Oil and natural gas extraction on federal land

From Ballotpedia - Reading time: 19 min

From Ballotpedia - Reading time: 19 min

![]() This article does not receive scheduled updates. If you would like to help our coverage grow, consider donating to Ballotpedia. Contact our team to suggest an update.

This article does not receive scheduled updates. If you would like to help our coverage grow, consider donating to Ballotpedia. Contact our team to suggest an update.

As of 2013, the federal government owned between 635 million to 640 million acres, or 28 percent, of the 2.27 billion acres of land in the United States. Approximately 26 percent of the land owned by the federal government (around 166 million acres) can be leased to private individuals and companies for energy development, including drilling for crude oil and natural gas, solar energy generation, and geothermal energy production. Oil and natural gas drilling on federal lands in the United States is primarily overseen by the U.S. Bureau of Land Management (BLM). According to the Congressional Research Service, federal agencies manage their acreage for the purpose of "preservation, recreation, and [the] development of natural resources."[1][2]

See also: Energy policy in the United States and Fracking in the United States

Background[edit]

Mineral rights[edit]

The United States allows property owners to have a right to land they own (surface rights) and a right to the minerals located under their property (mineral rights). Any ownership structure where someone has a property right, an air right, and a mineral right on a piece of land is called fee simple ownership. In some cases, an individual with the mineral right is not the same person as the individual with the property right.[3][4]

The federal government holds the mineral rights for almost all federal lands, with the exception of 4 million acres of acquired lands. As of 2015, the federal government managed roughly 700 million acres of mineral rights, half of which contain oil or natural gas reserves. Of the 700 million acres, 258 million acres were managed by the U.S. Bureau of Land Management (BLM), 57 million acres had split-estate ownership (in which private individuals had surface rights while the federal government owned the subsurface mineral rights), and 385 million acres were managed by other federal agencies.[2][4][5]

The Mineral Leasing Act of 1920 permitted the BLM to manage oil and gas leases for private individuals across 564 million acres of land, including state and federal lands, national forests, BLM-managed lands, and other areas where the federal government possesses the mineral rights. According to the BLM, there were 63,000 onshore crude oil and natural gas wells on federal lands. The production from these wells accounted for 5 percent of U.S. crude oil production and 11 percent of domestic natural gas production (the BLM provided no year for these data).[6][7]

Bureau of Land Management[edit]

As of 2015, the U.S. Bureau of Land Management (BLM) managed 247.8 million surface acres in addition to 700 million acres of subsurface mineral resources. Of these 700 million acres, around 166 million acres (23.71 percent) can be leased for energy development. The BLM's land management policies are meant to balance energy development, grazing, recreation and conservation. As of 2015, most oil and gas leases on federal land were managed by the BLM in coordination with the federal agency responsible for the land or non-federal owners (for example, the federal government may lease the mineral rights below land that is owned by a private individual).[1][2][4][8]

The table below can be expanded to show surface and subsurface ownership by the BLM across the United States. The column showing split-estate federal minerals refers to land where the federal government holds the mineral rights and a private owner holds the surface rights to an area. According to the BLM, the exact figure of split-estate ownership was not known as of 2015 but ranged between 55 million acres to 60 million acres. The BLM oversees the development of minerals on some American Indian-owned lands, which is included in the table below. The column titled BLM-managed public lands refers acreage where the BLM holds both the surface and mineral rights.[2][4]

| Surface and subsurface land ownership for the BLM, in million of acres for fiscal year 2014 | ||||||

|---|---|---|---|---|---|---|

| State | Total state acreage | Federal minerals | Federal surface lands | BLM-managed public lands | Split-estate federal minerals | American Indian trust minerals |

| Alaska | 365.48 | 237 | 237 | 73 | 0 | 1.2 |

| Arizona | 72.69 | 35.8 | 33 | 12.2 | 3 | 20.7 |

| California | 100.21 | 47.5 | 45 | 15.3 | 2.5 | 0.6 |

| Colorado | 66.49 | 29 | 24.1 | 8.3 | 5.2 | 0.8 |

| Eastern states* | -- | 40 | 40 | 0.1 | 0.3 | 2.3 |

| Hawaii | 4.11 | 0.6 | 0.6 | 0 | 0 | 0 |

| Idaho | 52.93 | 36.5 | 33.1 | 11.6 | 3.4 | 0.6 |

| Kansas | 52.51 | 0.8 | 0.7 | 0 | 0.1 | 0 |

| Montana | 93.27 | 37.8 | 26.1 | 8. 0 | 11.7 | 5.5 |

| Nebraska | 49.03 | 0.7 | 0.7 | 0.1 | 0 | 0.1 |

| Nevada | 70.26 | 58.7 | 58.4 | 47.8 | 0.3 | 1.2 |

| New Mexico | 77.77 | 36 | 26.5 | 13.4 | 9.5 | 8.4 |

| North Dakota | 44.45 | 5.6 | 1.1 | 0.1 | 4.5 | 0.9 |

| Oklahoma | 44.09 | 2.3 | 1.7 | 0.1 | 0.5 | 1.1 |

| Oregon | 61.6 | 33.9 | 32.4 | 16.1 | 1.5 | 0.8 |

| South Dakota | 48.88 | 3.7 | 2.1 | 0.2 | 1.6 | 5 |

| Texas | 168.22 | 4.5 | 4.5 | 0.1 | 0 | 0 |

| Utah | 52.7 | 35.2 | 34 | 22.8 | 1.2 | 2.3 |

| Washington | 42.69 | 12.5 | 12.2 | 0.4 | 0.3 | 2.6 |

| Wyoming | 62.34 | 41.6 | 30 | 18.3 | 11.6 | 1.9 |

| U.S. total | 1,529.72 | 699.7 | 643.2 | 247.9 | 57.2 | 56 |

| Note: *Eastern states include the 31 states east of the Mississippi River Source: U.S. Bureau of Land Management, "Mineral and Surface Acreage Managed by the BLM" U.S. Bureau of Land Management, "Public Land Statistics 2014" | ||||||

Regulation[edit]

The process to develop oil and natural gas on federal lands has five phases:

1. Land use planning

2. Lease sales

3. Well permitting

4. Well operations and production

5. Well reclamation

Land use planning involves resource management plans (RMP). RMPs are guidelines involving the types of activities that take place on federal land. These plans contain information on the land's resources and the potential environmental impact of oil or gas exploration. RMPs are developed with input from stakeholder groups, the public, and local, state and tribal governments. The plans identify potential areas where oil or gas activity could occur; these areas are known as parcels. Any individual can nominate a parcel for consideration for oil and gas development by writing to a BLM state office. The BLM reviews the nominations before the parcels are put up for sale. Parcels are put up for competitive bidding during a lease sale. BLM state offices are required by law to hold lease sales quarterly if land is available. If a bidder secures a lease, the leaseholder has the right to drill for oil or natural gas (within the parameters given below) for 10 years or as long as there is a producing well on the parcel. Leaseholders must pay an annual fee of $1.50 per acre for the first five years of a lease; after five years, the fee is $2.00 per acre. Royalty fees are also charged on the production of oil and natural gas on federal lands. As of 2014, this fee was 12.5 percent, though exceptions can be made.[5][7][9][10][11]

After a lease has been obtained, the leaseholder must submit an Application for Permit to Drill (APD). If this permit is approved, a BLM geologist will identify groundwater aquifers and other potential health or safety risks. Based on these risks, the geologists may require additional well construction procedures. Once a permit to drill is obtained, drilling can begin. The BLM performs inspections during well construction, drilling, and production. BLM inspectors determine whether oil and gas operators are following their APD. BLM officials are required to be on location during any drilling, well casing, or cementing activities. In addition, "If the fracturing of the well is considered to be a 'non-routine' fracture for the area, the BLM will always be onsite during those operations as well as when abnormal conditions develop during the drilling or completion of a well," according to the BLM.[12][13][14][15]

Well reclamation—the return of a well site to conditions before the well was built—begins before a well is constructed. The BLM requires operators to minimize impacts to the surface around a well. During the oil and gas extraction process, operators are required to reclaim areas that are no longer needed for production. The BLM defines a reclaimed well site as "a condition equal to or closely approximating that which existed before the land was disturbed." BLM inspectors review sites before, during, and after reclamation.[16]

Application for Permit to Drill[edit]

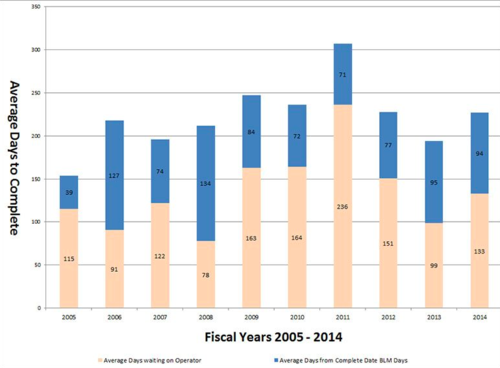

Before drilling can occur on federal lands, an Application for Permit to Drill (APD) must be submitted and approved by the U.S. Bureau of Land Management (BLM). In fiscal year (FY) 2014, the BLM approved 3,769 APDs. During that time, the BLM spent an average of 94 days to review an APD. In addition, oil and gas operators spent an average of 133 days to address the BLM's feedback. The table below can be expanded to show drilling permits approved by fiscal year for each state.[12][17]

| Approved Applications for Permit to Drill, fiscal years 2004 to 2014 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| State | FY 2004 | FY 2005 | FY 2006 | FY 2007 | FY 2008 | FY 2009 | FY 2010 | FY 2011 | FY 2012 | FY 2013 | FY 2014 |

| Alabama | 6 | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 2 | 0 | 0 |

| Alaska | 14 | 9 | 9 | 7 | 12 | 8 | 0 | 0 | 2 | 10 | 8 |

| Arizona | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 |

| Arkansas | 5 | 23 | 11 | 14 | 25 | 28 | 18 | 12 | 12 | 18 | 25 |

| California | 109 | 203 | 165 | 313 | 231 | 169 | 281 | 369 | 355 | 181 | 181 |

| Colorado | 378 | 488 | 650 | 765 | 684 | 473 | 593 | 509 | 422 | 314 | 316 |

| Connecticut | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Delaware | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Florida | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Georgia | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Hawaii | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Idaho | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Illinois | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Indiana | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Iowa | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Kansas | 1 | 0 | 2 | 10 | 0 | 3 | 2 | 0 | 0 | 1 | 1 |

| Kentucky | 4 | 0 | 0 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Louisiana | 27 | 62 | 26 | 65 | 45 | 2 | 1 | 3 | 2 | 6 | 6 |

| Maine | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Maryland | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Massachusetts | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Michigan | 11 | 0 | 8 | 4 | 5 | 0 | 1 | 0 | 0 | 1 | 1 |

| Minnesota | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Mississippi | 9 | 15 | 4 | 7 | 3 | 2 | 1 | 1 | 3 | 6 | 10 |

| Missouri | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Montana | 134 | 0 | 119 | 150 | 141 | 57 | 66 | 26 | 51 | 26 | 26 |

| Nebraska | 1 | 1 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 0 | 0 |

| Nevada | 10 | 9 | 8 | 14 | 7 | 7 | 3 | 3 | 2 | 7 | 7 |

| New Hampshire | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| New Jersey | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| New Mexico | 1,319 | 583 | 1,414 | 1,213 | 1,224 | 1,105 | 945 | 883 | 1,073 | 925 | 920 |

| New York | 0 | 0 | 0 | 0 | 4 | 0 | 0 | 0 | 0 | 0 | 0 |

| North Carolina | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| North Dakota | 66 | 109 | 72 | 88 | 65 | 147 | 135 | 197 | 255 | 254 | |

| Ohio | 3 | 0 | 0 | 0 | 0 | 1 | 3 | 1 | 1 | 1 | |

| Oklahoma | 10 | 0 | 18 | 16 | 18 | 4 | 10 | 7 | 17 | 33 | 33 |

| Oregon | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pennsylvania | 0 | 0 | 0 | 0 | 0 | 6 | 0 | 0 | 0 | 0 | 0 |

| Rhode Island | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| South Carolina | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| South Dakota | 0 | 0 | 1 | 4 | 4 | 0 | 1 | 3 | 3 | 2 | 2 |

| Tennessee | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Texas | 29 | 44 | 13 | 23 | 24 | 78 | 31 | 37 | 18 | 18 | |

| Utah | 517 | 66 | 458 | 896 | 943 | 557 | 402 | 602 | 848 | 965 | 963 |

| Vermont | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Virginia | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 0 | 0 |

| Washington | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| West Virginia | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Wisconsin | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Wyoming | 3,399 | 3,120 | 3,692 | 3,557 | 3,155 | 1,975 | 1,538 | 1,660 | 1,229 | 1,001 | 997 |

| U.S. total | 6,052 | 4,579 | 6,738 | 7,124 | 6,617 | 4,487 | 4,090 | 4,244 | 4,256 | 3,770 | 3,769 |

| Source: U.S. Bureau of Land Management, "Oil and Gas Statistics" | |||||||||||

Inspections[edit]

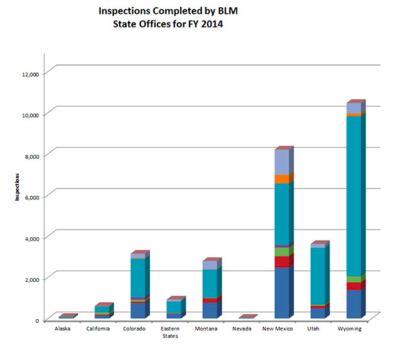

Inspections are overseen by employees of the BLM. The following graphs show the number and type of inspections performed by the BLM from fiscal year 2007 to 2014. The BLM performs eight types of inspections:

- Production inspections take place at oil and gas sites; inspectors review equipment and procedures (shown in dark blue in the graphs below).

- Drilling inspections focus on wells being drilled (red).

- Abandonment inspections focus on wells being plugged or decommissioned (light green).

- Workover inspections are "conducted on an existing producing, depleted producer or service well[s]" (purple).

- Environmental inspections are performed by specialists who oversee "reclamation, erosion concerns, topsoil stock piling, location, road, and pit construction and use, spills, water disposal methods, tank battery dikes and surface hazards" (dark green).

- Records verification inspections are done to review that the production records sent to the BLM match on-site production records (orange).

- Undesirable event inspections occur after spills, leaks or accidents (periwinkle).

- Alleged theft inspections occur when a theft is reported to the BLM (pink).

Bureau of Land Management employees performed approximately 30,000 inspections on oil and gas sites in 2014. During the years shown, agency employees performed around 35,000 inspections in 2011. Over one-third of fiscal year 2014 inspections were done by employees of the Wyoming field office. The second-most inspections were performed by employees in the Colorado field office.[18]

Leases[edit]

Leases can be held by any adult citizen of the United States. Corporations and associations organized under federal, state or local law can also hold leases. All leases must be offered at a competitive lease auction before they can be issued as a noncompetitive lease. Noncompetitive leases can only be sold if they do not receive a bid over a two-year period. "The maximum competitive lease size is 2,560 acres in the lower 48 States and 5,760 acres in Alaska. The maximum noncompetitive lease size in all States is 10,240 acres," according to the BLM. Bidding for competitive leases is done during an oral auction at a BLM state office.[7]

The graph below shows the number of onshore oil and natural gas leases across the United States from FY 1985 to FY 2014. The graph also shows the number of leases where oil or gas was produced (producing leases) during this time period. In 1985, there were 116,985 active leases. In 2014, there were 23,657 producing leases. From FY 1985 to FY 2014, there were averages of 60,644 leases and 21,043 producing leases. The table below the graph contains lease data from FY 2004 to 2014.[19]

| Onshore oil and gas lease statistics, fiscal years 2004 to 2014 | |||||

|---|---|---|---|---|---|

| Fiscal year | Acres leased | New leases issued | Acres leased during the year | Producing leases on federal lands | Producing acres on federal lands |

| 2004 | 35,446,444 | 2,699 | 4,157,121 | 21,889 | 11,671,414 |

| 2005 | 36,452,327 | 3,514 | 4,314,207 | 23,511 | 12,529,618 |

| 2006 | 45,341,322 | 3,746 | 4,385,378 | 22,859 | 12,267,612 |

| 2007 | 44,479,478 | 3,499 | 4,634,736 | 21,680 | 11,629,625 |

| FY 2008 | 47,242,495 | 2,416 | 2,615,259 | 23,293 | 14,543,425 |

| 2009 | 45,364,991 | 2,072 | 1,913,602 | 22,599 | 12,842,209 |

| 2010 | 41,186,158 | 1,308 | 1,353,663 | 22,676 | 12,205,416 |

| 2011 | 38,463,552 | 2,188 | 2,016,176 | 22,682 | 12,316,233 |

| 2012 | 37,792,212 | 1,729 | 1,752,060 | 23,306 | 12,512,974 |

| 2013 | 36,092,482 | 1,468 | 1,172,808 | 23,507 | 12,617,743 |

| 2014 | 34,592,450 | 1,157 | 1,197,852 | 23,657 | 12,690,806 |

| Source: U.S. Bureau of Land Management, "Oil and Gas Statistics" | |||||

Lease sales[edit]

In fiscal year (FY) 2014, the BLM collected $202,534,383 in revenue from oil and gas lease sales on 5.8 million acres of land. An average of 77.24 percent of the acres the BLM put up for lease received a bid in FY 2014. A majority of the acres put up for lease in FY 2014 were in Alaska. Parcels auctioned off in July 2014 in New Mexico, Oklahoma and Texas had the highest revenue of any single auction in 2014—$83,104,824. This averaged to $6,256.95 for each of the 13,282 acres of land auctioned.[20]

| Oil and gas lease sales in the United States, fiscal year 2014 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| BLM state office | Date of sale | Total revenue | Parcels posted | Acreage posted | Parcels offered day of sale | Acreage offered day of sale | Parcels receiving bids | Percent of parcels receiving bids § | Acreage receiving bids | Percent of acreage receiving bids § |

| Eastern states* | 9/18/2014 | $49,633 | 2 | 80 | 2 | 80 | 2 | 100.00% | 80 | 100.00% |

| Nevada | 9/9/2014 | $68,416 | 71 | 117,838 | 71 | 117,838 | 9 | 12.68% | 15,476 | 13.13% |

| Utah | 8/19/2014 | $36,334 | 22 | 39,288 | 22 | 39,288 | 2 | 9.09% | 2,063 | 5.25% |

| Wyoming | 8/5/2014 | $11,064,900 | 77 | 42,045 | 77 | 41,802 | 74 | 96.10% | 40,601 | 97.13% |

| Nevada | 7/17/2014 | $137,472 | 102 | 174,021 | 102 | 173,921 | 27 | 26.47% | 38,071 | 21.89% |

| New Mexico, Oklahoma and Texas | 7/16/2014 | $83,104,824 | 32 | 13,597 | 31 | 13,282 | 31 | 100.00% | 13,282 | 100.00% |

| Montana, North Dakota and South Dakota | 7/15/2014 | $1,115,909 | 52 | 15,504 | 50 | 15,469 | 50 | 100.00% | 15,469 | 100.00% |

| Eastern states* | 6/19/2014 | $22,291 | 9 | 802 | 9 | 802 | 8 | 88.89% | 642 | 80.05% |

| Colorado | 6/12/2014 | $295,688 | 23 | 18,837 | 12 | 7,936 | 7 | 58.33% | 4,676 | 58.92% |

| Montana, North Dakota and South Dakota | 5/21/2014 | $4,582,755 | 43 | 14,620 | 43 | 14,620 | 43 | 100.00% | 14,620 | 100.00% |

| Utah | 5/20/2014 | $2,927,005 | 96 | 102,726 | 93 | 102,262 | 62 | 66.67% | 50,072 | 48.96% |

| Wyoming | 5/6/2014 | $10,864,041 | 53 | 52,350 | 53 | 52,350 | 53 | 100.00% | 52,350 | 100.00% |

| New Mexico, Oklahoma and Texas | 4/16/2014 | $658,195 | 14 | 2,774 | 14 | 2,774 | 14 | 100.00% | 2,774 | 100.00% |

| Eastern states* | 3/20/2014 | $425,937 | 23 | 18,244 | 22 | 18,224 | 22 | 100.00% | 18,224 | 100.00% |

| New Mexico, Oklahoma and Texas | 2/26/2014 | $31,325,593 | 77 | 42,182 | 77 | 42,182 | 77 | 100.00% | 42,182 | 100.00% |

| Colorado | 2/13/2014 | $413,441 | 9 | 7,435 | 9 | 7,435 | 6 | 66.67% | 6,705 | 90.18% |

| Wyoming | 2/11/2014 | $14,079,138 | 167 | 153,934 | 165 | 152,035 | 165 | 100.00% | 152,035 | 100.00% |

| Montana, North Dakota and South Dakota | 1/28/2014 | $17,513,861 | 45 | 2,939 | 40 | 2,261 | 40 | 100.00% | 2,261 | 100.00% |

| Eastern states* | 12/12/2013 | $505,912 | 18 | 1,480 | 17 | 1,280 | 17 | 100.00% | 1,280 | 100.00% |

| Nevada | 12/10/2013 | $1,979,581 | 178 | 303,334 | 178 | 303,334 | 54 | 30.34% | 93,816 | 30.93% |

| New Mexico | 11/21/2013 | $11,363,974 | 17 | 5,554 | 17 | 5,554 | 17 | 100.00% | 5,554 | 100.00% |

| Utah | 11/19/2013 | $3,399,486 | 82 | 143,981 | 35 | 44,021 | 29 | 82.86% | 36,475 | 82.86% |

| Colorado | 11/14/2013 | $9,973 | 10 | 2,518 | 10 | 2,518 | 7 | 70.00% | 1,945 | 77.24% |

| Alaska | 11/6/2013 | $2,885,153 | 408 | 4,458,146 | 408 | 4,458,146 | 22 | 5.39% | 245,293 | 5.50% |

| Wyoming | 11/5/2013 | $2,834,233 | 35 | 42,677 | 35 | 42,677 | 34 | 97.14% | 42,587 | 99.79% |

| Montana, North Dakota and South Dakota | 10/22/2013 | $870,638 | 87 | 21,645 | 87 | 21,645 | 84 | 96.55% | 20,845 | 96.30% |

| U.S. total | -- | $202,534,383 | 1,752 | 5,798,551 | 1,679 | 5,683,736 | 956 | -- | 919,378 | -- |

| *Eastern states include the 31 states east of the Mississippi River; § Percentages are for day of sales Source: U.S. Bureau of Land Management, "Oil and Gas Lease Sales, Fiscal Year 2014" | ||||||||||

Oil and gas production[edit]

The Office of Natural Resources Revenue (ONRR) provides data on mineral production on federal lands. The tables below show federal onshore oil and natural gas production (in terms of the amount sold) for fiscal years 2004 to 2014. In fiscal year 2014, New Mexico produced the most oil from federal lands—57,991,603 barrels. Of the states with oil production, Arkansas had the lowest level of production with one barrel of oil.[21]

| Onshore oil production on federal lands in the United States, in thousands of barrels, fiscal years 2004 to 2014 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| State | FY 2004 | FY 2005 | FY 2006 | FY 2007 | FY 2008 | FY 2009 | FY 2010 | FY 2011 | FY 2012 | FY 2013 | FY 2014 |

| Alabama | 321.64 | 236.97 | 103.47 | 69.83 | 63.89 | 43.83 | 40.38 | 37.56 | 34.40 | 31.00 | 24.52 |

| Alaska | 233.38 | 210.73 | 230.12 | 193.62 | 163.19 | 131.34 | 159.15 | 170.27 | 158.40 | 539.23 | 594.01 |

| Arizona | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Arkansas | 0.06 | 0.04 | 0.03 | 0.02 | 0.01 | 0.01 | 0.00 | 0.01 | 0.00 | 0.00 | 0.001 |

| California | 14,063.87 | 14,242.57 | 16,187.28 | 17,798.59 | 15,403.05 | 13,993.01 | 13,998.92 | 14,633.83 | 15,016.44 | 15,311.45 | 14,967.07 |

| Colorado | 4,167.61 | 4,898.33 | 5,629.65 | 4,810.75 | 4,629.51 | 4,480.42 | 4,308.20 | 4,131.21 | 4,578.12 | 4,282.25 | 4,780.39 |

| Connecticut | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Delaware | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Florida | 0.45 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Georgia | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Hawaii | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Idaho | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Illinois | 38.03 | 34.71 | 34.59 | 41.25 | 33.88 | 34.08 | 31.87 | 26.97 | 28.66 | 26.73 | 20.67 |

| Indiana | 1.97 | 1.21 | 0.73 | 0.26 | 0.31 | 0.67 | 4.77 | 2.53 | 2.41 | 2.20 | 0.00 |

| Iowa | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Kansas | 115.25 | 194.92 | 551.70 | 381.35 | 329.28 | 280.19 | 246.05 | 269.30 | 265.79 | 234.37 | 190.37 |

| Kentucky | 11.65 | 13.15 | 11.26 | 12.31 | 13.71 | 12.89 | 13.32 | 12.74 | 11.99 | 11.86 | 11.10 |

| Louisiana | 516.53 | 455.95 | 411.77 | 447.00 | 452.11 | 389.35 | 361.30 | 357.75 | 367.50 | 317.53 | 339.90 |

| Maine | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Maryland | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Massachusetts | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Michigan | 24.10 | 22.84 | 29.00 | 28.04 | 34.35 | 31.63 | 48.35 | 35.42 | 32.72 | 32.25 | 29.15 |

| Minnesota | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Mississippi | 483.72 | 426.66 | 329.75 | 296.54 | 255.23 | 247.18 | 257.00 | 301.95 | 284.71 | 409.65 | 408.70 |

| Missouri | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Montana | 3,802.29 | 3,719.63 | 3,882.22 | 3,852.65 | 3,764.48 | 3,435.79 | 3,098.58 | 2,843.67 | 2,712.03 | 2,667.81 | 2,576.22 |

| Nebraska | 38.58 | 37.23 | 39.42 | 69.00 | 59.29 | 39.39 | 38.16 | 34.28 | 24.70 | 26.71 | 25.93 |

| Nevada | 465.84 | 451.75 | 420.98 | 416.62 | 414.58 | 444.75 | 445.53 | 409.01 | 367.29 | 335.34 | 314.27 |

| New Hampshire | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| New Jersey | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| New Mexico | 29,743.72 | 26,014.58 | 24,410.78 | 24,874.88 | 25,111.49 | 27,997.02 | 30,648.96 | 34,191.41 | 41,269.57 | 50,250.65 | 57,991.60 |

| New York | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| North Carolina | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| North Dakota | 5,668.16 | 6,233.58 | 6,851.44 | 7,201.01 | 7,360.63 | 7,327.97 | 8,898.89 | 11,159.08 | 14,764.91 | 15,677.00 | 16,127.49 |

| Ohio | 28.73 | 31.45 | 31.10 | 33.61 | 32.73 | 28.86 | 32.15 | 24.20 | 24.27 | 16.38 | 14.43 |

| Oklahoma | 173.26 | 148.26 | 133.76 | 171.03 | 198.35 | 219.97 | 169.02 | 279.98 | 488.98 | 411.71 | 342.71 |

| Oregon | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Pennsylvania | 0.62 | 0.00 | 0.00 | 0.01 | 0.01 | 3.72 | 7.54 | 2.82 | 3.80 | 1.70 | 1.22 |

| Rhode Island | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| South Carolina | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| South Dakota | 165.34 | 173.44 | 197.95 | 189.71 | 203.07 | 182.38 | 161.27 | 165.10 | 229.69 | 229.27 | 201.42 |

| Tennessee | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Texas | 430.76 | 415.96 | 377.10 | 341.49 | 324.71 | 331.08 | 291.14 | 360.64 | 484.78 | 350.48 | 273.28 |

| Utah | 4,689.93 | 5,902.97 | 7,299.33 | 8,540.37 | 9,749.03 | 11,337.64 | 11,271.80 | 11,118.34 | 10,991.61 | 11,680.61 | 13,195.80 |

| Vermont | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Virginia | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.00 |

| Washington | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| West Virginia | 0.04 | 0.12 | 0.71 | 0.00 | 0.00 | 0.00 | 0.02 | 0.00 | 0.00 | 0.00 | 0.00 |

| Wisconsin | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Wyoming | 32,033.79 | 32,447.90 | 33,196.71 | 34,519.68 | 34,461.28 | 33,532.54 | 33,385.91 | 32,841.43 | 33,149.70 | 34,208.74 | 36,372.70 |

| Total US | 97,219.34 | 96,314.96 | 100,360.87 | 104,289.63 | 103,058.16 | 104,525.72 | 107,918.28 | 113,409.49 | 125,292.47 | 137,054.93 | 148,802.95 |

| Note: Oil includes black wax crude, condensate, drip or scrubber condensate, fuel oil inlet scrubber, oil, oil lost, other liquid hydrocarbons, sweet crude and yellow wax crude. These data are collected in terms of sale years, which are "transactions for sales that took place in a given fiscal year and do not include adjusted or corrected transactions for sales that took place in previous fiscal years."[22] Source: Office of Natural Resource Revenue, "Statistical Information" | |||||||||||

According to the ONRR, Wyoming was first in natural gas production on federal lands in fiscal year 2014 with 1,118,572.41 million cubic feet (MMCF) of natural gas. Natural gas production on federal lands was lowest in Pennsylvania. In fiscal year 2014, 11.91 MMCF of natural gas was produced on federal lands in Pennsylvania.[21]

| Onshore natural gas production on federal lands, in MMCF, fiscal years 2004 to 2014 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| State | FY 2004 | FY 2005 | FY 2006 | FY 2007 | FY 2008 | FY 2009 | FY 2010 | FY 2011 | FY 2012 | FY 2013 | FY 2014 |

| Alabama | 53,477.72 | 47,567.63 | 44,489.84 | 36,462.63 | 33,777.67 | 30,361.81 | 28,210.00 | 23,001.79 | 19,946.41 | 18,990.02 | 18,430.66 |

| Alaska | 33,707.07 | 35,561.24 | 30,748.22 | 25,468.66 | 22,863.05 | 20,992.08 | 18,497.95 | 15,747.92 | 15,534.96 | 12,670.47 | 13,078.97 |

| Arizona | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Arkansas | 7,519.41 | 9,249.09 | 10,100.39 | 9,964.81 | 10,388.41 | 14,674.47 | 17,977.56 | 13,993.55 | 12,391.93 | 10,884.98 | 10,349.28 |

| California | 3,473.01 | 3,727.26 | 5,307.77 | 4,509.28 | 4,977.95 | 4,917.14 | 5,976.73 | 8,815.77 | 11,680.03 | 6,746.33 | 7,076.67 |

| Colorado | 141,659.94 | 189,008.37 | 204,410.15 | 230,357.33 | 252,663.32 | 267,582.03 | 271,607.96 | 309,852.06 | 340,405.39 | 334,594.79 | 339,478.33 |

| Connecticut | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Delaware | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Florida | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Georgia | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Hawaii | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Idaho | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Illinois | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Indiana | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Iowa | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Kansas | 10,159.74 | 9,069.61 | 8,372.31 | 7,655.99 | 7,660.04 | 7,335.33 | 6,551.38 | 5,971.55 | 4,925.08 | 4,454.63 | 4,037.52 |

| Kentucky | 271.90 | 248.38 | 278.00 | 285.01 | 314.80 | 271.37 | 218.39 | 166.82 | 119.62 | 83.54 | 78.88 |

| Louisiana | 14,245.70 | 29,484.86 | 30,491.96 | 29,733.94 | 30,249.47 | 22,903.46 | 16,855.92 | 19,443.81 | 20,120.92 | 16,040.41 | 11,124.90 |

| Maine | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Maryland | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Massachusetts | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Michigan | 4,137.57 | 4,058.85 | 4,089.54 | 3,801.51 | 3,457.62 | 2,615.24 | 2,255.88 | 1,954.29 | 1,680.64 | 1,505.65 | 1,200.39 |

| Minnesota | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Mississippi | 904.42 | 1,067.45 | 1,035.55 | 756.58 | 687.51 | 709.04 | 833.83 | 1,045.24 | 707.25 | 526.29 | 252.10 |

| Missouri | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Montana | 24,047.16 | 28,714.40 | 31,635.65 | 32,089.08 | 31,665.34 | 29,840.00 | 25,589.86 | 22,130.34 | 16,908.12 | 12,822.98 | 12,163.00 |

| Nebraska | 0.00 | 961.11 | 1,842.68 | 651.65 | 135.59 | 12.80 | 0.00 | 0.64 | 2.74 | 1.72 | 1.30 |

| Nevada | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| New Hampshire | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| New Jersey | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| New Mexico | 942,889.00 | 933,540.09 | 914,703.21 | 877,646.98 | 827,498.11 | 801,359.63 | 746,392.17 | 715,763.44 | 690,164.54 | 659,891.23 | 646,876.09 |

| New York | 19.93 | 16.61 | 11.85 | 11.11 | 9.74 | 11.72 | 28.82 | 87.36 | 45.51 | 33.42 | 20.65 |

| North Carolina | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| North Dakota | 7,631.94 | 8,778.50 | 10,149.40 | 10,320.92 | 9,294.35 | 8,312.83 | 8,729.75 | 8,913.20 | 10,809.33 | 12,845.98 | 12,330.81 |

| Ohio | 682.50 | 639.23 | 618.24 | 648.93 | 611.65 | 550.57 | 561.85 | 530.12 | 448.67 | 401.02 | 362.33 |

| Oklahoma | 16,097.07 | 15,767.83 | 15,545.37 | 15,134.42 | 15,949.18 | 15,973.90 | 15,107.42 | 12,616.78 | 13,020.50 | 12,744.45 | 12,504.35 |

| Oregon | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Pennsylvania | 75.08 | 82.64 | 64.40 | 80.25 | 60.31 | 82.94 | 114.17 | 70.40 | 84.69 | 23.22 | 11.91 |

| Rhode Island | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| South Carolina | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| South Dakota | 242.17 | 209.86 | 203.49 | 194.95 | 230.66 | 406.60 | 311.50 | 229.10 | 166.74 | 142.60 | 112.62 |

| Tennessee | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Texas | 23,289.79 | 22,512.77 | 22,469.48 | 25,855.44 | 24,638.24 | 23,306.72 | 21,202.17 | 28,742.01 | 53,220.53 | 48,141.37 | 38,250.09 |

| Utah | 134,604.73 | 171,680.53 | 192,970.98 | 227,168.37 | 254,597.42 | 284,850.56 | 265,305.61 | 269,401.38 | 295,347.51 | 270,580.99 | 253,252.35 |

| Vermont | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Virginia | 423.89 | 665.87 | 601.96 | 225.22 | 227.17 | 215.70 | 196.25 | 185.60 | 176.79 | 162.78 | 127.34 |

| Washington | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| West Virginia | 1,339.31 | 1,285.82 | 2,416.56 | 972.39 | 935.79 | 824.83 | 753.43 | 675.46 | 388.62 | 162.42 | 152.92 |

| Wisconsin | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Wyoming | 982,350.34 | 1,067,043.53 | 1,129,666.12 | 1,352,353.03 | 1,548,710.94 | 1,658,363.01 | 1,579,968.61 | 1,459,200.62 | 1,398,380.14 | 1,231,399.84 | 1,118,572.41 |

| U.S. total | 2,403,249.38 | 2,580,941.53 | 2,662,223.11 | 2,892,348.50 | 3,081,604.34 | 3,196,473.78 | 3,033,247.22 | 2,918,539.23 | 2,906,676.66 | 2,655,851.12 | 2,499,845.86 |

| Note: Natural gas includes coal bed methane, flash gas, fuel gas, gas lost (flared or vented), nitrogen, processed (residue) gas, unprocessed (wet) gas and gas plant products. These data are collected in terms of sale years, which are "transactions for sales that took place in a given fiscal year and do not include adjusted or corrected transactions for sales that took place in previous fiscal years."[23] Source: Office of Natural Resource Revenue, "Statistical Information" | |||||||||||

Revenue[edit]

The federal government collects taxes on oil and gas production from federal land in the form of royalties, rents, bonuses and other revenue. Royalty fees are charged after oil or natural gas is produced in paying quantities. The fees are applied to the revenue collected from companies that sell oil or natural gas. For onshore federal lands, the royalty fee was 12.5 percent as of 2015. Rents are an annual fee of $1.50 per acre for the first five years of a lease; after five years, the fee is $2.00 per acre. Bonuses are the amount collected from the highest bidder after land is leased. Other revenue includes interest, settlement agreements, and estimated and minimum royalties. Of the revenue collected, 50 percent goes to the state where the production occurred, 40 percent goes to the Land and Water Conservation Fund and the remaining 10 percent goes to the U.S. Treasury.[5][7][21][24][25]

The table below shows total revenue from onshore oil and gas production on federal lands in thousands of dollars. In FY 2014, New Mexico had the highest revenue from oil and gas activity on federal lands—$1.16 billion. Idaho had the least with $8,000. Total revenue collected increased by 76 percent, from $1.89 billion in FY 2004 to $3.33 billion in FY 2014.[21]

| Oil and gas revenue from federal lands by state, in thousands of dollars, fiscal years 2004 to 2014 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| State | FY 2004 | FY 2005 | FY 2006 | FY 2007 | FY 2008 | FY 2009 | FY 2010 | FY 2011 | FY 2012 | FY 2013 | FY 2014 |

| Alabama | $1,761 | $1,770 | $1,934 | $3,384 | $2,526 | $1,058 | $1,099 | $1,882 | $2,587 | $800 | $1,572 |

| Alaska | $17,382 | $76,678 | $26,161 | $42,248 | $27,809 | $50,191 | $25,191 | $18,485 | $19,023 | $24,803 | $25,967 |

| Arizona | $135 | $180 | $76 | $100 | $517 | $507 | $48 | $21 | $23 | $60 | $34 |

| Arkansas | $6,950 | $20,949 | $15,883 | $24,875 | $36,430 | $9,304 | $11,620 | $9,730 | $5,228 | $5,306 | $5,683 |

| California | $27,261 | $35,248 | $93,505 | $102,054 | $176,330 | $87,615 | $124,860 | $175,536 | $196,742 | $188,278 | $175,556 |

| Colorado | $118,022 | $197,548 | $247,156 | $194,203 | $317,959 | $250,886 | $184,948 | $217,474 | $180,455 | $190,531 | $242,998 |

| Connecticut | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Delaware | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Florida | $10 | $5 | $5 | $5 | $7 | $7 | $3 | $3 | $3 | $0 | $0 |

| Georgia | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Hawaii | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Idaho | $6 | $4 | $3 | $18 | $41 | $34 | $15 | $15 | $15 | $15 | $8 |

| Illinois | $158 | $205 | $254 | $296 | $423 | $216 | $281 | $287 | $319 | $301 | $242 |

| Indiana | $7 | $8 | $7 | $4 | $5 | $122 | $71 | $43 | $46 | $44 | $26 |

| Iowa | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Kansas | $6,323 | $7,716 | $11,541 | $8,293 | $12,341 | $4,432 | $6,518 | $7,283 | $5,614 | $5,376 | $5,217 |

| Kentucky | $41 | $28 | $68 | $23 | $22 | $21 | $21 | $22 | $15 | $48 | $60 |

| Louisiana | $14,143 | $38,746 | $45,813 | $38,347 | $56,040 | $17,077 | $51,764 | $26,567 | $17,644 | $12,951 | $12,178 |

| Maine | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Maryland | $2 | $11 | $8 | $12 | $11 | $9 | $8 | $10 | $6 | $10 | $16 |

| Massachusetts | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Michigan | $1,672 | $2,280 | $2,966 | $2,600 | $4,145 | $2,435 | $1,624 | $1,510 | $1,173 | $1,501 | $1,549 |

| Minnesota | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Mississippi | $2,735 | $2,987 | $4,202 | $6,278 | $4,263 | $2,224 | $2,930 | $5,556 | $9,150 | $6,126 | $5,557 |

| Missouri | $0 | $0 | $0 | $0 | $0 | $0 | $7 | $0 | $0 | $0 | $0 |

| Montana | $30,681 | $41,671 | $50,520 | $47,533 | $69,686 | $34,617 | $40,786 | $44,160 | $38,017 | $37,195 | $34,414 |

| Nebraska | $174 | $300 | $429 | $522 | $768 | $267 | $347 | $393 | $306 | $336 | $381 |

| Nevada | $4,764 | $9,767 | $13,432 | $10,674 | $13,520 | $11,021 | $9,767 | $11,095 | $15,459 | $12,036 | $10,004 |

| New Hampshire | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Jersey | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Mexico | $741,921 | $1,007,244 | $1,099,364 | $951,354 | $1,320,205 | $581,843 | $782,704 | $899,479 | $861,075 | $1,002,964 | $1,164,661 |

| New York | $13 | $16 | $14 | $10 | $12 | $7 | $16 | $48 | $15 | $14 | $14 |

| North Carolina | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| North Dakota | $28,740 | $77,106 | $65,553 | $66,104 | $109,078 | $135,252 | $123,614 | $223,445 | $208,287 | $245,721 | $211,340 |

| Ohio | $562 | $654 | $846 | $857 | $1,073 | $597 | $811 | $588 | $507 | $436 | $398 |

| Oklahoma | $10,323 | $13,309 | $15,276 | $18,998 | $21,442 | $22,257 | $9,741 | $14,141 | $18,501 | $12,483 | $12,167 |

| Oregon | $64 | $51 | $1,315 | $936 | $418 | $410 | $394 | $501 | $435 | $375 | $377 |

| Pennsylvania | $62 | $79 | $200 | $98 | $107 | $111 | $181 | $108 | $109 | $121 | $74 |

| Rhode Island | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| South Carolina | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| South Dakota | $923 | $1,365 | $1,675 | $2,011 | $2,752 | $1,563 | $1,637 | $2,328 | $3,916 | $2,861 | $3,928 |

| Tennessee | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Texas | $21,300 | $30,582 | $27,666 | $27,932 | $38,492 | $29,401 | $58,478 | $38,825 | $26,971 | $36,305 | $27,429 |

| Utah | $106,286 | $181,980 | $301,597 | $229,893 | $380,198 | $176,644 | $260,221 | $276,652 | $286,970 | $266,001 | $302,453 |

| Vermont | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Virginia | $322 | $428 | $456 | $191 | $414 | $139 | $116 | $104 | $78 | $88 | $80 |

| Washington | $2,553 | $1,019 | $5,341 | $1,328 | $1,096 | $1,043 | $606 | $388 | $33 | $0 | $0 |

| West Virginia | $805 | $1,081 | $1,079 | $1,004 | $2,209 | $733 | $666 | $509 | $477 | $577 | $610 |

| Wisconsin | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Wyoming | $741,884 | $1,047,148 | $1,269,723 | $997,553 | $1,740,752 | $784,986 | $1,163,704 | $1,201,053 | $863,021 | $940,908 | $1,081,037 |

| U.S. total | $1,887,983 | $2,798,163 | $3,304,064 | $2,779,740 | $4,341,089 | $2,207,027 | $2,864,797 | $3,178,239 | $2,762,220 | $2,994,569 | $3,326,031 |

| Note: Revenue includes reported royalties, rents, bonuses and other revenue. All data are for onshore production by sales year. "--" indicates data were not available. Sources: Office of Natural Resources Revenue, "Statistical Information" | |||||||||||

In FY 2014, $29.38 billion was collected in royalty fees for onshore oil and natural gas production on federal lands. Rental revenue totaled $372.92 million in 2014. Bonuses totaled $1.63 billion in 2014 while $284.01 million was collected in other revenue.[21]

| Oil and gas revenue from federal lands in the United States by type, in millions of dollars, fiscal years 2005 to 2014 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| State | FY 2005 | FY 2006 | FY 2007 | FY 2008 | FY 2009 | FY 2010 | FY 2011 | FY 2012 | FY 2013 | FY 2014 |

| Reported royalties | $20,842.96 | $26,428.77 | $22,456.47 | $35,662.26 | $16,509.97 | $23,158.62 | $25,887.05 | $23,774.72 | $25,952.49 | $29,379.04 |

| Rents | $538.42 | $591.72 | $625.65 | $629.47 | $591.34 | $511.47 | $457.23 | $438.66 | $410.60 | $372.92 |

| Bonus | $2,721.08 | $2,515.97 | $1,859.37 | $1,945.30 | $3,723.38 | $1,904.59 | $2,951.09 | $2,234.67 | $1,890.26 | $1,627.81 |

| Other revenue | $1,167.81 | $126.69 | -$107.96 | $652.02 | -$817.19 | $430.35 | $255.99 | -$210.64 | $213.12 | $284.01 |

| Total | $25,270.27 | $29,663.16 | $24,833.53 | $38,889.06 | $20,007.50 | $26,005.03 | $29,551.36 | $26,237.41 | $28,466.46 | $31,663.78 |

| Note: All data are for onshore production by sales year; "--" indicates data were not available. Sources: Office of Natural Resources Revenue, "Statistical Information" | ||||||||||

Other federal agencies[edit]

Forest Service[edit]

Mining on lands managed by the Forest Service is overseen by the Minerals & Geology Management (MGM) division. According to MGM, over 5 million acres, or approximately 2.6 percent, of its land is leased for oil, gas, coal and phosphate mining. As of 2015, this production was valued at around $2 billion annually. As of 2015, the agency had a memorandum of understanding with the Bureau of Land Management for managing oil and gas drilling on National Forest System lands. The memorandum allows the BLM to oversee certain oil and gas leases on National Forest System lands.[1][26][27]

Fish and Wildlife Service[edit]

The U.S. Fish and Wildlife Service (FWS) managed 300.2 million acres of land as of 2013. The main purpose of the FWS is to conserve species, including species listed under the Endangered Species Act. The FWS manages the National Wildlife Refuge System.[1]

According to the FWS, oil and gas development can occur on National Wildlife Refuge System lands under two conditions:

| “ |

1) the wells/mineral rights remained in private, state/local government, or tribal ownership when a refuge was established or lands were added, and 2) in Alaska, the wells/mineral rights are part of land interests conveyed to Native corporations under the Alaska Native Claims Settlement Act, or held by the State of Alaska and other private landowners.[28] |

” |

| —U.S. Fish and Wildlife Service, [29] | ||

Management of oil or gas drilling is done under the agency's Oil and Gas Program. In May 2015, the FWS reported that there were 5,000 total wells across 103 refuges and four Wetland Management Districts. Of these wells, 1,700 wells were active and 450 wells were unplugged (wells that are no longer producing but not fully restored). The map below has black dots for each National Wildlife Refuge and is shaded in dark gray showing unconventional oil and gas reserves across the 50 states.[29][30]

National Park Service[edit]

As of 2015, the National Park Service (NPS) managed 79.7 million acres of land. Resource extraction, including oil and gas drilling, timber harvesting, etc., is generally not permitted on these lands. The NPS requires oil and gas operators to obtain approval of their extraction plans before oil and gas activity can occur. If a plan is approved and the operator gets a reclamation bond, drilling can occur.[1][31][32]

Federal laws[edit]

The General Mining Law of 1872 regulates the mining of certain mineral resources on federal lands. The law permits individuals and corporations to prospect on public domain lands and to stake claims on mineral discoveries. The 42nd United States Congress passed the legislation in April 1872. It was signed into law by President Ulysses S. Grant in May 1872.[33][34][35]

The Mineral Leasing Act of 1920 (MLA) regulates the leasing of public lands for the development of coal, oil, natural gas, other hydrocarbons and other minerals. Prior to the Mineral Leasing Act, these minerals were subject to the General Mining Law of 1872 (and, in the case of coal, the Coal Act of 1873). Approved by the 66th United States Congress, the act was signed into law by President Woodrow Wilson on February 25, 1920. Federal land that is excluded from the leasing provisions set forth in the MLA include national parks and monuments; lands in incorporated cities, towns or villages; and areas within the National Wilderness Preservation System. Furthermore, the Secretary of the Interior may elect to withdraw lands from use under the act.[36][37] [38]

The Federal Land Policy and Management Act of 1976 (FLPMA) mandated that public lands remain under federal ownership. The law authorized the U.S. Bureau of Land Management to carry out a multiple-use policy for federal lands. In fall 1976, the law was passed by the 94th United States Congress and signed into law by President Gerald Ford. The law defines multiple-use management as the "management of public lands and their various resource values so that they are utilized in the combination that will best meet the present and future needs of the American people." Sustained yield is defined as "the achievement and maintenance in perpetuity of a high-level annual or regular periodic output of the various renewable resources of the public lands consistent with multiple use."[39][40]

Recent news[edit]

The link below is to the most recent stories in a Google news search for the terms Oil gas federal land United States. These results are automatically generated from Google. Ballotpedia does not curate or endorse these articles.

Oil and natural gas extraction on federal land in the 50 states[edit]

Click on a state below to read more about that state's energy policy.

See also[edit]

Footnotes[edit]

- ↑ 1.0 1.1 1.2 1.3 1.4 Congressional Research Service, "Federal Land Ownership: Overview and Data," February 8, 2012

- ↑ 2.0 2.1 2.2 2.3 U.S. Bureau of Land Management, "Public Land Statistics 2014," May 2015

- ↑ Geology.com, “Mineral Rights,” accessed January 29, 2014

- ↑ 4.0 4.1 4.2 4.3 U.S. Bureau of Land Management, "Mineral and Surface Acreage Managed by the BLM," October 13, 2011

- ↑ 5.0 5.1 5.2 U.S. Bureau of Land Management, "Leasing of Onshore Federal Oil and Gas Resources," September 29, 2015

- ↑ U.S. Bureau of Land Management, "Oil and Gas," September 4, 2015

- ↑ 7.0 7.1 7.2 7.3 U.S. Bureau of Land Management, "Qs&As About Oil and Gas Leasing," July 10, 2012

- ↑ U.S. Bureau of Land Management, "Surface Operating Standards and Guidelines for Oil and Gas Exploration and Development The Gold Book," 2007

- ↑ U.S. Bureau of Land Management, "Decision Support, Planning, & NEPA," December 3, 2013

- ↑ U.S. Bureau of Land Management, "Competitive LEASING," October 20, 2009

- ↑ U.S. Bureau of Land Management, "Oil and Gas Lease Sales," accessed October 20, 2014

- ↑ 12.0 12.1 U.S. Bureau of Land Management, "Fracking on BLM Colorado Well Sites," accessed May 9, 2014

- ↑ U.S. Bureau of Land Management, "Average Application for Permit to Drill (APD) Approval Timeframes: FY2005 - FY2014," January 6, 2015

- ↑ U.S. Bureau of Land Management, "Environmental REVIEW and PERMITTING," October 20, 2009

- ↑ U.S. Bureau of Land Management, "OPERATIONS and PRODUCTION Monitoring, Inspection and Enforcement," October 20, 2009

- ↑ U.S. Bureau of Land Management, "RECLAMATION and Abandonment," October 20, 2009

- ↑ U.S. Bureau of Land Management, "Average Application for Permit to Drill (APD) Approval Timeframes: FY2005 - FY2014," January 6, 2015

- ↑ U.S. Bureau of Land Management, "Oil & Gas Inspections and Enforcement," December 31, 2014

- ↑ U.S. Bureau of Land Management, "Oil and Gas Statistics," accessed October 8, 2015

- ↑ U.S. Bureau of Land Management, "Oil and Gas Lease Sales, Fiscal Year 2014," accessed October 6, 2015

- ↑ 21.0 21.1 21.2 21.3 21.4 Office of Natural Resource Revenue, "Statistical Information," accessed October 11, 2015

- ↑ Office of Natural Resource Revenue, "ONRR’s Frequently Asked Questions – FAQs," accessed October 8, 2015

- ↑ Office of Natural Resource Revenue, "ONRR’s Frequently Asked Questions – FAQs," accessed October 8, 2015

- ↑ Office of Natural Resources Revenue, "Oil and Gas Reporter Training Report of Sales and Royalty Remittance (Form 2014)," accessed October 16, 2015

- ↑ Department of the Interior, "Natural Resource Revenues from U.S. Federal Lands," accessed October 16, 2015

- ↑ U.S. Forest Service, "Welcome to Minerals & Geology Management," accessed October 5, 2015

- ↑ U.S. Forest Service, "Memorandum of Understanding Between United States Department of the Interior Bureau of Land Management and United States Department of Agriculture Forest Service," July 2006

- ↑ Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

- ↑ 29.0 29.1 U.S. Fish and Wildlife Service, "Non-Federal Oil & Gas Development on National Wildlife Refuge System Lands," May 2015

- ↑ U.S. Fish and Wildlife Service, "Oil and Gas," June 17, 2015

- ↑ National Park Service, "Oil and Gas Management," April 14, 2014

- ↑ National Park Service, "Operators Handbook for Nonfederal Oil and Gas Development in Units of the National Park System," October 2006

- ↑ Congressional Research Service, "Issue Brief for Congress: Mining on Federal Lands," updated June 11, 2002

- ↑ The Library of Congress, "Congressional Globe: Debates and Proceedings, 1833-1873," accessed August 14, 2014

- ↑ U.S. Bureau of Land Management, "Mining Claims and Sites on Federal Lands," accessed August 15, 2014

- ↑ United States House of Representatives, "Mineral Leasing Act (and Supplementary Laws)," updated January 15, 2014

- ↑ Center of the American West, "Mineral Leasing Act," accessed August 21, 2014

- ↑ Congressional Research Service, "Energy Projects on Federal Lands: Leasing and Authorization," February 1, 2012

- ↑ U.S. Bureau of Land Management, "The Federal Land Policy and Management Act of 1976 as Amended," accessed August 20, 2014

- ↑ Danver, S.L. (2013). Encyclopedia of Politics of the American West. Los Angeles, CA: SAGE Reference/CQ Press.

KSF

KSF