Country risk

Topic: Finance

From HandWiki - Reading time: 3 min

From HandWiki - Reading time: 3 min

| Categories of |

| Financial risk |

|---|

| Credit risk |

| Market risk |

| Liquidity risk |

| Operational risk |

| Reputational risk |

| Volatility risk |

| Settlement risk |

| Profit risk |

| Systemic risk |

| Non-financial risk |

Country risk refers to the risk of investing or lending in a country, arising from possible changes in the business environment that may adversely affect operating profits or the value of assets in the country. For example, financial factors such as currency controls, devaluation or regulatory changes, or stability factors such as mass riots, civil war and other potential events contribute to companies' operational risks. This term is also sometimes referred to as political risk; however, country risk is a more general term that generally refers only to risks influencing all companies operating within or involved with a particular country.

Political risk analysis providers and credit rating agencies use different methodologies to assess and rate countries' comparative risk exposure. Credit rating agencies tend to use quantitative econometric models and focus on financial analysis, whereas political risk providers tend to use qualitative methods, focusing on political analysis. However, there is no consensus on methodology in assessing credit and political risks.

Ratings

| Rank | Rank change | Country | Overall score |

|---|---|---|---|

| 1 | — | Singapore | 88.6 |

| 2 | — | Norway | 87.66 |

| 3 | — | Switzerland | 87.64 |

| 4 | — | Denmark | 85.67 |

| 5 | ▲2 | Sweden | 85.59 |

| 6 | ▼1 | Luxembourg | 83.85 |

| 7 | ▼1 | Netherlands | 83.76 |

| 8 | ▲4 | Finland | 83.1 |

| 9 | — | Canada | 82.98 |

| 10 | ▲1 | Australia | 82.18 |

| Score out of 100. Rank change to previous quarter.

Source: Euromoney Country Risk - published January 2018. [1] | |||

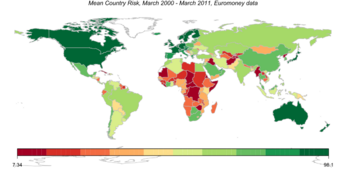

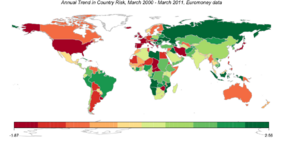

The least-risky countries for investment. Ratings are further broken down into components including political risk, economic risk. Euromoney's quarterly country risk index “Country risk survey” monitors the political and economic stability of 185 sovereign countries. Results focus foremost on economics, specifically sovereign default risk and/or payment default risk for exporters (a.k.a. “trade credit” risk).

Partial list of credit risk rating agencies

- Fitch Ratings (U.S.)

- Moody's (U.S.)

- Standard & Poor's (U.S.)

- CTRISKS (Greater China)

Partial list of political risk analysis organizations

- Euromoney Country Risk, ECR

- IHS Country Risk

- BMI Research

- Country Risk Solutions

- Economist Intelligence Unit

- Eurasia Group

- Maplecroft

- Oxford Analytica

- The PRS Group, Inc.

See also

- Credit rating agency

- National average salary

- Offshoring

- Workforce productivity

- List of countries by natural disaster risk

References

- ↑ [1] : Survey which monitors the political and economic stability of 185 sovereign countries, according to ratings agencies and market experts. The information is compiled from Risk analysts; poll of economic projections; on GNI; World Bank’s Global Development Finance data; Moody’s Investors Service, Standard & Poor’s and Fitch IBCA; OECD consensus groups (source: ECGD); the US Exim Bank and Atradius UK; heads of debt syndicate and loan syndications; Atradius, London Forfaiting, Mezra Forfaiting and WestLB.

External links

Downloadable country analysis and reports

- Coface Economic Studies

- Credendo Country Risk Ratings

- The Benche Analysis & Reports

- Euler Hermes Country Reports

- Maplecroft

- The PRS Group, Inc.

|

KSF

KSF