Economics of coffee

Topic: Finance

From HandWiki - Reading time: 10 min

From HandWiki - Reading time: 10 min

Coffee is a popular beverage and an important commodity. Tens of millions of small producers in developing countries make their living growing coffee. Over 2.25 billion cups of coffee are consumed in the world daily. Over 90 percent of coffee production takes place in developing countries — mainly South America — while consumption happens primarily in industrialized economies. There are 25 million small producers who rely on coffee for a living worldwide. In Brazil , where almost a third of the world's coffee is produced, over five million people are employed in the cultivation and harvesting of over three billion coffee plants; it is a more labor-intensive culture than alternative cultures of the same regions, such as sugar cane or cattle, as its cultivation is not automated, requiring frequent human attention.

Coffee is a major export commodity and was the top agricultural export for 12 countries in 2004; the world's seventh-largest legal agricultural export, by value, in 2005; and "the second most valuable commodity exported by developing countries," from 1970 to circa 2000,[1][2] which is frequently misstated — see coffee commodity market.[3][4] Unroasted, or green, coffee beans comprise one of the most traded agricultural commodities in the world;[5] the commodity is traded in futures contracts on many exchanges, including the New York Board of Trade, New York Mercantile Exchange, New York Intercontinental Exchange. Important trading and processing centers for coffee in Europe are Hamburg and Trieste.

World production

| Top Ten Green Coffee Producers – 2011 (millions of metric tons) | |

|---|---|

| 2.70 | |

| 1.28 | |

| 0.63 | |

| 0.47 | |

| 0.40 | |

| 0.37 | |

| 0.33 | |

| 0.28 | |

| 0.25 | |

| 0.24 | |

| World Total | 8.46 |

| Source: UN Food and Agriculture Organization (FAO)[1] | |

At least 20 to 25 million families around the world make a living from growing coffee. With an assumed average family size of five people, more than 100 million people are dependent on coffee growing. A total of 10.3 million tons of green coffee were harvested worldwide in 2018.[6]

In 2016, global coffee exports were $19.4 billion. Coffee is not the second most important commercial product in the world after petroleum, but it is the second most important commercial product that is exported by developing countries. For some countries like East Timor, this is the only export item worth mentioning. Coffee sales fluctuate strongly: for example, they fell from 14 billion US dollars in 1986 to 4.9 billion US dollars in the crisis year 2001/2002. This so-called coffee crisis lasted for several years, with consequences for coffee producers worldwide.[7]

In 2009, Brazil was the world leader in production of green coffee, followed by Vietnam, Indonesia, Colombia and Ethiopia.[8] Arabica coffee beans are cultivated in Latin America, eastern Africa, Arabia, or Asia. Robusta coffee beans are grown in western and central Africa, throughout southeast Asia, and to some extent in Brazil.[9]

Beans from different countries or regions can usually be distinguished by differences in flavor, aroma, body, acidity and girth (texture)[10] These taste characteristics are dependent not only on the coffee's growing region, but also on genetic subspecies (varietals) and processing.[11] Varietals are generally known by the region in which they are grown, such as Colombian, Java and Kona.

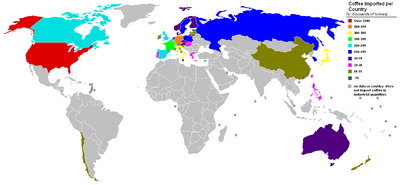

Consumption

In the year 2000 in the US, coffee consumption was 22.1 gallons (100.5 litres) per capita.[12] More than 150 million Americans (18 and older) drink coffee on a daily basis, with 65 percent of coffee drinkers consuming their hot beverage in the morning. In 2008, it was the number-one hot beverage of choice among convenience store customers, generating about 78 percent of sales within the hot dispensed beverages category.[13]

Pricing

According to the Composite Index of the London-based coffee export country group International Coffee Organization the monthly coffee price averages in international trade had been well above 1000 US cent/lb during the 1920s and 1980s, but then declined during the late 1990s reaching a minimum in September 2001 of just 417 US cent per lb and stayed low until 2004. The reasons for this decline included a collapse of the International Coffee Agreement of 1962–1989[14] with Cold War pressures, which had held the minimum coffee price at US$1.20 per pound.

The expansion of Brazilian coffee plantations and Vietnam's entry into the market in 1994, when the United States trade embargo against it was lifted added supply pressures to growers. The market awarded the more affordable Vietnamese coffee suppliers with trade and caused less efficient coffee bean farmers in many countries such as Brazil , Nicaragua, and Ethiopia not to be able to live off of their products, which at many times were priced below the cost of production, forcing many to quit the coffee bean production and move into slums in the cities. (Mai, 2006).

The decline in the ingredient cost of green coffee, while not the only cost component of the final cup being served, occurred at the same time as the rise in popularity specialty cafés, which sold their beverages at unprecedented high prices. According to the Specialty Coffee Association of America, in 2004 16 percent of adults in the United States drank specialty coffee daily; the number of retail specialty coffee locations, including cafés, kiosks, coffee carts and retail roasters, amounted to 17,400 and total sales were $8.96 billion in 2003.

Specialty coffee, however, is frequently not purchased on commodities exchanges — for example, Starbucks purchases nearly all its coffee through multi-year, private contracts that often pay double the commodity price.[15] It is also important to note that the coffee sold at retail is a different economic product than wholesale coffee traded as a commodity, which becomes an input to the various ultimate end products so that its market is ultimately affected by changes in consumption patterns and prices.

In 2005, however, the coffee prices rose (with the above-mentioned ICO Composite Index monthly averages between 78.79 (September) and 101.44 (March) US Cent per lb). This rise was likely caused by an increase in consumption in Russia and China as well as a harvest which was about 10 to 20 percent lower than that in the record years before. Many coffee bean farmers can now live off their products, but not all of the extra-surplus trickles down to them, because rising petroleum prices make the transportation, roasting and packaging of the coffee beans more expensive. Prices have risen from 2005 to 2009 and sharply in the second half of 2010 on fears of a bad harvest in key coffee-producing countries, with the ICO indicator price reaching 231 in March 2011.[16]

Classification

A number of classifications are used to label coffee produced under certain environmental or labor standards. For instance, "Bird-Friendly"[17] or "shade-grown coffee" is said to be produced in regions where natural shade (canopy trees) is used to shelter coffee plants during parts of the growing season.

Fair trade coffee is produced by small coffee producers who belong to cooperatives; guaranteeing for these cooperatives a minimum price, though with historically low prices, current fair-trade minimums are lower than the market price of only a few years ago. Fairtrade America is the primary organization currently overseeing Fair Trade coffee practices in the United States, while the Fairtrade Foundation does so in the United Kingdom.

Commodity chain for the coffee industry

The coffee industry currently has a commodity chain that involves producers, middlemen exporters, importers, roasters, and retailers before reaching the consumer.[18] Middlemen exporters, often referred to as coffee "coyotes", purchase coffee directly from small farmers.[18] Large coffee estates and plantations often export their own harvests or have direct arrangements with a transnational coffee processing or distributing company. Under either arrangement, large producers can sell at prices set by the New York Coffee Exchange.

Green coffee is then purchased by importers from exporters or large plantation owners.[18] Importers hold inventory of large container loads, which they sell gradually through numerous small orders. They have capital resources to obtain quality coffee from around the world, capital normal roasters do not have. Roasters' heavy reliance on importers gives the importers great influence over the types of coffee that are sold to consumers.

In the United States, there are around 1,200 roasters. Roasters have the highest profit margin in the commodity chain.[18] Large roasters normally sell pre-packaged coffee to large retailers, such as Maxwell House, Folgers and Millstone.

Coffee reaches the consumers through cafes and specialty stores selling coffee, of which, approximately, 30 percent are chains, and through supermarkets and traditional retail chains. Supermarkets and traditional retail chains hold about 60 percent of market share and are the primary channel for both specialty coffee and non-specialty coffee. Twelve billion pounds of coffee is consumed around the globe annually, and the United States alone has over 130 million coffee drinkers.

Coffee is also bought and sold by investors and price speculators as a tradable commodity. Coffee Arabica futures contracts are traded on the New York Board of Trade (NYBOT) under ticker symbol KC with contract deliveries occurring every year in March, May, July, September, and December.[19] Coffee Robusta futures are traded on ICE London (Liffe) under ticker symbol RC with contract deliveries occurring every year in January, March, May, July, September and November.[20]

Coffee and the environment

Originally, coffee farming was done in the shade of trees, which provided natural habitat for many animals and insects, roughly approximating the biodiversity of a natural forest.[21][22] These traditional farmers used compost of coffee pulp and excluded chemicals and fertilizers. They also typically cultivated bananas and fruit trees as shade for the coffee trees,[23] which provided additional income and food security.

However, in the 1970s and 1980s, during the Green Revolution, the US Agency for International Development and other groups gave eighty million dollars to plantations in Latin America for advancements to go along with the general shift to technified agriculture.[24] These plantations replaced their shade grown techniques with sun cultivation techniques to increase yields, which in turn destroyed forests and biodiversity.[25]

Sun cultivation involves cutting down trees, and high inputs of chemical fertilizers and pesticides. Environmental problems, such as deforestation, pesticide pollution, habitat destruction, soil and water degradation, are the effects of most modern coffee farms, and the biodiversity on the coffee farm and in the surrounding areas suffer.[21] Of the 50 countries with the highest deforestation rates from 1990 to 1995, 37 were coffee producers.[26]

As a result, there has been a return to both traditional and new methods of growing shade-tolerant varieties. Shade-grown coffee can often earn a premium as a more environmentally sustainable alternative to mainstream sun-grown coffee.

COVID-19 impact

The COVID-19 pandemic has produced both supply and demand effects on the coffee industry.[27]

The effects on the industry caused by the pandemic will take some time to materialize, as there is a lag between the cause of the impact and its effects being measurable.[27]

Causes of these effects can include direct impacts of employees missing work due to illness and indirect, as the result of measures taken to reduce the spread of the virus. For example, social distancing and work-from-home policies can have an impact on the effectiveness and productivity of individuals, groups, firms, etc.[28]

Supply effects

COVID-19 has had a direct effect on export infrastructure such as warehouses and ports.[27][29] These impacts include disruptions in supply chains, delays in shipments, and an increase in transaction costs.[27] Delays and disruptions are caused by changes to processes aimed at reducing the spread of the virus. For a warehouse, these changes can include reduced staff onsite, increased social distancing meaning fewer employees performing the same task in the same area, etc. For a transportation division, these changes can include increased time spent at border for COVID-related inspections and checks, reduced drivers as a result of sickness, etc.[30]

Global coffee exports for March 2020 were 3.7% lower than for March 2021,[27][31] which is neither extreme nor solely attributed to COVID-19.[27]

Demand effects

Coffee prices initially increased in the early weeks of the pandemic, likely as a result of widespread switching to at-home consumption from out-of-home consumption.[27] However, because demand for coffee tends to remain relatively inelastic (meaning changes in price have little effect on demand) there has so far been little change recorded in the demand for coffee.[27]

Fair trade coffee

See also

- Black Gold

References

- ↑ Talbot, John M. (2004). Grounds for Agreement: The Political Economy of the Coffee Commodity Chain. Rowman & Littlefield. p. 50. "So many people who have written about coffee have gotten it wrong. Coffee is not the second most valuable primary commodity in world trade, as is often stated. [...] It is not the second most traded commodity, a nebulous formulation that occurs repeatedly in the media. Coffee is the second most valuable commodity exported by developing countries."

- ↑ Pendergrast, Mark (April 2009). "Coffee: Second to Oil?". Tea & Coffee Trade Journal: 38–41. http://www.teaandcoffee.net/0409/. Retrieved 27 May 2014.

- ↑ Pendergrast, Mark (1999). Uncommon Grounds: The History of Coffee and How It Transformed Our World. New York: Basic Books. ISBN 978-0-465-03631-8.

- ↑ "FAOSTAT Core Trade Data (commodities/years)". FAO Statistics Division. 2007. http://faostat.fao.org/site/343/DesktopDefault.aspx?PageID=343. To retrieve export values: Select the "commodities/years" tab. Under "subject", select "Export value of primary commodity." Under "country," select "World." Under "commodity," hold down the shift key while selecting all commodities under the "single commodity" category. Select the desired year and click "show data." A list of all commodities and their export values will be displayed.

- ↑ Mussatto, Solange I.; Machado, Ercília M. S.; Martins, Silvia; Teixeira, José A. (2011). "Production, Composition, and Application of Coffee and Its Industrial Residues". Food and Bioprocess Technology 4 (5): 661–72. doi:10.1007/s11947-011-0565-z.

- ↑ Fernando E. Vega, Eric Rosenquist, Wanda Collins: Global project needed to tackle coffee crisis. In: Nature. (425/6956) 2003, p 343.

- ↑ Mark Pendergrast: Coffee second only to oil? Is coffee really the second largest commodity? In: Tea & Coffee Trade Journal. April 2009.

- ↑ "Coffee: World Markets and Trade". Foreign Agricultural Service Office of Global Analysis. United States Department of Agriculture. December 2009. http://www.fas.usda.gov/htp/coffee/2009/December_2009/2009_coffee_december.pdf.

- ↑ "Botanical Aspects". London: International Coffee Organization. http://www.ico.org/botanical.asp.

- ↑ Davids, Kenneth (2001). Coffee: A Guide to Buying Brewing and Enjoying (5th ed.). New York: St. Martin's Griffin. ISBN 978-0-312-24665-5.

- ↑ Castle, Timothy James (1991). The Perfect Cup: A Coffee Lover's Guide to Buying, Brewing, and Tasting. Reading, Mass.: Aris Books. p. 158. ISBN 978-0-201-57048-9. https://books.google.com/books?id=BOvMw4fnVZYC&q=the+perfect+cup.[yes|permanent dead link|dead link}}]

- ↑ "Bottled water pours past competition". DSN Retailing Today. 13 October 2003. http://findarticles.com/p/articles/mi_m0FNP/is_19_42/ai_109025996.

- ↑ Fact Sheets: Coffee Sales

- ↑ Daviron, Benoit; Ponte, Stefano (2005). "3". The Coffee Paradox. Zed Books, London & NY. p. 86. ISBN 978-1-84277-457-1.

- ↑ Rickert, Eve (15 December 2005). Environmental effects of the coffee crisis: a case study of land use and avian communities in Agua Buena, Costa Rica. MSc Thesis, The Evergreen State College. https://archive.org/details/Rickert_EVE_MES_Thesis_2005.

- ↑ ICO. "ICO Indicator Prices". http://www.ico.org/prices/p2.htm.

- ↑ "Shade-Grown Coffee Plantations". https://nationalzoo.si.edu/scbi/migratorybirds/coffee/.

- ↑ 18.0 18.1 18.2 18.3 "www.globalexchange.org". http://www.globalexchange.org/index.html.

- ↑ "Coffee C ® Futures". https://www.theice.com/products/15/Coffee-C-Futures.

- ↑ "Robusta Coffee Futures - ICE". https://www.theice.com/products/37089079/Robusta-Coffee-Futures.

- ↑ 21.0 21.1 Janzen, Daniel H., ed (1983). Natural History of Costa Rica. Chicago, IL: University of Chicago Press. ISBN 978-0-226-39334-6.

- ↑ "Fact Sheets". si.edu. http://nationalzoo.si.edu/scbi/migratorybirds/fact_sheets/default.cfm?fxsht=1.

- ↑ Krigsvold, Marsha, ed (2001). Diversification Options for Coffee Growing Areas in Central America. Chemonics International Inc..

- ↑ "NRDC: Coffee, Conservation, and Commerce in the Western Hemisphere - Chapter 3". nrdc.org. http://www.nrdc.org/health/farming/ccc/chap3.asp.

- ↑ The grind over sun coffee, Smithsonian Migratory Bird Center

- ↑ "11 Incredible Facts About The Global Coffee Industry". businessinsider. 2011. http://www.businessinsider.com/facts-about-the-coffee-industry-2011-11?IR=T.

- ↑ 27.0 27.1 27.2 27.3 27.4 27.5 27.6 27.7 Hernandez, Manuel A.; Pandolph, Rebecca; Sänger, Christoph; Vos, Rob (2020). "Volatile coffee prices: Covid-19 and market fundamentals". Washington, DC: International Food Policy Research Institute. https://ebrary.ifpri.org/digital/collection/p15738coll2/id/133746. Retrieved 2021-04-15.

- ↑ "Q&A: COVID-19 pandemic – impact on food and agriculture" (in en). http://www.fao.org/2019-ncov/q-and-a/impact-on-food-and-agriculture/en/.

- ↑ "COVID-19 MOMBASA PORT SITUATION STATEMENT BY THE ACTING MANAGING DIRECTOR ENG. RASHID SALIM". https://www.kpa.co.ke/Pages/COVID-19-MOMBASA-PORT-SITUATION-STATEMENT-BY-THE-ACTING-MANAGING-DIRECTOR-ENG.-RASHID-SALIM.aspx.

- ↑ "COVID-19 cuts global maritime trade, transforms industry | UNCTAD". https://unctad.org/news/covid-19-cuts-global-maritime-trade-transforms-industry.

- ↑ Coffee Market Report - April 2020, International Coffee Organization, April 2020, http://www.ico.org/news/cmr-0420-e.pdf, retrieved 15 April 2021

External links

- Eco-certified coffee: How much is there? – Market share of eco-certified coffees as of 2013 with links to references and industry sources.

- Corporate coffee: How much is eco-certified? – Top North American coffee brands and the amount of certified coffees each purchased annually, most 2008–2013.

- Coffee latest trade data on ITC Trade Map

- Articles on world coffee trade at the Agritrade web site.

|

KSF

KSF