and receive worse care than the uninsured." Tanner argues that this is due to Medicaid's level of reimbursement to doctors:[15]

| “ | While Medicaid costs taxpayers a lot of money, it pays doctors little. On average, Medicaid reimburses doctors only 72 cents out of each dollar of costs. As a result, many doctors limit the number of Medicaid patients they serve or refuse to take them at all.[13] | ” |

| —Michael Tanner | ||

The National Federation of Independent Business (NFIB) also advocated against Medicaid expansion in February 2017, arguing that the federal government may not always agree to cover 90 percent of the costs:[16]

| “ | Our small business members have looked at this issue from every perspective and believe expanding an underfunded, cumbersome, and poorly administered program like Medicaid would be irresponsible. The bottom line is this: Does anyone really believe that Washington will continue to pick up 90 percent of new costs after 2020?[13] | ” |

| —Gregg Thompson, state director of the North Carolina NFIB chapter | ||

Benefits[edit]

In large part, the states "determine the type, amount, duration, and scope" of benefits offered to individuals enrolled in Medicaid, according to the Centers for Medicare and Medicaid Services. However, benefits are subject to federal minimum standards. The federal government has outlined 16 benefits that are required of all Medicaid programs:[17][18][19]

- Hospital services for inpatients

- Hospital services for outpatients

- Health screenings for individuals and children under age 21

- Nursing facility care

- Home healthcare

- Physician checkups and other services

- Rural health clinic visits

- Visits to federally qualified health centers

- Laboratory tests and X-rays

- Family planning

- Nurse midwife care

- Maternity and newborn care

- Visits to pediatric and family nurse practitioners

- Visits to licensed freestanding birth centers

- Emergency and non-emergency medical transportation

- Tobacco cessation programs for pregnant women

In addition, the Affordable Care Act required that all Medicaid enrollees who became eligible under expanded programs receive coverage for prescription drugs, substance abuse treatment, and mental health treatment. Beyond the required benefits, there are several other optional benefits states may choose to offer enrollees, such as dental care and physical therapy. Other services may be offered with approval from the secretary of the United States Department of Health and Human Services. Benefits offered may not differ from person to person due to diagnoses or condition of health.[17][19][20]

Optional benefits offered in New Hampshire

According to the Henry J. Kaiser Family Foundation, as of 2017, the optional benefits included in the bulleted list below were offered in New Hampshire. Note that other, less common specialized services may also be offered, such as nutrition services and acupuncture. For more complete information on Medicaid benefits, links to state Medicaid offices can be found here.[19][21]

- Freestanding ambulatory surgery centers

- Public and mental health clinics

- Dental care

- Dental surgery

- Optometrists

- Podiatrists

- Psychologists

- Occupational therapy

- Physical therapy

- Speech/hearing/language therapy

- Eyeglasses

- Hearing aids

- Home medical equipment

- Prosthetics

- Adult health screenings

- Case management

- Home or community-based long-term care

- Personal care

- Private duty nurse

- Inpatient psychiatric care for individuals under age 21

- Inpatient care for mental diseases for individuals age 65+

State and federal spending[edit]

Total spending[edit]

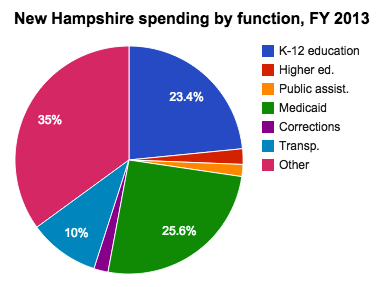

During fiscal year 2016, Medicaid spending nationwide amounted to nearly $553.5 billion. Spending per enrollee amounted to $7,067 in fiscal year 2013, the most recent year for which per-enrollee figures were available as of June 2017. Total Medicaid spending grew by 33 percent between fiscal years 2012 and 2016. The Medicaid program is jointly funded by the federal and state governments, and at least 50 percent of each state's Medicaid funding is matched by the federal government, although the exact percentage varies by state. Medicaid is the largest source of federal funding that states receive. Changes in Medicaid enrollment and the cost of healthcare can impact state budgets. For instance, in New Hampshire, the percentage of the state's budget dedicated to Medicaid rose from 24.9 percent in 2010 to 29.7 percent in 2015. However, state cuts to Medicaid funding can also mean fewer federal dollars received by the state.[22][23][24]

During fiscal year 2016, combined federal and state spending for Medicaid in New Hampshire totaled about $2 billion. Spending on New Hampshire's Medicaid program increased by about 66.5 percent between fiscal years 2012 and 2016. Hover over the points on the line graph below to view Medicaid spending figures for New Hampshire. Click [show] on the red bar below the graph to view these figures as compared with three of New Hampshire's neighboring states.[25][26][27][28][29]

| Total Medicaid spending, fiscal years 2012 - 2016 | ||||||

|---|---|---|---|---|---|---|

| State | 2012 | 2013 | 2014 | 2015 | 2016 | Percentage change |

| New Hampshire | $1,186,815,817 | $1,202,784,581 | $1,343,718,320 | $1,716,225,884 | $1,975,716,666 | 66.5% |

| Maine | $2,413,167,313 | $2,887,138,817 | $2,457,176,578 | $2,477,405,878 | $2,581,657,130 | 7.0% |

| Massachusetts | $12,925,713,343 | $13,166,355,820 | $14,602,722,338 | $15,378,247,995 | $17,121,704,904 | 32.5% |

| Vermont | $1,353,425,573 | $1,473,569,964 | $1,534,774,141 | $1,632,611,663 | $1,679,754,722 | 24.1% |

| United States | $415,154,234,831 | $438,233,172,298 | $475,910,000,000 | $523,709,237,879 | $553,453,647,756 | 33.31% |

| Note: Expenditures include both state and federal expenditures. Expenditures do not include administrative costs. Percentages calculated by Ballotpedia. | ||||||

Spending details[edit]

In 2013, the most recent year per enrollee spending figures were available as of June 2017, spending per enrollee in New Hampshire amounted to $8,560. Total enrollment in 2017 amounted to 187,000 individuals. Total federal and state Medicaid spending for New Hampshire during 2016 amounted to about $2 billion. The federal government paid 60.2 percent of these costs, while the state paid the remaining 39.8 percent. Medicaid accounted for 29.7 percent of New Hampshire's budget in 2015.[30][31][32][33][34]

| Medicaid spending details | |||||||

|---|---|---|---|---|---|---|---|

| State | Total spending (2016) | Enrollment (March 2017) | Per enrollee spending (2013) | FMAP percentage (2018)* | Federal share (2016) | State share (2016) | Percent of state budget (2015) |

| New Hampshire | $1,975,716,666 | 186,941 | $8,560 | 50.0% | 60.2% | 39.8% | 29.7% |

| Maine | $2,581,657,130 | 267,252 | $8,856 | 64.3% | 62.8% | 37.2% | 32.8% |

| Massachusetts | $17,121,704,904 | 1,631,999 | $9,541 | 50.0% | 54.1% | 45.9% | 23.8% |

| Vermont | $1,679,754,722 | 168,961 | $8,427 | 53.5% | 59.3% | 40.7% | 28.5% |

| United States | $553,453,647,756 | 74,600,261 | $7,067 | 50.00% | 63.0% | 37.0% | 28.2% |

| Note: FMAP stands for Federal Medical Assistance Percentage and represents the percentage of state Medicaid spending that is eligible for federal matching funds. | |||||||

Medicaid spending can generally be broken up into the following categories:

- Acute care services are those that are typically provided within a short time frame, such as inpatient hospital stays, lab tests, and prescription drugs.

- Long-term care services are those provided over a long period of time, such as home care and mental health treatment.

- Disproportionate Share Hospital (DSH) payments are funds given to hospitals that tend to serve more low-income and uninsured patients than other hospitals.

- Payments to Medicare include covering Medicare premiums for individuals who are dually eligible for both Medicaid and Medicare.

- FFS refers to fee-for-service payments, in which doctors are reimbursed for each test and service performed.

- Managed care is the practice of paying private health plans with Medicaid funds to cover enrollees.

The largest portion—38 percent—of Medicaid spending in New Hampshire in 2016 went to managed care. The next-largest portion of Medicaid spending in New Hampshire went to FFS long-term care, which comprised about 33 percent of spending. About 2 percent of Medicaid spending in New Hampshire was used for payments to Medicare. Hover over the sections in the column chart below to view more data points for New Hampshire and three of its neighboring states.[35]

| Back to top↑ |

Children's Health Insurance Program[edit]

The Children's Health Insurance Program (CHIP) is a public healthcare program for low-income children who are ineligible for Medicaid. CHIP and Medicaid are related programs, and the former builds on Medicaid's coverage of children. States may run CHIP as an extension of Medicaid, as a separate program, or as a combination of both. Like Medicaid, CHIP is financed by both the states and the federal government, and states retain general flexibility in the administration of its benefits.[36]

CHIP is available specifically for children whose families make too much to qualify for Medicaid, meaning they must earn incomes above 138 percent of the federal poverty level, or $33,948 for a family of four in 2017. Upper income limits for eligibility for CHIP vary by state, from 175 percent of the federal poverty level (FPL) in North Dakota to 405 percent of the FPL in New York. States have greater flexibility in designing their CHIP programs than with Medicaid. For instance, fewer benefits are required to be covered under CHIP. States can also charge a monthly premium and require cost sharing, such as copayments, for some services; the total cost of premiums and cost sharing may be no more than 5 percent of a family's annual income. As of January 2017, 14 states charged only premiums to CHIP enrollees, while nine states required only cost sharing. Sixteen states required both premiums and cost sharing. Eleven states did not require either premiums or cost sharing.[9][36][37][38][39]

As of 2017, New Hampshire served CHIP enrollees through Medicaid. Its upper eligibility limit was 323 percent of the FPL, meaning a family of four had to make less than $79,458 per year to qualify. The state did not impose premiums or cost sharing. Below is a table with some general information about CHIP in New Hampshire, including spending figures, the state's federal match percentage, and enrollment in the program. These data points are compared with those of its neighboring states.[40][41][42][43][44]

| General CHIP information for New Hampshire | |||||||

|---|---|---|---|---|---|---|---|

| State | Total CHIP expenditures, 2015 (millions) | Enhanced FMAP, 2017* | CHIP enrollment, 2014 | Program type | |||

| Federal | State | Total | |||||

| New Hampshire | $24.8 | $4.2 | $29.0 | 88.0% | 16,651 | Medicaid Expansion | |

| Maine | $23.4 | $8.5 | $31.8 | 98.1% | 22,310 | Combination | |

| Massachusetts | $377.9 | $203.5 | $581.3 | 88.0% | 168,941 | Combination | |

| Vermont | $13.6 | -$4.1 | $9.5 | 91.1% | 4,766 | Medicaid Expansion | |

| United States | $9,528.00 | $3,933.40 | $13,461.40 | 88.00% | 8,129,426 | N/A | |

| * FMAP stands for Federal Medical Assistance Percentage and reflects the percentage of state dollars spent on CHIP that are eligible for matching funds from the federal government. | |||||||

| Back to top↑ |

Historical data[edit]

Enrollment[edit]

To view detailed historical data on Medicaid enrollment in New Hampshire for 2010, click "Show more" below to expand the section.

According to a July 2014 report from the Pew Charitable Trusts, in 2010 there were 167,560 New Hampshire residents enrolled in Medicaid. By 2013, Medicaid covered 10 percent of New Hampshire residents; between 2000 and 2012, this figure had increased by 3.8 percentage points. In 2010 the majority of spending, 69 percent, was on the elderly and disabled, who made up 27 percent of Medicaid enrollees. This was typical of most states, since this group of enrollees is "more likely to have complex health care needs that require costly acute and long-term care services," according to the Pew Charitable Trusts. The proportion of these individuals who are enrolled in Medicaid is taken into consideration when lawmakers make appropriations for the program each year.[45]

| Distribution of Medicaid enrollment and payments, 2010 | ||||||

|---|---|---|---|---|---|---|

| State | Enrollment rates | Payment for services | ||||

| Total | Elderly and disabled individuals | Parents and children | Total (in billions) | Elderly and disabled individuals | Parents and children | |

| New Hampshire | 167,560 | 27% | 73% | $1.1 | 69% | 31% |

| Maine | 375,943 | 38% | 62% | $2.2 | 75% | 25% |

| Massachusetts | 1,690,693 | 26% | 74% | $11.6 | 66% | 34% |

| Vermont | 196,412 | 24% | 76% | $1.2 | 56% | 44% |

| United States | 66,390,642 | 24% | 76% | $369.3 | 64% | 36% |

| Source: The Pew Charitable Trusts, "State Health Care Spending on Medicaid" | ||||||

Dual eligibility[edit]

- See also: Medicaid and Medicare dual eligibility

To view detailed historical data on dual eligibility for Medicaid and Medicare in New Hampshire for 2011, click "Show more" below to expand the section.

Enrollment[edit]

Some individuals, such as low-income seniors, are eligible for both Medicare and Medicaid; these individuals are known as dual-eligible beneficiaries. For those enrolled in Medicare who are eligible, enrolling in Medicaid may provide some benefits not covered by Medicare, such as stays longer than 100 days at nursing facilities, prescription drugs, eyeglasses, and hearing aids. Medicaid may also be used to help pay for Medicare premiums. According to the Henry J. Kaiser Family Foundation, in 2011 there were 119,700 dual eligibles in New Hampshire, or 14 percent of Medicaid enrollees. While average Medicaid spending per enrollee was $4,782, spending per dual eligible was $12,530.[46][47][48][49][50]

| Dual eligible enrollment, fiscal year 2011 | |||||||

|---|---|---|---|---|---|---|---|

| State | Total Medicaid enrollment* | Medicaid spending per enrollee | Number of dual eligibles | Dual eligibles as a percent of Medicaid enrollees | Medicaid spending per dual eligible | ||

| New Hampshire | 133,700 | $7,254 | 34,500 | 20% | $20,565 | ||

| Maine | 287,800 | $5,968 | 104,000 | 28% | $14,069 | ||

| Massachusetts | 1,190,300 | $8,717 | 255,100 | 17% | $29,072 | ||

| Vermont | 138,800 | $6,291 | 30,000 | 15% | $10,299 | ||

| United States | 53,535,000 | $5,790 | 9,972,300 | 15% | $16,904 | ||

| * Data on Medicaid enrollment figures may differ depending on the source of data and the computational methods used, such as "point-in-time" figures versus "ever-enrolled" figures. Source: The Henry J. Kaiser Family Foundation, "State Health Facts" | |||||||

Spending[edit]

Total Medicaid spending for dual eligibles in New Hampshire amounted to $589 million in 2011. Most payments were made toward long-term care.[51]

| Medicaid spending for dual eligibles by service, fiscal year 2011 (in millions) | ||||||

|---|---|---|---|---|---|---|

| State | Medicare premiums | Acute care | Prescribed drugs | Long-term care | Total | |

| New Hampshire | $24 | $97 | $7 | $462 | $589 | |

| Maine | $114 | $633 | $14 | $539 | $1,299 | |

| Massachusetts | $407 | $2,146 | $31 | $2,949 | $5,533 | |

| Vermont | $6 | $173 | $0 | $86 | $264 | |

| United States | $13,489 | $40,190 | $1,462 | $91,765 | $146,906 | |

| Source: The Henry J. Kaiser Family Foundation, "State Health Facts" | ||||||

| Back to top↑ |

Recent news[edit]

The link below is to the most recent stories in a Google news search for the terms Medicaid New Hampshire. These results are automatically generated from Google. Ballotpedia does not curate or endorse these articles.

See also[edit]

Medicaid in the 50 states[edit]

Click on a state below to read more about the Medicaid program in that state.

Footnotes[edit]

- ↑ 1.0 1.1 National Academy for State Health Policy, "Where States Stand on Medicaid Expansion Decisions," accessed June 28, 2017

- ↑ 2.0 2.1 State of New Hampshire, "State of the State Speech," accessed September 21, 2015

- ↑ 3.0 3.1 Governing, "Shifting Tone, Sununu Says Medicaid Expansion Yields 'Great Results",' February 13, 2017

- ↑ The Kaiser Commission on Medicaid and the Uninsured, "Medicaid Enrollment in 50 States," February 2010 (Note 1)

- ↑ Center on Budget and Policy Priorities, "Policy Basics: Introduction to Medicaid," June 19, 2015

- ↑ 6.0 6.1 The Henry J. Kaiser Family Foundation, "Medicaid Financing: How Does it Work and What are the Implications?" May 20, 2015

- ↑ Centers for Medicare and Medicaid Services

- ↑ Kaiser Health News, "Consumer’s Guide to Health Reform," April 13, 2010

- ↑ 9.0 9.1 9.2 Office of The Assistant Secretary for Planning and Evaluation, "Poverty Guidelines," accessed June 9, 2017

- ↑ The Henry J. Kaiser Family Foundation, "Federal Core Requirements and State Policy Options in medicaid: Current Policies and Key Issues," accessed May 13, 2017

- ↑ Medicaid.gov, "Medicaid & CHIP in New Hampshire," accessed May 13, 2017

- ↑ Center for American Progress, "10 Frequently Asked Questions About Medicaid Expansion," April 2, 2013

- ↑ 13.0 13.1 13.2 13.3 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

- ↑ Bloomberg BMA, "Medicaid Expansion Will Drive Affordability, Insurance Leader Says," September 29, 2016

- ↑ 15.0 15.1 Cato Institute, "No Miracle in Medicaid Expansion," February 4, 2014

- ↑ National Federation of Independent Business, "NFIB Calls for Halt on Last-Minute Medicaid Expansion Attempt," February 1, 2017

- ↑ 17.0 17.1 Medicaid.gov, "Benefits," accessed June 8, 2017

- ↑ The Commonwealth Fund, "Medicaid Benefit Designs for Newly Eligible Adults: State Approaches," May 11, 2015

- ↑ 19.0 19.1 19.2 The Henry J. Kaiser Family Foundation, "KCMU Medicaid Benefits Database: General Benefits and Cost-Sharing Notes," January 2014

- ↑ The Henry J. Kaiser Family Foundation, "Medicaid Benefits Data Collection," accessed September 24, 2015

- ↑ The Henry J. Kaiser Family Foundation, "Medicaid Benefits Data Collection," accessed September 24, 2015

- ↑ The Henry J. Kaiser Family Foundation, "Total Medicaid Spending," accessed July 17, 2015

- ↑ Medicaid and CHIP Payment and Access Commission, "Medicaid Benefit Spending per Full-Year Equivalent Enrollee by State and Eligibility Group, FY 2012," accessed September 14, 2015

- ↑ The Pew Charitable Trusts, "State Health Care Spending on Medicaid: Table B.1," accessed July 17, 2015

- ↑ The Henry J. Kaiser Family Foundation, "Total Medicaid Spending - 2012," accessed July 17, 2015

- ↑ Kaiser Family Foundation, "Total Medicaid Spending - 2013," accessed May 31, 2017

- ↑ Kaiser Family Foundation, "Total Medicaid Spending - 2014," accessed May 31, 2017

- ↑ MACPAC, "Medicaid Spending by State, Category, and Source of Funds," accessed May 31, 2017

- ↑ Kaiser Family Foundation, "Total Medicaid Spending - 2016," accessed May 31, 2017

- ↑ MACPAC, "Medicaid Benefit Spending Per Full-Year Equivalent (FYE) Enrollee by State and Eligibility Group," accessed May 26, 2017

- ↑ MACPAC, "Medicaid as a Share of State Budgets Including and Excluding Federal Funds by State," accessed May 26, 2017

- ↑ Kaiser Family Foundation, "Federal and State Share of Medicaid Spending," accessed May 26, 2017

- ↑ Kaiser Family Foundation, "Federal Medical Assistance Percentage (FMAP) for Medicaid and Multiplier," accessed May 26, 2017

- ↑ Medicaid.gov, "March 2017 Medicaid and CHIP Enrollment Data Highlights," accessed May 26, 2017

- ↑ The Henry J. Kaiser Family Foundation, "Distribution of Medicaid Spending by Service," accessed May 31, 2017

- ↑ 36.0 36.1 The Henry J. Kaiser Family Foundation, "Children’s Health Coverage: Medicaid, CHIP and the ACA," March 26, 2014

- ↑ Healthcare.gov, "The Children's Health Insurance Program (CHIP)," accessed March 24, 2016

- ↑ National Health Law Program, "Q & A: The Supreme Court's Decision on the ACA's Medicaid Expansion," July 23, 2016

- ↑ Kaiser Family Foundation, "Premium, Enrollment Fee, and Cost Sharing Requirements for Children, January 2017," accessed June 9, 2017

- ↑ The Henry J. Kaiser Family Foundation, "Medicaid and CHIP Eligibility, Enrollment, Renewal, and Cost Sharing Policies as of January 2017: Findings from a 50-State Survey," accessed May 31, 2017

- ↑ Medicaid and CHIP Payment and Access Commission, "CHIP Spending by State," accessed May 26, 2016

- ↑ The Henry J. Kaiser Family Foundation, "Enhanced Federal Medical Assistance Percentage (FMAP) for CHIP," accessed May 26, 2016

- ↑ The Henry J. Kaiser Family Foundation, "CHIP Program Name and Type," accessed May 26, 2016

- ↑ The Henry J. Kaiser Family Foundation, "Total Number of Children Ever Enrolled in CHIP Annually," accessed May 26, 2017

- ↑ The Pew Charitable Trusts, "State Health Care Spending on Medicaid," July 2014

- ↑ The Henry J. Kaiser Family Foundation, "Monthly Medicaid Enrollment (in thousands)," accessed September 4, 2015

- ↑ The Henry J. Kaiser Family Foundation, "Medicaid Spending per Enrollee (Full or Partial Benefit)," accessed September 4, 2015

- ↑ The Henry J. Kaiser Family Foundation, "Number of Dual Eligible Beneficiaries," accessed September 4, 2015

- ↑ The Henry J. Kaiser Family Foundation, "Dual Eligibles as a Percent of Total Medicaid Beneficiaries," accessed September 4, 2015

- ↑ The Henry J. Kaiser Family Foundation, "Medicaid Spending per Dual Eligible per Year," accessed September 4, 2015

- ↑ The Henry J. Kaiser Family Foundation, "Distribution of Medicaid Spending for Dual Eligibles by Service (in Millions)," accessed July 17, 2015

KSF

KSF