Lloyds Banking Group

Topic: Company

From HandWiki - Reading time: 42 min

From HandWiki - Reading time: 42 min

| |||||||||||||||||||||||||||||

25 Gresham Street | |||||||||||||||||||||||||||||

| Formerly |

| ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Type | Public | ||||||||||||||||||||||||||||

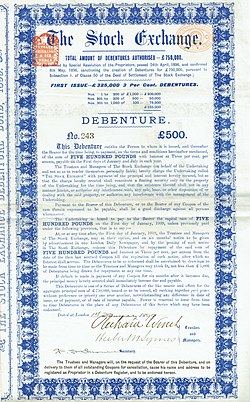

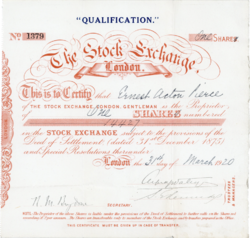

London Stock Exchange (LSE) is a stock exchange in the City of London, England , United Kingdom. As of August 2023,[update] the total market value of all companies trading on the LSE stood at $3.18 trillion.[4] Its current premises are situated in Paternoster Square close to St Paul's Cathedral in the City of London. Since 2007, it has been part of the London Stock Exchange Group (LSEG (LSE: [Script error: No such module "Stock tickers/LSE". LSEG])).[5] The LSE is the most-valued stock exchange in Europe as of 2023.[6] According to the 2020 Office for National Statistics report, approximately 12% of UK-resident individuals reported having investments in stocks and shares.[7] According to the 2020 Financial Conduct Authority (FCA) report, approximately 15% of UK adults reported having investments in stocks and shares.[8] HistoryCoffee HouseThe Royal Exchange had been founded by English financier Thomas Gresham and Sir Richard Clough on the model of the Antwerp Bourse. It was opened by Elizabeth I of England in 1571.[9][10] During the 17th century, stockbrokers were not allowed in the Royal Exchange due to their rude manners. They had to operate from other establishments in the vicinity, notably Jonathan's Coffee-House. At that coffee house, a broker named John Castaing started listing the prices of a few commodities, such as salt, coal, paper, and exchange rates in 1698. Originally, this was not a daily list and was only published a few days of the week.[11] This list and activity was later moved to Garraway's coffee house. Public auctions during this period were conducted for the duration that a length of tallow candle could burn; these were known as "by inch of candle" auctions. As stocks grew, with new companies joining to raise capital, the royal court also raised some monies. These are the earliest evidence of organised trading in marketable securities in London. Royal ExchangeAfter Gresham's Royal Exchange building was destroyed in the Great Fire of London, it was rebuilt and re-established in 1669. This was a move away from coffee houses and a step towards the modern model of stock exchange.[12] The Royal Exchange housed not only brokers but also merchants and merchandise. This was the birth of a regulated stock market, which had teething problems in the shape of unlicensed brokers. In order to regulate these, Parliament passed an Act in 1697 that levied heavy penalties, both financial and physical, on those brokering without a licence. It also set a fixed number of brokers (at 100), but this was later increased as the size of the trade grew. This limit led to several problems, one of which was that traders began leaving the Royal Exchange, either by their own decision or through expulsion, and started dealing in the streets of London. The street in which they were now dealing was known as 'Exchange Alley', or 'Change Alley'; it was suitably placed close to the Bank of England. Parliament tried to regulate this and ban the unofficial traders from the Change streets. Traders became weary of "bubbles" when companies rose quickly and fell, so they persuaded Parliament to pass a clause preventing "unchartered" companies from forming. After the Seven Years' War (1756–1763), trade at Jonathan's Coffee House boomed again. In 1773, Jonathan, together with 150 other brokers, formed a club and opened a new and more formal "Stock Exchange" in Sweeting's Alley. This now had a set entrance fee, by which traders could enter the stock room and trade securities. It was, however, not an exclusive location for trading, as trading also occurred in the Rotunda of the Bank of England. Fraud was also rife during these times and in order to deter such dealings, it was suggested that users of the stock room pay an increased fee. This was not met well and ultimately, the solution came in the form of annual fees and turning the Exchange into a Subscription room. The Subscription room created in 1801 was the first regulated exchange in London, but the transformation was not welcomed by all parties. On the first day of trading, non-members had to be expelled by a constable. In spite of the disorder, a new and bigger building was planned, at Capel Court. William Hammond laid the first foundation stone for the new building on 18 May. It was finished on 30 December when "The Stock Exchange" was incised on the entrance. First Rule Book In the Exchange's first operating years, on several occasions there was no clear set of regulations or fundamental laws for the Capel Court trading. In February 1812, the General Purpose Committee confirmed a set of recommendations, which later became the foundation of the first codified rule book of the Exchange. Even though the document was not a complex one, topics such as settlement and default were, in fact, quite comprehensive. With its new governmental commandments[13] and increasing trading volume, the Exchange was progressively becoming an accepted part of the financial life in the city. In spite of continuous criticism from newspapers and the public, the government used the Exchange's organised market (and would most likely not have managed without it) to raise the enormous amount of money required for the wars against Napoleon. Foreign and regional exchangesAfter the war and facing a booming world economy, foreign lending to countries such as Brazil, Peru and Chile was a growing market. Notably, the Foreign Market at the Exchange allowed for merchants and traders to participate, and the Royal Exchange hosted all transactions where foreign parties were involved. The constant increase in overseas business eventually meant that dealing in foreign securities had to be allowed within all of the Exchange's premises. Just as London enjoyed growth through international trade, the rest of Great Britain also benefited from the economic boom. Two other cities, in particular, showed great business development: Liverpool and Manchester. Consequently, in 1836 both the Manchester and Liverpool stock exchanges were opened. Some stock prices sometimes rose by 10%, 20% or even 30% in a week. These were times when stockbroking was considered a real business profession, and such attracted many entrepreneurs. Nevertheless, with booms came busts, and in 1835 the "Spanish panic" hit the markets, followed by a second one two years later. The Exchange before the World Wars By June 1853, both participating members and brokers were taking up so much space that the Exchange was now uncomfortably crowded, and continual expansion plans were taking place. Having already been extended west, east, and northwards, it was then decided the Exchange needed an entire new establishment. Thomas Allason was appointed as the main architect, and in March 1854, the new brick building inspired from the Great Exhibition stood ready. This was a huge improvement in both surroundings and space, with twice the floor space available. By the late 1800s, the telephone, ticker tape, and the telegraph had been invented. Those new technologies led to a revolution in the work of the Exchange. First World War As the financial centre of the world, both the City and the Stock Exchange were hit hard by the outbreak of World War I in 1914. Due to fears that borrowed money was to be called in and that foreign banks would demand their loans or raise interest, prices surged at first. The decision to close the Exchange for improved breathing space and to extend the August Bank Holiday to prohibit a run on banks, was hurried through by the committee and Parliament, respectively. The Stock Exchange ended up being closed from the end of July until the New Year, causing street business to be introduced again, as well as the "challenge system". The Exchange was set to open again on 4 January 1915 under tedious restrictions: transactions were to be in cash only. Due to the limitations and challenges on trading brought by the war, almost a thousand members quit the Exchange between 1914 and 1918. When peace returned in November 1918, the mood on the trading floor was generally cowed. In 1923, the Exchange received its own coat of arms, with the motto Dictum Meum Pactum, My Word is My Bond. Second World WarIn 1937, officials at the Exchange used their experiences from World War I to draw up plans for how to handle a new war. The main concerns included air raids and the subsequent bombing of the Exchange's perimeters, and one suggestion was a move to Denham, Buckinghamshire. This however never took place. On the first day of September 1939, the Exchange closed its doors "until further notice" and two days later World War II was declared. Unlike in the prior war, the Exchange opened its doors again six days later, on 7 September. As the war escalated into its second year, the concerns for air raids were greater than ever. Eventually, on the night of 29 December 1940, one of the greatest fires in London's history took place. The Exchange's floor was hit by a clutch of incendiary bombs, which were extinguished quickly. Trading on the floor was now drastically low and most was done over the phone to reduce the possibility of injuries. The Exchange was only closed for one more day during wartime, in 1945 due to damage from a V-2 rocket. Nonetheless, trading continued in the house's basement. Post-war After decades of uncertain if not turbulent times, stock market business boomed in the late 1950s. This spurred officials to find new, more suitable accommodation. The work on the new Stock Exchange Tower began in 1967. The Exchange's new 321 feet (98 metres) high building had 26 storeys with council and administration at the top, and middle floors let out to affiliate companies. Queen Elizabeth II opened the building on 8 November 1972; it was a new City landmark, with its 23,000 sq ft (2,100 m2) trading floor.  1973 marked a year of changes for the Stock Exchange. First, two trading prohibitions were abolished. A report from the Monopolies and Mergers Commission recommended the admittance of both women and foreign-born members on the floor. Second, in March the London Stock Exchange formally merged with the eleven British and Irish regional exchanges, including the Scottish Stock Exchange.[14] This expansion led to the creation of a new position of Chief Executive Officer; after an extensive search this post was given to Robert Fell. There were more governance changes in 1991, when the governing Council of the Exchange was replaced by a Board of Directors drawn from the Exchange's executive, customer, and user base; and the trading name became "The London Stock Exchange". FTSE 100 Index (pronounced "Footsie 100") was launched by a partnership of the Financial Times and the Stock Exchange on 3 January 1984. This turned out to be one of the most useful indices of all, and tracked the movements of the 100 leading companies listed on the Exchange. IRA bombingOn 20 July 1990, a bomb planted by the Provisional Irish Republican Army (IRA) exploded in the men's toilets behind the visitors' gallery. The area had already been evacuated and nobody was injured.[15] About 30 minutes before the blast at 8:49 a.m., a man who said he was a member of the IRA told Reuters that a bomb had been placed at the exchange and was about to explode. Police officials said that if there had been no warning, the human toll would have been very high.[16] The explosion ripped a hole in the 23-storey building in Threadneedle Street and sent a shower of glass and concrete onto the street.[17] The long-term trend towards electronic trading platforms reduced the Exchange's attraction to visitors, and although the gallery reopened, it was closed permanently in 1992. "Big Bang"The biggest event of the 1980s was the sudden de-regulation of the financial markets in the UK in 1986. The phrase "Big Bang" was coined to describe measures, including abolition of fixed commission charges and of the distinction between stockjobbers and stockbrokers on the London Stock Exchange, as well as the change from an open outcry to electronic, screen-based trading. In 1995, the Exchange launched the Alternative Investment Market, the AIM, to allow growing companies to expand into international markets. Two years later, the Electronic Trading Service (SETS) was launched, bringing greater speed and efficiency to the market. Next, the CREST settlement service was launched. In 2000, the Exchange's shareholders voted to become a public limited company, London Stock Exchange plc. London Stock Exchange also transferred its role as UK Listing Authority to the Financial Services Authority (FSA-UKLA). EDX London, an international equity derivatives business, was created in 2003 in partnership with OM Group. The Exchange also acquired Proquote Limited, a new generation supplier of real-time market data and trading systems.   The old Stock Exchange Tower became largely redundant with Big Bang, which deregulated many of the Stock Exchange's activities: computerised systems and dealing rooms replaced face-to-face trading. In 2004, London Stock Exchange moved to a brand-new headquarters in Paternoster Square, close to St Paul's Cathedral. In 2007, the London Stock Exchange merged with Borsa Italiana, creating London Stock Exchange Group (LSEG). The Group's headquarters are in Paternoster Square. The Stock Exchange in Paternoster Square was the initial target for the protesters of Occupy London on 15 October 2011. Attempts to occupy the square were thwarted by police.[18] Police sealed off the entrance to the square as it is private property, a High Court injunction having previously been granted against public access to the square.[19] The protesters moved nearby to occupy the space in front of St Paul's Cathedral.[20] The protests were part of the global Occupy movement. On 25 April 2019, the final day of the Extinction Rebellion disruption in London, 13 activists glued themselves together in a chain, blocking the entrances of the Stock Exchange.[21][22] The protesters were all later arrested on suspicion of aggravated trespass.[22] Extinction Rebellion had said its protesters would target the financial industry "and the corrosive impacts of the ... sector on the world we live in" and activists also blocked entrances to HM Treasury and the Goldman Sachs office on Fleet Street.[23] ActivitiesPrimary marketsThere are two main markets on which companies trade on the LSE: the main market and the alternative investment market. Main MarketThe main market is home to over 1,300 large companies from 60 countries.[24] The FTSE 100 Index ("footsie") is the main share index of the 100 most highly capitalised UK companies listed on the Main Market.[25] Alternative Investment MarketThe Alternative Investment Market is LSE's international market for smaller companies. A wide range of businesses including early-stage, venture capital-backed, as well as more-established companies join AIM seeking access to growth capital. The AIM is classified as a Multilateral Trading Facility (MTF) under the 2004 MiFID directive, and as such it is a flexible market with a simpler admission process for companies wanting to be publicly listed.[26] Secondary marketsThe securities available for trading on London Stock Exchange:[27]

Post tradeThrough the Exchange's Italian arm, Borsa Italiana, the London Stock Exchange Group as a whole offers clearing and settlement services for trades through CC&G (Cassa di Compensazione e Garanzia) and Monte Titoli.[28][29] is the Groups Central Counterparty (CCP) and covers multiple asset classes throughout the Italian equity, derivatives and bond markets. CC&G also clears Turquoise derivatives. Monte Titoli (MT) is the pre-settlement, settlement, custody and asset services provider of the Group. MT operates both on-exchange and OTC trades with over 400 banks and brokers. TechnologyLondon Stock Exchange's trading platform is its own Linux-based edition named Millennium Exchange.[30] Their previous trading platform TradElect was based on Microsoft's .NET Framework, and was developed by Microsoft and Accenture. For Microsoft, LSE was a good combination of a highly visible exchange and yet a relatively modest IT problem.[31] Despite TradElect only being in use for about two years,[32] after suffering multiple periods of extended downtime and unreliability[33][34] the LSE announced in 2009 that it was planning to switch to Linux in 2010.[35][36] The main market migration to MillenniumIT technology was successfully completed in February 2011.[37] LSEG provides high-performance technology, including trading, market surveillance and post-trade systems, for over 40 organisations and exchanges, including the Group's own markets. Additional services include network connectivity, hosting and quality assurance testing. MillenniumIT, GATElab and Exactpro are among the Group's technology companies.[38] The LSE facilitates stock listings in a currency other than its "home currency". Most stocks are quoted in GBP but some are quoted in EUR while others are quoted in USD. Mergers and acquisitionsOn 3 May 2000, it was announced that the LSE would merge with the Deutsche Börse; however this fell through.[39] On 23 June 2007, the London Stock Exchange announced that it had agreed on the terms of a recommended offer to the shareholders of the Borsa Italiana S.p.A. The merger of the two companies created a leading diversified exchange group in Europe. The combined group was named the London Stock Exchange Group, but still remained two separate legal and regulatory entities. One of the long-term strategies of the joint company is to expand Borsa Italiana's efficient clearing services to other European markets. In 2007, after Borsa Italiana announced that it was exercising its call option to acquire full control of MBE Holdings; thus the combined Group would now control Mercato dei Titoli di Stato, or MTS. This merger of Borsa Italiana and MTS with LSE's existing bond-listing business enhanced the range of covered European fixed income markets. London Stock Exchange Group acquired Turquoise (TQ), a Pan-European MTF, in 2009.[40] On 9 October 2020, London Stock Exchange agreed to sell the Borsa Italiana (including Borsa's bond trading platform MTS) to Euronext for €4.3 billion (£3.9 billion) in cash.[41] Euronext completed the acquisition of the Borsa Italiana Group on 29 April 2021 for a final price of €4,444 million.[42] On 12 Dec 2022, Microsoft bought a nearly 4% stake in LSE (London Stock Exchange Group) as part of a ten-year cloud deal.[43] NASDAQ bidsIn December 2005, London Stock Exchange rejected a £1.6 billion takeover offer from Macquarie Bank. London Stock Exchange described the offer as "derisory", a sentiment echoed by shareholders in the Exchange. Shortly after Macquarie withdrew its offer, the LSE received an unsolicited approach from NASDAQ valuing the company at £2.4 billion. This too it rejected. NASDAQ later pulled its bid, and less than two weeks later on 11 April 2006, struck a deal with LSE's largest shareholder, Ameriprise Financial's Threadneedle Asset Management unit, to acquire all of that firm's stake, consisting of 35.4 million shares, at £11.75 per share.[44] NASDAQ also purchased 2.69 million additional shares, resulting in a total stake of 15%. While the seller of those shares was undisclosed, it occurred simultaneously with a sale by Scottish Widows of 2.69 million shares.[45] The move was seen as an effort to force LSE to the negotiating table, as well as to limit the Exchange's strategic flexibility.[46] Subsequent purchases increased NASDAQ's stake to 25.1%, holding off competing bids for several months.[47][48][49] United Kingdom financial rules required that NASDAQ wait for a period of time before renewing its effort. On 20 November 2006, within a month or two of the expiration of this period, NASDAQ increased its stake to 28.75% and launched a hostile offer at the minimum permitted bid of £12.43 per share, which was the highest NASDAQ had paid on the open market for its existing shares.[50] The LSE immediately rejected this bid, stating that it "substantially undervalues" the company.[51] NASDAQ revised its offer (characterized as an "unsolicited" bid, rather than a "hostile takeover attempt") on 12 December 2006, indicating that it would be able to complete the deal with 50% (plus one share) of LSE's stock, rather than the 90% it had been seeking. The U.S. exchange did not, however, raise its bid. Many hedge funds had accumulated large positions within the LSE, and many managers of those funds, as well as Furse, indicated that the bid was still not satisfactory. NASDAQ's bid was made more difficult because it had described its offer as "final", which, under British bidding rules, restricted their ability to raise its offer except under certain circumstances. In the end, NASDAQ's offer was roundly rejected by LSE shareholders. Having received acceptances of only 0.41% of rest of the register by the deadline on 10 February 2007, Nasdaq's offer duly lapsed.[52] On 20 August 2007, NASDAQ announced that it was abandoning its plan to take over the LSE and subsequently look for options to divest its 31% (61.3 million shares) shareholding in the company in light of its failed takeover attempt.[53] In September 2007, NASDAQ agreed to sell the majority of its shares to Borse Dubai, leaving the United Arab Emirates-based exchange with 28% of the LSE.[54] Proposed merger with TMX GroupOn 9 February 2011, London Stock Exchange Group announced it had agreed to merge with the Toronto-based TMX Group, the owners of the Toronto Stock Exchange, creating a combined entity with a market capitalization of listed companies equal to £3.7 trillion.[55] Xavier Rolet, CEO of the LSE Group at the time, would have headed the new enlarged company, while TMX Chief Executive Thomas Kloet would have become the new firm president. London Stock Exchange Group however announced it was terminating the merger with TMX on 29 June 2011 citing that "LSEG and TMX Group believe that the merger is highly unlikely to achieve the required two-thirds majority approval at the TMX Group shareholder meeting".[56] Even though LSEG obtained the necessary support from its shareholders, it failed to obtain the required support from TMX's shareholders. Opening timesNormal trading sessions on the main orderbook (SETS) are from 08:00 to 16:30 local time every day of the week except Saturdays, Sundays and holidays declared by the exchange in advance. The detailed schedule is as follows:

[57] Auction Periods (SETQx) SETSqx (Stock Exchange Electronic Trading Service – quotes and crosses) is a trading service for securities less liquid than those traded on SETS. The auction uncrossings are scheduled to take place at 8:00, 9:00, 11:00, 14:00, and 16:35. Observed holidays are New Year's Day, Good Friday, Easter Monday, May Bank Holiday, Spring Bank Holiday, Summer Bank Holiday, Christmas Day, and Boxing Day. If New Year's Day, Christmas Day, and/or Boxing Day falls on a weekend, the following working day is observed as a holiday. Arms

See also

References

Further reading

External links[ ⚑ ] 51°30′54.25″N 0°5′56.77″W / 51.5150694°N 0.0991028°W

| |||||||||||||||||||||||||||||

| Industry | |||||||||||||||||||||||||||||

| Founded | 16 January 2009[note 1] | ||||||||||||||||||||||||||||

| Headquarters | |||||||||||||||||||||||||||||

Area served | United Kingdom | ||||||||||||||||||||||||||||

Key people |

| ||||||||||||||||||||||||||||

| Products |

| ||||||||||||||||||||||||||||

| Revenue | |||||||||||||||||||||||||||||

| Total assets | |||||||||||||||||||||||||||||

| Total equity | |||||||||||||||||||||||||||||

Number of employees | 63,000 (2025)[2] | ||||||||||||||||||||||||||||

| Divisions |

| ||||||||||||||||||||||||||||

| Subsidiaries |

| ||||||||||||||||||||||||||||

| Website | {{{1}}} | ||||||||||||||||||||||||||||

Footnotes / references

| |||||||||||||||||||||||||||||

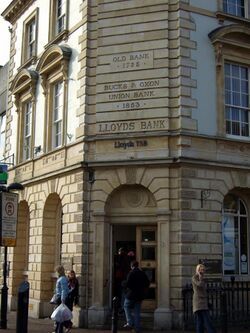

Lloyds Banking Group plc is a British financial institution formed through the acquisition of HBOS by Lloyds TSB in 2009. It is one of the UK's largest financial services organisations, with 30 million customers and 65,000 employees.[3] Lloyds Bank was founded in 1765 but the wider Group's heritage extends over 320 years, dating back to the founding of the Bank of Scotland by the Parliament of Scotland in 1695.[4]

The Group's headquarters are located at 33 Old Broad Street in the City of London, while its registered office is on The Mound in Edinburgh. It also operates office sites in Birmingham, Bristol, West Yorkshire and Glasgow.[5] The Group also has overseas operations in the US and Europe. Its headquarters for business in the European Union is in Berlin, Germany.[6]

The business operates under a number of distinct brands, including Lloyds Bank, Halifax, Bank of Scotland and Scottish Widows. Former Chief Executive António Horta-Osório told The Banker, "We will keep the different brands because the customers are very different in terms of attitude".[7]

Lloyds Banking Group is listed on the London Stock Exchange (LSE) and is a constituent of the FTSE 100 Index. It had a market capitalisation of approximately yes|yes|GB|}}£32.6 billion as of 31 December 2024—the 21st-largest of any LSE listed company[8]—and has a secondary listing on the New York Stock Exchange in the form of American depositary receipts.

History

Origins

Lloyds Bank is one of the oldest banks in the UK, tracing its establishment to Taylors and Lloyds founded in 1765 in Birmingham by button maker John Taylor and iron producer and dealer Sampson Lloyd II.[9] Through a series of mergers, Lloyds became one of the Big Four banks in the UK.[10]

Bank of Scotland, which originated in the 17th century, is the second-oldest surviving UK bank after the Bank of England. In 2001, a wave of consolidations in the UK banking market led the former Halifax Building Society—which originated in 1853—to agree to a £10.8 billion merger with Bank of Scotland.[11]

Trustee Savings Bank (TSB) can trace its roots back to the first savings bank founded by Henry Duncan in Ruthwell, Dumfriesshire, in 1810. TSB itself was created in 1985 by an Act of Parliament that merged all the remaining savings banks in England & Wales as TSB Bank plc and in Scotland (except Airdrie Savings Bank) as TSB Scotland plc.[12]

Lloyds/TSB merger

In 1995, Lloyds Bank plc merged with TSB Group plc, forming Lloyds TSB Group plc.[13]

In 2000, the group acquired Scottish Widows, a mutual life-assurance company based in Edinburgh, in a deal worth £7 billion.[14] This made the group the second-largest UK provider of life assurance and pensions after Prudential. In September the same year, Lloyds TSB purchased Chartered Trust from Standard Chartered Bank for £627 million to form Lloyds TSB Asset Finance Division, which provides motor, retail and personal finance in the United Kingdom under the trading name Black Horse.[15]

Lloyds TSB continued to take part in the consolidation, making a takeover bid for Abbey National in 2001, which was later rejected by the Competition Commission.[16] In October 2003, Lloyds TSB Group agreed on the sale of its subsidiary NBNZ Holdings Limited—comprising the Group's New Zealand banking and insurance operations—to Australia and New Zealand Banking Group.[17] In July 2004, Lloyds TSB Group announced the sale of its business in Argentina to Banco Patagonia Sudameris S.A.[18] and its business in Colombia to Primer Banco del Istmo, S.A.[19]

On 20 December 2005, Lloyds TSB announced that it had reached an agreement to sell its credit card business Goldfish to Morgan Stanley Bank International Limited for £175 million.[20] In 2007, Lloyds TSB announced that it had sold its Abbey Life assurance division to Deutsche Bank for £977 million.[21]

Acquisition of HBOS

On 17 September 2008, the BBC reported that HBOS was in takeover talks with Lloyds TSB, in response to a precipitous drop in HBOS's share price.[22] The talks concluded successfully that evening with a proposal to create a banking giant which would hold a third of UK mortgages.[23] An announcement was made on 18 September 2008.[24][25]

On 19 November 2008, the new acquisition and government preference share purchase was agreed by Lloyds TSB shareholders.[26] HBOS shareholders overwhelmingly approved the deal on 12 December.[27] Lloyds TSB Group changed its name to Lloyds Banking Group upon completion of the takeover on 19 January 2009.[28]

On 12 February 2009, Eric Daniels, the CEO of the Group, was questioned about the banking crisis during a session of the Treasury Select Committee of the House of Commons. One of the key issues concerned Lloyds' takeover of HBOS and the amount of due diligence carried out before the acquisition. Daniels said that a company would always like to do more due diligence on another company, but there are legal limits on how much is possible before an actual acquisition. Losses were slightly more than the £10 billion originally identified by the due diligence owing to write-offs of property loans because of falling property prices and the lack of demand for it. The then-Chairman of Lloyds, Sir Victor Blank, said in August 2009 that losses had been "at the worst end of expectations" and that the Lloyds board was surprised by the speed at which the losses—which were caused by the unexpectedly sharp contraction of the world economy in late 2008 and early 2009—happened.[29] This position was confirmed by Archie Kane, a senior Lloyds executive in Scotland, in evidence to the Scottish Parliament's economy committee in December 2009.[30]

On 13 February 2009, Lloyds Banking Group revealed that the losses at HBOS exceeded initial estimates, amounting to approximately £10 billion. The share price of Lloyds Banking Group fell 32% on the London Stock Exchange, carrying other bank shares with it.[31]

October 2008 to January 2009

On 13 October 2008, Prime Minister Gordon Brown announced a government plan for the Treasury to invest £37 billion (US$64 billion, €47 billion) of new capital into major UK banks—including Royal Bank of Scotland Group, Lloyds TSB and HBOS—to avert a collapse of the financial sector.[32][33] Barclays avoided taking a capital investment from the UK government by raising capital privately, and HSBC moved capital to its UK business from its other businesses overseas.[34]

It was later confirmed that Lloyds TSB would have been required by the Financial Services Authority (FSA) to take additional capital from the government if it had not taken over HBOS.[35] After the recapitalisations and Lloyds' acquisition of HBOS, the UK government held a 43.4% stake in Lloyds Banking Group.[36]

February to June 2009

In February 2009, after it became apparent that the recession would be deeper than originally anticipated, the FSA was instructed to "stress test" the banks against a severe economic downturn. The FSA stated that the assumptions underlying the stress test were not intended to be a forecast of what was likely to happen but to simulate a near-catastrophic economic scenario. These assumptions included:

- A peak-to-trough fall in UK gross domestic product (GDP) of over 6%, with no growth until 2011 and returning to trend-rate growth in 2012;

- A rise in UK unemployment to just over 12%;

- A 50% peak-to-trough fall in UK house prices;

- A 60% peak-to-trough fall in UK commercial property prices.[37]

The conclusion from this exercise was that Lloyds would need additional capital if such a scenario ever occurred. Because the wholesale funding markets were effectively closed at the time, in March 2009 Lloyds made a compromise with the UK government consisting of two elements:

- The first element was the redemption of preference shares. The £4 billion of preference (non-voting) shares held by UKFI were repaid on 8 June 2009 following the issue of new ordinary shares—this avoided the payment of £480 million annual interest to the Treasury and allowed Lloyds to resume payment of dividends when profits allowed. These new ordinary shares were initially available to existing shareholders through an open offer at 38.43 pence that closed on 5 June 2009—87% were taken up. The remaining 13% were placed in the market on 8 June 2009 at 60 pence. This open offer and placing was underwritten by the Treasury; if none of these new ordinary shares had been bought by existing shareholders or the open market, the government—as underwriters of the deal—would have bought them, and their shareholding would have increased to a maximum of 65%. This did not happen; the government's holding remained at 43.4% and Lloyds became the first European bank to repay the government's "credit crunch" investment.[38] Following the government's 43.4% participation in June's Open Offer, the average buying price of the government's total shareholding was 122.6 pence.[39]

- The government implemented an asset protection scheme. Lloyds agreed in principle to enter the government's asset protection scheme to insure it against potential future losses on previous loans—primarily on the old HBOS portfolio. The fee for this would have been paid for by the issue to the government of new 'B' (non-voting) shares, which could have increased the government holding to a maximum of c. 62%—or higher if the government had bought all the ordinary shares issued to redeem the preference shares.[40]

June 2009 to present

Lloyds' impairments peaked in the first half of 2009; by mid-2009 the asset protection scheme increasingly looked like a poor deal for Lloyds. Following negotiations, the government confirmed on 3 November 2009 that Lloyds would not enter the scheme—although RBS still would. Instead, Lloyds launched a rights issue to raise capital from existing shareholders; as an existing 43.4% shareholder, the government chose to take part in this and thus maintained its shareholding at 43.4%.[43][44] Following this, the National Audit Office calculated the government's average buying price for its entire stake in Lloyds to be about 74 pence.[45]

It was announced in the government's pre-budget report on 9 December 2009 that the forecast for the total loss to taxpayers for all the bank bailouts had been reduced from £50 billion to £10 billion—in part because of the restructuring of the government's asset protection scheme.[46] The final part of the December 2009 capital raise involved issuing new shares to debt holders in February 2010. This diluted existing shareholders—including the UK Government, whose shareholding was reduced from 43.4% to around 41%.[47] The group sold its 70% stake in insurance company Esure to Esure Group Holdings on 11 February 2010. The share was valued at around £185 million.[48]

On 4 November 2012, it was reported that Lloyds was considering selling its 60% stake in St James's Place Wealth Management to raise around £1 billion.[49] In April 2013, Lloyds sold its loss-making Spanish retail operation—originally Banco Halifax Hispania—and the local investment management business in Spain to Banco de Sabadell. Lloyds will receive a 1.8% stake in Sabadell worth about €84 million and an additional sum of up to €20 million over the next five years.[50] In September 2013, it was reported that the UK government was planning to sell up to a quarter of its shares in Lloyds Banking Group.[51] The government sold 6% of its shares on 17 September 2013 at 75p, raising £3.2 billion and reducing its stake to 32.7%.[52] The UK government then sold a further 7.8% on 26 March 2014 at 75.5p, raising a further £4.2bn and reducing its stake to 24.9%.[53] A trading plan of incremental sales during 2015 reduced the publicly owned stake to below 10% by the end of October.[54] Sales resumed in November 2016, as the holding was reduced to 7.99%.[55] On 17 March 2017, the British government confirmed its remaining shares in Lloyds Banking Group had been sold.[56]

In February 2025, Lloyds Banking Group nearly tripled the amount it is setting aside to cover the car finance mis-selling scandal to £1.2bn.[57] Lloyds is one of the lenders who could potentially be forced to compensate consumers after a court ruling in October 2024 determined that paying a “secret” commission to car dealers who had arranged the loans without disclosing the sum and terms of that commission to borrowers was unlawful.[58]

In early 2025, Lloyds Banking Group secured a £99 million contract to provide banking services for HM Revenue & Customs (HMRC), replacing Barclays after a decade.[59]

As of 2025, the bank provided cross-brand service from all branches, allowing customers of Lloyds to use Halifax and Bank of Scotland branches and vice versa.[60]

Divestment

The UK government's purchase of a 43.4% stake in the group in 2009 was considered as state aid; under European Commission competition laws, the group would be required to sell a portion of its business.[62] The group's divestment plan—codenamed "Verde"—identified 632 branches which would be transferred to a new business. Customers with accounts held by the branches, and staff employed within them, would be transferred. The new business would be formed from some Lloyds TSB branches in England and Wales and all branches of Lloyds TSB Scotland plc and Cheltenham & Gloucester plc; these would operate under the TSB brand as TSB Bank plc.[63] The remainder of the Lloyds TSB business would be rebranded as Lloyds Bank.[64]

Lloyds Banking Group reached a Heads of Terms agreement in July 2012 to sell the Verde branches to The Co-operative Bank for £750 million.[65][66] The final transfer of TSB Bank plc to the new owner was due to be completed by late 2013. In February 2013, it was reported that Lloyds Banking Group was considering a stock market flotation of the TSB business as an alternative, should the transfer not be completed.[67] On 24 April 2013, The Co-operative Bank decided not to proceed with the acquisition because of the economic downturn and the tough regulatory environment imposed on banks. Lloyds Banking Group said that the rebranding to TSB Bank would still take place and that the new bank will be divested through an initial public offering in 2014.[68] TSB Bank began operations on 9 September 2013, under CEO Paul Pester.[69]

Lloyds Banking Group announced that 25% of TSB's shares would be floated on 24 June 2014;[70] however, with the offer being 10 times oversubscribed, 35% of TSB's shares were sold at 260p on 20 June.[71] Banco Sabadell agreed to purchase TSB in March 2015 and completed the acquisition on 8 July 2015. The purchase meant Lloyds sold its final holding in TSB.[72][73]

Divisions and subsidiaries

The business is divided into five divisions:[74][75]

- Private equity

- Consumer lending and consumer relationships

- Business & commercial banking

- Corporate & institutional banking

- Insurance, pensions and investments

Senior leadership

Refers to chairmen and chief executives since 2009, when Lloyds Banking Group was formed.

Current leadership

- Chairman: Robin Budenberg (since January 2021)[76]

- Chief Executive: Charlie Nunn (since August 2021)[77]

List of former chairmen

List of former chief executives

Sponsorships and responsible business programmes

Lloyds Banking Group is an active supporter of disability rights and best practice; it is a Gold member of the Employers' Forum on Disability. In 2010, the group helped create and currently sponsors the Royal Association for Disability Rights (RADAR) Radiate network, which aims to support and develop a talent pool of people with disabilities and health conditions and to potentially act as a source of thinking for organisations on how 'disabled talent' is best spotted and developed.[82]

In 2011, Lloyds Banking Group established the Lloyds Scholars Programme, a social mobility programme aimed at UK students, in partnership with nine leading UK universities.[83] The Scholars Programme takes 15 students per university per year and consists of a £1000 per annum scholarship paid directly to the student to help with living costs, a Lloyds Banking Group mentor and two ten-week internships, paid at £18,000 pro rata.[84] The programme supports students throughout their university career and requires scholars to complete 100 hours of volunteering in their local community per year of their degree.[84] There are also restrictions on who can apply, which exclude medical and veterinary students, as well as anyone with a residual household income as defined by their student funding body of more than £25,000 per annum, since the programme is a social mobility initiative.[84]

Awards and recognition

In July 2007, Euromoney announced Lloyds TSB as the winners of its Awards for Excellence.[86]

In June 2008, Lloyds TSB Group came top in the Race for Opportunity's (RfO) annual survey.[87]

In May 2009, Lloyds TSB Corporate Markets was recognised as 'Bank of the Year' for the fifth year running at the Real FD/CBI FDs' Excellence Awards.[88]

In October 2009's "What Investment" magazine awards, Halifax won Best Savings Account Provider, and Halifax Share Dealing was also named Best Share Dealing Service.[89]

In October 2009's "Consumer Money Awards," Halifax won Best First-Time Mortgage Provider. Lloyds' brands were commended in several other categories, including Cheltenham & Gloucester for Best Remortgage Provider and Best High Street Mortgage Provider; Lloyds TSB for Best Current Account Provider, Best Student Account Provider and Best Customer Service Provider; and Halifax for Best ISA Provider and Best High Street Savings Provider.[90]

In November 2009's "Your Mortgage Award," Halifax won the award for Best Overall Mortgage Lender for the eighth year running, as well as Best Large Loans Mortgage Lender. Birmingham Midshires was named Best Specialist and Buy-to-Let Mortgage Lender, and Lloyds TSB won the award for Best Overseas Mortgage Lender.[91]

Controversies

Money laundering

A 2010 report by The Wall Street Journal described how Credit Suisse, Barclays, Lloyds Banking Group, and other banks were involved in helping the Alavi Foundation, Bank Melli, the Government of Iran, and others circumvent US laws banning financial transactions with certain states. They did this by stripping information out of wire transfers, thereby concealing the source of funds. Lloyds Banking Group settled with the US government for US$350 million. The US government's Manhattan District Attorney's Office was involved, although the case was merged with one at the federal US Department of Justice.[93]

Tax avoidance

In 2009, a case was brought against Lloyds by HM Revenue and Customs on grounds of tax avoidance. Lloyds was accused of disguising loans to American companies as investments in order to reduce the tax liability on them.[94]

Complaints via the Financial Ombudsman Service

Lloyds TSB received 9,952 complaints via the Financial Ombudsman Service in the last half of 2009. This, when added to the other brands of the Lloyds Banking Group, was twice the number of complaints received by Barclays—the next-most-complained-about UK bank. The Financial Ombudsman Service upheld fewer complaints against Lloyds TSB than it did against Barclays.[95]

Islamic Account

In 2014, Lloyds launched the 'Islamic Account', a current account aimed at Muslims which it stated was compliant with Sharia law – namely, the prohibition of credit or debit interest. Critics of the new policy stated that the account amounted to religious discrimination, as users of the Sharia-compliant account would not incur interest if they went overdrawn, in contrast with users of typical current accounts. The bank responded that the account was available to both Muslims and non-Muslims and that comparisons of interest rates between its Islamic Account and traditional current accounts were "meaningless".[96]

HBOS Reading fraud

Lloyds Banking Group has been criticised for failing to compensate, or even apologise to, victims of fraud perpetrated by employees of HBOS.[97][98] LBG was accused of treating the whistle-blowers involved in the HBOS Reading fraud poorly. Customers Paul and Nikki Turner presented evidence of the fraud to the board but were ignored. Indeed, the bank tried to evict them from their home on twenty-two occasions.[99] Sally Masterton was an accountant working for Lloyds who greatly assisted Thames Valley Police in their investigation of the fraud, codenamed Operation Hornet. She wrote a report on the fraud at the request of the bank, called Project Lord Turnbull. She subsequently left the bank and claimed constructive dismissal.[100]

Overdraft fees

In January 2019, the Group was criticised by the Chair of the Business, Energy and Industrial Strategy Committee for changes to its overdraft fees policy. Rachel Reeves MP said of the changes that "While [they] might be legal, they are not within the spirit of the FCA's recommendations" to scrap overdraft fees and replace them with a single interest rate and that they would "increase the charges for the vast majority of customers".[101]

Lloyds Business Support Unit

A review conducted by Thames Valley Police indicated that fraud may have been committed at the Lloyds Business Support Unit based in Bristol. Lloyds Banking Group has denied this.[102] There are more than two hundred alleged victims of the unit who have asked the police to investigate their claims.[103]

References

- ↑ 1.0 1.1 1.2 1.3 1.4 "Annual Results 2024". Lloyds Banking Group. https://www.lloydsbankinggroup.com/assets/pdfs/investors/financial-performance/lloyds-banking-group-plc/2024/q4/2024-lbg-fy-results.pdf.

- ↑ "Our brands". Lloyds Banking Group. https://www.lloydsbankinggroup.com/who-we-are/our-brands.html.

- ↑ "Our brands" (in en). Lloyds Banking Group. https://www.lloydsbankinggroup.com/who-we-are/our-brands.html.

- ↑ "Our Heritage" (in en). https://www.lloydsbankinggroup.com/who-we-are/our-heritage.html.

- ↑ "Roles and Departments" (in en). Lloyds Banking Group. https://www.lloydsbankinggroup.com/careers/roles-and-departments.html.

- ↑ "Lloyds Bank GmbH". Lloyds Banking Group. https://www.lloydsbank.eu/.

- ↑ "António Horta-Osório moves out of his comfort zone". The Banker, April 2011

- ↑ "FTSE All-Share Index Ranking". UK Stock Challenge. http://www.stockchallenge.co.uk/ftse.php.

- ↑ "Lloyds BankHistory". Lloyds TSB. http://www.lloydstsb.com/about_ltsb/lloyds_bank.asp.

- ↑ Kar-Gupta, Sudip (1 September 2011). "UK banks prepare for inevitable shake-up". Reuters. https://www.reuters.com/article/britain-banks-idUSL5E7K111Q20110901.

- ↑ "BoS and Halifax agree merger". BBC News. 4 May 2001. https://news.bbc.co.uk/2/hi/business/1312047.stm.

- ↑ "TSB Bank History". Lloyds TSB. http://www.lloydstsb.com/about_ltsb/tsb.asp.

- ↑ "Lloyds Bank to merge with TSB". The New York Times. 12 October 1995. https://query.nytimes.com/gst/fullpage.html?res=990CE2DA163EF931A25753C1A963958260.

- ↑ "Lloyds TSB buys Scottish Widows". BBC News. 23 June 1999. https://news.bbc.co.uk/2/hi/business/375807.stm.

- ↑ "Standard Chartered wins $1.3bn Chase deal". The Independent. 2 September 2000. https://www.independent.co.uk/news/business/news/standard-chartered-wins-13bn-chase-deal-700061.html.

- ↑ "Report damns Lloyds TSB's bid for Abbey National". The Telegraph (London). 14 March 2001. https://www.telegraph.co.uk/money/main.jhtml?xml=/money/standfirst/2001/03/09/cnlods09.xml.

- ↑ "Lloyds TSB confirms possible sale of National Bank". The New Zealand Herald. 17 June 2003. http://www.nzherald.co.nz/section/3/story.cfm?c_id=3&objectid=3507900.

- ↑ "Banco Hiptecario Prospectus Page 118". Banco Hiptecario. 2007. http://www.hipotecario.com.ar/media/pdf/InformacionFinanciera/Bonos/Prospectos2007-en.pdf.

- ↑ "Banistmo-Lloyds deal receives regulator approval". BN Americas. 26 November 2004. http://www.bnamericas.com/news/banking/Banistmo-Lloyds_deal_receives_regulator_approval.

- ↑ "Lloyds TSB sells Goldfish brand". BBC News. 20 December 2005. https://news.bbc.co.uk/2/hi/business/4544520.stm.

- ↑ "Lloyds sells Abbey Life for £977m". The Daily Telegraph. 31 July 2007. https://www.telegraph.co.uk/finance/markets/2813187/Lloyds-sells-Abbey-Life-for-977m.html.

- ↑ "HBOS confirms Lloyds merger talks". BBC News. 17 September 2008. https://news.bbc.co.uk/2/hi/business/7621151.stm.

- ↑ "Lloyds TSB Seals Merger with HBOS". BBC News. 17 September 2008. https://news.bbc.co.uk/1/hi/business/7622180.stm.

- ↑ Peston, Robert (4 December 2009). "How HBOS escaped closure". BBC News. https://www.bbc.co.uk/blogs/thereporters/robertpeston/2009/12/how_hbos_escaped_closure.html.

- ↑ Warner, Jeremy (26 November 2009). "Why Lloyds gave-up (sic) opportunity to withdraw from disastrous HBOS deal". The Telegraph (London). http://blogs.telegraph.co.uk/finance/jeremywarner/100002264/why-lloyds-gave-up-opportunity-to-withdraw-from-disastrous-hbos-deal/.

- ↑ "Lloyds TSB: Results of General Meeting". http://www.investorrelations.lloydstsb.com/media/pdf_irmc/ir/2008/2008Nov19_LTSB_GM_Poll_Results.pdf.

- ↑ "HBOS shareholders back takeover". BBC News. 12 December 2008. https://news.bbc.co.uk/2/hi/business/7778914.stm.

- ↑ "Lloyds HBOS merger gets go-ahead". BBC News. 12 January 2009. https://news.bbc.co.uk/1/hi/business/7823521.stm.

- ↑ Peston, Robert (22 August 2009). "Robert Peston interview with Sir Victor Blank". BBC News. https://news.bbc.co.uk/2/hi/business/8214677.stm.

- ↑ "HBOS was 'finished' before Lloyds takeover". The Telegraph. 2 December 2009. https://www.telegraph.co.uk/news/uknews/scotland/6710682/HBOS-was-finished-before-Lloyds-takeover.html.

- ↑ "Lloyds shares tumble as HBOS slumps to £10bn loss". The Telegraph. 13 February 2009. https://www.telegraph.co.uk/finance/newsbysector/banksandfinance/4612681/Lloyds-shares-tumble-as-HBOS-slumps-to-10bn-loss.html.

- ↑ "Brown: We'll be rock of stability". BBC News. 13 October 2008. https://news.bbc.co.uk/2/hi/uk_news/politics/7666695.stm.

- ↑ Jones, Sarah (13 October 2008). "Stocks Rebound After Government Bank Bailout; Lloyds Gains". Bloomberg. https://www.bloomberg.com/apps/news?pid=20601102&sid=aCMY6HCQ_Tjc&refer=ukU.K.

- ↑ Dey, Iain (3 October 2009). "How the government bailout saved our banks". The Times (Times Newspapers Ltd). http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article6860385.ece.

- ↑ Griffiths, Katherine (3 October 2009). "Britain's banking crisis: how it happened". The Times (Times Newspapers Ltd). http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article6860385.ece.

- ↑ "U.K. government to take 43.4% in combined Lloyds, HBOS group". 12 January 2009. http://www.marketwatch.com/story/uk-government-to-take-434-in-combined-lloyds-hbos-group.

- ↑ "Lloyds GAPS documentation". p. 11. http://webcasts.lloydsbankinggroup.com/capitalraising/files/2009Nov3_LBG_GAPS_Alternative_Rights_Issue.pdf.

- ↑ "Placing and Open Offer Completed". Lloyds Banking Group. http://www.lloydsbankinggroup.com/media/pdfs/investors/2009/2009Jun8_LBG_P&COO_Completion(US).pdf.

- ↑ Sharp, Tim (12 October 2009). "Taxpayer loss from RBS and Lloyds bail-outs". The Herald. http://www.heraldscotland.com/business/markets-economy/taxpayer-loss-from-rbs-and-lloyds-bail-outs-1.925914.

- ↑ Peston, Robert (10 September 2009). "Lloyds to cut use of taxpayer insurance". BBC. https://www.bbc.co.uk/blogs/thereporters/robertpeston/2009/09/lloyds_to_cut_use_of_taxpayer.html.

- ↑ Wyke, Terry. Public Sculpture of Greater Manchester (p. 88). Liverpool University Press, 2004

- ↑ Press, Susan. "Manchester – Lloyds TSB on King Street". Manchester Evening News, 8 September 2003.

- ↑ "Stock Exchange announcement". London Stock Exchange. 3 November 2009. http://www.londonstockexchange.com/exchange/prices-and-news/news/market-news/market-news-detail.html?announcementId=10257587.

- ↑ "Lloyds Analyst Presentation". http://webcasts.lloydsbankinggroup.com/capitalraising/files/FINAL_-_Analyst_Presentation.pdf.

- ↑ Jill Treanor (31 December 2009). "guardian.co.uk". The Guardian (UK). https://www.theguardian.com/business/2009/dec/31/taxpayers-make-loss-rbs-lloyds.

- ↑ "Key points: The pre-Budget report at-a-glance". BBC News. 9 December 2009.

- ↑ Fletcher, Nick (12 February 2010). "Taxpayers' stake in Lloyds Banking Group to drop after share issue". The Guardian (UK). https://www.theguardian.com/business/marketforceslive/2010/feb/12/lloyds-banking-group-barclay.

- ↑ "Lloyds sells 70% stake in Esure". BBC News. 11 February 2010. https://news.bbc.co.uk/2/hi/uk_news/scotland/8510620.stm.

- ↑ "Lloyds mulling St James's Place stake sale: report". Reuters. https://www.reuters.com/article/us-lloyds-idUSBRE8A308120121104.

- ↑ "Lloyds to sell Spanish retail division to Sabadell". BBC News. 29 April 2013. https://www.bbc.co.uk/news/business-22335045.

- ↑ Scuffham, Matt (10 September 2013). "Lloyds shares hit three-year high as state considers stake sale". Reuters. http://uk.reuters.com/article/uk-lloyds-shares-idUKBRE98909820130910.

- ↑ "Lloyds share sale raises £3.2bn". BBC News. 17 September 2013. https://www.bbc.co.uk/news/business-24122713.

- ↑ "Lloyds stake sale raises £4.2bn". BBC News. 26 March 2014. https://www.bbc.co.uk/news/business-26744600.

- ↑ "Government reduces Lloyds shareholding to below 7%". HM Treasury. 13 December 2016. https://www.gov.uk/government/news/government-reduces-lloyds-shareholding-to-below-7.

- ↑ "Government sells more shares in Lloyds Banking Group". BBC News. 22 November 2016. https://www.bbc.co.uk/news/business-38062159.

- ↑ "Share sale returns Lloyds to private sector". BBC News. 17 May 2017. https://www.bbc.co.uk/news/business-39932871.

- ↑ "Car finance scandal: Lloyds sets aside £1.2bn for potential payouts" (in en-GB). 2025-02-20. https://www.bbc.co.uk/news/articles/cj0q422mn70o.

- ↑ Makortoff, Kalyeena; correspondent, Kalyeena Makortoff Banking (2025-02-20). "Lloyds puts aside a further £700m for compensation over car finance scandal" (in en-GB). The Guardian. ISSN 0261-3077. https://www.theguardian.com/business/2025/feb/20/lloyds-puts-aside-another-700m-for-compensation-over-car-finance-scandal.

- ↑ Quinio, Akila; Aliaj, Ortenca; Agyemang, Emma (2025-03-02). "HMRC to ditch Barclays as government's bank in favour of Lloyds". Financial Times. https://www.ft.com/content/4eb12cc1-4a45-4f5f-8ca2-a6e2329a430e.

- ↑ "Lloyds, Halifax and Bank of Scotland customers to use any branch" (in en-GB). 2025-01-09. https://www.bbc.com/news/articles/czx5x96lgpno.

- ↑ "Five Ways, Birmingham, in 1935". Birmingham City Council. Retrieved 27 November 2009

- ↑ "Rights Issue and Capital Enhancement Proposals". Presentations and Webcasts, Lloyds Banking Group, 3 November 2009

- ↑ Simon, Emma (26 November 2012). "Millions of Lloyds customers told banking details to change". Daily Telegraph. https://www.telegraph.co.uk/finance/personalfinance/consumertips/banking/9703432/Millions-of-Lloyds-customers-told-banking-details-to-change.html.

- ↑ Banham, Mark (13 September 2010). "Lloyds TSB to rebrand as Lloyds Bank". Marketing. http://www.marketingmagazine.co.uk/news/1028017/.

- ↑ Hiscott, Graham (19 July 2012). "'Proud to make banking boring again': Co-op buys 632 branches from Lloyds and aims to restore faith in the industry". Daily Mirror. https://www.mirror.co.uk/money/city-news/co-operative-bank-buys-632-lloyds-1150437.

- ↑ Peston, Robert (19 July 2012). "Lloyds bigs up the Co-op". BBC News. https://www.bbc.co.uk/news/business-18899185.

- ↑ Treanor, Jill (8 February 2013). "Co-op plan to take over Lloyds branches 'facing difficulty'". The Guardian. https://www.theguardian.com/business/2013/feb/08/co-op-lloyds-branches.

- ↑ "Lloyds' branch sale to Co-op falls through". BBC News. 24 April 2013. https://www.bbc.co.uk/news/business-22276082.

- ↑ "TSB name reappears across UK High Streets". BBC News. 8 September 2013. https://www.bbc.co.uk/news/business-24006941.

- ↑ "TSB IPO price range announced". IG Markets. http://www.ig.com/uk/shares-news/2014/06/10/tsb-ipo-price-range-announced-16989.

- ↑ "TSB shares jump on trading debut and lift prospects for future Lloyds sell-off". The Guardian. 20 June 2014. https://www.theguardian.com/business/2014/jun/20/lloyds-tsb-branches-valuation-share-sale.

- ↑ "TSB sold to Spanish bank in £1.7bn deal". The Telegraph. 20 March 2015. https://www.telegraph.co.uk/finance/newsbysector/banksandfinance/11484514/TSB-sold-to-Spanish-bank-in-1.7bn-deal.html.

- ↑ "TSB agrees £1.7bn takeover by Spain's Sabadell". BBC News. https://www.bbc.co.uk/news/business-31980833.

- ↑ "Lloyds CEO shakes up bank after strategy launch, some executives to exit". Reuters. 15 March 2022. https://www.reuters.com/world/uk/lloyds-ceo-shakes-up-bank-after-strategy-launch-some-executives-exit-2022-03-15/.

- ↑ "Lloyds to Divide Its Three Units Into Five". PYMNTS.com. 15 March 2022. https://www.pymnts.com/news/banking/2022/lloyds-to-divide-its-three-units-into-five/.

- ↑ "Robin Budenberg". https://www.lloydsbankinggroup.com/who-we-are/group-overview/directors-and-governance/robin-budenberg.html.

- ↑ 77.0 77.1 "Directors". https://www.lloydsbankinggroup.com/who-we-are/group-overview/directors-and-governance.html.

- ↑ "Sir Victor Blank". The Jewish Leadership Council. https://www.thejlc.org/sir_victor_blank.

- ↑ "Sir Win Bischoff, Chairman, Financial Reporting Council". ICGN. https://www.icgn.org/speakers/sir-win-bischoff-chairman-financial-reporting-council.

- ↑ Dickinson, Clare. "Lloyds told to pay bonus to former CEO Eric Daniels". https://www.fnlondon.com/articles/lloyds-ordered-to-pay-bonus-former-ceo-eric-daniels-20180327.

- ↑ Walker, Owen; Morris, Stephen; Massoudi, Arash (1 December 2020). "Credit Suisse picks António Horta-Osório as chairman". Financial Times. https://www.ft.com/content/0afc85c4-89af-4648-b21c-98ded5cea7fa.

- ↑ "RADAR Radiate Network". http://www.radiate-net.org.uk/.

- ↑ "HELPING MANAGE THE FINANCIAL STRAIN OF UNIVERSITY". http://www.lloydsbankinggroup.com/our-group/responsible-business/our-community-programmes/lloyds-scholars/.

- ↑ 84.0 84.1 84.2 "Lloyds Scholars". https://www.lloydsbank.com/banking-with-us/in-your-community/scholars.html.

- ↑ Tyack, Geoffrey Oxford: An Architectural Guide (pp.262–3) Oxford University Press, 1998

- ↑ "SLloyds TSB – Best Bank Award". http://www.financemarkets.co.uk/2007/07/16/lloyds-tsb-%E2%80%93-best-bank-award/.

- ↑ "Lloyds TSB tops workforce diversity chart". 24 June 2008. http://www.peoplemanagement.co.uk/pm/articles/2008/06/lloyds-tsb-tops-workforce-diversity-chart.htm.

- ↑ "Real FD Awards". http://www.realfd.net/daily-insights/leading-the-finance-team/5227621/winners-of-the-2008-cbirealfd-fds-excellence-awards-announced.thtml.

- ↑ "What Investment UK – Investment opportunities and savings advice for private investors". whatinvestment.co.uk. http://www.whatinvestment.co.uk/.

- ↑ "Consumer Money Awards 2009 Results moneyfacts.co.uk". http://downloads.moneyfacts.co.uk/moneyfactsgroup/pdf/cma_2009_newsletter.pdf.

- ↑ "Your Mortgage Awards 2009 yourmortgage.co.uk". http://www.yourmortgage.co.uk/your_mortgage_awards.

- ↑ COMMERCIAL STREET 1. 1164 (West Side) SE 02 NE SP/147 Lloyds Bank II 2, see Images of England No. 447622 National Monuments Record, English Heritage (retrieved 23 November 2009).

- ↑ Mollenkamp, Carrick (3 September 2010). "Probe Circles Globe to Find Dirty Money". The Wall Street Journal. https://online.wsj.com/news/articles/SB10001424052748703431604575468094090700862.

- ↑ Tax gap reporting team (11 February 2009). "Lloyds faces accusations of tax avoidance". The Guardian (London). https://www.theguardian.com/business/2009/feb/11/tax-gap-lloyds.

- ↑ Insley, Jill (25 February 2010). "Lloyds group tops ombudsman complaints". The Guardian (London). https://www.theguardian.com/money/2010/feb/25/lloyds-bank-complaints-ombudsman.

- ↑ "Lloyds Bank scraps overdraft fees on Islamic accounts" (in en). 26 April 2014. http://www.independent.co.uk/news/uk/home-news/lloyds-bank-removes-overdraft-fee-from-islamic-accounts-9291932.html.

- ↑ Verity, Andy; Lewis, David (30 January 2017). "Former HBOS manager found guilty of corruption and fraud". BBC News. https://www.bbc.co.uk/news/business-38772660.

- ↑ Reporter: Andy Verity; Producer: David Lewis; Editor: Gail Champion (31 January 2017). "The Turnaround Game". File on Four. BBC. BBC Radio Four. Retrieved 31 January 2017.

- ↑ "Cambridge couple vindicated in massive fraud case". Cambridge Live. 30 January 2017. https://www.cambridge-news.co.uk/business/business-news/cambridge-couple-vindicated-massive-fraud-12529459.

- ↑ "Lloyds: how HBOS whistleblower exposed failings in UK regulation". Financial Times. https://www.ft.com/content/2fb12910-264d-11e9-b329-c7e6ceb5ffdf.

- ↑ Read, Simon (14 January 2019). "Lloyds' overdraft fees are 'unacceptable'" (in en-GB). BBC News. https://www.bbc.com/news/business-46864604.

- ↑ "Review alleges 'major fraud' at Lloyds Bristol unit committed". BBC News. 25 October 2020. https://www.bbc.co.uk/news/uk-england-bristol-54630259.

- ↑ "Lloyds Bank police probe may get more funding after angry meeting". BBC News. 29 June 2022. https://www.bbc.com/news/uk-england-bristol-61974749.

External links

- Template:Wikidata-inline

- No URL found. Please specify a URL here or add one to Wikidata.

- Lloyds Banking Group companies grouped at OpenCorporates

|

KSF

KSF