Central Bank of Sri Lanka

From Wikipedia - Reading time: 10 min

From Wikipedia - Reading time: 10 min

You can help expand this article with text translated from the corresponding article in Sinhala. (December 2008) Click [show] for important translation instructions.

|

| |

| Headquarters | Colombo |

|---|---|

| Coordinates | 6°56′02″N 79°50′32″E / 6.93399°N 79.84225°E |

| Established | 28 August 1950 |

| Governor | Dr. Nandalal Weerasinghe |

| Central bank of | Sri Lanka |

| Currency | Sri Lankan rupee LKR (ISO 4217) |

| Reserves | US$6 billion |

| Preceded by | Currency Board System |

| Website | www |

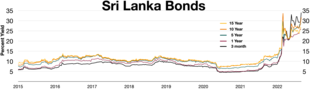

Inverted yield curve in the first half of 2022 during Sri Lankan economic crisis

The Central Bank of Sri Lanka (abbr. CBSL; Sinhala: ශ්රී ලංකා මහ බැංකුව, romanized: Sri Lanka Maha Bankuwa) is the monetary authority of Sri Lanka. It was established in 1950 under the Monetary Law Act No.58 of 1949 (MLA) and in terms of the Central Bank of Sri Lanka Act No. 16 of 2023, the CBSL is a body corporate with perpetual succession and a common seal. The Central Bank has administrative and financial autonomy. The CBSL has two main boards in operation, namely, the Governing Board (GB) and the Monetary Policy Board (MPB).

History

[edit]The Central Bank of Sri Lanka was established in 1950, two years after independence. The founder governor of the Central Bank of Sri Lanka was John Exter, while the minister of finance at the time was J. R. Jayewardene. Under the former name of Central Bank of Ceylon, it replaced the Currency Board that until then had been responsible for issuing the country's money. It is a member of the Asian Clearing Union.

The bank's main tasks are the conduct of monetary policy in Sri Lanka and also has wide supervisory powers over the financial system.

The bank is engaged in developing policies to promote financial inclusion and is a member of the Alliance for Financial Inclusion (AFI).[1][2]

With a view to encouraging and promoting the development of the productive resources of Sri Lanka, the CBSL is responsible for securing price stability and financial system stability. The CBSL is also responsible for currency issuance and management. In addition, the CBSL is the advisor on economic affairs as well as the banker to the Government of Sri Lanka (GOSL). On behalf of GOSL, the CBSL, as its agent, is responsible for four agency functions, viz. management of the Employees Provident Fund; management of the public debt of Sri Lanka; administration of the provisions of the Exchange Control Act; and administration of foreign and government-funded credit schemes for regional development.[3]

Organisational structure

[edit]

The Governor of the CBSL functions as its chief executive officer. The Governor, Deputy Governors and Assistant Governors, along with the Heads of Departments, form the senior management of the CBSL. Functionally, the CBSL presently consists of 29 departments, each headed by a Director (or equivalent), reporting to the Governor or the Deputy Governor through an Assistant Governor, with the exception of the Management Audit Department, which reports directly to the governor. The Economic Research and Bank Supervision Departments were explicitly set up under the original legislation establishing the CBSL, with certain statutory functions. The Economic Research Department, headed by the Director of Economic Research/Chief Economist, is required to compile data and conduct economic research for the guidance of the Monetary Board and for the information of the public, while the Bank Supervision Department, headed by the Director of Bank Supervision, is required to engage in the continuous regulation and supervision of all banking institutions in Sri Lanka.

The current members of the Governing Board of the Central Bank of Sri Lanka are:[4]

- Hon. Dr P. Nandalal Weerasinghe (Governor) - Chairman

- Vish Govindasamy - Appointed Member

- Nihal Fonseka - Appointed Member

- Dr. Ravi Rathnayake - Appointed Member

- Anushka Wijesinha - Appointed Member

- Rajeev Amarasuriya - Appointed Member

- Manil Jayesinghe - Appointed Member

The current members of the Monetary Policy Board of the Central Bank of Sri Lanka are:[4]

- Hon. Dr P. Nandalal Weerasinghe (Governor) - Chairman

- Vish Govindasamy - Appointed Member

- Nihal Fonseka - Appointed Member

- Dr. Ravi Rathnayake - Appointed Member

- Anushka Wijesinha - Appointed Member

- Dr.(Ms) Dushni Weerakoon - Appointed Member

- Prof. Priyanga Dunusinghe - Appointed Member

- Rajeev Amarasuriya - Appointed Member

- Manil Jayesinghe - Appointed Member

- Mrs. T. M. J. Y. P. Fernando - Senior Deputy Governor

- Mrs. K. M. A. N. Daulagala - Deputy Governor

Governors

[edit]Corporate Management

[edit]The corporate management of the Central Bank of Sri Lanka includes the Governor, Deputy Governors and Assistant Governors.[5]

See also

[edit]- Sri Lankan rupee

- Colombo Central Bank bombing

- Currency museum, Colombo

- Fintech Association of Sri Lanka

- List of central banks

References

[edit]- ^ "Alliance for Financial Inclusion". Alliance for Financial Inclusion | Bringing smart policies to life. Archived from the original on September 27, 2015. Retrieved Sep 23, 2020.

- ^ "AFI members". AFI Global. 2011-10-10. Archived from the original on 2012-02-20. Retrieved 2012-02-23.

- ^ "About the Bank- Overview | Central Bank of Sri Lanka". www.cbsl.gov.lk. Retrieved Sep 23, 2020.

- ^ a b "Corporate Structure | Central Bank of Sri Lanka". www.cbsl.gov.lk. Retrieved 2024-06-03.

- ^ "Principal Officers". Central Bank of Sri Lanka. Retrieved 2024-11-08.

External links

[edit] Media related to Central Bank of Sri Lanka at Wikimedia Commons

Media related to Central Bank of Sri Lanka at Wikimedia Commons- Official website

KSF

KSF