Bitcoin

From RationalWiki - Reading time: 38 min

From RationalWiki - Reading time: 38 min

| The dismal science Economics |

| Economic systems |

| Major concepts |

| The worldly philosophers |

“”Billionaire crypto evangelist Mark Cuban apparently fell victim to a hack when an attacker was able to siphon around $870,000 in multiple cryptocurrencies from a wallet belonging to him. Cuban later acknowledged the hack to DL News. "They must have been watching," he said, explaining that "I'm pretty sure I downloaded a version of MetaMask with some shit in it".

|

| —Web3 is going great[1] |

“”[Bitcoin is] the best penny stock and the worst currency in the world. … Bitcoin is a revolutionary technology built on reactionary economics.

|

| —Matt O'Brien[2] |

Bitcoin (code: BTC, XBT;[note 1] symbol: ₿) is a digital commodity that derives almost all its current "value" from fetishization and speculative mania. It's also a slow, inefficient, wasteful and arguably obsolete payment network. The payment network is mostly only useful for pseudo-anonymity, crime, or for avoiding censorship.

The composition of a Bitcoin network's payment record (i.e. "blockchain"[3]) is ultimately determined by those who continually direct the most (otherwise pointless) computing power toward a new block of transactions seeking legitimacy. This is called "proof-of-work-based payment-validation consensus". A large cabal of computer processing aggregation can, in theory, dishonestly manipulate the payment history of Bitcoin. Bitcoin enthusiasts argue that greed itself prevents such a cabal from hijacking the entire ecosystem, due to fear of completely destroying the Bitcoin price. The enthusiasts have so far been correct about this. The Bitcoin payment network, for over 10 years, has been successfully secured by market economy greed and proof of environmentally unfriendly waste of electricity.[note 2]

Initially developed by "anarcho"-capitalists, Bitcoin is of course defined by unparalleled wealth inequality, with 0.01% of Bitcoin buyers owning 27% of the commodity.[4] Despite anarcho-capitalists being nominally opposed to authoritarianism, the wealth inequality in the Bitcoin economy is much closer to North Korea's planned economy than any modern, Western, economy.[5] While GINI-type statistics are intended to apply to nations or social groups,[6] and are not necessarily applicable to other situations, it may still apply to Bitcoin ideologues:

“”How problematic is the unequal distribution of Bitcoin?

If you harbor the notion that Bitcoin is an alternative to the US Dollar/Fed system (as many diehard Bitcoin true believers do) then this seems very problematic, as a world where Bitcoin became the primary unit of exchange would be a severely unequal one. |

| —Joe Weisenthal[5] |

Origin[edit]

Users and use cases[edit]

Bitcoin, being designed for market economies and notional independence from the control of governmental entities, tends to appeal to anarcho-capitalists, laissez-faire advocates, libertarians, whistleblowers, people in countries with hyper-inflation![]() (although Bitcoin itself hyperinflates frequently), leakers of confidential/private information, activists under target by their respective government, technophiles,[7] and criminals. At the same time, Bitcoin also does not enjoy the security, protection, and dispute resolution which large state apparatuses tend to provide, making it a volatile and often insecure asset.

(although Bitcoin itself hyperinflates frequently), leakers of confidential/private information, activists under target by their respective government, technophiles,[7] and criminals. At the same time, Bitcoin also does not enjoy the security, protection, and dispute resolution which large state apparatuses tend to provide, making it a volatile and often insecure asset.

Use cases![]() for the commodity include avoiding censorship from online payment services, fundraising for activism which is under target by government, purchasing illicit goods (e.g., drugs, child pornography[8][9] and stolen data on darknet markets

for the commodity include avoiding censorship from online payment services, fundraising for activism which is under target by government, purchasing illicit goods (e.g., drugs, child pornography[8][9] and stolen data on darknet markets![]() ), darknet scams (e.g., murder-for-hire),[10][11] and extortion (e.g., "ransomware", for which it is the payment method of choice).[12][13] In 2014, it was the preferred medium of exchange for internal use by online criminals,[14][15] but this may have changed since. Although Bitcoin circulates widely on the darknet, it has a key flaw; it's one of the most transparent medium of exchange in existence.[16][17] It is not anonymous per se. Once you associate a user with their Bitcoin address, you can read all their transactions on the blockchain; hence, to ensure anonymity, Bitcoin addresses must be changed frequently and it must be used together with other instruments, like Tor. The lack of privacy in Bitcoin caused the appearance of other cryptocurrencies

), darknet scams (e.g., murder-for-hire),[10][11] and extortion (e.g., "ransomware", for which it is the payment method of choice).[12][13] In 2014, it was the preferred medium of exchange for internal use by online criminals,[14][15] but this may have changed since. Although Bitcoin circulates widely on the darknet, it has a key flaw; it's one of the most transparent medium of exchange in existence.[16][17] It is not anonymous per se. Once you associate a user with their Bitcoin address, you can read all their transactions on the blockchain; hence, to ensure anonymity, Bitcoin addresses must be changed frequently and it must be used together with other instruments, like Tor. The lack of privacy in Bitcoin caused the appearance of other cryptocurrencies![]() focusing on user privacy, like Dash, Monero, etc. Monero in particular has increasingly displaced Bitcoin as the cryptocurrency of choice for darknet markets.[18]

focusing on user privacy, like Dash, Monero, etc. Monero in particular has increasingly displaced Bitcoin as the cryptocurrency of choice for darknet markets.[18]

Economics[edit]

“”Years earlier, Bitcoin had promised that it would spread its benefits to all its users, but by 2014 large chunks of the Bitcoin economy were owned by a few people who had been wealthy enough before Bitcoin came along to invest in this new system. Most of the new coins being released each day were collected by a few large mining syndicates. If this was the new world, it didn't seem all that different from the old one — at least not yet.

|

| —Nathaniel Popper[19] |

The notable bit about Bitcoin is that it is intended to be entirely decentralised. The blockchain, the cryptographically-authenticated public ledger of every Bitcoin transaction ever, is reconciled by agreement of over 50% of all miners — an attempt at a practical solution to the Byzantine Generals' Problem![]() in computer science.[20]

in computer science.[20]

For a period, you could buy almost anything with Bitcoin, as services appeared that either accepted payment for Bitcoin or acted as a proxy for major retailers, before petering out in the late 2010s as market participants shifted to using Bitcoin as purely a medium of speculation.[note 3] Part of the reason this no longer happens is that exchange fees, Bitcoin network fees and premiums charged by payment proxy services mean you will invariably be spending dramatically more money paying with Bitcoin than with whatever currency is accepted by your government for taxes, whose total direct costs to the user are typically nil.[note 4]

Before the late 2010s, it was common to see large dark web services (such as multiple sites called the "Silk Road") offer illegal paraphernalia, including drugs, for Bitcoin. However, with recent advances in blockchain tracking technology, and the bust of virtually every large darkweb drug market so far, there are virtually no large, reputable dark web services that sell illegal paraphernalia anymore.

To allow payment with a high-volatility commodity like Bitcoin, it is common for merchants to price their goods in the local standard currency, but receive payment via Bitcoin converted at current market rates.[21] Even then receiving payments in Bitcoin can be a risk, as the price of Bitcoin may plummet faster and further than your profit margin, forcing you to choose between taking a loss, or hoarding Bitcoins hoping the price will rise.[22]

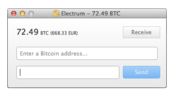

Bitcoin advocates often contrast Bitcoin with "fiat money".[note 5] Bitcoin is not as dissimilar to fiat money as many Bitcoin fanatics claim. This is because Bitcoin has no intrinsic value (i.e., has no use value), similar to the US dollar.[note 6] Hardcore Bitcoin evangelists argue that Bitcoin could be a mainstream payment method if 300 million people similarly behaved as though it was one, i.e., would do work in exchange for it. This has not happened and is unlikely to ever happen, unless maybe if one defines more centralized side-chain hacks like the "lightning network" as Bitcoin, and if a federal government only accepted Bitcoin for taxes. One thing that prevents Bitcoin from being a mainstream exchange medium is that it's designed to be deflationary, and therefore this gives more incentive to hoard it than to spend it. Another is that the Bitcoin network is one of the most inefficient payment mediums in existence, as it can only process up to 7 transactions per second globally (without more centralized side-chains), according to Bitcoin enthusiasts themselves.[23] Also, if your wallet file is deleted, your bitcoins are gone for good.

"Babbage" at The Economist took it seriously and found it quite interesting,[24] but has muted his praise over time.[25] Other economists have criticized the idea (to the point of calling it a scam), citing inherent design problems.[26][27][28][29][30] Paul Krugman initially refrained from poking fun at the concept, but considered it a reimplementation of the gold standard, with the economic problems that implies;[31] he's since judged it as effectively just another right-wing affinity fraud, in which big libertarians prey upon smaller ones.[32] Warren Buffett has called it a "mirage."[33] Joseph Stiglitz has stated Bitcoin is only good because of its lack of supervision as well as its capacity for tax evasion and general circumvention of rules, even stating that it is a financial bubble that provides thrills with the ups and downs on its value, and that it serves no useful social purpose; on these grounds, he calls for the outlawing of Bitcoin, noting that as soon as it would happen, its value would right away tumble down since outlawing it would kill demand.[34][35] About 25% of the European Central Bank's report on "Virtual Currency Schemes" is about Bitcoin,[36] and both the European Banking Authority and US Consumer Financial Protection Bureau have warned about major consumer protection issues.[37][38]

The trouble with re-implementing the gold standard in the 21st century is that financial attacks, just like cryptographic attacks, don't get less effective with time — if you apply attacks evolved in a hundred years of Red Queen's race against regulation, then remove the regulation, the subeconomy in question is utterly defenseless. As one quant on Hacker News outlined:[39]

Bitcoin takes the monetary system back essentially a hundred years. We know how to beat that system. In fact, we know how to nuke it for profit. Bitcoin is volatile, inherently deflationary and has no lender of last resort. Cornering and squeezing would work well - they use mass in a finite trading space. Modern predatory algos like bandsaw (testing markets by raising and suddenly dropping prices), sharktooth (electronically front-running orders), and band-burst (creating self-perpetuating volatile equilibria in a leverage-sensitive trading space, e.g. an inherently deflationary one), would rapidly wreak havoc. There is also a part of me that figures regulators will turn a blind eye to Bitcoin shenanigans.

And we can now see this in practice: the $1200/BTC peak in late 2013 was caused by the market manipulation known as "painting the tape";[40] Mt. Gox in particular appears to have suffered chronic tape-painting.[41] Note that the "free market" completely failed to deal with fraud in this environment: all other exchanges were tracking Mt. Gox's blatantly skewed prices.

In 2014 Bitcoin began a sharp decline after a principal exchange, Mt. Gox,![]() shut down following three months of blatant market manipulation.[42][43] It was later revealed that an undiscovered "leak" in the company's bitcoin wallet had rendered them insolvent in 2012, and virtually penniless by 2014.[44]

shut down following three months of blatant market manipulation.[42][43] It was later revealed that an undiscovered "leak" in the company's bitcoin wallet had rendered them insolvent in 2012, and virtually penniless by 2014.[44]

In 2018, it was shown that the 2017 astronomical rise in price was also due to market manipulation (pump and dump), caused by a different cryptocurrency, "tether", whose company (also Tether) likely falsely claimed to have 1-to-1 US dollar reserves.[45]

The 51% attack[edit]

“”Instead of becoming a currency free of the controls of governments and banks, Bitcoin is now largely controlled by a small collection of interested parties who have heavily invested in securing the network. And ironically, greater acceptance of Bitcoin will likely come only with additional regulations.

|

| —PC Gamer,

How Bitcoin and cryptocurrencies are hurting gamers[46] |

Bitcoin relies on distributed consensus: the blockchain is what a majority of mining capacity says it is. Since mining is the "core of the Bitcoin protocol", there is the possibility of what is termed a "51% attack", where miners could consolidate into a cartel to exceed 50% of the mining power (yes, a de facto monopoly) and so could unilaterally ratify the entire blockchain to do things like double-spending confirmed transactions and preventing any new transactions or just ones they don't like from happening while they're in control (though they cannot take other people's coins).[47][48] But this was considered unlikely because Bitcoin enthusiasts were highly distributed individualists. This type of attack was confirmed to have happened in 2019 for the cryptocurrency Ethereum Classic on two different exchanges, in the amounts of US$1.1 million and $200,000.[49]

This worked quite well early on. However, proof-of-work algorithms benefit from economies of scale,![]() which leads to centralization directly. So as mining became more difficult and demanded more specialized resources, single mining "pools" became a substantial fraction of Bitcoin's network hashrate. In June 2014, mining pool GHash reached 51%, leading to calls to use decentralized pooling options.[50] In 2015, nine mining pools controlled 75% of the hashpower.[51]

which leads to centralization directly. So as mining became more difficult and demanded more specialized resources, single mining "pools" became a substantial fraction of Bitcoin's network hashrate. In June 2014, mining pool GHash reached 51%, leading to calls to use decentralized pooling options.[50] In 2015, nine mining pools controlled 75% of the hashpower.[51]

Economically, it would be foolish for, e.g., GHash to just kick over the board because they could — cornering the market in an insubstantial good is only worth it while people trust the value of the insubstantial good — but the actual problem is that the group with 51% of all mining capacity will be able to "undermine the rules of the currency itself."[52] GHash quickly backed down to under 50% and claims it wants to fix the deeper problem,[53] but the economic incentives of "selfish mining" remain.

Cornell researchers have identified many more subtle attacks one can make even with less than 50%,[54] and GHash had previously conducted a "49% attack" (a "Finney attack"[55]) — wherein a large miner double-spends coins, just not with certainty—against a gambling site.[56] They blamed this on a rogue employee, but this in itself shows that individuals can be motivated to trash a whole system for temporary personal gain. Again, real financial systems have government regulation for this specific threat.

The greater fool[edit]

Cryptocurrencies such as Bitcoin, while perhaps not pyramid schemes strictly speaking, are something related, known in economics as greater fool theory.![]() The greater fool theory means that the buyer of overvalued assets can only profit from their purchase by finding an even greater fool to sell them to at an even more inflated price. The greater fool theory is the mechanism that fuels pump and dump in the world of securities fraud. Among cryptocurrencies, it explains why volatile pricing is a feature and not a fixable bug.[57] The are several reasons why the greater fool is built into cryptocurrencies:[57][58]

The greater fool theory means that the buyer of overvalued assets can only profit from their purchase by finding an even greater fool to sell them to at an even more inflated price. The greater fool theory is the mechanism that fuels pump and dump in the world of securities fraud. Among cryptocurrencies, it explains why volatile pricing is a feature and not a fixable bug.[57] The are several reasons why the greater fool is built into cryptocurrencies:[57][58]

- Scarcity

- Computational complexity of transactions, resulting in the currency being a poor model for retail

- Every transaction is a taxable event (profit or loss); paying taxes is anathema to crypto-libertarians

- Scarcity of dollars (fiat currency) for stable coins or for cashing out

- Scarcity of buyers

Hardware[edit]

So who's doing the math? The answer is the most powerful distributed computing project in the world.[note 7] While other distributed computing systems are investigating protein folding or sifting through radiotelescope data for signs of intelligent communication from the stars, Bitcoins are being generated by people running hashing algorithms to process transactions on a poorly-traded virtual commodity.

But it's long past the point where you can do any decent amount of processing on a standard desktop system (or, as some less-than-ethical Bitcoiners have, sneaking processing code into JavaScript on web pages, or simply deploying a Trojan on someone's desktop box). Bitcoin miners quickly moved to the GPUs of video cards, then field-programmable gate arrays (FPGAs) specifically programmed for the algorithm, and now mining is done on ASIC chips specifically designed for Bitcoin mining based on said FPGAs. There are even companies selling Bitcoin mining rigs; their frequently-sketchy workmanship wouldn't endear them to IT pros or the FTC, but they're still better than some of the firetrap rigs that Bitcoiners have put together for themselves.[59]

The irony of all this is that once hardware and power costs are factored in, it's hard to make a profit from Bitcoin mining. Many more-savvy Bitcoiners filch their power from someone else and don't factor in the equipment cost at all; poor understanding of economics is a recurring theme in the Bitcoin community.

Energy usage[edit]

Bitcoin is also an environmental disaster, using on the order of 1 gigawatt (GW) (that's a billion watts) according to a 2013 and 2014 paper[61][62] Estimates would be about 7 GW by end of 2015 as the paper[61] shows approximately power use scales linearly with mining difficulty and mining difficulty in December 2015 is about 7 times the difficulty than when the paper is published (remember, mining each Bitcoin is more difficult than the previous one). For comparison, the entire nation of Ireland runs about 3 GW average. The network cost per transaction (of any size) is around $20 $176 of electricity, and it only gets worse every year.[63][64] Thus, Bitcoin runs on libertarians externalising their costs to others.[note 8] This is the same for any transaction; a $200 fee to transfer tens of millions of dollars between countries isn't so bad, but imagine a world where you had to pay a $200 surcharge whenever you ordered fast food, which makes the routine purchases of everyday life impossible, defeating the entire premise of a Crypto-based society. At the moment, the miners are paid in newly minted coins; as less and less Crypto are minted each cycle, the miners need to charge everyone more and more actual dollars in order to keep mining. If only they'd based it on protein folding.[65] In 2018, it was estimated that cryptocurrency energy consumption has exceeded private usage within Iceland, and that Iceland may not be able to keep up with energy demand.[66] A 2018 analysis found that the energy cost of mining cryptocurrencies per unit value was comparable to or exceeded the cost of mining precious metals and rare earths: Bitcoin (17 megajoules), Ethereum (7 MJ), Litecoin (7 MJ) and Monero (14 MJ) vs. gold (5 MJ), platinum (7 MJ) and rare earth oxides (9 MJ).[67] Given that cryptocurrency mining energy costs increased exponentially within a 30-month period, and that the current costs are comparable to that of a small country, cryptocurrencies are actually contributing to global warming (with Bitcoin alone generating an estimated 22 megatons in CO2 emissions a year, comparable to a large city like Las Vegas, or a small country like Sri Lanka) for what is essentially no return to society that couldn't be achieved through, say, Venmo, PayPal, Square, etc etc.[67][68][69][70]

As of 2024, the University of Cambridge (which maintains a live feed of total estimated energy usage of the Bitcoin network) estimates that the Bitcoin blockchain alone consumes anywhere from 140 to 160 terawatt hours a year, creating greenhouse gas emissions on the same level as those of the entire country of Greece and consuming 0.5% of the planet's entire energy, all to sustain a system with ridiculously low real world economic utility.[71]

Pissing off gamers[edit]

Bizarrely, Bitcoin has somehow gotten away with the absolute worst sin on the internet: interfering with PC games. Typically, a decent, current-generation Graphics Processing Unit (GPU) will cost around $300-400, but as the price of Bitcoin rises, miners have been purchasing GPUs at a faster rate than manufacturers can produce them. As such, the price has skyrocketed to the point where the GPU can cost more than the rest of the gaming rig combined.[72] When Bitcoin falls in price, the GPUs will crash in price as well; this happened before, during the 2018 Bitcoin price spike.[73]

This is a mixed bag. So long as the money is going to the manufacturer, well, that's more profit for them, and they can develop ever-better cards and also have a guarantee that their mid-range cards will all be sold at some point, so in theory, in the long run gamers will get better cards as a result. But higher prices paid doesn't always mean the money goes straight to the manufacturer; if the manufacturer/retailer isn't able to jack up the prices themselves, e.g., the manufacturer is in a long-term contract with Walmart to provide 100,000 units at X price, scalpers move in and buy up all the stock then resell online (which is what's happening now), giving only the original sale price to the retailer.

Manufacturing problems[edit]

As mentioned earlier, Bitcoin doesn't just use electricity, but hardware as well, and manufacturing hundreds of thousands of extra graphics cards and other computers doesn't simply happen in a vacuum. GPUs are primarily silicon, but also contain small amounts of copper, gold, silver, platinum, iridium, etc,[74] and mining raw metals is pretty much the dirtiest major industry on the planet. Not all of the metals get recovered as not all get recycled, and even the ones that do, well, "recycling electronics" often means "burning the electronics and having small children sift through the incredibly toxic garbage". Short of astro-mining, these metals are finite, and using up all of our rubidium on crunching fake numbers could be a real problem if in the future we, e.g., discover clean fusion but it requires metals we no longer have enough of.

Anonymity issues[edit]

Despite having a reputation for being used to pay for illegal goods and services anonymously, bitcoin is the one of the most transparent mediums of exchange because it records everything in a blockchain. A blockchain is a gigantic database that records every transaction ever made for everyone to see — including your grandma;[75][16][17] paper money transactions do not suffer from this flaw. Individuals who wish to maintain anonymity must hide their IP with tools such as Tor and change their wallet's address every time a transaction is made (most clients do the latter automatically).[17]

Even with precautions like Tor put into place, there are no known examples of a major government having significant issues tracking down a Bitcoin user it targeted. Bitcoin therefore mostly only provides anonymity for those seeking privacy around less resourceful or motivated entities, such as random individuals or small businesses. In this sense Bitcoin is at best like an envelope, a VPN, for money. It can give you a small, but meaningful, amount of anonymity protection compared to just using Paypal.

Bitcoin Mixing[edit]

Bitcoin mixers![]() are services used by clients to create a misdirection of the origin of said clients' bitcoins; in layman's terms, it cleans dirty money. The services aren't free; they charge a small fee, 1.5% of the amount exchanged for certain services (or 100% for unlucky people).[76][77] Assuming it doesn't have that 100% fee, bitcoin mixers trade a client's bitcoins with other people's at random — for better or for worse. Unfortunately, this includes trading a client's bitcoins with other people's tainted coins that could possibly be related to drug money or avocado erotica that are now connected to said client's wallet.[78] Bitcoin mixing in certain countries can count as breaking anti-structuring laws.

are services used by clients to create a misdirection of the origin of said clients' bitcoins; in layman's terms, it cleans dirty money. The services aren't free; they charge a small fee, 1.5% of the amount exchanged for certain services (or 100% for unlucky people).[76][77] Assuming it doesn't have that 100% fee, bitcoin mixers trade a client's bitcoins with other people's at random — for better or for worse. Unfortunately, this includes trading a client's bitcoins with other people's tainted coins that could possibly be related to drug money or avocado erotica that are now connected to said client's wallet.[78] Bitcoin mixing in certain countries can count as breaking anti-structuring laws.![]() [78]

[78]

How effective are they at hiding money? This isn't the case of a drug dealer owning a fast food joint and claiming all the cash earnings are from the front business, no, the blockchain is the ledger of every transaction ever made. It doesn't matter whose wallet the coins go to or where they are physically in the real world; all wallets are tracked at all times. While tracking by hand would be impractical, a computer could still track the flow of Bitcoin no matter how many times a coin is traded, and so these services do nothing beyond taking money from suckers.

Advocates[edit]

“”Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding the fire of truth, exponentially growing ever smarter, faster and stronger behind a wall of encrypted energy.

|

| —Michael Saylor |

The cryptography is robust, so many highly vocal internet libertarians think this is all that is needed, because they don't understand people, know very little about economics, and apparently nothing of how reliable financial computing infrastructures are built—real banks tend to use mainframes in highly redundant configurations, not AWS virtual servers without backups—and generally show terrifying naïveté and incompetence. This then bites them in the arse when they discover that running a Magic: The Gathering Online card exchange site is insufficient experience to securely run a currency exchange,[80] or discover they have no backups.[81] Many were sufficiently naïve as to fall for, not just a Ponzi scheme, but a Ponzi scheme that had already been tried in EVE Online's in-game currency.[82] There are also people who understand this level of computer science, but still keep their wallet.dat file in plain text on a Windows box, ready for reaping by malware and/or access via social engineering.[83][84][85][86][87] This is the sort of thing that gets bitcoins called "Dunning-Krugerrands."[88]

The decentralised nature attracts libertarian extremists (go read any Bitcoin forum for more wacko libertarianism than you ever thought possible). There are Bitcoin advocates who are not annoying Randroid fools, but the ones who are tend to drown out all the others. It is unsurprising, then, that some business writers have accused them of cultish behavior;[52][89] some proponents are simply aghast that anyone might not consider it valuable for services rendered.[90]

One of the otherwise-saner advocates is Rick Falkvinge, founder of the Swedish Pirate Party, who has put all his savings into bitcoins.[91] However, he also details its problems.[92] He is a big fan of Bitcoin not as a general currency, but as a pure medium of exchange, substituting for PayPal or credit cards and changing back into real a more popular currency at each end—as the Visa/Mastercard/PayPal oligopoly's willingness to block recipients they, the American government or fundamentalists don't like, starts to become a practical problem.

Andrew Napolitano from Fox Business Network supports Bitcoin as well. In a move that may make many of his fans cry, Ron Paul does not.[93]

Banks and exchanges[edit]

There are multiple Bitcoin "banks," but most of this seems to revolve around doing things with bitcoins,[94] leading to accusations of cargo cult economics. And scams. There are lots of scammers in the Bitcoin community, who are punished by the harshest method imaginable: getting a "scammer" tag on the BitcoinTalk.org forum.

There is a Bitcoin exchange hack or collapse approximately every month; up to 2015, a third of exchanges had been hacked.[95] Leaving any money exposed on a Bitcoin exchange is a terrible idea.

One Bitcoin exchange, Bitcoin-Central (now called Paymium), has achieved bank status in France.[96] Their aim is to supply an alternative to PayPal, and their central bank backing on balances only applies to accounts in euros rather than in bitcoins. On the other hand, other players in the Bitcoin field have had to suspend operations because US banks view companies involved with Bitcoin as too high risk to do business with,[97] or have had to suspend US dollar withdrawals for undisclosed reasons.[98]

China[edit]

Despite Western-oriented services being portrayed as synonymous with the Bitcoin "brand" — Mt. Gox was still responsible for 90% of all Bitcoin transactions by the end of 2012,[99] so this isn't entirely unwarranted — Chinese exchanges actually overtook it in output before its collapse.[100] This presents another serious problem for the cryptocurrency moving forward: attempts by the US government to impose regulations post-Gox pale in comparison to recent pressure by Beijing to crack down on the Chinese market.[101] One incentive is off-the-books currency exchange: buy hardware and electricity in yuan, make it into bitcoins and sell the bitcoins for dollars.

The scheme[edit]

“”[This] Bitcoin crash is traumatic. I haven't seen this many libertarians cry since they found out Ayn Rand took Social Security for eight years.

|

| —Drew Fairweather[102] |

In order to prop up the initial system, Bitcoin mining was designed to bribe early users with exponentially better rewards than latecomers could get for the same effort. In its current state — and as predicted as part of its core design curve — it is not feasible for a newcomer to Bitcoin to mine their own assets. The economies of scale are far too large and home PC equipment is obsolete. So, to join the network at all, new users must instead give ever-increasing amounts of wealth to previous bitcoiners who are sitting around doing nothing. This effectively makes Bitcoin a pump-and-dump scheme wherein these early adopters, who have more bitcoins than anyone else ever will and did little or no work and assumed no risk, hype it up so they can offload their bitcoins onto fools who think they'll strike it rich as speculators. At the same time, those speculators, who are providing all of the capital (the amount of money Bitcoin is actually worth is limited to the amount of fiat currency placed in Bitcoin exchanges, as that is the only way new value can enter the ecosystem) and taking all of the risk of a crash, are chasing far lower percentage returns than initial users would receive. This is another classic characteristic of both mania bubbles and the aforementioned pump-and-dump scheme. This means the system runs on opportunism, especially among people who like the idea of decentralized techno-money. This setup is defended as an acceptable trade-off and/or a fair reward for propping up the system.[103]

In the meantime, speculators and opportunists have remained Bitcoin's main users: according to one 2012 study, only 22% of existing bitcoins were in circulation at all, there were a total of 75 active users/businesses with any kind of volume, one (unidentified) user owned a quarter of all bitcoins in existence, and one large owner was trying to hide their wealth accumulation by moving it around in thousands of smaller transactions.[104] Meanwhile, businesses, from family stores to multimillion-dollar corporations, have jumped onto Bitcoin to seem forward-looking and get a cut of the Bitcoin action.[105] But go on, dive in and get rich.

Elon Musk gets involved[edit]

The whole situation wasn't fucked enough, so Musk stuck his dick in it. At the beginning of 2021,[106] Tesla bought $1.5 BILLION worth of Bitcoin, and was very vocal about soon allowing purchases of cars with coin, which caused the price to skyrocket. In March 2021, Tesla began accepting Bitcoins as payment, and Bitcoin soon peaked at around $60,000. In a pure not-at-all-suspicious coincidence, Tesla began selling off their own coins,[107] which can't be true because Musk adamantly insists that he never sold the Bitcoins.[108] Then Tesla stopped accepting Bitcoin in May 2021.[109][110] Absolutely nothing suspicious at all. Just normal business.

There is of course another less conspiratorial explanation. To purchase a Tesla, you had to put in a deposit of $2500 in fiat money or the equivalent value of Bitcoin. If Bitcoin was worth $50,000, you'd have to put up 1/20th of a coin, or really, 5 million satoshis. But if you cancelled, Tesla got to choose in which currency to refund you. If Bitcoin plummeted to $25,000, Tesla simply returned the $1250 worth of satoshis to you and you lost $1250. However, if Bitcoin increased to $100,000, Tesla gave you $2500 cash and kept the $5000 worth of satoshis. To make matters worse, Lemon Laws require that a car with manufacturing defects could be returned for a refund, and, you guessed it, Tesla's contract gives them the choice of which currency to pay you in.[111]

The scam isn't completely one-sided though; when given a quote, you had 30 minutes to complete the purchase or you would have to get a new quote.[112] This was needed because of Bitcoin's notoriously volatile price, but even in those 30 minutes it's possible for Bitcoin to plummet or spike, in which case Tesla could be selling a $80,000 car for $75,000 worth of coins. Tesla's image revolves around being "the cool company", their line of cars even spell out "S3XY" for this reason,[113] and Musk absolutely does not want to become known as "the dickish car company". So just trade in your coins for fiat when you want to buy a car, which defeats the purpose of having a second currency in the first place.

More mundane problems[edit]

“”I would take Monopoly money before I took cryptocurrency.

|

| —Manager of Tony and Joe’s Seafood Place on a floor below billionaire tech executive and Bitcoin evangelist Michael Saylor's penthouse[114] |

The real and overriding issue with Bitcoin is that it does practically nothing that isn't already possible, while also introducing flaws of its own:

- Security: The insecure nature of Bitcoin has turned out to be a major issue, with an estimated 17-25% (between 2.78 and 3.79 million Bitcoins valued at US$8500 each in November 2017) of all Bitcoins lost forever — this does not include Bitcoins merely lost to theft.[115] The wide range in estimates is due to the uncertainty of whether the original ("Satoshi") Bitcoins were lost.[115] The losses can occur "from a misdirected transaction or the loss of a private key through death or carelessness."[115] If the Satoshi coins were not lost, and they suddenly appear, it could deliver a big shock to the Bitcoin market.[115] Following the 2019 sudden death of the founder of Canada's biggest cryptocurrency exchange, QuadrigaCX, $190 million in other people's cryptocurrency holdings became inaccessible, possibly indefinitely.[116] In 2020, US$1 billion in bitcoin was seized by the US government from someone who had stolen it from Ross Ulbricht's Silk Road illicit drug operation in 2012-2013.[117]

- Thefts: As of 2017, it was estimated that 980,000 Bitcoins had been stolen (worth roughly US$15 billion as of December 6th 2017).[118] Stolen Bitcoins are rarely recoverable. In January 2018, about $400 million in NEM cryptocoins were stolen from the Japanese exchange Coincheck in a single event.[119] A relatively small amount of cryptocurrency was stolen in 2018: 215 Ethereum coins (about US$152,000); this was accomplished not by exploiting a security flaw in the cryptocurrency but by exploiting a security flaw in the internet, the Border Gateway Protocol.[120] In 2022, hackers stole $600 million in crypto from the NFT video game Axie Infinity.[121] The blockchain analytics company Chainalysis has estimated that North Korea has stolen a total of $3 billion in cryptocurrency as of 2023, largely funding its nuclear weapons program.[122]

- Fiat coin: For the average person, it's far more hassle than it's worth when the rest of the world takes traditional currencies (or "fiat" on Bitcoin communities, who use it as a snarl word[note 9]), and that there's nothing they can buy with Bitcoin that they can't buy with the money they already have. Responses to this range from wishful thinking that this will be irrelevant when Bitcoin takes over the world and then goes to the Moon, to assertions that people will choose Bitcoin despite its comparative lack of utility simply because they like the idea, to prognostications that when more small businesses start accepting Bitcoin — and why wouldn't they! — popularity will boom (this has been tried in Cleveland, with poor results[123]).

- Retail hassles: Much is made of Bitcoin's efficiency for buying things online — but there's almost nothing you can buy with Bitcoin that you can't buy with the money you already have, and a credit or debit card already lets you buy things online with minimal hassle and with fraud protection. Escrow is touted as a solution for this, but there are almost no working examples. When Butterfly Labs[124] stiffed people on Bitcoin mining equipment, Bitcoiners who paid with filthy fiat via PayPal were able to raise chargebacks and get their money refunded, which many did gleefully;[125] those who paid with Bitcoin had no recourse other than the courts.

- Almost all online retailers who supposedly accept Bitcoin actually charge whatever the price of the product would be in conventional currency at the current exchange rate, then cash in the bitcoins as soon as is feasible. This raises questions about how stable Bitcoin's "economy" is when a lot of its participants wouldn't be involved if they couldn't get conventional money out of it.

- Speed: Being a distributed computing project means that Bitcoin transactions are at the mercy of not only network latency (like credit or fund transfer transactions) but the time it takes for the transaction to be processed and stored around the network. The protocol design is for this to take approximately ten minutes (average; in practice it varies randomly between a minute and several hours) — barely usable for network orders, but problematic for point-of-sale use (the beer-selling example doesn't bother reconciling in real time, as the owner is treating the Bitcoin risk as a marketing expense). In 2015, transaction times over an hour are increasing in frequency.

- Scalability: Bitcoin is already failing to scale. It is limited to a worldwide total of 7 transactions per second, due to the design of the protocol,[126] and around 2.7 transactions per second in practice.[127] (Compare PayPal, which claims an average of 134 transactions per second as of 2014;[128] Visa, which ran approximately 15,000 transactions per second in 2013, with a capacity of 47,000 transactions per second;[129] even Western Union alone averages 29 transactions per second.[130]) The blockchain passed 150 gigabytes in February 2018.[131] This is large enough to be problematic for individuals to download, and its growth rate is increasing. A stress test by some Reddit /r/bitcoin posters sent confirmation times to eight hours with very little effort or expense.[132]

- Physical bitcoins: For those who prefer a non-virtual virtual currency, some companies came up with physical bitcoins. One of the more popular was the Casascius coin, which was forced to change into empty non-virtual virtual coins after the US Financial Crimes Enforcement Network classified the coins as a form of "money transmitting".[133] Fraud has been another concern with physical bitcoins.[133]

- Non-fixed supply: It is widely believed that there is a fixed supply of bitcoins — this is something that appeals to goldbugs since it makes Bitcoin a sort of virtual gold. In fact, the Bitcoin protocol could theoretically be changed by community consensus to include additional coins; many other changes to the protocol have already occurred, such as an updates to allow for new payment conditions. The regular addition to the maximum number of coins could be motivated by a desire to avoid the inevitable deflationary spiral, but it could also destroy confidence among hardcore goldbugs.[134]

- Transaction fees: It is often predicted that Bitcoin will overtake other online payment schemes ("In five years, if you try to use fiat currency they will laugh at you." — Silicon Valley investor Tim Draper[135]). Current design, however, limits the system to handling only a few transactions per second. Though Bitcoin transactions were once free, the fees for transactions is becoming an increasingly significant problem, with fees averaging $20/transaction, but rising as high as $400 based on demand, with the current trend towards increased fees.[134]

- Taxation: In the US, the Internal Revenue Service regards Bitcoin as property and not as currency, so every transaction is regarded as a profit or loss for tax purposes.[136] For investors in large brokerage firms, trading in property like real estate mutual funds is not a big deal because the brokerage firms (which aren't involved in virtual currency) take care of summarizing the profits and losses for the investor, but for Bitcoin investors, who use intermediaries such as Coinbase, the investors are currently on their own.[136] Compounding this problem is that if one actually finds a retailer that accepts Bitcoin, then each purchase has tax implications because it requires transacting Bitcoin.[136] The IRS recently forced Coinbase to divulge the tax information of its customers, so don't plan to slip under the radar.[136]

- Poorly-secured wallets: Most people use wallets to store their cryptocurrency keys to facilitate transfers and for security. A security flaw was discovered in wallets created before 2016, and millions of people who use such wallets are now known to be at risk of theft. Compounding this problem, many of the companies that created these wallets have gone out of business.[137] In 2024, a scam wallet application appeared on the Canonical Snap Store for Linux. At least one poor slob discovered that the app was a scam after his nine bitcoins (around US $490K at the time) were gobbled up by the app.[138]

Other distributed cryptocurrencies[edit]

“”Over 70% of ICO [Initial Coin Offering] funding (by $ volume) to-date went to higher quality projects, although over 80% oprojects (by # share) were identified as scams.

|

| —Sherwin Dowlat & Michael Hodapp[139] |

A number of copycat cryptocurrencies ("altcoins") exist as a consequence of the Bitcoin experiment, only a few of which, such as Litecoin![]() and Dogecoin,

and Dogecoin,![]() have achieved any notability. A few of these have significant distinctions from Bitcoin, such as Namecoin, which is part of a decentralized ".bit" DNS project,[140] and Freicoin, which incorporates demurrage to discourage speculative hoarding, but most of them are simple forks of the Bitcoin code. Since the media attention on Bitcoin in early 2013[141] a glut of such "coins" has flooded the market, with increasingly silly names like BBQcoin, Memecoin, Junkcoin, Sexcoin, and Shitcoin.[note 10] And don't forget Coinye West.[142]

have achieved any notability. A few of these have significant distinctions from Bitcoin, such as Namecoin, which is part of a decentralized ".bit" DNS project,[140] and Freicoin, which incorporates demurrage to discourage speculative hoarding, but most of them are simple forks of the Bitcoin code. Since the media attention on Bitcoin in early 2013[141] a glut of such "coins" has flooded the market, with increasingly silly names like BBQcoin, Memecoin, Junkcoin, Sexcoin, and Shitcoin.[note 10] And don't forget Coinye West.[142]

Dogecoin[edit]

Dogecoin[143] gained some popularity on cuteness value and use for tipping on Reddit.[144] Unlike most altcoins, Dogecoin is slightly inflationary rather than deflationary.[145] Despite having similar get-rich hopes, most Dogecoin fans are also notably less dickish than Bitcoin fans, though that's not hard to achieve. Elon Musk is a notable exception, with Dogecoin's co-founder Jackson Palmer a "self-absorbed grifter" for Musk's alleged market manipulation of the coin.[146]

Ethereum[edit]

Ethereum is the trendy altcoin in 2016, which offers a platform for smart contracts. (Imagine Bitcoin as a spreadsheet, Ethereum as a spreadsheet with macros.) In practice, it's traded like any other cryptocurrency, with pumps[147] and dumps[148] and so forth. One of the most prominent Ethereum smart contracts is an "honest Ponzi"[149] and another, "The DAO", lost $50 million to security bugs in the smart contract code.[150]

In addition, like many altcoins, Ethereum was substantially premined before a big launch sale[151] and its creator, Vitalik Buterin (the recipient of a Thiel Fellowship[152]), is partially cashing out after it was pumped; he described this as "sound financial planning."[153]

Before Ethereum, Vitalik Buterin had proposed to solve an NP-complete problem in polynomial time by using a quantum computer. Of course, he didn't have a quantum computer, because nobody has one of sufficient size. Instead, he was going to simulate it on a classical computer. Sadly for his Fields Medal hopes, he couldn't convince people to fund this enterprise.[154] The particular NP-complete problem he wanted to solve was not any of the zillions of long-known NP-complete problems it would have been useful to have a solution to — he wanted to use it to mine Bitcoins more efficiently. For some reason, even Bitcoin programmers make fun of his computer science skills.[155]

In 2021 Virgil Griffith, one of the developers of Ethereum, pleaded guilty to conspiring to violate the International Emergency Economic Powers Act by facilitating cryptocurrency transactions for North Korea.[156]

In 2019, Ethereum announced that currency would be moving from a proof of stake![]() model to a model with the goal to also increase throughput by splitting up the workload into many blockchains running in parallel with each other (a process Ethereum labeled as sharding) in a project titled Ethereum 2.0. The first stage of this project "The Beacon Chain" was launched in December 2020 and created the Beacon Chain, the proof-of-stake (PoS) blockchain that will act as the central coordination and consensus hub of Ethereum 2.0. Stage 2 will see this chain merge into the Ethereum's network, making proof-of-stake the main consensus method for the currency and is scheduled to occur in the second quarter of 2022 (subject to a likely delay). Stage 3, which is scheduled to occur in 2023 (also subject to delays), will see the launch of shard chains. Ethereum claims this transition will result in a 99.95% decline in energy consumption for Ethereum.[157][158][159][160] Given proof of stake works by just iterating through who owns the largest wallets, proof of stake basically solves cryptocurrency's energy consumption issue.[161]

model to a model with the goal to also increase throughput by splitting up the workload into many blockchains running in parallel with each other (a process Ethereum labeled as sharding) in a project titled Ethereum 2.0. The first stage of this project "The Beacon Chain" was launched in December 2020 and created the Beacon Chain, the proof-of-stake (PoS) blockchain that will act as the central coordination and consensus hub of Ethereum 2.0. Stage 2 will see this chain merge into the Ethereum's network, making proof-of-stake the main consensus method for the currency and is scheduled to occur in the second quarter of 2022 (subject to a likely delay). Stage 3, which is scheduled to occur in 2023 (also subject to delays), will see the launch of shard chains. Ethereum claims this transition will result in a 99.95% decline in energy consumption for Ethereum.[157][158][159][160] Given proof of stake works by just iterating through who owns the largest wallets, proof of stake basically solves cryptocurrency's energy consumption issue.[161]

Reception[edit]

Many Bitcoin advocates really don't like altcoins.[162] Most of the value proposition of Bitcoin is the strictly limited quantity available, and they perceive altcoins as undermining their HODLing,[note 11] instead suggesting the way to resolve Bitcoin's scaling problems without altcoins is with hypothetical add-ons such as sidechains.[164] (Though sidechain developers themselves are not so optimistic.[165]) They dismiss altcoins as scams (though they don't regard the substantially-premined Bitcoin as one). However, there is no way for them to stop altcoins from being created.

Scamcoins[edit]

To be fair, quite a lot of altcoins since the 2013 boom were blatant scams: make a coin, premine it, promise far-fetched features in BitcoinTalk's altcoin forum,[166] get it onto an exchange, sell it for Bitcoins. USBCoin, for example, netted 150 BTC this way.[167] DafuqCoin compromised exchanges because nobody checked the code before running it.[168][169] Bitconnect![]() literally used a pyramid in one of its promotional images.[170] And then there's Ponzicoin, which quite openly ran a series of Ponzi schemes for several months as a form of gambling before shutting down due to operator error.[171] Here's where it gets even dumber... It happened a second time, in 2018. Despite the developer pointing out it was a scam, people invested 250 Ether coins, which were worth more than $250,000 in about 8 hours.[172]

literally used a pyramid in one of its promotional images.[170] And then there's Ponzicoin, which quite openly ran a series of Ponzi schemes for several months as a form of gambling before shutting down due to operator error.[171] Here's where it gets even dumber... It happened a second time, in 2018. Despite the developer pointing out it was a scam, people invested 250 Ether coins, which were worth more than $250,000 in about 8 hours.[172]

BitcoinTalk dealt with these coins firmly: it limited advertisement signature image dimensions.

NFTs[edit]

An addition to the messy pile of crypto nonsense are "Non-fungible Tokens" or NFTs. Unlike cryptocurrencies, which merely list changes between wallets, NFTs are smart contracts created on blockchains that support those (the most popular one of these being Ethereum, although they get minted on many other scamcoins) that are considered unique to whatever wallet is listed as the owner for the smart contract at the time. All this really does is add all the scams going on in the art auctioning world to cryptocurrencies, while also adding all the major issues that cryptocurrencies themselves have.

El Salvador adoption[edit]

In September 2021, El Salvador President Nayib Bukele pushed the country to become the first country to adopt Bitcoin as its official currency. Previously, the US dollar had been the official currency since 2001, which remains an official currency.[173] El Salvador was actually doing fine with US currency as legal tender before Bitcoin adoption (stable mortgage rates, low inflation, low money transfer rates from overseas).[174] In 2022, the value of crypto currencies tanked, as they are wont to do. The consequence of this was a loss of $22 million in national reserves,[175] and continued criticism from the International Monetary Fund[176] and World Bank.[177]

The moral of the story[edit]

In a gold rush, the money's in selling shovels. But Butterfly Labs proved that even the shovel-merchants are crooks.[124] Cash up front, please.

Culture[edit]

As Bitcoin has grown in popularity, its advocates have discovered common interests with other groups. This has expanded from the early links between the Bitcoin movement and libertarian, anarchist, and minarchist groups. It is unsurprising that some Bitcoin enthusiasts hold conspiracy theories about fiat currency and the gold standard and Jewish conspiracies controlling world banking.[178] But Bitcoin culture goes well beyond that: there are subcultures like the "bitcoin carnivore", "bitcoin and meat maximalists", who embrace an extreme version of the paleo diet while trying to free themselves from the shackles of banking, big food, and carbohydrates, minting their own money and killing their own dinner.[179][180]

See also[edit]

External links[edit]

- See the Wikipedia article on Cryptocurrency and crime.

- Bitcoin.org

- BitcoinTalk forum, glorious home of the revolution

- Buttcoin, criticism by vicious statists who hate freedom

- Bitcoin currency statistics and charts

- The Bitcoin Bubble and the Future of Currency, Felix Salmon (The ultimate primer on why Bitcoin, if not drastically retooled, will eventually fail — and how some of its features may be repurposed elsewhere.)

- Use your computer for something actually relevant.

- Advanced Bitcoin Simulator and Bitcoin Mining Profit Calculator: Gaiden, brilliant dark satires of Bitcoin, its community and its history.

- Dead Coins — autopsies of failed coin launches

- Coinpsy — another list of failed coin launches

- CoinMarketCap — Bitcoin and Cryptocurrencies market capitalization

- ExchangeRates.Pro — Bitcoin and Cryptocurrencies price comparison at the exchanges

- Bitcoin is a Ponzi

Notes[edit]

- ↑ As per the ISO currency code standard, "BTC" is actually incorrect as a descriptor for Bitcoin. Currency codes comprise an ISO two-letter country code (e.g. "GB" for the United Kingdom) and a third letter denoting the currency unit ("P", so "GBP" for the pound sterling). "BTC" therefore would imply a Bhutanese currency. "XBT" is unofficial, but is in line with the standard, as non-currencies like gold or international currency units get an "X" prefix. Of course, as Bitcoiners are often both ignorant of how the world works and arrogant enough to think they can sweep the whole lot away, they often ignore petty rules and convention, referring to their baby as "BTC" anyway.

- ↑ Some payment networks near identical to Bitcoin such as Vertcoin haven't been so fortunate, having fallen victim to targeted computer processing power aimed at dishonestly manipulating the payment history. This subsequently hurt the long-term price trajectory of all the coins that were successfully targeted. Bitcoin is an outlier simply due to a lack of will by computer processing aggregators to perform such an attack on Bitcoin

- ↑ Very few retailers took Bitcoin directly, instead contracting with businesses like Coinbase who would convert the (typically) USD price of whatever it is you were buying into Bitcoin, collect that from the buyer and give the seller USD.

- ↑ There are some indirect costs of using credit or debit cards, which in 2024 are typically around 1-2% of the transaction - however aside from this being only an indirect cost to the consumer, since these fees are borne by merchants, this is still dramatically lower than the total transaction cost of Bitcoin.

- ↑ Types of money include "commodity money", whose metallic forms are usually called specie. The canonical forms of commodity money are gold and silver, but other goods, from cigarettes to beaver pelts have been used as commodity money. There is also "representative money", scrips that can be redeemed for commodity money. Finally, there is "fiat money", which is called into being by declaring it to be money, usually but not necessarily by a government issuing it and binding itself to accept it in payment. The distinctive thing about commodity money is that it consists of things that have intrinsic value; whatever the value of the currency unit indicated by the coin, it also has "melt value" that can always be realized. Bitcoin is "fiat money" in that it consists of code that has been declared to be money. Unlike other fiat currencies, there is no entity that backs the currency by declaring its willingness to accept Bitcoin as payment for anything.

- ↑ One significant difference is that the US government usually asks people to pay taxes in US dollars.

- ↑ Wikipedia's list of distributed computing projects

listed Bitcoin at 312,000 teraflops equivalent as of November 2012; second place was Folding@home at 8,588 teraflops as of February 2012. Bitcoin actually uses integer calculations, so that number's fudged, but it's still the largest by a ridiculous margin. Actual participant numbers were much smaller: a few thousand for Bitcoin, a few hundred thousand for Folding@home.

listed Bitcoin at 312,000 teraflops equivalent as of November 2012; second place was Folding@home at 8,588 teraflops as of February 2012. Bitcoin actually uses integer calculations, so that number's fudged, but it's still the largest by a ridiculous margin. Actual participant numbers were much smaller: a few thousand for Bitcoin, a few hundred thousand for Folding@home.

- ↑ Then comes the argument that in a libertarian world everyone would have generated their own power and those who want to make more money would "invest in infrastructures" and keep their tools of trade in working order.

- ↑ Note that in real economics, "fiat" simply means "money not backed by a commodity". Thus, Bitcoin is also fiat. The usage of "fiat" as a snarl word comes from goldbug screeds. Bitcoiners adopted this usage of the word without realising the term also applied to Bitcoins.

- ↑ The Shitcoin term has already been in use by Bitcoin detractors to describe Bitcoin, and by Bitcoin advocates to describe all non-Bitcoin cryptocurrencies. In October 2013, someone did the obvious and introduced a Shitcoin for real.

- ↑ HODLing was initially a typo for "HOLDing" that was later reverse-acronymmed to Hold On for Dear Life.[163]

References[edit]

- ↑ Crypto booster Mark Cuban hacked for $870,000. Web3 is going great, 15 September 2023.

- ↑ Bitcoin is teaching libertarians everything they don't know about economics by Matt O'Brien (January 8, 2018) The Washington Post.

- ↑ See the Wikipedia article on blockchain.

- ↑ Bitcoin’s Inequality Problem Is Putting the Dollar to Shame: Of the 19 million bitcoin currently in circulation, just 0.01% of buyers control around 27% of the cryptocurrency by Mack DeGeurin (December 20, 2021) Gizmodo.

- ↑ 5.0 5.1 How Bitcoin Is Like North Korea by Joe Weisenthal (Jan 12, 2014, 8:04 AM) Business Insider.

- ↑ See the Wikipedia article on Gini coefficient.

- ↑ What is Bitcoin and how does it work?, Mashable

- ↑ Crypto Payments for Child Porn Grew 32% in 2019: Report

- ↑ Bitcoin Trail Leads to Bust of Massive Child Porn Site

- ↑ Silk Road Boss' First Murder-for-Hire Was His Mentor's Idea by Andy Greenberg (04.01.15 5:00 pm) Wired.

- ↑ Hitman Network Says It Accepts Bitcoins to Murder for Hire by Eli Lake (10.17.135:45 AM ET) The Daily Beast.

- ↑ What Is Ransomware? A Guide to the Global Cyberattack’s Scary Method by Kim Zetter (05.14.17 1:00 pm) Wired.

- ↑ McAfee Labs Report Sees New Ransomware Surge 165 Percent in First Quarter of 2015 (June 9, 2015) McAfee (archived from September 17, 2015).

- ↑ Kiell (11 December 2014). "A Carder’s First Experience". Retrieved 18 August 2015.

- ↑ Kujawa, Adam (24 January 2014). "FBI Takes Down Poorly Secured Carders". Retrieved 23 August 2015.

- ↑ 16.0 16.1 Frequently Asked Questions: Is Bitcoin anonymous? Bitcoin.org

- ↑ 17.0 17.1 17.2 Protect your privacy Bitcoin.org

- ↑ Greenberg, Andy (25 January 2017). "Monero, the Drug Dealer's Cryptocurrency of Choice, Is on Fire". Wired. Retrieved 19 March 2023.

- ↑ Nathaniel Popper, Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money

- ↑ [1]The Byzantine General's Problem: Lamport, Shostak, and Pease for SRI International

- ↑ "Eliminate Bitcoin Volatility Risk with BitPay"

- ↑ Deep Web Drug Dealers Are Freaking Out About The Bitcoin Crash by Rob Price (Jan. 16, 2015, 3:48 PM) Business Insider.

- ↑ Bitcoin Lightning Network vs Visa and Mastercard: How do they stack up? by Francisco Rodrigues (Aug 24, 2022) Cointelegraph.

- ↑ Bits and bob (Babbage, The Economist, 2011-06-13); print version

- ↑ Bitcoin bank heist (Babbage, The Economist, 2014-02-26)

- ↑ There Are Smart Kinds of Money and Dumb Kinds of Money, Brookings Institution

- ↑ Is Bitcoin a Real Currency? An economic appraisal, NBER

- ↑ The Bitcoin Question: Currency versus Trust-less Transfer Technology, OECD

- ↑ Heads or Tails? What the Future Holds for Bitcoin and ‘Altcoins’, University of Pennsylvania

- ↑ In Search of a Stable Electronic Currency, The New York Times

- ↑ Golden Cyberfetters, The New York Times

- ↑ The Long Cryptocon, The New York Times

- ↑ Buffett: ‘Stay Away’ From Bitcoin, VentureBeat (The author's belief that the currency should be rebranded as 'Bitgold' is particularly ironic because that was the name of one of its precursors.

)

)

- ↑ "Bitcoin ‘Ought to Be Outlawed,’ Nobel Prize Winner Stiglitz Says", Bloomberg.

- ↑ "Stiglitz Says Bitcoin 'Ought to Be Outlawed'", Bloomberg.

- ↑ Virtual Currency Schemes: October 2012, ECB

- ↑ Warning to consumers on virtual currencies, EBA

- ↑ CFPB warns consumers about bitcoin 'Wild West', The Hill

- ↑ Professional Traders Show Interest in Bitcoin, Hacker News

- ↑ Bitcoin's Vast Overvaluation Appears Caused by Price-fixing, Falkvinge

- ↑ Bots were responsible for bitcoin’s stratospheric ascent, anonymous report claims, GigaOM

- ↑ Bitcoin Exchange Mt. Gox Goes Offline Amid Allegations of $350 Million Hack, Wired (Later revised to half a billion USD.)

- ↑ What the Bitcoin theft might look like if it happened in the real world, Maclean's

- ↑ WizSec. The missing MtGox bitcoin. 19 April, 2015. Archived on 19 April, 2015 from The Missing MtGox Bitcoins.

- ↑ Bitcoin's astronomical rise last year was buoyed by market manipulation, researchers say by Hamza Shaban (June 14, 2018 at 10:25 AM) The Washington Post.

- ↑ How Bitcoin and cryptocurrencies are hurting gamers by Jarred Walton (July 05, 2017) PC Gamer.

- ↑ The Economics of Bitcoin Mining: Bitcoin in the Presence of Adversaries, Princeton University (They describe it more ominously as a "Goldfinger attack.")

- ↑ Weaknesses: Attacker has a lot of computing power Bitcoin Wiki.

- ↑ Once hailed as unhackable, blockchains are now getting hacked: More and more security holes are appearing in cryptocurrency and smart contract platforms, and some are fundamental to the way they were built. by Mike Orcutt (February 19, 2019) MIT Technology Review.

- ↑ Bitcoin Mining Software P2Pool Calls For Hardfork Upgrade In 24 Hours Before BIP66 Takes Effect by Lester Coleman (June 27, 2015 6:56 PM UTC) Crypto Coin News.

- ↑ Bitcoin Network Capacity Analysis – Part 3: Miner Incentives (Jun 09, 2015) TradeBlock.

- ↑ 52.0 52.1 The Doomsday Cult of Bitcoin, New York Magazine

- ↑ Ghash.io: We Will Never Launch a 51% Attack Against Bitcoin, CoinDesk

- ↑ How a Mining Monopoly Can Attack Bitcoin, Hacking Distributed

- ↑ Bitcoin: What is a Finney attack? (2012) StackExchange.

- ↑ GHash.IO and double-spending against BetCoin Diceimg (RoadTrain, BitcoinTalk forums, 30 October 2013)

- ↑ 57.0 57.1 Line Goes Up – The Problem With NFTs by Dan Olson (Jan 21, 2022) YouTube. Time 35:38 through 39:02.

- ↑ The Intellectual Incoherence of Cryptoassets by Stephen Diehl (November 7, 2021).

- ↑ The Bitcoin Mining Accidents blog has disappeared, but you may enjoy the most famous tale from it, of heatstroke-induced brain damage from an overheating Bitcoin rig. In 2014, a huge Bitcoin mine burned down in Bangkok, Thailand, showing that not just small-time idiots are susceptible to getting burned.

- ↑ Decarbonizing Bitcoin: Law and policy choices for reducing the energy consumption of Blockchain technologies and digital currencies, Jon Truby, Energy Research & Social Science

- ↑ 61.0 61.1 Bitcoin power consumption is estimated at between 0.1 and 10 GW average over 2014; Ireland consumed around 3 GW average. O'Dwyer and Malone. "Bitcoin Mining and its Energy Footprint." Presented at ISSC 2014 / CIICT 2014, Limerick, June 26–27 2014.

- ↑ 982MWh per day in 2013: Bitcoin’s Environmental Problem, CleanTechnica

- ↑ $20 in October 2014; peak was $90/transaction in January 2014. (NASDAQ charges way less in comparison per transaction, indicated by the fact that your broker makes money with said commissions.)

- ↑ Bitcoin Electricity Consumption Carbon Footprint Fortune, October 2021

- ↑ Someone did come up with CureCoin, which rewards both ASICs securing the blockchain and CPU/GPU protein folding. Note that protein folding doesn't have the same security properties hashes have.

- ↑ Cryptocurrency mining in Iceland is using so much energy, the electricity may run out by Rick Noack (February 13, 2018 at 12:24 PM) The Washington Post.

- ↑ 67.0 67.1 Quantification of energy and carbon costs for mining cryptocurrencies by Max J. Krause & Thabet Tolaymat (2018) Nature Sustainability 1:711–718.

- ↑ Mining Bitcoin Can Be More of an Energy Drain Than Actual Mining by Brian Kahn (11/05/18 12:13pm) Gizmodo.

- ↑ Bitcoin Surges 15% Overnight Because Nobody Learned Their Lesson After the Last Crash by Matt Novak (April 2, 2019; 7:20am) Gizmodo.

- ↑ Bitcoin leaves a carbon footprint as large as Las Vegas, study finds

- ↑ Cambridge Bitcoin Electricity Consumption Index

- ↑ Bad news for gamers, GPUs are skyrocketing

- ↑ [arstechnica.com/gaming/2018/07/declining-cryptocurrency-prices-are-making-graphics-cards-affordable-again Lower Bitcoin price making GPUs cheaper]

- ↑ [www.usgs.gov/news/digital-gold-rush-depends-traditional-gold Digital gold rush depends on traditional gold]

- ↑ Mixing service Bitcoin Wiki.

- ↑ Our Fees (2014) Bitcoin Mixing Service (August 11, 2014).

- ↑ Our Fees Coin Mixer (archived from August 11, 2014). Note: As of 2020, accessing the live site on some browsers brings upa security risk warning!

- ↑ 78.0 78.1 Mixing service Bitcoin Wiki.

- ↑ Number Go Up: Inside Crypto's Wild Rise and Staggering Fall by Zeke Faux (2023) Crown Currency. ISBN 0593443810.

- ↑ Inside the Mega-Hack of Bitcoin: the Full Story (Jason Mick, DailyTech, 2011-06-19)

- ↑ "No database backups ... Everyone had root."

- ↑ Suspected multi-million dollar Bitcoin pyramid scheme shuts down, investors revolt, The Verge

- ↑ Bitcoin-stealing trojan spotted in the wild, VentureBeat

- ↑ Mac Bitcoin-stealing malware spreads via cracked versions of Angry Birds and other apps, Polygon

- ↑ Bitcoin’s skyrocketing value ushers in era of $1 million hacker heists, Ars Technica

- ↑ $1.2 million in Bitcoins hijacked in 'social engineering' attack, Engadget

- ↑ Bitcoin stolen via malware-infected pirated copy of Fallout 4, SiliconANGLE

- ↑ In mathematics we trust, MetaFilter

- ↑ The Bitcoin personality cult lives on, Financial Times

- ↑ The average Bitcoin evangelist. (Want to laugh for a few more minutes? Here's a full collection of insane Bitcoin comments from Reddit — yes, they're all real.)

- ↑ Why I'm Putting All My Savings Into Bitcoin, Falkvinge

- ↑ "Bitcoin's Four Hurdles," parts 1, 2, 3, and 4

- ↑ Ron Paul Slams Stability of US Dollar and Bitcoin in Pro-Gold Rant, The Raw Story

- ↑ Firm says online gambling accounts for almost half of all Bitcoin transactions, Ars Technica

- ↑ Risk of Bitcoin Hacks and Losses Is Very Real (August 29, 2016 4:56 AM EST) Reuters via Fortune.

- ↑ Virtual cash exchange becomes bank, BBC

- ↑ Bitspend ceases trading due to frozen accounts, CoinDesk

- ↑ Mt. Gox temporarily suspends USD withdrawals, CoinDesk

- ↑ Bitcoin trading volume since 2010 at Bitcoinity

- ↑ Timeline: a history of Bitcoin in China in 2013, Tech in Asia

- ↑ Bitcoin’s Uncertain Future in China, United States-China Economic and Security Review Commission

- ↑ "Look at the big picture!"

- ↑ FAQ – Economy on the "official" Bitcoin Wiki.

- ↑ A look at the Bitcoin network transaction history, TechnoLlama

- ↑ What Companies Accept Bitcoin?, NASDAQ

- ↑ Business Insider

- ↑ Tesla sells bitcoin in Q1, coindesk

- ↑ CNBC

- ↑ Tesla won't accept Bitcoin

- ↑ BBC

- ↑ You’re a Lemon if You Buy a Tesla With Bitcoin, Coindesk

- ↑ coindesk

- ↑ Tesla naming convention

- ↑ Cryptocurrency is suddenly everywhere — except in the cash register: While interest in crypto has exploded, few people are using it for its intended purpose: to pay for things by Tory Newmyer (January 12, 2022) The Washington Post.

- ↑ 115.0 115.1 115.2 115.3 Exclusive: Nearly 4 Million Bitcoins Lost Forever, New Study Says by Jeff John Roberts and Nicolas Rapp (November 25, 2017) Fortune.

- ↑ After founder's sudden death, cryptocurrency exchange can’t access $190 million in holdings by Taylor Telford (February 4, 2019 at 2:18 PM) The Washington Post.

- ↑ Justice Department Seizes $1 Billion of Bitcoin Tied to Silk Road Website: Agency says a hacker stole funds in 2012, 2013 from drug website, left untouched for years by Paul Vigna (Updated Nov. 5, 2020 6:23 pm ET) The Wall Street Journal.

- ↑ Hackers steal $64 million from cryptocurrency firm NiceHash by Jim Finkle & Jeremy Wagstaff (December 6, 2017 / 7:20 PM) Reuters.

- ↑ Coincheck Says It Lost Crypto Coins Valued at About $400 Million by Yuji Nakamura & Andrea Tan (January 26, 2018, 12:23 AM PST; Updated on January 26, 2018, 10:49 AM PST) Bloomberg.

- ↑ A $152,000 Cryptocurrency Theft Just Exploited A Huge 'Blind Spot' In Internet Security by Thomas Fox-Brewster (Apr 24, 2018, 02:10pm) Forbes.

- ↑ Hackers hit popular video game, stealing more than $600 million in cryptocurrency: A blockchain powering the NFT game Axie Infinity was attacked, leading to one of the biggest crypto swipes to date by Steven Zeitchik (March 29, 2022) The Washington Post.

- ↑ How North Korea’s Hacker Army Stole $3 Billion in Crypto, Funding Nuclear Program Regime has trained cybercriminals to impersonate tech workers or employers, amid other schemes by Robert McMillan & Dustin Volz (June 11, 2023 9:00 am ET) The Wall Street Journal.

- ↑ "Bitcoin Boulevard no longer booming", Marketplace

- ↑ 124.0 124.1 Adrianne Jeffries, FTC shuts down Butterfly Labs, the second-most hated company in Bitcoinland. The Verge, 23 September 2014.

- ↑ Refunds!

- ↑ Scalability on the "official" Bitcoin Wiki.

- ↑ Re: Bitcoin 20MB Fork by solex (February 04, 2015, 10:17:57 PM) Bitcoin Forum.

- ↑ About Paypal (archived from Feburary 3, 2015). "PayPal customers made 1.06 billion transactions*** in Q4 2014": 1.06e9 / (60×60×24×365.25/4) = 134.

- ↑ [Stress Test Prepares VisaNet for the Most Wonderful Time of the Year (Oct 10, 2013) Visa

- ↑ Western Union 2013 Annual Report, page 2 (archive)

- ↑ Higher and higher.

- ↑ Stress Test Recap (45sbvad, /r/bitcoin, 30 May 2015); graph

- ↑ 133.0 133.1 10 Physical Bitcoins: the Good, the Bad and the Ugly by Nermin Hajdarbegovic (September 14, 2014 at 19:15 BST) CoinDesk.

- ↑ 134.0 134.1 Five myths about bitcoin: No, the currency isn't beyond the reach of the law, and it won't replace cash. by Joseph Bonneau & Steven Goldfeder (December 15, 2017) The Washington Post.

- ↑ Tim Draper On Bitcoin: 'In 5 Years If You Use Fiat Currency, They Will Laugh At You' by John Koetsier (Nov 7, 2017 @ 10:10 AM) Forbes.

- ↑ 136.0 136.1 136.2 136.3 'It's going to be a nightmare': Some bitcoin investors are in for a rocky tax season by Brian Fung (January 11, 2018) The Washington Post.

- ↑ If you created a bitcoin wallet before 2016, your money may be at risk: A company that helps recover cryptocurrency discovered a software flaw putting as much as $1 billion at risk from hackers. Now it’s going public in hopes people will move their money before they get robbed. by Joseph Menn (November 14, 2023) The Washington Post.

- ↑ Exodus Bitcoin Wallet: $490K Swindle. popey.com, 20 February 2024.

- ↑ Cryptoasset Market Coverage Initiation: Network Creation by Sherwin Dowlat & Michael Hodapp (July 11, 2018) Satis Group Crypto Research via Bloomberg.

- ↑ Although it has since moved to piggybacking off the Bitcoin blockchain, since one miner took over 70% of the Namecoin hashing power for much of 2014 and 2015.

- ↑ Because Cyprus. [2] [3]

- ↑ Coinye developers say they're abandoning project as Kanye West escalates legal battle, The Verge

- ↑ To the moon!

- ↑ Online Donors Send Jamaican Bobsled Team To Sochi, NPR

- ↑ Dogecoin to allow annual inflation of 5 billion coins each year, forever, Ars Technica

- ↑ Co-creator of Dogecoin lashes out at ‘self-absorbed grifter’ Elon Musk over bitcoin stand by Graeme Massie (15 May 2021 00:34) Independent.

- ↑ Bitcoin rival Ethereum's price skyrockets by Jessica Sier (Feb 11, 2016 – 4.34pm) Fienancial Review.

- ↑ Is Ethereum a Bubble or is it Being Pumped – What Does the Data Say? Are bots generating fake ETH volumes, are investors fleeing bitcoin for Ethereum, is there a SPAM campaign to pump its by Avi Mizrahi (24/02/2016 | 16:57 GMT+2) Finance Magnates.

- ↑ Introducing SmartPonzi, a Ponzi scheme simulator ÐApp based on Ethereum self.ethereum by smartcontractor (c. October 2015) /r/ethereum Reddit (archived from 3 Mar 2016 10:11:15 UTC)

- ↑ Digital currency Ethereum is cratering because of a $50 million hack by Rob Price (Jun. 17, 2016, 10:34 AM 12,030) Business Insider.

- ↑ Code your own utopia: Meet Ethereum, bitcoin's most ambitious successor by Nathan Schneider (April 7, 2014 5:00AM ET) Aljazeera America.

- ↑ Josh Elliott (July 2, 2014). "Why a 20-year-old Toronto drop-out accepted $100,000 to stay out of school". CTV News.

- ↑ We Need to Think of Ways to Increase ETH Adoption by u/defenderofjustice (April 21, 2016) Reddit (archived from 23 Apr 2016 15:02:56 UTC).

- ↑ Vitalik’s Quantum Quest (August 16, 2016) Bitcoin Error Log (archived from 15 Oct 2016 12:27:07 UTC).

- ↑ Can we not have egomaniacs, ex-cons, and scam artists leading efforts to fork? (c. 2017) Reddit.

- ↑ Cryptocurrency expert pleads guilty to conspiring to help North Korea dodge sanctions by Shayna Jacobs (September 27, 2021) The Washington Post.

- ↑ Joe Lubin Talks Trump, Blockchain’s ‘Frankenstein,’ And Willingness To Work With China by Michael del Castillo (November 9, 2019) Forbes.

- ↑ The world’s second-biggest cryptocurrency is getting a major upgrade — here’s what you need to know by Ryan Browne (Dec 1 2020) CNBC.

- ↑ Energy Footprint of Blockchain Consensus Mechanisms Beyond Proof-of-Work by Moritz Platt et al. (Q3 2021) UCL Centre for Blockchain Technologies.

- ↑ The energy consumption of Ethereum 2.0, Algorand, Cardano, Hedera, Polkadot and Tezos has been studied. by Moritz Platt et al. (2021) 2021 IEEE International Conference on Blockchain and Cryptocurrency (ICBC).

- ↑ Here’s how to fix cryptocurrency’s energy consumption problem: ‘Proof of stake’ replaces cryptocurrency mining with vastly more efficient cryptocurrency validation. by Doug Aamoth (05-25-21) Fast Company.

- ↑ Call the whambulance

- ↑ For Bitcoin, HODLing Is The Best Strategy… With One Big Caveat by Matt Hougan (Apr 23, 2018, 06:00am) Forbes.

- ↑ "Sidechains Can Replace Altcoins and ‘Bitcoin 2.0' Platforms"

- ↑ Blockstream to Release First Open-Source Code for Sidechains by u/bubbasparse (c. 2016) Reddit.

- ↑ e.g. USBcoin

- ↑ USBcoin Confirmed As Scam, Removed From Bittrex, Fifth Scam Coin on Bittrex Exchange In Little Over A Month (Ian DeMartino, CoinTelegraph, 28 July 2014)

- ↑ Dafuq Coin, the first malware coin (Cryptocurrency Times, 4 May 2014) (archive)

- ↑ READ ME NOW! - dafuqcoin is a trojan - pool operators/exchanges beware (BitcoinTalk, 22 April 2014)

- ↑ Cryptocurrencies: Last Week Tonight with John Oliver by LastWeekTonight (Mar 11, 2018) YouTube.

- ↑ Update: After alleged scam, “Ponzicoin” refunds around $7,000 due to error

- ↑ Maina, Saruni. (January 26, 2018). Developer Shuts Down Fake Cryptocurrency PonziCoin after Things Go “Crazy Out of Hand”. Tech Weez. Retrieved: 7 July, 2019.