Penn Central Transportation Company

From Wikipedia - Reading time: 20 min

From Wikipedia - Reading time: 20 min

| |

Penn Central (PC) SD45 No. 6133 at Horseshoe Curve in Blair County, Pennsylvania, on September 13, 1970, three months after PC filed for bankruptcy | |

| Overview | |

|---|---|

| Headquarters | Philadelphia, Pennsylvania, U.S. |

| Reporting mark | PC |

| Locale | Connecticut Delaware Illinois Indiana Kentucky Maryland Massachusetts Michigan Missouri New York New Jersey Ohio Ontario Pennsylvania Quebec Rhode Island Washington, DC West Virginia |

| Dates of operation | 1968–1976 |

| Predecessor | Pennsylvania Railroad New York Central System New York, New Haven and Hartford Railroad |

| Successor | Amtrak Conrail |

| Technical | |

| Track gauge | 4 ft 8+1⁄2 in (1,435 mm) |

| Electrification | 12.5 kV 25 Hz AC: New Haven-Washington, D.C./South Amboy; Philadelphia-Harrisburg 700V DC: Harlem Line; Hudson Line |

| Length | 20,530 miles (33,040 kilometres) |

| Other | |

| Website | pcrrhs.org |

The Penn Central Transportation Company, commonly abbreviated to Penn Central, was an American class I railroad that operated from 1968 to 1976. Penn Central combined three traditional corporate rivals, the Pennsylvania, New York Central and the New York, New Haven and Hartford railroad, each of which were united by large-scale service into the New York metropolitan area and to a lesser extent New England and Chicago. The new company failed barely two years after formation, the largest bankruptcy in U.S. history at the time. Penn Central's railroad assets were nationalized into Conrail along with those of other bankrupt northeastern railroads; its real estate and insurance holdings successfully reorganized into American Premier Underwriters.

History

[edit]

Pre-merger

[edit]The Penn Central railroad system developed in response to challenges facing northeastern American railroads during the late 1960s. While railroads elsewhere in North America drew revenues from long-distance shipments of commodities such as coal, lumber, paper and iron ore, railroads in the densely populated northeast traditionally depended on a heterogeneous mix of services, including:

- Commuter/intercity passenger rail service

- Railway Express Agency freight service

- Break-bulk freight service via boxcars

- Consumer goods and perishables (produce and dairy products)

These labor-intensive, short-haul services proved vulnerable to competition from automobiles, buses, and trucks, a threat recently invigorated by the new limited-access highways authorized in the Federal-Aid Highway Act of 1956.[1] At the same time, contemporary railroad regulation restricted the extent to which U.S. railroads could react to the new market conditions. Changes to passenger fares and freight shipment rates required approval from the capricious Interstate Commerce Commission (ICC), as did mergers or abandonment of lines.[2]: 164–166 Merger, which eliminated duplicative back office employees, seemed an escape.[2][failed verification]

The situation was particularly acute for the Pennsylvania (PRR) and New York Central (NYC) railroads. Both had extensive physical plants dedicated to their passenger custom. As that revenue stream faded following WWII, neither could slim their assets fast enough to earn a substantial profit (although the NYC came much closer).[2]: 215, 258

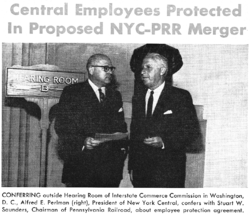

In 1957, the two proposed a merger, despite severe organizational and regulatory hurdles.[2]: 215 Neither railroad had much respect for its merger partner; the lines had fought bitterly over New York-Chicago custom and ill-will remained in the executive suites.[2]: 248, 256 Amongst middle management, the company's corporate cultures all but precluded integration: a team of young, flexible managers had begun reshaping the NYC from a traditional railroad into a multimodal express-freight transporter, while the PRR continued to bet on a railroad revival.[2]: 248, 258 At a technical level, the two companies served independent markets east of Cleveland (running through their namesake states), but virtually identical trackage west of Cleveland meant any merger would have anticompetitive effect.[2]: 215

For decades, merger proposals had tried to balance the competitors instead, joining them with lesser partners end-to-end. The unexpected NYC+PRR proposal required all the northeastern railroads to reconsider their corporate strategy, clouding the waters for the ICC. The resulting negotiations took nearly a decade, and when the PRR and NYC merged, they faced three competitors of comparable size: the Erie had merged with the Delaware, Lackawanna & Western to create the Erie Lackawanna Railway (EL) in 1960, the Chesapeake & Ohio Railway (C&O) acquired control of the Baltimore & Ohio (B&O) in 1963, and the Norfolk & Western Railway (N&W) absorbed several railroads, including the Nickel Plate and the Wabash, in 1964.[2]: 215

Regulators also required the new company to incorporate the bankrupt New York, New Haven & Hartford Railroad (NH) and New York, Susquehanna & Western Railway (NYS&W);[4] if neither the N&W and C&O would buy the Lehigh Valley Railroad (LV), then that railroad should be incorporated as well. Ultimately, only the New Haven successfully joined the Penn Central; the conglomerate failed before it could incorporate the latter two.[2]: 248 The only railroad leaving the Penn Central was the PRR's controlling interest in the N&W, whose dividends had generated much of the PRR's premerger profitability.

Merger begins

[edit]The legal merger (formally, an acquisition of the NYC by the PRR) concluded on February 1, 1968. The Pennsylvania Railroad, the nominal survivor of the merger, changed its name to Pennsylvania New York Central Transportation Company, and soon began using "Penn Central" as a trade name. That trade name became official a month later on May 8, 1968.[2]: 248 Saunders later commented: "Because of the many years it took to consummate the merger, the morale of both railroads was badly disrupted and they were faced with unmanageable problems which were insurmountable. In addition to overcoming obstacles, the principal problem was too much governmental regulation and a passenger deficit which amounted to more than $100 million a year."[5]

Almost immediately after the transaction cleared, the organizational headwinds presaged during the merger negotiations began to overwhelm the new corporation's management.[6]: 233–234 As ex-PRR managers began to secure the plum jobs, the forward-thinking ex-NYC managers departed for greener pastures.[2]: 248 Clashing union contracts prevented the company's left hand from talking to its right,[6]: 233–234 and incompatible computer systems meant that PC classification clerks regularly lost track of train movements.[2][failed verification]

Subpar track conditions, the result of years of deferred maintenance, deteriorated further, particularly in the Midwest. Derailments and wrecks occurred regularly; when the trains avoided mishap, they operated far below design speed, resulting in delayed shipments and excessive overtime. Operating costs soared, and shippers soured on the products. In 1969, most of Maine's potato production rotted in the PC's Selkirk Yard, hurting the Bangor & Aroostook Railroad, whose shippers vowed never to ship by rail again.[7] Although both PRR and NYC had been profitable pre-merger,[2]: 248 Penn Central was — at one point — losing $1 million per day.[citation needed]

As PC's management struggled to wrestle the company into submission, the structural headwinds facing all northeastern railroads continued unabated. The industrial decline of the Rust Belt consumed shippers through the Northeast and Midwest.[2] Penn Central's executives tried to diversify the troubled firm into real estate and other non-railroad ventures, but in a slow economy these businesses performed little better than the original railroad assets. Worse, these new subsidiaries diverted management attention away from the problems in the core business.

To create the illusion of success, management also insisted on paying dividends to shareholders, desperately borrowing funds to buy time for the business to turn around. Thanks to the dubious accounting strategies of the company's CFO David C. Bevan the railroad had done a good job in 1968 and 1969 of concealing the company's true state to get the money they needed. For example in 1969 the railroad reported a loss of $56 million, while in reality the true figure was around $220 million.[8]: 105 A large portion of the savings that year came from writing off the entire passenger department, along with some associated depreciation costs at a total value of $130.5 million.[9] The real financial state of the railroad was hidden to such an extent that not even Saunders knew how bad it really was.[8]: 79

All of this financial wrangling was technically legal thanks to the fact that the SEC did not have purview over railroads. That was instead handled by the ICC, which was much more lenient. Many banks were still wary of how unspecific their reports had become, and it would get progressively harder and harder to get loans as time went on.[8]: 88

Bankruptcy

[edit]

By 1970 the situation had become dire. Banks had mostly stopped giving loans, while at the same time around $150 million worth of debts were due that year. The railroad had lost over $100 million in the first quarter.[8]: 105 Bevan confided in Saunders the true financial picture, and Saunders then got to work trying to get the government to give them a loan guarantee. What they wanted was $750 million from congress, and if that didn't work they could get $200 million directly from the Department of Defense. Penn Central argued that it was technically a defense contractor because of the large amount of freight they carried for the military.[8]: 112

This ended up backfiring for Saunders since one of the demands placed on the railroad to get the loans was to change up the executive suite. Saunders thought this only meant Bevan would be fired, and called a meeting to act on the demand. The board instead fired both of them. They also used to opportunity to fire Perlman which they had wanted to do for a while.: 109 Despite the concessions, in the end opposition from southern politicians crushed both plans for loans.[8]: 113 With all of their options having dried up Penn Central voted on June 21, 1970 to file for section 77 bankruptcy.[11]

At the time of the bankruptcy Penn Central was the nation's sixth-largest corporation and had become its largest bankruptcy.[2][12]: 248 (The Enron Corporation's 2001 bankruptcy eclipsed the PC in large measure). George Drury described the bankruptcy as "a cataclysmic event, both to the railroad industry and to the nation's business community,"[2]: 250 not least because Penn Central increasingly appeared the proverbial canary in the coal mine. Across the nation, railroads discontinued Penn Central's core business (passenger trains) as fast as regulators would let them. The Rock Island, midway through a decade spent arguing with regulators about a merger, was stumbling towards another stunning bankruptcy, as was the Milwaukee Road, the nation's most technologically advanced transcontinental.

The new president of the railroad, Paul H. Gorman, quickly left after the bankruptcy. The search for a new president was concluded when the Southern Railway's, Graham Claytor offered up William H. "Wild Bill" Moore to head the company. Moore had been a protégé of the previous Southern president, D. William Brosnan who had been known for both cutting costs, and for routinely firing workers on the spot. On one occasion he had thrown a desk at a vice president he had fired. For this behavior Brosnan had been ousted from the presidency, and Claytor did not appreciate Moore's continued presence, which ultimately is why he was chosen for the position.[8]: 137

When he assumed the presidency, Moore had set out to do as he had been taught by Brosnan, and worked to slash budgets; sensibly or otherwise. Plans to invest into new yards that had been made by Perlman were all scrapped, and track maintenance was done as minimally as it could be. Additionally he gave more radios to switch crews and closed many unautomated hump yards.[8]: 139

In 1972, the damage from Hurricane Agnes destroyed important Penn Central branches and main lines,[13] and pushed the other northeastern roads into bankruptcy. By the mid-1970s, no major player east of Rochester-Pittsburgh, north of Pittsburgh-Philadelphia, and southwest of the Maine-New Hampshire border remained solvent.

Under the auspices of the U.S. Department of Transportation (U.S. DOT), Penn Central agreed to trial new technologies to revive the flagging passenger services on what would become the Northeast Corridor. PC continued to operate the PRR's Metroliner service between New York City and DC, and introduced a new United Aircraft TurboTrain between New York City and Boston. But the new equipment proved useless without high-quality track to run it on, or a railroad capable of releasing schedules to the ticket-seeking public. In response, the Nixon administration developed Amtrak, which relieved any railroad that desired it of the obligation to operate passenger service.[2]: 250

PC unsuccessfully attempted to sell-off the air rights to Grand Central Terminal, and allow developers to build skyscrapers above the terminal, in order to fund continued operations. The resulting lawsuit, Penn Central Transportation Co. v. New York City, was decided in 1978, when the U.S. Supreme Court ruled that PC could not sell Grand Central's air rights because the terminal was a New York City designated landmark.[14][15]

By 1974 the railroad's physical plant was in an abysmal state. Deferred maintenance, and damage from Hurricane Agnes had pushed the railroad to where in a single month it suffered 649 derailments. The hump yard in Cleveland, Ohio was averaging 6 derailments every day.[16] It was also around this time when there were reported "standing derailments" where rotted cross ties on the track would break under the weight of an unmoving car. In 1973 the Federal Railroad Administration had done an inspection of PC's mainlines and come to the conclusion that the entire railroad would need to be shut down if the situation was not fixed soon.[8]: 141

Something had to be done, and while that was on the horizon; a short term fix was to just fire Moore. A lot of people at the railroad hated him. This came to a head just before Christmas of 1973 as Moore had been taking a Metroliner from D.C. to Philadelphia, when the train stopped just outside of the tunnel into Baltimore. 20 coal hoppers had derailed in the tunnel, and Moore went to the train telephone to tell the division superintendent he wanted it cleared in an hour. After an hour he went back to the phone, and fired the superintendent on the spot. Following this an engineer in another train phoned in to say "Merry Christmas to you, too, you son of a bitch." Moore then realized he had accidentally routed the call over the P.A. system, and everything had been played over the loudspeaker in every car. The chief trustee, Jervis Langdon Jr. heard about this and was quickly able to get rid of Moore and insert himself as the new president thanks to the fact that Moore had also been using railroad employees to work on his house. Langdon took over January 4, 1974, and the superintendent was rehired the same day.[8]: 143

In May 1974, the bankruptcy court concluded that the railroad operations of PC could never provide enough income to reorganize the company. In the Regional Rail Reorganization Act of 1973, the federal government nationalized Penn Central to save it. For two years, the United States Railway Association sorted through the assets of PC (and six other bankrupt railroads: Erie Lackawanna, Lehigh Valley Railroad, Reading Company, Lehigh & Hudson River Railway, Central Railroad of New Jersey and Pennsylvania-Reading Seashore Lines) to decide what could be reshaped into a viable railroad. Then, on April 1, 1976, Penn Central transferred those rail operations to the government-owned Consolidated Rail Corporation (Conrail).[2]: 250 [17]

Facing the continued loss of market share to the trucking industry, the railroad industry and its unions asked the federal government for deregulation. The 1980 Staggers Act, which deregulated the railroad industry, proved to be a key factor in bringing Conrail and the old PC assets back to life.[18] During the 1980s, the deregulated Conrail had the muscle to implement the route reorganization and productivity improvements that the PC had unsuccessfully tried to implement between 1968 and 1970. Hundred of miles of former PRR and NYC trackage were abandoned to adjacent landowners or rail trail use. The stock of the subsequently-profitable Conrail was refloated on Wall Street in 1987, and the company operated as an independent, private-sector railroad from 1987 to 1999.

Corporate survival

[edit]

The Pennsylvania Railroad absorbed the New York Central Railroad on February 1, 1968, and at the same time changed its name to Pennsylvania New York Central Transportation Company to reflect this. The trade name of "Penn Central" was adopted, and, on May 8, the former Pennsylvania Railroad was officially renamed the Penn Central Company.

The first Penn Central Transportation Company (PCTC) was incorporated on April 1, 1969, and its stock was assigned to a new holding company called Penn Central Holding Company. On October 1, 1969, the Penn Central Company, the former Pennsylvania Railroad, absorbed the first PCTC and was renamed the second Penn Central Transportation Company the next day; the Penn Central Holding Company became the second Penn Central Company. Thus, the company that was formerly the Pennsylvania Railroad became the first Penn Central Company and then became the second PCTC.[2]: 248

The old Pennsylvania Company, a holding company chartered in 1870, reincorporated in 1958 and long a subsidiary of the PRR, remained a separate corporate entity throughout the period following the merger.

The former Pennsylvania Railroad, now the second PCTC, gave up its railroad assets to Conrail in 1976 and absorbed its legal owner, the second Penn Central Company, in 1978, and at the same time changed its name to The Penn Central Corporation. In the 1970s and 1980s, the company now called The Penn Central Corporation was a small conglomerate that largely consisted of the diversified sub-firms it had before the crash.

Among the properties the company owned when Conrail was created were the Buckeye Pipeline and a 24 percent stake in Madison Square Garden (which stands above Penn Station) and its prime tenants, the New York Knicks basketball team and New York Rangers hockey team, along with Six Flags Theme Parks. Though the company retained ownership of some rights-of-way and station properties connected with the railroads, it continued to liquidate these and eventually concentrated on one of its subsidiaries in the insurance business.

The former Pennsylvania Railroad changed its name to American Premier Underwriters in March 1994.[19] It became part of Carl Lindner's Cincinnati financial empire American Financial Group.

Grand Central Terminal

[edit]

Until late 2006, American Financial Group still owned Grand Central Terminal, though all railroad operations were managed by the Metropolitan Transportation Authority (MTA). The U.S. Surface Transportation Board approved the sale of several of American Financial Group's remaining railroad assets to Midtown TDR Ventures LLC, an investment group controlled by Argent Ventures,[20] in December 2006.[21] The current lease with the MTA was negotiated to last through February 28, 2274.[21] The MTA paid $2.4 million annually in rent in 2007 and had an option to buy the station and tracks in 2017, although Argent could extend the date another 15 years to 2032.[20] The assets included the 156 miles (251 km) of rail used by the Hudson and Harlem Lines, and Grand Central Terminal, as well as unused development rights above the tracks in Midtown Manhattan. The platforms and yards extend for several blocks north of the terminal building under numerous streets and existing buildings leasing air rights, including the MetLife Building and Waldorf-Astoria Hotel.[20]

In November 2018, the MTA proposed purchasing the Hudson and Harlem Lines as well as the Grand Central Terminal for up to $35.065 million, plus a discount rate of 6.25%. The purchase would include all inventory, operations, improvements, and maintenance associated with each asset, except for the air rights over Grand Central.[22] The MTA's finance committee approved the proposed purchase on November 13, 2018, and the purchase was approved by the full board two days later.[23][24] The deal finally closed in March 2020, with the MTA taking ownership of the terminal and rail lines.[25]

Heritage

[edit]Few railroad historians and former employees view the mega-railroad's brief existence favorably, and the company has little presence in the railroad enthusiast press.[2]: 250 The preservation group Penn Central Railroad Historical Society was formed in July 2000 to preserve the history of the often-scorned company.[26]

As part of Norfolk Southern Railway's 30th anniversary, the railroad painted 20 new locomotives utilizing former liveries of predecessor railroads. Unit number 1073, a SD70ACe, is painted in a Penn Central Heritage scheme.

As part of the 40th anniversary of the Metro-North Railroad, four locomotives were painted in a different heritage scheme to honor a predecessor railroad. Locomotive 217 was painted in the Penn Central Blue and Yellow scheme.

See also

[edit]- Alfred E. Perlman - PC President

- Stuart T. Saunders - PC Chairman & CEO

- History of rail transport in the United States

- Penn Central Transportation Co. v. New York City (1978 Supreme Court case)

References

[edit]- ^ Geisst, Charles R. (2006). Encyclopedia of American Business History, Volume 2. New York: Infobase Publishing. p. 226. ISBN 978-0-8160-4350-7.

- ^ a b c d e f g h i j k l m n o p q r s t Drury, George H. (1994). The Historical Guide to North American Railroads: Histories, Figures, and Features of more than 160 Railroads Abandoned or Merged since 1930. Waukesha, Wisconsin: Kalmbach Media. ISBN 0-89024-072-8.

- ^ Loving, Jr, Rush (December 2020). "The Day Railroading Fell Apart". Trains. Kalmbach Media. pp. 20–31.

- ^ "Susquehanna Withdraws Demand For Merger With Penn Central". The News. Vol. 73. March 17, 1969. p. 4. Retrieved October 27, 2024 – via Newspapers.com.

- ^ Goldman, Ari L. (February 9, 1987). "Stuart T. Saunders, Driver Force Behind Penn Central, Dies at 77". The New York Times. Retrieved February 5, 2018.

- ^ a b Stover, John F. (1997). American Railroads (2nd ed.). Chicago: University of Chicago Press. ISBN 978-0-226-77658-3.

- ^ Schafer, Mike (2000). More Classic American Railroads. Osceola, Wisconsin: MBI Publishing Co. p. 14. ISBN 978-0-7603-0758-8.

- ^ a b c d e f g h i j Loving, Rush (2011). The men who loved trains: the story of men who battled greed to save an ailing industry. Bloomington: Indiana University Press. ISBN 978-0253347572.

- ^ "Penn Central Annual Report, 1969" (PDF).

- ^ "Penn Central Post Magazine, September 1970 Issue" (PDF).

- ^ Charlton, Linda (June 22, 1970). "PENN CENTRAL IS GRANTED AUTHORITY TO REORGANIZE UNDER BANKRUPTCY LAWS". New York Times.

- ^ "Michigan's Railroad History 1825 - 2014" (PDF). Michigan Department of Transportation. 2014-10-13. Retrieved 2024-05-31.

- ^ Baer, Christopher T. "PRR Chronology: A General Chronology of the Pennsylvania Railroad Company Predecessors and Successors and its Historical Context". PRR CHRONOLOGY 1972 June 2005 Edition. Archived from the original on 22 December 2013. Retrieved 27 April 2013.

- ^ Penn Central Transp. Co. v. New York City, 438 U.S. 104, 135 (U.S. 1978).

- ^ Weaver, Warren Jr. (June 27, 1978). "Ban on Grand Central Office Tower Is Upheld by Supreme Court 6 to 3". The New York Times. Retrieved December 24, 2018.

- ^ "Penn Central 1974 - Movie used to get federal funding".

- ^ Railroad Revitalization and Regulatory Reform Act, Pub. L. 94-210, 90 Stat. 31, 45 U.S.C. § 801. February 5, 1976

- ^ Staggers Rail Act of 1980, Pub. L. 96-448, 94 Stat. 1895. Approved 1980-10-14.

- ^ "Companies betting on name game". The Albany Herald. Associated Press. August 7, 1994. p. 2D.

- ^ a b c Weiss, Lois (July 6, 2007). "Air Rights Make Deals Fly". New York Post. Retrieved January 7, 2016.

- ^ a b U.S. Surface Transportation Board, "Midtown TDR Ventures LLC-Acquisition Exemption-American Premier Underwriters, Inc., The Owasco River Railway, Inc., and American Financial Group, Inc.," 71 FR 71026 (December 7, 2006).

- ^ "Metro-North Railroad Committee Meeting November 2018" (PDF). Metropolitan Transportation Authority. November 13, 2018. pp. 73–74. Archived from the original (PDF) on November 11, 2018. Retrieved November 10, 2018.

- ^ Berger, Paul (November 13, 2018). "After Years of Renting, MTA to Buy Grand Central Terminal". Wall Street Journal. Retrieved November 14, 2018.

- ^ "New York's Grand Central Terminal sold for US$35m". Business Times. November 20, 2018. Retrieved November 25, 2018.

- ^ "MTA takes ownership of Grand Central Terminal". Progressive Railroading. March 13, 2020. Retrieved March 17, 2020.

- ^ "Who We Are". Penn Central Railroad Historical Society. Retrieved 2022-12-25.

Further reading

[edit]- Daughen, Joseph R. & Peter Binzen (1999). The Wreck of the Penn Central (2nd ed.). Boston: Beard Books Little, Brown. ISBN 1-893122-08-5.

- Salsbury, Stephen (1982). No Way to Run a Railroad. New York: McGraw-Hill. ISBN 0-07-054483-2.

- Sobel, Robert (1977). The Fallen Colossus. New York: Weybright and Talley. ISBN 978-0-679-40138-4.

External links

[edit]- "Penn Central Document, Timetable and Publication Archive". UnlikelyPCRR.com. Archived from the original on 2011-08-30. Retrieved 2008-06-20.

- "Penn Central Information". Penn Central Railroad USA at Tripod.com.

- "Penn Central Maps and Track Diagrams". Penn Central Railroad Online.

- "Penn Central Railroad Historical Society". pcrrhs.org.

- "Penn Central 1974". Film produced by PC to solicit federal funding at YouTube.com. 31 December 2010.

KSF

KSF