Wise

Topic: Company

From HandWiki - Reading time: 28 min

From HandWiki - Reading time: 28 min

| Error creating thumbnail: Unable to save thumbnail to destination | |||||||||||||||||||||||||||||

| Type of business | Public company | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Traded as | Short description: Stock exchange in the City of London

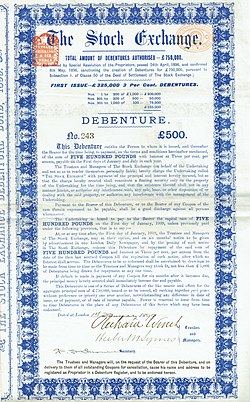

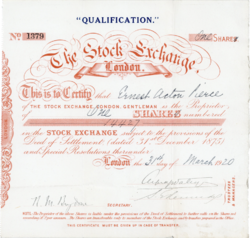

London Stock Exchange (LSE) is a stock exchange in the City of London, England , United Kingdom. As of August 2023,[update] the total market value of all companies trading on the LSE stood at $3.18 trillion.[3] Its current premises are situated in Paternoster Square close to St Paul's Cathedral in the City of London. Since 2007, it has been part of the London Stock Exchange Group (LSEG (LSE: [Script error: No such module "Stock tickers/LSE". LSEG])).[4] The LSE is the most-valued stock exchange in Europe as of 2023.[5] According to the 2020 Office for National Statistics report, approximately 12% of UK-resident individuals reported having investments in stocks and shares.[6] According to the 2020 Financial Conduct Authority (FCA) report, approximately 15% of UK adults reported having investments in stocks and shares.[7] HistoryCoffee HouseThe Royal Exchange had been founded by English financier Thomas Gresham and Sir Richard Clough on the model of the Antwerp Bourse. It was opened by Elizabeth I of England in 1571.[8][9] During the 17th century, stockbrokers were not allowed in the Royal Exchange due to their rude manners. They had to operate from other establishments in the vicinity, notably Jonathan's Coffee-House. At that coffee house, a broker named John Castaing started listing the prices of a few commodities, such as salt, coal, paper, and exchange rates in 1698. Originally, this was not a daily list and was only published a few days of the week.[10] This list and activity was later moved to Garraway's coffee house. Public auctions during this period were conducted for the duration that a length of tallow candle could burn; these were known as "by inch of candle" auctions. As stocks grew, with new companies joining to raise capital, the royal court also raised some monies. These are the earliest evidence of organised trading in marketable securities in London. Royal ExchangeAfter Gresham's Royal Exchange building was destroyed in the Great Fire of London, it was rebuilt and re-established in 1669. This was a move away from coffee houses and a step towards the modern model of stock exchange.[11] The Royal Exchange housed not only brokers but also merchants and merchandise. This was the birth of a regulated stock market, which had teething problems in the shape of unlicensed brokers. In order to regulate these, Parliament passed an Act in 1697 that levied heavy penalties, both financial and physical, on those brokering without a licence. It also set a fixed number of brokers (at 100), but this was later increased as the size of the trade grew. This limit led to several problems, one of which was that traders began leaving the Royal Exchange, either by their own decision or through expulsion, and started dealing in the streets of London. The street in which they were now dealing was known as 'Exchange Alley', or 'Change Alley'; it was suitably placed close to the Bank of England. Parliament tried to regulate this and ban the unofficial traders from the Change streets. Traders became weary of "bubbles" when companies rose quickly and fell, so they persuaded Parliament to pass a clause preventing "unchartered" companies from forming. After the Seven Years' War (1756–1763), trade at Jonathan's Coffee House boomed again. In 1773, Jonathan, together with 150 other brokers, formed a club and opened a new and more formal "Stock Exchange" in Sweeting's Alley. This now had a set entrance fee, by which traders could enter the stock room and trade securities. It was, however, not an exclusive location for trading, as trading also occurred in the Rotunda of the Bank of England. Fraud was also rife during these times and in order to deter such dealings, it was suggested that users of the stock room pay an increased fee. This was not met well and ultimately, the solution came in the form of annual fees and turning the Exchange into a Subscription room. The Subscription room created in 1801 was the first regulated exchange in London, but the transformation was not welcomed by all parties. On the first day of trading, non-members had to be expelled by a constable. In spite of the disorder, a new and bigger building was planned, at Capel Court. William Hammond laid the first foundation stone for the new building on 18 May. It was finished on 30 December when "The Stock Exchange" was incised on the entrance. First Rule Book In the Exchange's first operating years, on several occasions there was no clear set of regulations or fundamental laws for the Capel Court trading. In February 1812, the General Purpose Committee confirmed a set of recommendations, which later became the foundation of the first codified rule book of the Exchange. Even though the document was not a complex one, topics such as settlement and default were, in fact, quite comprehensive. With its new governmental commandments[12] and increasing trading volume, the Exchange was progressively becoming an accepted part of the financial life in the city. In spite of continuous criticism from newspapers and the public, the government used the Exchange's organised market (and would most likely not have managed without it) to raise the enormous amount of money required for the wars against Napoleon. Foreign and regional exchangesAfter the war and facing a booming world economy, foreign lending to countries such as Brazil, Peru and Chile was a growing market. Notably, the Foreign Market at the Exchange allowed for merchants and traders to participate, and the Royal Exchange hosted all transactions where foreign parties were involved. The constant increase in overseas business eventually meant that dealing in foreign securities had to be allowed within all of the Exchange's premises. Just as London enjoyed growth through international trade, the rest of Great Britain also benefited from the economic boom. Two other cities, in particular, showed great business development: Liverpool and Manchester. Consequently, in 1836 both the Manchester and Liverpool stock exchanges were opened. Some stock prices sometimes rose by 10%, 20% or even 30% in a week. These were times when stockbroking was considered a real business profession, and such attracted many entrepreneurs. Nevertheless, with booms came busts, and in 1835 the "Spanish panic" hit the markets, followed by a second one two years later. The Exchange before the World Wars By June 1853, both participating members and brokers were taking up so much space that the Exchange was now uncomfortably crowded, and continual expansion plans were taking place. Having already been extended west, east, and northwards, it was then decided the Exchange needed an entire new establishment. Thomas Allason was appointed as the main architect, and in March 1854, the new brick building inspired from the Great Exhibition stood ready. This was a huge improvement in both surroundings and space, with twice the floor space available. By the late 1800s, the telephone, ticker tape, and the telegraph had been invented. Those new technologies led to a revolution in the work of the Exchange. First World War As the financial centre of the world, both the City and the Stock Exchange were hit hard by the outbreak of World War I in 1914. Due to fears that borrowed money was to be called in and that foreign banks would demand their loans or raise interest, prices surged at first. The decision to close the Exchange for improved breathing space and to extend the August Bank Holiday to prohibit a run on banks, was hurried through by the committee and Parliament, respectively. The Stock Exchange ended up being closed from the end of July until the New Year, causing street business to be introduced again, as well as the "challenge system". The Exchange was set to open again on 4 January 1915 under tedious restrictions: transactions were to be in cash only. Due to the limitations and challenges on trading brought by the war, almost a thousand members quit the Exchange between 1914 and 1918. When peace returned in November 1918, the mood on the trading floor was generally cowed. In 1923, the Exchange received its own coat of arms, with the motto Dictum Meum Pactum, My Word is My Bond. Second World WarIn 1937, officials at the Exchange used their experiences from World War I to draw up plans for how to handle a new war. The main concerns included air raids and the subsequent bombing of the Exchange's perimeters, and one suggestion was a move to Denham, Buckinghamshire. This however never took place. On the first day of September 1939, the Exchange closed its doors "until further notice" and two days later World War II was declared. Unlike in the prior war, the Exchange opened its doors again six days later, on 7 September. As the war escalated into its second year, the concerns for air raids were greater than ever. Eventually, on the night of 29 December 1940, one of the greatest fires in London's history took place. The Exchange's floor was hit by a clutch of incendiary bombs, which were extinguished quickly. Trading on the floor was now drastically low and most was done over the phone to reduce the possibility of injuries. The Exchange was only closed for one more day during wartime, in 1945 due to damage from a V-2 rocket. Nonetheless, trading continued in the house's basement. Post-war After decades of uncertain if not turbulent times, stock market business boomed in the late 1950s. This spurred officials to find new, more suitable accommodation. The work on the new Stock Exchange Tower began in 1967. The Exchange's new 321 feet (98 metres) high building had 26 storeys with council and administration at the top, and middle floors let out to affiliate companies. Queen Elizabeth II opened the building on 8 November 1972; it was a new City landmark, with its 23,000 sq ft (2,100 m2) trading floor.  1973 marked a year of changes for the Stock Exchange. First, two trading prohibitions were abolished. A report from the Monopolies and Mergers Commission recommended the admittance of both women and foreign-born members on the floor. Second, in March the London Stock Exchange formally merged with the eleven British and Irish regional exchanges, including the Scottish Stock Exchange.[13] This expansion led to the creation of a new position of Chief Executive Officer; after an extensive search this post was given to Robert Fell. There were more governance changes in 1991, when the governing Council of the Exchange was replaced by a Board of Directors drawn from the Exchange's executive, customer, and user base; and the trading name became "The London Stock Exchange". FTSE 100 Index (pronounced "Footsie 100") was launched by a partnership of the Financial Times and the Stock Exchange on 3 January 1984. This turned out to be one of the most useful indices of all, and tracked the movements of the 100 leading companies listed on the Exchange. IRA bombingOn 20 July 1990, a bomb planted by the Provisional Irish Republican Army (IRA) exploded in the men's toilets behind the visitors' gallery. The area had already been evacuated and nobody was injured.[14] About 30 minutes before the blast at 8:49 a.m., a man who said he was a member of the IRA told Reuters that a bomb had been placed at the exchange and was about to explode. Police officials said that if there had been no warning, the human toll would have been very high.[15] The explosion ripped a hole in the 23-storey building in Threadneedle Street and sent a shower of glass and concrete onto the street.[16] The long-term trend towards electronic trading platforms reduced the Exchange's attraction to visitors, and although the gallery reopened, it was closed permanently in 1992. "Big Bang"The biggest event of the 1980s was the sudden de-regulation of the financial markets in the UK in 1986. The phrase "Big Bang" was coined to describe measures, including abolition of fixed commission charges and of the distinction between stockjobbers and stockbrokers on the London Stock Exchange, as well as the change from an open outcry to electronic, screen-based trading. In 1995, the Exchange launched the Alternative Investment Market, the AIM, to allow growing companies to expand into international markets. Two years later, the Electronic Trading Service (SETS) was launched, bringing greater speed and efficiency to the market. Next, the CREST settlement service was launched. In 2000, the Exchange's shareholders voted to become a public limited company, London Stock Exchange plc. London Stock Exchange also transferred its role as UK Listing Authority to the Financial Services Authority (FSA-UKLA). EDX London, an international equity derivatives business, was created in 2003 in partnership with OM Group. The Exchange also acquired Proquote Limited, a new generation supplier of real-time market data and trading systems.   The old Stock Exchange Tower became largely redundant with Big Bang, which deregulated many of the Stock Exchange's activities: computerised systems and dealing rooms replaced face-to-face trading. In 2004, London Stock Exchange moved to a brand-new headquarters in Paternoster Square, close to St Paul's Cathedral. In 2007, the London Stock Exchange merged with Borsa Italiana, creating London Stock Exchange Group (LSEG). The Group's headquarters are in Paternoster Square. The Stock Exchange in Paternoster Square was the initial target for the protesters of Occupy London on 15 October 2011. Attempts to occupy the square were thwarted by police.[17] Police sealed off the entrance to the square as it is private property, a High Court injunction having previously been granted against public access to the square.[18] The protesters moved nearby to occupy the space in front of St Paul's Cathedral.[19] The protests were part of the global Occupy movement. On 25 April 2019, the final day of the Extinction Rebellion disruption in London, 13 activists glued themselves together in a chain, blocking the entrances of the Stock Exchange.[20][21] The protesters were all later arrested on suspicion of aggravated trespass.[21] Extinction Rebellion had said its protesters would target the financial industry "and the corrosive impacts of the ... sector on the world we live in" and activists also blocked entrances to HM Treasury and the Goldman Sachs office on Fleet Street.[22] ActivitiesPrimary marketsThere are two main markets on which companies trade on the LSE: the main market and the alternative investment market. Main MarketThe main market is home to over 1,300 large companies from 60 countries.[23] The FTSE 100 Index ("footsie") is the main share index of the 100 most highly capitalised UK companies listed on the Main Market.[24] Alternative Investment MarketThe Alternative Investment Market is LSE's international market for smaller companies. A wide range of businesses including early-stage, venture capital-backed, as well as more-established companies join AIM seeking access to growth capital. The AIM is classified as a Multilateral Trading Facility (MTF) under the 2004 MiFID directive, and as such it is a flexible market with a simpler admission process for companies wanting to be publicly listed.[25] Secondary marketsThe securities available for trading on London Stock Exchange:[26]

Post tradeThrough the Exchange's Italian arm, Borsa Italiana, the London Stock Exchange Group as a whole offers clearing and settlement services for trades through CC&G (Cassa di Compensazione e Garanzia) and Monte Titoli.[27][28] is the Groups Central Counterparty (CCP) and covers multiple asset classes throughout the Italian equity, derivatives and bond markets. CC&G also clears Turquoise derivatives. Monte Titoli (MT) is the pre-settlement, settlement, custody and asset services provider of the Group. MT operates both on-exchange and OTC trades with over 400 banks and brokers. TechnologyLondon Stock Exchange's trading platform is its own Linux-based edition named Millennium Exchange.[29] Their previous trading platform TradElect was based on Microsoft's .NET Framework, and was developed by Microsoft and Accenture. For Microsoft, LSE was a good combination of a highly visible exchange and yet a relatively modest IT problem.[30] Despite TradElect only being in use for about two years,[31] after suffering multiple periods of extended downtime and unreliability[32][33] the LSE announced in 2009 that it was planning to switch to Linux in 2010.[34][35] The main market migration to MillenniumIT technology was successfully completed in February 2011.[36] LSEG provides high-performance technology, including trading, market surveillance and post-trade systems, for over 40 organisations and exchanges, including the Group's own markets. Additional services include network connectivity, hosting and quality assurance testing. MillenniumIT, GATElab and Exactpro are among the Group's technology companies.[37] The LSE facilitates stock listings in a currency other than its "home currency". Most stocks are quoted in GBP but some are quoted in EUR while others are quoted in USD. Mergers and acquisitionsOn 3 May 2000, it was announced that the LSE would merge with the Deutsche Börse; however this fell through.[38] On 23 June 2007, the London Stock Exchange announced that it had agreed on the terms of a recommended offer to the shareholders of the Borsa Italiana S.p.A. The merger of the two companies created a leading diversified exchange group in Europe. The combined group was named the London Stock Exchange Group, but still remained two separate legal and regulatory entities. One of the long-term strategies of the joint company is to expand Borsa Italiana's efficient clearing services to other European markets. In 2007, after Borsa Italiana announced that it was exercising its call option to acquire full control of MBE Holdings; thus the combined Group would now control Mercato dei Titoli di Stato, or MTS. This merger of Borsa Italiana and MTS with LSE's existing bond-listing business enhanced the range of covered European fixed income markets. London Stock Exchange Group acquired Turquoise (TQ), a Pan-European MTF, in 2009.[39] On 9 October 2020, London Stock Exchange agreed to sell the Borsa Italiana (including Borsa's bond trading platform MTS) to Euronext for €4.3 billion (£3.9 billion) in cash.[40] Euronext completed the acquisition of the Borsa Italiana Group on 29 April 2021 for a final price of €4,444 million.[41] On 12 Dec 2022, Microsoft bought a nearly 4% stake in LSE (London Stock Exchange Group) as part of a ten-year cloud deal.[42] NASDAQ bidsIn December 2005, London Stock Exchange rejected a £1.6 billion takeover offer from Macquarie Bank. London Stock Exchange described the offer as "derisory", a sentiment echoed by shareholders in the Exchange. Shortly after Macquarie withdrew its offer, the LSE received an unsolicited approach from NASDAQ valuing the company at £2.4 billion. This too it rejected. NASDAQ later pulled its bid, and less than two weeks later on 11 April 2006, struck a deal with LSE's largest shareholder, Ameriprise Financial's Threadneedle Asset Management unit, to acquire all of that firm's stake, consisting of 35.4 million shares, at £11.75 per share.[43] NASDAQ also purchased 2.69 million additional shares, resulting in a total stake of 15%. While the seller of those shares was undisclosed, it occurred simultaneously with a sale by Scottish Widows of 2.69 million shares.[44] The move was seen as an effort to force LSE to the negotiating table, as well as to limit the Exchange's strategic flexibility.[45] Subsequent purchases increased NASDAQ's stake to 25.1%, holding off competing bids for several months.[46][47][48] United Kingdom financial rules required that NASDAQ wait for a period of time before renewing its effort. On 20 November 2006, within a month or two of the expiration of this period, NASDAQ increased its stake to 28.75% and launched a hostile offer at the minimum permitted bid of £12.43 per share, which was the highest NASDAQ had paid on the open market for its existing shares.[49] The LSE immediately rejected this bid, stating that it "substantially undervalues" the company.[50] NASDAQ revised its offer (characterized as an "unsolicited" bid, rather than a "hostile takeover attempt") on 12 December 2006, indicating that it would be able to complete the deal with 50% (plus one share) of LSE's stock, rather than the 90% it had been seeking. The U.S. exchange did not, however, raise its bid. Many hedge funds had accumulated large positions within the LSE, and many managers of those funds, as well as Furse, indicated that the bid was still not satisfactory. NASDAQ's bid was made more difficult because it had described its offer as "final", which, under British bidding rules, restricted their ability to raise its offer except under certain circumstances. In the end, NASDAQ's offer was roundly rejected by LSE shareholders. Having received acceptances of only 0.41% of rest of the register by the deadline on 10 February 2007, Nasdaq's offer duly lapsed.[51] On 20 August 2007, NASDAQ announced that it was abandoning its plan to take over the LSE and subsequently look for options to divest its 31% (61.3 million shares) shareholding in the company in light of its failed takeover attempt.[52] In September 2007, NASDAQ agreed to sell the majority of its shares to Borse Dubai, leaving the United Arab Emirates-based exchange with 28% of the LSE.[53] Proposed merger with TMX GroupOn 9 February 2011, London Stock Exchange Group announced it had agreed to merge with the Toronto-based TMX Group, the owners of the Toronto Stock Exchange, creating a combined entity with a market capitalization of listed companies equal to £3.7 trillion.[54] Xavier Rolet, CEO of the LSE Group at the time, would have headed the new enlarged company, while TMX Chief Executive Thomas Kloet would have become the new firm president. London Stock Exchange Group however announced it was terminating the merger with TMX on 29 June 2011 citing that "LSEG and TMX Group believe that the merger is highly unlikely to achieve the required two-thirds majority approval at the TMX Group shareholder meeting".[55] Even though LSEG obtained the necessary support from its shareholders, it failed to obtain the required support from TMX's shareholders. Opening timesNormal trading sessions on the main orderbook (SETS) are from 08:00 to 16:30 local time every day of the week except Saturdays, Sundays and holidays declared by the exchange in advance. The detailed schedule is as follows:

[56] Auction Periods (SETQx) SETSqx (Stock Exchange Electronic Trading Service – quotes and crosses) is a trading service for securities less liquid than those traded on SETS. The auction uncrossings are scheduled to take place at 8:00, 9:00, 11:00, 14:00, and 16:35. Observed holidays are New Year's Day, Good Friday, Easter Monday, May Bank Holiday, Spring Bank Holiday, Summer Bank Holiday, Christmas Day, and Boxing Day. If New Year's Day, Christmas Day, and/or Boxing Day falls on a weekend, the following working day is observed as a holiday. Arms

See also

References

Further reading

External links

[ ⚑ ] 51°30′54.25″N 0°5′56.77″W / 51.5150694°N 0.0991028°W

| ||||||||||||||||||||||||||||

| Founded | January 2011 | ||||||||||||||||||||||||||||

| Headquarters | , United Kingdom | ||||||||||||||||||||||||||||

| Country of origin | United Kingdom | ||||||||||||||||||||||||||||

| No. of locations | 5 main offices (Tallinn, London, Budapest, Singapore, Austin, Texas ) | ||||||||||||||||||||||||||||

| Founder(s) | Taavet Hinrikus, Kristo Käärmann | ||||||||||||||||||||||||||||

| Chairman | Taavet Hinrikus | ||||||||||||||||||||||||||||

| CEO | Kristo Käärmann | ||||||||||||||||||||||||||||

| Industry | Financial services | ||||||||||||||||||||||||||||

| Services | Foreign exchange, remittance | ||||||||||||||||||||||||||||

| Revenue | £846 million (March 2023)[1] | ||||||||||||||||||||||||||||

| Operating income | £157.2 million (March 2023)[2] | ||||||||||||||||||||||||||||

| Profit | £114.0 million (March 2023)[3] | ||||||||||||||||||||||||||||

| Total assets | £11,904 million (March 2023)[4] | ||||||||||||||||||||||||||||

| Total equity | £576.9 million (March 2023)[5] | ||||||||||||||||||||||||||||

| Employees | 4411 (March 2023)[6] | ||||||||||||||||||||||||||||

| Website | {{{1}}} | ||||||||||||||||||||||||||||

Wise (formerly TransferWise) is a UK-based foreign exchange financial technology company founded by Estonian businessmen Kristo Käärmann and Taavet Hinrikus in January 2011.[7][8][9] Wise specializes in cross-border payment transfers. As of 2023, it offers three main products: Wise Account, Wise Business, and Wise Platform.[10]

History

Wise was cofounded by Taavet Hinrikus (Skype's first employee),[11] and financial consultant Kristo Käärmann.

Hinrikus moved from Estonia to London around 2006. Hinrikus experienced frustration whenever he made an international money transfer between Estonia and the United Kingdom . Claiming that "most of the charge was hidden in the exchange rate. The banks try hard to make it extremely difficult to understand what you’re paying for. There is no transparency in the market"[12]

The company's system has been compared to the hawala money transfer system.[13][14][15][16]

In its first year of operation, transactions through Wise amounted to €10 million.[17] In 2012, Wise was named one of "East London's 20 hottest tech startups" by The Guardian , Start-Up of the Week by Wired UK, one of five "start-ups to watch" at Seedcamp's 2012 US Demo Day by TechCrunch, and appeared in Startups.co.uk's list of the top 100 UK start-ups of 2012.[18][19][20][21]

In April 2013, Wise stopped letting users purchase Bitcoin, citing pressure from banking providers.[22][unreliable source?] Independent comparison site Monito reported that Wise was on average 83% cheaper than the big four UK banks on major currency "routes", but could be up to 90% cheaper in certain specific cases.[23]

In May 2015, Wise was ranked No. 8 on CNBC 's 2015 Disruptor 50 list,[24] and in August 2015, the company was named a World Economic Forum Tech Pioneer.[25]

On 8 April 2017, an internal memo from British bank Santander claimed the bank would lose 84% of its revenue from its money transfer business if its charges were the same as Wise.[26] Also in April 2017, the company announced the opening of its APAC hub in Singapore.[27] In 2019, the company announced opening an office in Brussels.[28] In May 2017, the company announced its customers were sending over £1 billion every month using the service,[29] and that the company had turned profitable six years after being founded.[30]

On 21 January 2021, Sky News reported that Wise had appointed Goldman Sachs and Morgan Stanley as joint global coordinators for its planned initial public offering.[31] On 22 February 2021, the company rebranded from TransferWise to Wise.[32][33][34] As part of this rebranding, the company also launched a new website domain.[32] The company rebranded to reflect its expanded product offering beyond international money transfer.[35]

On 2 July 2021, it was announced in a prospectus published by the company that co-founder Taavet Hinrikus would step down as chair within a year.[36] It was also announced that David Wells would replace him in this position.

On 7 July 2021, Wise went public with a direct listing on the London Stock Exchange and was valued at $11 billion.[37]

On 27 June 2022, the Financial Conduct Authority reported that the Wise CEO, Kristo Käärmann, was included on their list of individuals and businesses receiving penalties for a deliberate default regarding their tax affairs.[38] He would remain on the list for 12 months, starting in September 2021. He reportedly failed to pay £720,000 for the 2017–2018 tax year.[39]

In 2023, the founders, Käärmann and Hinrikus, have improved their positions in The Sunday Times Rich List 2023 of the wealthiest people in the UK. Käärmann, ranked as 156th, being worth £1.134 billion and Hinrikus ranked 197th with a net worth of £861 million.[40]

Services

Wise offers three products: Wise Account, Wise Business, and Wise Platform. Wise is not a bank, as it states it does not lend out customer money to others.[41] However, it offers accounts through Wise Account for customers to hold their money while sending, receiving, and spending.[10] Customers may opt-in to earn interest on the account and gain FDIC insurance on up to $250,000 of their deposit, relying on Wise's partnership with banks.[41] Wise Business allows businesses to perform cross-border money transfers. Wise Platform is a platform allowing "banks and businesses to offer their customers fast, cheap and transparent ways to manage their money across borders".[10]

As of 2023, Wise partners with BlackRock for its interest bearing accounts.[42]

Funding

Wise received seed funding amounting to $1.3 million from a consortium including venture firms IA Ventures and Index Ventures, IJNR Ventures, NYPPE as well as individual investors such as PayPal co-founder Max Levchin, former Betfair CEO David Yu, and Wonga.com co-founder Errol Damelin.[43] Wise also received investment after being named one of Seedcamp 2011's winners.[44]

In May 2013, it was announced that Wise had secured a $6 million investment round led by Peter Thiel's Valar Ventures.[45] Wise raised a further $25 million in June 2014, adding Richard Branson as an investor.[46]

In January 2015, it was announced that Wise had raised a $58 million Series C round, led by investors Andreessen Horowitz.[47] In May 2016, Wise secured a funding of $26 million. This raised the company's valuation to $1.1 billion. As of May 2016, Wise has raised a total of $117 million in funding.[48]

In November 2017, the company raised a $280 million Series E led by Old Mutual Global Investors and Institutional Venture Partners, as well as Sapphire Ventures, Japanese Mitsui & Co., and World Innovation Lab.[49]

In May 2019, the company had the secondary investment round of $292 million and reached the total valuation of $3.5 billion, more than double the valuation Wise achieved in late 2017 at the time of its $280 million Series E round.[50]

In July 2020, the company disclosed a secondary investment round of $319 million and reached the total valuation of $5 billion, led by new investor D1 Capital Partners and existing shareholder Lone Pine Capital. Vulcan Capital also came on board as a new investor, with Baillie Gifford, Fidelity Investments and LocalGlobe adding to their existing holdings.[51]

Criticism

In May 2016, Wise's claim "you save up to 90% against banks" was called misleading by the UK Advertising Standards Authority.[52]

In June 2020, after experts raised ethical and privacy concerns around the digital COVID-19 immunity passports Wise was helping develop, the company conceded immunity passports were not a "perfect solution" and co-founder Hinrikus said they would not be launched publicly until there was scientific consensus on COVID-19 immunity.[53]

Wise used to be a preferred service for Ukrainian nationals to transfer cash, especially after the Russian invasion of the country, e.g., for supporting relatives that had to flee Ukraine. While other financial institutions kept their operations for Ukraine residents open, Wise suspended the opening of new accounts.[54][55]

In January 2023 Wise was accused of harming competition in an official letter to the UK Competition and Markets Authority by its competitor Atlantic Money. Wise is said to have removed the cheaper challenger from its international transfers price comparison table for economic reasons. Wise is also alleged to have denied Atlantic Money access to additional comparison sites the firm owns and controls.[56][57]

See also

- Azimo, competitor (2012–2022)

References

- ↑ "Wise 2023 Annual Reports and Accounts". https://wise.com/imaginary-v2/Wise-Annual-Report-Accounts-FY2023.pdf.

- ↑ "Wise 2023 Annual Reports and Accounts". https://wise.com/imaginary-v2/Wise-Annual-Report-Accounts-FY2023.pdf.

- ↑ "Wise 2023 Annual Reports and Accounts". https://wise.com/imaginary-v2/Wise-Annual-Report-Accounts-FY2023.pdf.

- ↑ "Wise 2023 Annual Reports and Accounts". https://wise.com/imaginary-v2/Wise-Annual-Report-Accounts-FY2023.pdf.

- ↑ "Wise 2023 Annual Reports and Accounts". https://wise.com/imaginary-v2/Wise-Annual-Report-Accounts-FY2023.pdf.

- ↑ "Wise 2023 Annual Reports and Accounts". https://wise.com/imaginary-v2/Wise-Annual-Report-Accounts-FY2023.pdf.

- ↑ Bryant, Martin (23 March 2015). "Money may make the world go round, but at what cost?". BBC News. https://www.bbc.co.uk/news/business-31639262.

- ↑ "TransferWise Steps Toward Banking With Multicurrency Account". Bloomberg.com. 2017-05-23. https://www.bloomberg.com/news/articles/2017-05-23/transferwise-steps-toward-banking-with-multicurrency-account.

- ↑ Bryant, Martin (26 January 2015). "TransferWise valued at bn by top Silicon Valley venture capital fund". https://www.independent.co.uk/news/business/news/transferwise-valued-at-1bn-by-top-silicon-valley-venture-capital-fund-10002618.html.

- ↑ 10.0 10.1 10.2 "Wise 2023 Annual Reports and Accounts". https://wise.com/imaginary-v2/Wise-Annual-Report-Accounts-FY2023.pdf.

- ↑ Temperton, James (2016-11-03). "Has Skype lost its way? Taavet Hinrikus reveals what the company taught him". Wired UK. ISSN 1357-0978. https://www.wired.co.uk/article/taavet-hinrikus-transferwise-skype-estonia. Retrieved 2019-04-02.

- ↑ "Skype's 1st employee: Taavet Hinrikus left Skype & founded TransferWise" (in en-GB). 2012-03-20. http://yhponline.com/2012/03/20/taavet-hinrikus-transferwise/.

- ↑ Price, Rob (27 January 2015). "London's $1 Billion Finance Startup TransferWise Is Just Like An Ancient Islamic Money Transfer System". Business Insider. http://www.businessinsider.com.au/transferwises-similarities-to-hawala-2015-1.

- ↑ Marco della Cava (18 August 2014). "London's TransferWise aims to disrupt banking". USA Today. https://www.usatoday.com/story/tech/2014/08/16/transferwise-takes-on-banking-money-transfer-fees/13622337/.

- ↑ Bennett Voyles (9 September 2015). "Online money transfers and the "Skype" of money". Forbes India. http://forbesindia.com/article/ckgsb/online-money-transfers-and-the-skype-of-money/40999/1.

- ↑ Leander Bindewald (8 July 2015). "You need never use a bank again. Here's why". The Guardian. https://www.theguardian.com/sustainable-business/2015/jul/07/banking-sector-credit-unions-local-currency-money.

- ↑ Bryant, Martin (28 February 2012). "Peer-to-peer currency exchange service Transferwise handles $13.4m in its first year". Insider. https://thenextweb.com/insider/2012/02/28/peer-to-peer-currency-exchange-service-transferwise-handles-13-4m-in-its-first-year/.

- ↑ Silver, James (8 July 2012). "East London's 20 hottest tech startups". The Guardian. https://www.theguardian.com/uk/2012/jul/08/east-london-20-hottest-tech-companies.

- ↑ "Startup of the Week: TransferWise". Wired. https://www.wired.co.uk/news/archive/2012-08/22/startup-of-the-week-transferwise. Retrieved 1 October 2012.

- ↑ "The 2012 Startups 100: revealed". Startups. 6 July 2012. http://www.startups.co.uk/transferwise-taavet-hinrikus-and-kristo-k%C3%A4%C3%A4rmann-startups-100.html.

- ↑ Taylor, Colleen (March 2012). "5 Startups to Watch from Seedcamp's 2012 US Demo Day". TechCrunch. https://techcrunch.com/2012/02/29/5-startups-to-watch-from-seedcamps-2012-us-demo-day-tctv/.

- ↑ "Bitcoin" (in en-us). https://transferwise.com/help/questions/2759169/bitcoin.

- ↑ "TransferWise – Are they that cheap or is it just (inaccurate) advertising?". Monito. 2016-05-26. https://www.monito.com/blog/transferwise-cheaper-banks/.

- ↑ "Meet the 2015 CNBC Disruptor 50 companies". CNBC. 12 May 2015. https://www.cnbc.com/id/102609977.

- ↑ Barber, Lynsey (5 August 2015). "Four UK firms named tech pioneers by WEF". http://www.cityam.com/221702/world-economic-forum-tech-pioneers-transferwise-and-mike-lynchs-darktrace-among-four-uk-firms.

- ↑ Collinson, Patrick (2017-04-08). "Revealed: the huge profits earned by big banks on overseas money transfers" (in en-GB). The Guardian. ISSN 0261-3077. https://www.theguardian.com/money/2017/apr/08/leaked-santander-international-money-transfers-transferwise.

- ↑ Russell, Jon (27 April 2017). "TransferWise moves into Asia Pacific with opening of regional HQ in Singapore | TechCrunch". https://techcrunch.com/2017/04/27/transferwise-asia-singapore-office/.

- ↑ Megaw, Nicholas (10 January 2019). "Brexit drives TransferWise to open Belgian office". https://www.ft.com/content/bbe1487e-1438-11e9-a581-4ff78404524e.

- ↑ CNBC.com, Neil Ainger, Writer at (2017-05-17). "Fintech unicorn Transferwise achieves first profit". https://www.cnbc.com/2017/05/17/fintech-unicorn-transferwise-achieves-first-profit.html.

- ↑ "TransferWise becomes profitable six years after being founded" (in en-GB). BBC News. 2017-05-17. https://www.bbc.co.uk/news/business-39943651.

- ↑ Kleinman, Mark (21 January 2021). "TransferWise picks banks to spearhead blockbuster flotation". https://news.sky.com/story/transferwise-picks-banks-to-spearhead-blockbuster-flotation-12194386.

- ↑ 32.0 32.1 O'Hear, Steve (22 February 2021). "TransferWise rebrands as Wise ahead of an expected IPO". TechCrunch. https://techcrunch.com/2021/02/21/wise/.

- ↑ Pratty, Freya; Lewin, Amy (22 February 2021). "TransferWise becomes Wise". Sifted. https://sifted.eu/articles/transferwise-becomes-wise/.

- ↑ Musgrove, Annie (22 February 2021). "Transferwise rebrands to Wise". Tech.eu. https://tech.eu/brief/transferwise-rebrands-to-wise/.

- ↑ "TransferWise becomes Wise" (in en-US). 2021-02-22. https://sifted.eu/articles/transferwise-becomes-wise/.

- ↑ Megaw, Nicholas (2021-07-02). "Wise co-founder Hinrikus to step down as chair within a year". https://www.ft.com/content/4157bb94-bfc4-40fb-b448-efb8b875b925.

- ↑ Ramnarayan, Abhinav; Adinarayan, Thyagaraju (7 July 2021). "Wise valued at $11 billion in record London direct listing". Reuters. https://www.reuters.com/business/wise-shares-indicated-open-10-bln-valuation-auction-2021-07-07/.

- ↑ "Financial Conduct Authority (FCA) Investigation into Kristo Käärmann". 2022-06-27. https://www.londonstockexchange.com/news-article/WISE/fca-investigation/15511882/.

- ↑ Jolly, Jasper (2022-06-27). "FCA investigates Wise co-founder after tax default". https://www.theguardian.com/business/2022/jun/27/fca-investigates-wise-kristo-kaarmann.

- ↑ Hankewitz, Sten (2023-05-21). "Estonian founders of Wise significantly improve in the Times Rich List 2023" (in en-GB). https://estonianworld.com/business/estonian-founders-of-wise-significantly-improve-in-the-times-rich-list-2023/.

- ↑ 41.0 41.1 "How our US entity, Wise US Inc. protects customer funds | Wise Help Centre" (in en). https://wise.com/help/articles/5toCJQjm9MkTs8bEKSm30O/how-our-us-entity-wise-us-inc-protects-customer-funds.

- ↑ "Meet Wise Interest." (in en-us). 2023-08-02. https://wise.com/gb/interest/.

- ↑ Johnson, Bobbie (17 April 2012). "Transferwise unveils Levchin, other superstar backers". Gigaoam. http://gigaom.com/europe/currency-startup-transferwise-unveils-superstar-backers/.

- ↑ "TransferWise". Seedcamp. http://www.seedcamp.com/companies/transferwise.

- ↑ O'Hear, Steve (13 May 2013). "P2P Currency Exchange TransferWise Raises $6M Led By Peter Thiel's Valar Ventures, With Participation From SV Angel, Others". TechCrunch. https://techcrunch.com/2013/05/13/tw/.

- ↑ O'Hear, Steve (9 June 2014). "Now Backed By Sir Richard Branson, TransferWise Raises $25M For Cheaper Money Transfers". TechCrunch. https://techcrunch.com/2014/06/09/cheeky-transferwise/.

- ↑ Price, Rob. "London Cash Startup TransferWise Is Now Worth $1 Billion". BusinessInsider. http://uk.businessinsider.com/transferwise-58-million-andreessen-horowitz-2015-1.

- ↑ O'Hear, Steve (25 May 2016). "Money transfer company TransferWise raises further $26M at $1.1B valuation". https://techcrunch.com/2016/05/25/money-transfer-company-transferwise-raises-further-26m-at-1-1b-valuation/.

- ↑ "TransferWise Announces $280M Investment Round as Company Focuses on New Products and APAC Expansion". 2 November 2017. https://www.ivp.com/news/press-release/transferwise-announces-280m-investment-round-as-company-focuses-on-new-products-and-apac-expansion/.

- ↑ "TransferWise now valued at $3.5B following a new $292M secondary round" (in en-US). http://social.techcrunch.com/2019/05/21/three-point-five-unicorns/.

- ↑ "TransferWise confirms new $5B valuation following $319M secondary share sale" (in en-US). 28 July 2020. https://techcrunch.com/2020/07/28/transferwise-five-unicorns/.

- ↑ "ASA Ruling on TransferWise Ltd". 2016-05-04. https://www.asa.org.uk/rulings/transferwise-ltd-a15-312197.html.

- ↑ Browne, Ryan (3 June 2020). "Start-ups are racing to develop Covid-19 'immunity passports' — but experts warn they're unethical". https://www.cnbc.com/2020/06/03/coronavirus-experts-warn-digital-immunity-passports-are-unethical.html.

- ↑ (in en) Wise та Revolut для українців всьо? Пояснення. Вересень 2022р., https://www.youtube.com/watch?v=gzTghRc80Lk, retrieved 2022-10-19

- ↑ Wise, Company (Oct 19, 2022). "Help Centre". https://wise.com/help/articles/2813542/why-cant-i-open-a-wise-balance.

- ↑ Browne, Ryan (27 January 2023). "$6.6 billion fintech Wise accused by rival of harming competition". https://www.cnbc.com/2023/01/27/6point6-billion-worth-fintech-wise-accused-by-rival-of-harming-competition.html.

- ↑ Makortoff, Kalyeena (27 January 2023). "UK fintech firm Wise accused of stifling competition by rival startup". https://www.theguardian.com/business/2023/jan/27/uk-fintech-firm-wise-accused-of-stifling-competition-by-rival-startup.

External links

KSF

KSF