Almond cultivation in California

From Wikipedia - Reading time: 11 min

From Wikipedia - Reading time: 11 min

California produces 80% of the world's almonds and 100% of the United States commercial supply.[1] Although almonds are not native to California, a hot, dry Mediterranean climate and developed water infrastructure create favorable conditions for commercial cultivation of the crop.[2] In 2020, there were 1.25 million acres (5,100 km2) devoted to almond farming in California, producing 2.8 billion pounds (1.3 Mt).[3]

Almonds are the state's most valuable export crop.[1] Farmers exported $4.9 billion worth to foreign countries in 2019, about 22% of the state's total agricultural exports, with the European Union, China and India as leading destinations.[1]

California almond farms import the majority of US commercial bee colonies to the state of California during the almond pollination season. Almond production in California is the source of several major environmental problems, including high demand for water and abundant waste of almond shells. As of 2021, due to a historic long-term drought in California, production was forecast to decline, and many almond orchards were being abandoned.[4] Shipping disruptions, reductions in consumer spending, and trade disputes during 2020-21 caused by the COVID-19 pandemic affected logistics and pricing of almonds.[3]

Economic impact

[edit]Almonds were California's third most valuable agricultural product in 2019, accounting for $4.9 billion (about 11%) of agricultural output.[1] Almond production increased from 703 million pounds (319 kt) in 2000 to 2.27 billion pounds (1.03 Mt) in 2017.[5] Prices rose over the same period, fueled in part by overseas demand. Newly planted almond acreage has displaced more traditional cash crops, such as cotton.[6]

In addition to consumer demand, the industry's growth has benefitted from mechanization. During the harvesting process, tree shakers are used to aggressively shake each almond tree, causing the nuts to fall to the ground. This reduces the need for labor relative to other crops, which has attracted farmers who are concerned with shortages of migrant workers.[2]

A 2014 report commissioned by the Almond Board of California, an industry group, found that the industry directly employed 21,000 people and indirectly supported an additional 83,000 jobs statewide. Including indirect effects, the industry added about $11 billion to the state's GSP.[7]

Exports

[edit]Almonds are California's most valuable export crop. Farmers exported $4.5 billion worth to foreign countries in 2016, about 22% of the state's total agricultural exports. The majority of these exports went to the European Union, China and India.[1] While the EU is the largest consumer, the latter two countries are expanding markets where the state's Almond Board has actively marketed the nuts as a healthy snack.[6]

As part of the 2018 China–United States trade war, China has imposed a 50% tariff on almonds. As a result, some Chinese businesses have resorted to importing almonds from other producers in Africa and Australia.[8]

During the global supply chain disruption, shipping companies placed a lower priority on products that paid lower shipping rates resulting in various exports being delayed. More than three-quarters of the containers leaving Los Angeles were empty in July 2021 whereas about two-thirds of the containers leaving U.S. ports are typically filled with exports. Many of containers were going back empty due to the rush by shippers to bring in imports of back-to-school supplies and fall fashions from Asia.[9] This impacted the almond growers along with Midwestern farmers who ship to customers overseas.[10]

Environmental issues

[edit]Bees

[edit]

Like many crops, almond cultivation requires cross-pollination. Although almonds can be pollinated by many insects, commercial almond farming is heavily dependent on honey bees. Commercial almond growers may rent hives during the blooming season to ensure pollination success.[11] Starting in 2006, California almond growers began to suffer losses due to colony collapse disorder, a poorly understood phenomenon resulting in the decline of bee populations.[2] While this increased pollination expenses for many growers, high demand for almonds created an incentive to transport bees from across the United States to California. The state's bee population has since partly recovered, and in 2018 accounted for more than half of all bee colonies in the United States.[2]

Water

[edit]

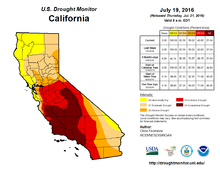

California suffered a severe drought from 2011 to 2017. In addition to economic consequences for the state's almond growers, the industry came under criticism for its water use. As of 2015, almond cultivation consumed about 10% of the state's water.[12] Furthermore, almond acreage increased by 14% from 2007 to 2014, while almond irrigation increased by 27%.[13] Critics have pointed out that the state's 6,000 almond farmers use roughly 35 times the amount of water as the 466,000 residents of Sacramento.[14]

To supplement reduced deliveries from the state's water system, many almond farmers increased groundwater pumping, which can unsustainably deplete aquifers and cause land subsidence.[14]

Almond production fell somewhat as a result of the drought, contributing to higher prices and dampening consumer demand.[2] To compensate, many farmers removed older, less-productive almond trees and replaced them with newer plantings that use less water. Since these trees will take about five years to become productive, some farmers have expressed concerns about a future almond surplus.[2]

Waste products

[edit]

In the 2015/2016 crop year, the California almond industry produced over 1.5 million metric tons (1,500,000 long tons; 1,700,000 short tons) of hulls and over 0.5 million metric tons (490,000 long tons; 550,000 short tons) of shells. Historically, these byproducts have been used for livestock feed and bedding, or as fuel for cogeneration plants. However, declining demand for these uses combined with an increasing supply of almonds has created a mismatch. The Almond Board of California, an industry association, has researched ways to incorporate almond byproducts into other industries such as food, automotive, and pharmaceuticals.[1][2]

One possible use investigated by the Board is feedstock for bioenergy. For example, biochar made from almond shells can be integrated into automobile and plane tires, allowing them to better resist changing temperatures. Biochar can also be used to make stronger, biodegradable plastic goods such as garbage bags and flower pots.

A similar sustainability initiative has been "whole orchard recycling". At the end of their productive life, whole almond trees are ground up and the remains are integrated back into the soil, which retains the tree's nutrients. This process also increases the soil's ability to hold water.[3][4]

Pests

[edit]Ferrisia gilli is an economically significant pest of almond in California.[15] F. gilli was formerly known as a California population of F. virgata (the striped mealybug), only being studied sufficiently to recognize that it is distinguishable from F. virgata due to its severe impact on pistachio and almond in this state.[15] Xanthomonas pruni (syn. X. campestris pv. pruni, syn. X. arboricola pv. pruni) was unknown here until detection in Sacramento and northern San Joaquin Valley in the spring of 2013.[16] Amyelois transitella (the misnamed navel orangeworm) is one of the worst pests of this crop here.[17] Because larvae are unable to bore through the hull, early adults oviposit into the previous year's fallen wasted almonds (mummies) and then attack the new crop in mid-June or early July when the hulls split.[17] As of 2020[update] NOW losses have no clear year-over-year or per-cultivar trends due to the great importance of overwintering, and the great variability of overwintering suitability of mummies by year and cultivar.[18]

See also

[edit]References

[edit]- ^ a b c d e f "California Agriculture Exports 2019-2020" (PDF). California Department of Food and Agriculture. 2020. Archived (PDF) from the original on December 8, 2023. Retrieved April 27, 2022.

- ^ a b c d e f g Bjerga, Alan. "California Almonds Are Back After Four Years Of Brutal Drought". bloomberg. Archived from the original on November 8, 2018. Retrieved November 7, 2018.

- ^ a b c EM Bruno; B Goodrich; RJ Sexton (November 10, 2021). "The Outlook for California's Almond Market". Department of Agricultural and Resource Economics, University of California, Davis. Archived from the original on April 30, 2022. Retrieved April 28, 2022.

- ^ a b "California drought takes toll on world's top almond producer". ABC10 News. Associated Press. August 17, 2021. Archived from the original on August 17, 2021. Retrieved April 28, 2022.

- ^ 2018 California Almond Objective Measurement Report (PDF), National Agricultural Statistics Service, Pacific Region, July 5, 2018, archived (PDF) from the original on October 30, 2020, retrieved December 21, 2018

- ^ a b Pierson, David (January 12, 2014). "California farms lead the way in almond production". Los Angeles Times. Archived from the original on November 30, 2018. Retrieved December 21, 2018.

- ^ Sumner, Daniel A.; Matthews, William A.; Medellín-Azuara, Josué; Bradley, Adrienne, The Economic Impacts of the California Almond Industry (PDF), University of California Agricultural Issues Center, archived (PDF) from the original on December 23, 2018, retrieved December 21, 2018

- ^ Craymer, Lucy. "U.S. Almond Farmers Are Reeling From Chinese Tariffs". The Wall Street Journal. Archived from the original on December 8, 2023. Retrieved November 5, 2018.

- ^ Horsley, Scott (July 23, 2021). "Farmers Have A Big Problem On Their Hands: They Can't Find A Way To Ship Their Stuff". NPR News. Archived from the original on August 19, 2022. Retrieved November 16, 2021.

- ^ Sahagún, Louis (July 5, 2022). "A billion pounds of California almonds stranded at ports amid drought, trade woes". Los Angeles Times. Archived from the original on July 6, 2022. Retrieved July 6, 2022.

- ^ Jimenez, Ilana (November 14, 2017). "Bees And Almonds: How Are Almond Trees Pollinated". gardeningknowhow. Archived from the original on March 23, 2018. Retrieved November 7, 2018.

- ^ Gonzales, Richard. "How Almonds Became A Scapegoat For California's Drought". npr. Archived from the original on December 22, 2018. Retrieved November 7, 2018.

- ^ Pickett, Mallory. "In The Midst Of Drought, California Farmers Used More Water For Almonds". Forbes. Archived from the original on December 22, 2018. Retrieved December 9, 2018.

- ^ a b Kasler, Dale; Reese, Phillip; Sabalow, Ryan. "California almonds, partly blamed for water shortage, now dropping in price". The Sacramento Bee. Archived from the original on December 22, 2018. Retrieved December 21, 2018.

- ^ a b Daane, Kent M.; Cooper, Monica L.; Triapitsyn, Serguei V.; Walton, Vaughn M.; Yokota, Glenn Y.; Haviland, David R.; Bentley, Walt J.; Godfrey, Kris E.; Wunderlich, Lynn R. (2008). "Vineyard managers and researchers seek sustainable solutions for mealybugs, a changing pest complex". California Agriculture. 62 (4). UC Agriculture and Natural Resources (UC ANR): 167–176. doi:10.3733/ca.v062n04p167. ISSN 0008-0845. S2CID 54928048.

- ^ Adaskaveg, J. E.; Holtz, B.; Duncan, R.; Doll, D. (December 2014). "Bacterial Spot of Almond in California – Update on the Disease and its Management". Sacramento Valley Almond News. UCANR. Archived from the original on July 1, 2022. Retrieved May 4, 2022.

- ^ a b Wilson, Houston; Burks, Charles S; Reger, Joshua E; Wenger, Jacob A (January 1, 2020). Tindall, Kelly (ed.). "Biology and Management of Navel Orangeworm (Lepidoptera: Pyralidae) in California". Journal of Integrated Pest Management. 11 (1). Entomological Society of America (OUP): 1–15. doi:10.1093/jipm/pmaa025. ISSN 2155-7470.

- ^ Machado, Mel (March 2020). "How much does NOW damage cost?" (PDF). Blue Diamond Growers & Almond Board of California. Archived (PDF) from the original on November 10, 2021. Retrieved May 9, 2022.

KSF

KSF