Special territories of members of the European Economic Area

From Wikipedia - Reading time: 49 min

From Wikipedia - Reading time: 49 min

Overseas Countries and Territories | |

|---|---|

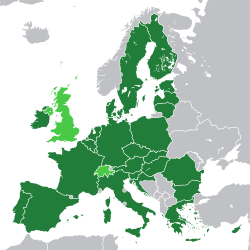

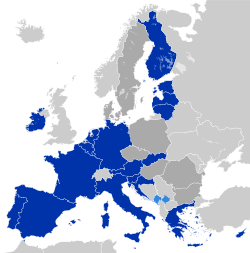

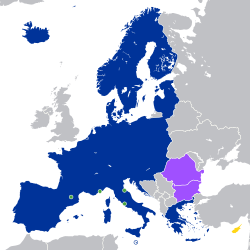

Location of the European Union and the special territories | |

| Largest settlements | Las Palmas, Santa Cruz de Tenerife, Ponta Delgada, Funchal, Nouméa, Cayenne, Saint-Denis, Mamoudzou, Fort-de-France, Les Abymes |

| Official language |

|

| Special territory | 9 Outermost Regions 13 Overseas Countries and Territories |

| Area | |

• Total | 2,733,792 km2 (1,055,523 sq mi) |

| Population | |

• Estimate | 6,114,658 |

| Currency | Euro (EUR; €; OMRs, 3 OCTs[a] and 9 special cases[b]) 5 others

|

| Date format | dd/mm/yyyy (AD) |

| This article is part of a series on |

|

|---|

|

|

The European Economic Area (EEA) has 32 special territories of EU member states and EFTA member states which, for historical, geographical, or political reasons, enjoy special status within or outside the European Union and the European Free Trade Association.

The special territories of EU member states are categorised under three headings: nine Outermost Regions (OMR) that form part of the European Union, though they benefit from derogations from some EU laws due to their geographical remoteness from mainland Europe; thirteen Overseas Countries and Territories (OCT)[1] that do not form part of the European Union, though they cooperate with the EU via the Overseas Countries and Territories Association; and ten special cases that form part of the European Union (with the exception of the Faroe Islands), though EU laws make ad hoc provisions. The Outermost Regions were recognised at the signing of the Maastricht Treaty in 1992,[2] and confirmed by the Treaty of Lisbon in 2007.[3]

The Treaty on the Functioning of the European Union states that both primary and secondary European Union law applies automatically to the outermost regions, with possible derogations due to the particularities of these territories. The Overseas Countries and Territories are recognised by Article 198 of the Treaty on the Functioning of the European Union which allows them to opt into EU provisions on the freedom of movement for workers and freedom of establishment, and invites them to join the Overseas Countries and Territories Association (OCTA) in order to improve cooperation with the European Union.[4] The status of an uninhabited territory, Clipperton, remains unclear since it is not explicitly mentioned in primary EU law and has a sui generis status at the national level.[5][d] Collectively, the special territories encompass a population of some 6.1 million people and a land area of about 2,733,792 square kilometres (1,055,500 sq mi). Around 80 percent of this area is represented by Greenland. The largest region by population, the Canary Islands, accounts for more than a third of the total population of the special territories. The smallest by land area is the island of Saba in the Caribbean (13 km2 or 5 sq mi). The French Southern and Antarctic Lands is the only special territory without a permanent population.

Outermost Regions

[edit]The Outermost Regions (OMR) are territories forming part of a member state of the European Union but situated a significant distance from mainland Europe. Due to this situation, they have derogation from some EU policies despite being part of the European Union.

According to the Treaty on the Functioning of the European Union, both primary and secondary European Union law applies automatically to these territories, with possible derogations to take account of their "structural social and economic situation (...) which is compounded by their remoteness, insularity, small size, difficult topography and climate, economic dependence on a few products, the permanence and combination of which severely restrain their development".[6] All form part of the European Union customs area; however, some fall outside of the Schengen Area and the European Union Value Added Tax Area.

Seven Outermost Regions were recognised at the signing of the Maastricht Treaty in 1992.[2] The Treaty of Lisbon included two additional territories (Saint Barthélemy and Saint Martin) in 2007.[6] Saint Barthélemy changed its status from OMR to OCT with effect from 1 January 2012.[3] Mayotte, which was an OCT, joined the EU as an OMR with effect from 1 January 2014.[7]

The 9 Outermost Regions of the European Union are:[8]

| Flag | Coat of arms | Name | Location | Area | Pop. | Capital | Largest settlement |

Official language |

State |

|---|---|---|---|---|---|---|---|---|---|

|

Azores | North Atlantic | 2,333 km2 (901 sq mi) | 245,746 | Angra do Heroísmo, Horta and Ponta Delgada | Ponta Delgada | Portuguese | ||

|

|

Madeira | 801 km2 (309 sq mi) | 289,000 | Funchal | Funchal | |||

|

Canary Islands | 7,493 km2 (2,893 sq mi) | 2,101,924 | Santa Cruz de Tenerife and Las Palmas |

Las Palmas | Spanish | |||

|

|

French Guiana | South America | 83,534 km2 (32,253 sq mi) | 281,612 | Cayenne | Cayenne | French | |

|

Guadeloupe | Caribbean | 1,628 km2 (629 sq mi) | 402,119 | Basse-Terre | Les Abymes | |||

|

Martinique | 1,128 km2 (436 sq mi) | 385,551 | Fort-de-France | Fort-de-France | ||||

|

Saint Martin | 53 km2 (20 sq mi) | 36,286 | Marigot | Marigot | ||||

| Mayotte | Indian Ocean | 374 km2 (144 sq mi) | 256,518 | Mamoudzou | Mamoudzou | ||||

| Réunion | 2,511 km2 (970 sq mi) | 865,826 | Saint-Denis | Saint-Denis | |||||

| Total | 99,855 km2 (38,554 sq mi) | 4,864,582 |

Autonomous Regions of Portugal

[edit]

Azores and Madeira are two groups of Portuguese islands in the Atlantic. Azores and Madeira are integral parts of the Portuguese Republic, but both have the special status as Autonomous Regions, with a degree of self-governance. Some derogations from the application of EU law apply in regards to taxation, fishing and transportation.[9][10] Their VAT is lower than the rest of Portugal, but they are not outside the EU VAT Area.

Canary Islands

[edit]The Canary Islands are a Spanish archipelago off the African coast which form one of the 17 autonomous communities of Spain–the country's principal first-level administrative division. They are outside the EU VAT Area.[11] The Canary Islands are the most populous and economically strongest territory of all the outermost regions in the European Union. The outermost regions office for support and information is located in these islands, in the city of Las Palmas on the island of Gran Canaria.

French overseas regions

[edit]

French Guiana, Guadeloupe, Martinique, Mayotte, and Réunion are five French overseas regions (which are also overseas departments) which under French law are, for the most part, treated as integral parts of the Republic. The euro is legal tender;[12] however, they are outside the Schengen Area and the EU VAT Area.[11]

Mayotte is the newest of the five overseas departments, having changed from an overseas collectivity with OCT status on 31 March 2011. It became an outermost region, and thus part of the EU, on 1 January 2014.[7]

Collectivity of Saint Martin

[edit]Saint Martin is the only overseas collectivity of France with the status of being an Outermost Region of the EU.[13] As with the French overseas departments, the euro is legal tender in Saint Martin, and it is outside the Schengen Area and the EU VAT Area.

On 22 February 2007, Saint Martin and Saint Barthélemy were broken away from the French overseas department of Guadeloupe to form new overseas collectivities. As a consequence their EU status was unclear for a time. While a report issued by the French parliament suggested that the islands remained within the EU as outermost regions,[14] European Commission documents listed them as being outside the European Community.[15] The legal status of the islands was clarified on the coming into force of the Treaty of Lisbon, which listed them as an outermost region.[16] However, Saint Barthélemy ceased being an outermost region and left the EU, to become an OCT, on 1 January 2012.

Overseas countries and territories

[edit]The overseas countries and territories (OCT) are dependent territories that have a special relationship with one of the member states of the EU. Their status is described in the Treaty on the Functioning of the European Union, and they are not part of the EU or the European Single Market. The Overseas Countries and Territories Association was created to improve economic development and cooperation between the OCTs and the EU,[17] and includes most OCTs except three territories which do not have a permanent local population.

The OCTs have been explicitly invited by the EU treaty to join the EU-OCT Association (OCTA).[4] They were listed in the Article 198 of the Treaty on the Functioning of the European Union, which aside from inviting them to join OCTA, also provided them the opportunity to opt into EU provisions on the freedom of movement for workers[18] and freedom of establishment.[19] Yet, the freedom of establishment is limited by Article 203 TFEU and the respective Council Decision on OCTs. Its Article 51(1)(a) prescribes only that "the Union shall accord to natural and legal persons of the OCTs a treatment no less favourable than the most favourable treatment applicable to like natural and legal persons of any third country with whom the Union concludes or has concluded an economic integration agreement." Again this can be, according to Article 51(2)(b) limited. The obligations provided for in paragraph 1 of this Article shall not apply to treatment granted under measures providing for recognition of qualifications, licences or prudential measures in accordance with Article VII of the General Agreement on Trade in Services (GATS) or the GATS Annex on Financial Services.

The OCTs are not subject to the EU's common external customs tariffs[20] but may claim customs on goods imported from the EU on a non-discriminatory basis.[21] They are not part of the EU and the EU acquis does not apply to them, though those joining OCTA are required to respect the detailed rules and procedures outlined by this association agreement (Council Decision 2013/755/EU).[22] OCTA members are entitled to ask for EU financial support.[23]

When the Rome Treaty was signed in March 1957, a total of 15 OCTs existed: French West Africa, French Equatorial Africa, Saint Pierre and Miquelon, Comoros Archipelago, French Madagascar, French Somaliland, New Caledonia, French Polynesia, French Southern and Antarctic Lands, French Togoland, French Cameroons, Belgian Congo, Ruanda-Urundi, Trust Territory of Somalia, Netherlands New Guinea. The list was since then revised multiple times, and comprised—as noted by the Lisbon Treaty—25 OCTs in 2007. One of the French territories subsequently switched status from OMR to OCT (Saint Barthélemy), while another French territory switched from OCT to OMR (Mayotte). As of July 2014, there are still 13 OCTs (six with France, six with the Netherlands and one with Denmark)[24] of which all have joined OCTA.

The 13 Overseas Countries and Territories of the European Union are:[25]

| Flag | Coat of arms | Name | Location | Area | Pop. | Capital | Largest settlement | Official language(s) | Sovereign state |

|---|---|---|---|---|---|---|---|---|---|

|

Greenland | North Atlantic and Arctic | 2,166,086 km2 (836,330 sq mi) | 56,483 | Nuuk | Nuuk | Greenlandic | ||

|

Curaçao | Caribbean | 444 km2 (171 sq mi) | 160,337 | Willemstad | Willemstad | Dutch, Papiamento, English | ||

|

|

Aruba | 179 km2 (69 sq mi) | 104,822 | Oranjestad | Oranjestad | Dutch, Papiamento, English, Spanish | ||

|

|

Sint Maarten | 37 km2 (14 sq mi) | 33,609 | Philipsburg | Lower Prince's Quarter | Dutch, English | ||

|

Bonaire | 294 km2 (114 sq mi) | 18,905 | Kralendijk | Kralendijk | Dutch | |||

|

Sint Eustatius | 21 km2 (8 sq mi) | 3,193 | Oranjestad | Oranjestad | ||||

|

Saba | 13 km2 (5 sq mi) | 1,991 | The Bottom | The Bottom | ||||

|

|

French Polynesia | Pacific | 4,167 km2 (1,609 sq mi) | 275,918 | Papeete | Faʻaʻā | French | |

|

New Caledonia | 18,576 km2 (7,172 sq mi) | 268,767 | Nouméa | Nouméa | ||||

| Wallis-et-Futuna | 142 km2 (55 sq mi) | 11,899 | Mata-Utu | Mata-Utu | |||||

|

Saint Barthélemy | Caribbean | 25 km2 (10 sq mi) | 9,279 | Gustavia | Gustavia | |||

|

Saint Pierre and Miquelon | North Atlantic | 242 km2 (93 sq mi) | 6,080 | Saint-Pierre | Saint Pierre | |||

|

|

French Southern and Antarctic Lands | Indian Ocean and Antarctica | 439,781 km2 (169,800 sq mi) | 0[e] | Saint-Pierre | Port-aux-Français (base) | ||

| Total | 2,630,007 km2 (1,015,451 sq mi) | 945,893 |

Overseas Countries and Territories Association

[edit]The Overseas Countries and Territories Association (OCTA) is an organisation founded on 17 November 2000 and headquartered in Brussels. All OCTs have joined OCTA as of February 2020. Its purpose is to improve economic development in overseas countries and territories, as well as cooperation with the European Union. On 25 June 2008, a Cooperation Treaty between the EU and OCTA was signed in Brussels.[26] The current chairman is Louis Mapou.[27]

French overseas territories

[edit]

The French Southern and Antarctic Lands (which also include the French Scattered Islands in the Indian Ocean, and the French claim of Adélie Land) are a disputed French Overseas Territory embodying the French claims to Antarctica but has no permanent population.[28] It has sui generis status within France.[29]

Saint Pierre and Miquelon, Saint Barthélemy, French Polynesia, and Wallis and Futuna are overseas collectivities (formerly referred to as overseas territories) of France, while New Caledonia is a "sui generis collectivity". Saint Barthélemy[30] and Saint Pierre and Miquelon use the euro,[31] while New Caledonia, French Polynesia and Wallis and Futuna use the CFP Franc, a currency which is tied to the euro and guaranteed by France. Natives of the collectivities are European citizens owing to their French citizenship and elections to the European Parliament are held in the collectivities.

On 22 February 2007, Saint Barthélemy and Saint Martin were separated from the French overseas department of Guadeloupe to form new overseas collectivities. As a consequence, their EU status was unclear for a time. While a report issued by the French parliament suggested that the islands remained within the EU as outermost regions,[14] European Commission documents listed them as being outside the European Community.[15] The legal status of the islands was clarified on the coming into force of the Lisbon Treaty which listed them as outermost regions.[16] However, Saint Barthélemy ceased being an outermost region and left the EU, to become an OCT, on 1 January 2012. The change was made to facilitate trade with countries outside the EU, notably the United States,[32] and was made possible by a provision of the Lisbon Treaty which allows the European Council to change the EU status of a Danish, Dutch, or French territory on the initiative of the member state concerned.[33]

Dutch overseas territories

[edit]

Six territories of the Netherlands—all of which are Caribbean islands—have OCT status. As such, they benefit from being able to have their own export and import policy to and from the EU, while still having access to various EU funds (such as the European Development Fund). The inhabitants of the islands are EU citizens owing to their Dutch citizenship, with the right to vote in elections to the European Parliament.[34] Initially they did not have voting rights for such elections, but the European Court of Justice granted them such rights, when they ruled their exclusion from the franchise was contrary to EU law, as all other Dutch citizens resident outside the EU did have the right to vote.[35] None of the islands use the euro as their currency. The US dollar is used on Bonaire, Sint Eustatius and Saba, while Curaçao and Sint Maarten utilize their own shared currency the Caribbean guilder, and finally the currency of Aruba is the Aruban florin.[34]

Aruba, Curaçao, and Sint Maarten are classified as "countries" under Dutch law, and have considerable internal autonomy. In June 2008, the Dutch government published a report on the projected effect on the islands were they to join the EU as outermost regions.[36][37] It concluded that the choice would be for the islands themselves to weigh up the advantages and disadvantages of becoming part of the EU as outermost regions, and that nothing would be done absent the islands specifically requesting it.[38]

Bonaire, Sint Eustatius, and Saba (collectively called Caribbean Netherlands) are "special municipalities" of the Netherlands proper. Their current OCT status, and the prospect of advancing their status to become part of the EU as new OMRs (outermost regions), was reviewed by the Dutch parliament in 2015,[39] as part of the planned review of the Dutch law (WOLBES and FINBES) concerning the quality of their recently implemented new public administration bodies.[40] In October 2015, the review concluded the present legal structures for governance and integration with European Netherlands was not working well within the framework of WolBES, but no recommendations were made in regards of whether a switch from OCT to OMR status would help improve this situation.[41][42][43][44]

The islands inherited their OCT status from the Netherlands Antilles which was dissolved in 2010. The Netherlands Antilles were initially specifically excluded from all association with the EEC by reason of a protocol attached to the Treaty of Rome, allowing the Netherlands to ratify on behalf of the Netherlands in Europe and Netherlands New Guinea only, which it subsequently did.[45] Following the entry into force of the Convention on the association of the Netherlands Antilles with the European Economic Community on 1 October 1964, however, the Netherlands Antilles became OCTs.

Greenland

[edit]

Greenland joined the then European Community in 1973 as a county along with Denmark, but after gaining autonomy with the introduction of home rule within the Kingdom of Denmark, Greenland voted to leave in 1982 and left in 1985, to become an OCT. The main reason for leaving is disagreements about the Common Fisheries Policy (CFP) and to regain control of Greenlandic fish resources to subsequently remain outside EU waters. Greenlandic nationals (OCT nationals) are, nonetheless, EU citizens due to Greenland's associated relationship with the EU within the meaning of EU treaties as well as holding Danish nationality.[citation needed]

The EU–Greenland relationship is a comprehensive partnership, which is complementary to the OCT association arrangements under "Council Decision 2013/755/EU"; based specifically on "Council Decision 2014/137 of 14 March 2014" (outlining the relations)[46] and the Fisheries Partnership Agreement of 30 July 2006.[47]

Special cases

[edit]While the outermost regions and the overseas countries and territories fall into structured categories to which common mechanisms apply, this is not true of all the special territories. 10 member state territories have ad hoc arrangements in their relationship with the EU. In those special cases, VAT rules do not apply and they may also be exempt from customs or excise rules.[48][49]

| Flag | Coat of Arms | Name | Area | Pop. | Sovereign State | Part of the EU | Customs Union[48] | VAT rules[48] | Excise rules[48] |

|---|---|---|---|---|---|---|---|---|---|

|

Melilla | 12.3 km2 (5 sq mi) | 86,384 | Yes | No | No | No | ||

|

Ceuta | 18.5 km2 (7 sq mi) | 85,144 | Yes | No | No | No | ||

|

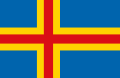

Åland | 1,580 km2 (610 sq mi) | 30,129 | Yes | Yes | No | No | ||

|

Faroe Islands | 1,399 km2 (540 sq mi) | 52,337 | No | No | No | No | ||

|

United Nations Buffer Zone in Cyprus[f] | 346 km2 (134 sq mi) | 8,686[53] | Yes | Yes[g] | No[55] | Yes[g] | ||

|

Livigno | 227.3 km2 (88 sq mi) | 6,721 | Yes | No | No | No | ||

|

|

Campione d'Italia[h] | 2.68 km2 (1 sq mi) | 1,961 | Yes | Yes[56] | No | Yes[56] | |

|

Büsingen am Hochrhein | 7.62 km2 (3 sq mi) | 1,536 | Yes | No | No | No | ||

|

Heligoland | 1.7 km2 (1 sq mi) | 1,265 | Yes | No | No | No | ||

| Mount Athos | 335.63 km2 (130 sq mi) | 1,811 | Yes | Yes | No | Yes | |||

| Total | 3,930 km2 (1,517 sq mi) | 303,283 |

Åland

[edit]

Åland, an autonomous archipelago belonging to Finland, but with partial autonomy, located between Sweden and Finland, with a Swedish-speaking population, joined the EU along with Finland in 1995. The islands had a separate referendum on accession and like the Finnish mainland voted in favour.

EU law, including the fundamental four freedoms, applies to Åland.[57] However, there are some derogations due to the islands' special status. Åland is outside the VAT area[11] and is exempt from common rules in relation to turnover taxes, excise duties and indirect taxation.[58] In addition, to protect the local economy, the treaty of accession allows for a concept of hembygdsrätt/kotiseutuoikeus (regional citizenship). Consequently, there are restrictions on the holding of property and real estate, the right of establishment for business purposes and limitations on who can provide services in Åland, for people not holding this status.[58] The status may be obtained by any Finnish citizen legally resident in Åland for 5 years who can demonstrate an adequate knowledge of the Swedish language.[59]

Büsingen am Hochrhein

[edit]The German village of Büsingen am Hochrhein is an exclave entirely surrounded by Switzerland and as such is for practical purposes, in a customs union with the latter non-EU country.[60] The euro is legal tender, though the Swiss franc is preferred. Büsingen is excluded from the EU customs union and the EU VAT area.[11] Swiss VAT generally applies.[61][62] Büsingen was also outside of the Schengen area until Switzerland joined on 12 December 2008.[citation needed]

Campione d'Italia and Livigno

[edit]The Italian exclave village of Campione d'Italia is enclaved by Switzerland's Ticino canton as well as Lake Lugano (or Ceresio), and is a comune in the Province of Como, whilst Livigno, a small and remote mountain resort town, is a comune in the Province of Sondrio. Both comuni are part of the Lombardy region. Although part of the EU, Livigno is excluded from the customs union and VAT area, with Livigno's tax status dating back to Napoleonic times. Campione is excluded from the EU VAT area. It was excluded from the EU customs area until the end of 2019.[11][63] Shops and restaurants in Campione accept payments in both euros and Swiss francs and prices are displayed in both currencies.[64]

Ceuta and Melilla

[edit]

Ceuta and Melilla are two Spanish cities on the North African coast. They are part of the EU but they are excluded from the common agricultural and fisheries policies.[65] They are also outside the customs union and VAT area,[11] but no customs are levied on goods exported from the Union into either Ceuta and Melilla and certain goods originating in Ceuta and Melilla are exempt from customs charges.

While nominally part of the Schengen Area (Schengen visas are valid), Spain performs identity checks on all sea and air passengers leaving the enclaves for elsewhere in the Schengen Area.[66]

Cyprus

[edit]

When the Republic of Cyprus became part of the European Union on 1 May 2004, the northern third of the island was outside of the effective control of its government due to the Turkish invasion of Cyprus, a United Nations buffer zone of varying width separated the two parts, and a further 3% of the island was taken up by UK sovereign bases (under British sovereignty since the Treaty of Establishment in 1960). Two protocols to the Treaty of Accession 2003—numbers 3 and 10, known as the "Sovereign Base Areas Protocol" and the "Cyprus Protocol" respectively—reflect this complex situation.

EU law only applies fully to the part of the island that is effectively controlled by the government of the Republic of Cyprus. EU law is suspended in the northern third of the island (the Turkish Republic of Northern Cyprus, whose independence is recognised only by Turkey) by article 1(1) of the Cyprus Protocol.[67] If the island is reunified, the Council of the European Union will repeal the suspension by a decision. Four months after such a decision has been adopted, new elections to the European Parliament will be held on the island to elect Cypriot representatives from the whole of the island.[68]

Cypriot nationality law applies to the entire island and is accordingly available to the inhabitants of Northern Cyprus and the British sovereign base areas on the same basis as to those born in the area controlled by the Republic of Cyprus.[69][70] Citizens of the Republic of Cyprus living in Northern Cyprus are EU citizens and are nominally entitled to vote in elections to the European Parliament; however, elections to that Parliament are not organised in Northern Cyprus as it is governed de facto by a separate state, albeit a state recognized only by Turkey.[71]

Akrotiri and Dhekelia

[edit]The United Kingdom has two sovereign base areas on Cyprus, namely Akrotiri and Dhekelia. Unlike other British overseas territories, their inhabitants (who are entitled to British Overseas Territories Citizenship) have never been entitled to British citizenship.

Prior to Cypriot accession to the EU in 2004, although the United Kingdom was an EU member at the time, EU law did not apply to the sovereign base areas.[72] This position was changed by the Cypriot accession treaty so that EU law, while still not applying in principle, applied to the extent necessary to implement a protocol attached to that treaty.[73] This protocol applied EU law relating to the Common Agricultural Policy, customs, indirect taxation, social policy and justice and home affairs to the sovereign base areas. The sovereign base areas' authorities also made provision for the unilateral application of directly applicable EU law.[74] The UK also agreed in the Protocol to keep enough control of the external (i.e. off-island and northern Cyprus) borders of the base areas to ensure that the border between the sovereign base areas and the Republic of Cyprus could remain fully open and would not have to be policed as an external EU border. Consequently, the sovereign base areas would have become a de facto part of the Schengen Area if and when Cyprus implemented it. The base areas are already de facto members of the eurozone due to their previous use of the Cypriot pound and their adoption of the euro as legal tender from 2008.[75]

Because Cypriot nationality law extends to Cypriots in the sovereign base areas, Cypriot residents, as citizens of the Republic of Cyprus, are entitled to EU citizenship. Just under half of the population of the sovereign base areas are Cypriots, the rest are British military personnel, support staff and their dependants.[76] In a declaration attached to the Treaty of Establishment of the Republic of Cyprus of 1960, the British government undertook not to allow new settlement of people in the sovereign base areas other than for temporary purposes.[77]

Under a protocol to the Brexit withdrawal agreement, certain provisions of EU law on agriculture, customs, indirect taxation, social security and border control continue to apply to the sovereign base areas.[78]

United Nations buffer zone

[edit]The United Nations buffer zone between north and south Cyprus ranges in width from a few metres in central Nicosia to several kilometres in the countryside. While it is nominally under the sovereignty of the Republic of Cyprus, it is effectively administered by the United Nations Peacekeeping Force in Cyprus (UNFICYP). The population of the zone is 8,686 (as of October 2007),[needs update] and one of the mandates of UNFICYP is "to encourage the fullest possible resumption of normal civilian activity in the buffer zone".[53] Inhabited villages located in the buffer zone are legally administered by the Republic of Cyprus but policed by UN peacekeepers.[50] Article 2.1 of the Cyprus Protocol[67] allows the European Council to determine to what extent the provisions of EU law apply in the buffer zone.[79]

Faroe Islands

[edit]

The Faroe Islands have never been part of the EU. Danish citizens residing on the islands are not considered citizens of a member state within the meaning of the treaties or, consequently, citizens of the European Union.[80] However, Faroese people, who are Danish citizens i.e. citizens of the Danish Realm, may become EU citizens by changing their registered residence to the Danish mainland.

The Faroe Islands are not part of the Schengen Area, and Schengen visas are not valid. However, the islands are part of the Nordic Passport Union and the Schengen Agreement provides that travellers passing between the islands and the Schengen Area are not to be treated as passing the external frontier of the Area.[81] This means that there is no formal passport control, but an identity check at check-in for air or boat travel to the islands where Nordic citizens on intra-Nordic travel need no passport, only showing the ticket plus identity card.[82]

Heligoland

[edit]

Heligoland is an archipelago of Germany situated in the North Sea 70 km (43 mi) off the German north-western coast. It is part of the EU, but is excluded from the customs union and the VAT area.[11]

Monastic community of Mount Athos

[edit]The Monastic community of Mount Athos is an autonomous monastic region of Greece. Greece's EU accession treaty provides that Mount Athos maintains its centuries-old special legal status,[83] guaranteed by article 105 of the Greek Constitution. It is part of the customs union but outside the VAT area.[11] Notwithstanding that a special permit is required to enter the peninsula and that there is a prohibition on the admittance of women, it is part of the Schengen Area.[84] The monastery has certain rights to house monks from countries outside the EU. A declaration attached to Greece's accession treaty to the Schengen Agreement states that Mount Athos's "special status" should be taken into account in the application of the Schengen rules.[85]

Plazas de Soberanía

[edit]Small islands scattered along the northern coast of Africa, collectively known as the plazas de soberanía have been integral parts of Spain since the 15th century and therefore also part of the European Union. Their currency is the euro.

Areas of extraterritoriality

[edit]The Saimaa Canal and Värska–Ulitina road are two of several distinct travel arrangements that exist or existed because of changes in borders over the course of the 20th century, where transport routes and installations ended up on the wrong side of the border. Some have become superfluous thanks to the Schengen Agreement. These listed examples pass the external EU border.

Saimaa Canal

[edit]Finland leases the 19.6-kilometre-long (12.2 mi) Russian part of the Saimaa Canal from Russia and is granted extraterritoriality rights.[86] The area is not part of the EU; it is a special part of Russia. Under the treaty signed by Finnish and Russian governments, Russian law is in force with a few exceptions concerning maritime rules and the employment of canal staff which fall under Finnish jurisdiction. There are also special rules concerning vessels travelling to Finland via the canal. Russian visas are not required for just passing through the canal, but a passport is needed and it is checked at the border.[86] Euros are accepted for the canal fees. Prior to the 50-year lease renewal coming into effect in February 2012, the Maly Vysotsky Island had also been leased and managed by Finland. Since then it has been fully managed by Russian authorities, and is no longer part of the concession territory.

Värska–Ulitina road

[edit]The road from Värska to Ulitina in Estonia, traditionally the only road to the Ulitina area, goes through Russian territory for one kilometre (0.6 mi) of its length, an area called Saatse Boot.[87] This road has no border control, but there is no connection to any other road in Russia. It is not permissible to stop or walk along the road. This area is a part of Russia but is also a de facto part of the Schengen area.

Switzerland

[edit]Some roads, railways and tram lines along the border of Switzerland allow transit between two Swiss places through neighbouring countries, or between the border and international airports and railway stations, without customs controls (and before 2008 without passport controls when those were otherwise needed at the Swiss border). See Privileged transit traffic#Switzerland.

Non-EU countries and territories with partial EU integration

[edit]Special territories of some other European countries are strongly connected to the European Union. These are as follows:

- special areas of the member states of the European Free Trade Association (EFTA):

- Norway

- Jan Mayen

- Svalbard: not part of the Schengen area, Norwegian VAT area[88] or the EU single market; free movement of people into the territory regardless of nationality[89]

- Bouvet Island

- Peter I Island and Queen Maud Land are disputed Norwegian territories embodying the Norwegian claims to Antarctica but have no permanent population.

- Switzerland

- Samnaun and Val Sampuoir: outside Swiss VAT area[90]

- Basel Badischer Bahnhof platforms: part of EU Customs Union, VAT area and single market

- Norway

- the United Kingdom is not a member state of the EU anymore, nevertheless, it has remained an associated country of the Euratom and is set to continue as participant in the EU's Joint European Torus and Fusion for Energy joint undertakings, as well as participant in the Euratom Supply Agency, the European Institute of Innovation and Technology and the executive agencies of the EU, while some of its territories and the Crown Dependencies are to remain partially integrated with the EU:

- Northern Ireland remains under the Northern Ireland Protocol of the Brexit withdrawal agreement de facto part of the European Single Market and the European Union Customs Union for the purposes of goods only, in order to prevent the creation of a customs border on the island of Ireland; along with the remainder of the United Kingdom, the Crown Dependencies and the Republic of Ireland, it has continued to form the Common Travel Area outside of the Schengen Area.

- Akrotiri and Dhekelia, a British territory, is partially integrated with Cyprus in the areas of agriculture, currency, customs, indirect taxation, social security and border control.

- Gibraltar, also a British territory, is in negotiations with the EU for an arrangement to participate in the Schengen Area and (with exceptions) the Single Market, pending implementation.[78][91]

Summary

[edit]Special territories of EU member states

[edit]This table summarises the various components of EU laws applied in the special territories of EU member states.

| Member states and territories | Application of EU law | EURATOM | EU citizenship | EU elections | Schengen area | EU VAT area | EU customs territory | EU single market | Eurozone | |

|---|---|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | Yes | Set to implement later[i] | Yes | Yes | Yes | Yes | ||

| With exemptions | ? | Yes | No | No | No | Yes[j] | With exemptions[k] | Yes | ||

| Suspended | No | Cypriot citizens[l] | No | No | No | No[93] | No[94] | TRY | ||

| Yes[m] | Yes | Yes | Yes | Yes | Yes | Yes | Yes | DKK (ERM II) | ||

| Minimal (OCT)[24] | No[95] | Yes | No | No | No | No[93] | Partial[96] | DKK (ERM II) | ||

| No | No[97] | No | No | No | No | No[93] | Minimal (FTA)[98][99] | DKK (ERM II) | ||

| Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | ||

| With exemptions | Yes[100] | Yes | Yes | Yes | No | Yes[93] | With exemptions | Yes | ||

| Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | ||

| With exemptions (OMR)[101] | Yes | Yes | Yes[n] | No[102] | VAT free | Yes[93] | Yes | Yes | ||

| With exemptions (OMR)[101] | Yes | Yes | Yes[n] | No[102] | Low-rate VAT | Yes[93] | Yes | Yes | ||

| With exemptions (OMR)[101] | Yes | Yes | Yes[n] | No[102] | Low-rate VAT | Yes[93] | Yes | Yes | ||

| With exemptions (OMR)[101] | Yes | Yes | Yes[n] | No[102] | Low-rate VAT | Yes[93] | Yes | Yes | ||

| With exemptions (OMR)[101] | Yes | Yes | Yes[n] | No[102] | VAT free | Yes[93] | Yes | Yes | ||

| With exemptions (OMR)[101] | Yes | Yes | Yes[n] | No[102] | Low-rate VAT | Yes[93] | Yes | Yes[103] | ||

| Minimal (OCT)[24] | Yes | Yes | Yes[n] | No[102] | No | No | Partial[96] | Yes[103] | ||

| Minimal (OCT)[24] | Yes | Yes | Yes[n] | No[102] | No | No[93] | Partial[96] | Yes[103] | ||

| Minimal (OCT)[24] | Yes | Yes | Yes[n] | No[102] | No | No[93] | Partial[96] | XPF, pegged to EUR | ||

| Minimal (OCT)[24] | Yes | Yes | Yes[n] | No[102] | No | No[93] | Partial[96] | XPF, pegged to EUR | ||

| Minimal (OCT)[24] | Yes | Yes | Yes[n] | No[102] | No | No[93] | Partial[96] | XPF, pegged to EUR | ||

| Minimal (OCT)[24] | Yes | Yes | No[o] | No[102] | No | No[93] | Partial[96] | Yes[104] | ||

| ? | Yes[105] | Yes[104] | No[o] | No[102] | ? | ? | ? | Yes[104] | ||

| Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | ||

| Yes | Yes | Yes | Yes | Yes[p] | Low-rate VAT | No[93] | Yes | Yes | ||

| Yes | Yes | Yes | Yes | Yes | VAT free | No[93] | Yes | Yes | ||

| Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | ||

| Agio Oros | Yes | Yes | Yes | Yes | Yes | VAT free[11] | Yes[93] | Yes | Yes | |

| Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | ||

| Yes | Yes | Yes | Yes | Yes | VAT free | No[93] | Yes | Yes | ||

| Yes | Yes | Yes | Yes | Yes[p] | Low-rate VAT | Yes[63] | Yes | Yes | ||

| Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | ||

| Minimal (OCT)[24] | No[q] | Yes | Yes | No[102] | No | No[106] | Partial[96] | USD | ||

| Minimal (OCT)[24] | No[q] | Yes | Yes | No[102] | No | No[106] | Partial[96] | USD | ||

| Minimal (OCT)[24] | No[q] | Yes | Yes | No[102] | No | No[106] | Partial[96] | USD | ||

| Minimal (OCT)[24] | No[107] | Yes[r] | Yes | No[102] | No | No[106] | Partial[96] | XCG | ||

| Minimal (OCT)[24] | No[107] | Yes[r] | Yes | No[102] | No | No[106] | Partial[96] | XCG | ||

| Minimal (OCT)[24] | ?[97][108] | Yes[r] | Yes | No[102] | No | No[106] | Partial[96] | AWG | ||

| Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | ||

| Yes (OMR) | Yes | Yes | Yes | Yes | Local rate | Yes | Yes | Yes | ||

| Yes (OMR) | Yes | Yes | Yes | Yes | Local rate | Yes | Yes | Yes | ||

| Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | ||

| With exemptions (OMR) | Yes | Yes | Yes | Yes | VAT free | Yes | Yes | Yes | ||

| With exemptions | Yes | Yes | Yes | Partial[s] | VAT free | No | Yes | Yes | ||

| With exemptions | Yes | Yes | Yes | Partial[s] | VAT free | No | Yes | Yes | ||

| Member states and territories | Application of EU law | EURATOM | EU citizenship | EU elections | Schengen area | EU VAT area | EU customs territory | EU single market | Eurozone | |

| Legend for the "Application of EU law" column: Full. Part of the EU.[110] — Minimal or none. Not part of the EU territory. | ||||||||||

Special territories of other European states

[edit]Special territories of EFTA states and some other European countries also have a special status in regard to EU laws applied.[98]

| Countries and territories | Application of EU law | EURATOM | Schengen area | EU VAT area | EU customs territory | EU single market | Adoption of euro | |||

|---|---|---|---|---|---|---|---|---|---|---|

| Partial | No | Yes | No | No | With exemptions, in EEA[111] | NOK | ||||

| Partial | No | No[112] | VAT free[88] | No | No[111][113] | NOK | ||||

| Partial | No | Yes[112][114] | VAT free[88] | No | Like rest of Norway[111] | NOK | ||||

| No | No | No | No | No | No | NOK | ||||

| No | No | No | No | No | No | NOK | ||||

| No | No | No | No | No | No | NOK | ||||

| Partial | Associated state | Yes | Swiss–Liechtenstein VAT area | Swiss–Liechtenstein customs territory | With exemptions, not in EEA[115] | CHF | ||||

| Partial | Associated state | Yes | VAT free[90] | Swiss–Liechtenstein customs territory | With exemptions, not in EEA[115] | CHF | ||||

| Partial | Associated state | Yes | Yes[90] | Yes | Yes[115] | CHF | ||||

| Partial | Associated state | CTA | No | No | No | GBP | ||||

| Partial[t] | Associated state | CTA | Goods only, de facto | Goods only, de facto | Goods only, de facto | GBP | ||||

| Partial[78] | Associated state | Set to implement later[i] | Yes[78] | Yes[78] | Partial[u] | Yes[117] | ||||

| Partial | Associated state | Set to implement later[118] | No | Set to implement later[118] | Partial | GIP | ||||

| Partial | Associated state | CTA | No | No | No | GGP | ||||

| Partial | Associated state | CTA | No | No | No | JEP | ||||

| Partial | Associated state | CTA | No | No | No | IMP | ||||

| Other British Overseas Territories | No | Associated state | No | No | No | No | Various currencies | |||

| Countries and territories | Application of EU law | EURATOM | Schengen area | EU VAT area | EU customs territory | EU single market | Adoption of euro | |||

Former special territories

[edit]Many currently independent states or parts of such were previously territories of the following EU members since the latter joined the EU or, previously the European Coal and Steel Community (ECSC):

- Belgium (with multiple territories, from ECSC formation until 1962)

- France (with multiple territories, from ECSC formation)

- Italy (with Italian Somaliland, from ECSC formation until 1960)

- The Netherlands (with multiple territories, from ECSC formation)

- Portugal (with multiple territories, from 1986 enlargement until 1999 (de facto)/2002 (de jure))

- United Kingdom (with multiple territories, from 1973 enlargement)

Most of these territories seceded before the implementation of the Maastricht Treaty in 1993 and the following years, meaning that cooperation like the EU citizenship, the VAT union or the Eurozone did not exist, so it made less difference to be a special territory then.

These were:

- Cambodia (gained independence from France in 1953), no Community treaty applied there, besides ECSC preferences[119]

- Laos (gained independence from France in 1954), no Community treaty applied there, besides ECSC preferences[119]

- Vietnam (gained independence from France in 1954), no Community treaty applied there, besides ECSC preferences[119]

- Tunisia (gained independence from France in 1956), no Community treaty applied there, besides ECSC preferences[119]

- Morocco (gained independence from France in 1956), no Community treaty applied there, besides ECSC preferences[119]

- Guinea (gained independence from France in 1958), had OCT status[120]

- Cameroon (French-administered part gained independence from France in 1960 along with some of UK-administered parts); had OCT status for the French part[120]

- Togo (gained independence from France in 1960), had OCT status[120]

- Mali (gained independence from France in 1960), had OCT status[120]

- Senegal (gained independence from France in 1960), had OCT status[120]

- Madagascar (gained independence from France in 1960), had OCT status[120]

- DR Congo (gained independence from Belgium in 1960), had OCT status[120]

- Somalia (Italian-administered part gained independence from Italy in 1960 along with UK-administered part); had OCT status for the Italian part[120]

- Benin (gained independence from France in 1960), had OCT status[120]

- Niger (gained independence from France in 1960), had OCT status[120]

- Burkina Faso (gained independence from France in 1960), had OCT status[120]

- Ivory Coast (gained independence from France in 1960), had OCT status[120]

- Chad (gained independence from France in 1960), had OCT status[120]

- Central African Republic (gained independence from France in 1960), had OCT status[120]

- Congo (gained independence from France in 1960), had OCT status[120]

- Gabon (gained independence from France in 1960), had OCT status[120]

- Mauritania (gained independence from France in 1960), had OCT status[120]

- Burundi (gained independence from Belgium in 1962), had OCT status[120]

- Rwanda (gained independence from Belgium in 1962), had OCT status[120]

- Netherlands New Guinea (transferred from the Netherlands to UN in 1962, later annexed by Indonesia), had OCT status[120]

- Suriname (gained independence from the Netherlands in 1975), had OCT status,[119][121][122] EURATOM application unsure.[123]

- Algeria (gained independence from France in 1962), had a status similar to OMR[124]

- The Bahamas (gained independence from the UK in 1973), had OCT status[125]

- Grenada (gained independence from the UK in 1973), had OCT status[125]

- Comoros (gained independence from France in 1975), had OCT status[120]

- Seychelles (gained independence from the UK in 1976), had OCT status[125]

- French Somaliland (gained independence from France as Djibouti in 1977), had OCT status[120]

- Solomon Islands (gained independence from the UK in 1978), had OCT status[125]

- Tuvalu (gained independence from the UK in 1978), had OCT status[125]

- Dominica (gained independence from the UK in 1978), had OCT status[125]

- Saint Lucia (gained independence from the UK in 1979), had OCT status[125]

- Kiribati (gained independence from the UK in 1979), had OCT status[125]

- Saint Vincent and the Grenadines (gained independence from the UK in 1979), had OCT status[125]

- Zimbabwe (gained de jure independence from the UK in 1980), no Community treaty applied there, besides ECSC preferences[119][126]

- Vanuatu (gained independence from the UK and France in 1980), generally had OCT status[127]

- Belize (gained independence from the UK in 1981), had OCT status[125]

- Antigua and Barbuda (gained independence from the UK in 1981), had OCT status[125]

- Saint Kitts and Nevis (gained independence from the UK in 1983), had OCT status[125]

- Brunei (gained independence from UK in 1984), had OCT status[125]

- Hong Kong (sovereignty transferred from the UK to China in 1997), no Community treaty applied there,[126] besides ECSC preferences[119]

- Macau (sovereignty transferred from Portugal to China in 1999), EURATOM was applicable,[128] besides the ECSC preferences[119]

- Timor-Leste (East Timor) (gained independence from Indonesia in 2002, considered under Portuguese administration before that), no Community treaty applied there[v]

The United Kingdom left the EU in 2020. When it was a member, some of its Crown Dependencies and Overseas Territories were partially integrated with the EU.

- Gibraltar was part of the EU and partially inside its single market.

- Jersey, Guernsey and the Isle of Man were not part of the EU, but were in its customs union and enjoyed free trade.

- Akrotiri and Dhekelia continue to have partial integration with Cyprus, an EU member state, even after the UK is no longer an EU member.

- Other territories which were Overseas Territories that year had OCT status.

Additionally in Europe there were special territories in the past that had different status than their "mainland", because of various reasons, but now are part of a member state. Some of these territories were as follows:

- The Austrian areas of Kleinwalsertal and Jungholz formerly enjoyed a special legal status. The two areas have road access only to Germany, and not directly to other parts of Austria. They were in customs and currency union with Germany and there were no border controls between Kleinwalsertal and Jungholz, respectively, and Germany. When Austria entered the EU (and its customs union) in 1995, the customs union became defunct. The entry into force of the Schengen Agreement for Austria (1997) and the introduction of the euro (2002) caused Kleinwalsertal and Jungholz to lose their remaining legal privileges. It is now legally treated in the same manner as the rest of Austria.

- Saar (merged with the Federal Republic of Germany on 1 January 1957), was fully part of the Community as French-administered European territory[129]

- West Berlin (merged with the Federal Republic of Germany on 3 October 1990), was subject to the full application of the treaties[w]

- German Democratic Republic (East Germany) was until 1972 on paper a part of one Germany and the European Community, since West Germany, the NATO countries and the European Community did not recognize the German Democratic Republic (East Germany) until 1972. East Germany did not recognize any membership of the EC. The West German government treated trade with East Germany as inter-German trade and not subject to the EC trade tariffs.

The following areas are still special member state territories, but have changed their status. See their entries in the article for details.

See also

[edit]- Dependent territory

- Elections to the European Parliament

- Enlargement of the European Union

- European Union Association Agreement

- European Union law

- Eurosphere

- Eurozone

- Foreign relations of the European Union

- Freedom of movement for workers in the European Union

- Free economic zone – Geographic area where economic activity between and within countries is less regulated

- Future enlargement of the European Union

- History of the European Union

- Member state of the European Union

- Microstates and the European Union

- Opt-outs in the European Union

- Outline of the European Union

- Withdrawal from the European Union

Notes

[edit]- ^ Saint Pierre and Miquelon, Saint Barthélemy and the French Southern and Antarctic Lands

- ^ Åland, Ceuta, Melilla, Heligoland, Livigno and Mount Athos; de jure in Büsingen am Hochrhein and Campione d'Italia*, as well as in the UN Buffer Zone in Cyprus

* Although most people pay with Swiss Francs in those 2 enclaves, only the euro has legal tender - ^ The Faroese króna is not a separate currency, but a local issue of the Danish krone

- ^ The Clipperton Island is a private property of the French State. The Scattered Islands were regarded as "residual territories of the Republic" until 2007. They are now a district of the French Southern and Antarctic Lands.

- ^ 150 non-permanent in winter, 310 in summer (research and military personnel)

- ^ Villages in the buffer zone are legally administered by the Republic of Cyprus.[50] The application of EU acquis communautaire is suspended in territories where the Republic of Cyprus does not exercise effective control.[51] Northern Cyprus is a de facto state that is partially dependent on Turkey.[52]

- ^ a b With exceptions[54]

- ^ Including the Italian national waters of Lake Lugano.

- ^ a b Akrotiri and Dhekelia, and Cyprus should implement together the Schengen area.[116]

- ^ Exceptions may be in place for Turkish goods and services destined for Pyla.

- ^ Due to the military nature of zone, the UN requires permits for some economic activity to ensure that the fundamental nature of the area as a buffer zone is not compromised.[92]

- ^ Cypriot nationality law extends to Northern Cyprus, meaning citizens of the Republic of Cyprus residing in Northern Cyprus are entitled to EU citizenship.

- ^ Opt-outs in force for some treaty provisions and legislations

- ^ a b c d e f g h i j k Part of the former Outre-Mer electoral constituency, now part of the single national constituency.

- ^ a b No permanent population; not part of any of the eight former European Parliament electoral constituencies of France.

- ^ a b Participating together with Switzerland

- ^ a b c Bonaire, Saba, and Sint Eustatius: Inherited status as non-member from the Netherlands Antilles.

- ^ a b c Voters from the territory, like Dutch citizens residing abroad, must register with the municipality of the Hague. A separate vote count is not available.

- ^ a b The full Schengen acquis applies to all Spanish territories, but there are border checks on departure from Ceuta and Melilla to Spain or other Schengen countries, because of specific arrangements for visa exemptions for Moroccan nationals resident in the provinces of Tetuan and Nador.[66][109]

- ^ The Northern Ireland Protocol applies EU law only to the extent necessary to prevent a customs border between Northern Ireland and the Republic of Ireland

- ^ In a declaration attached to the Treaty of Establishment of the Republic of Cyprus of 1960, the British government undertook not to allow new settlement of people in the sovereign base areas other than for temporary purposes, meaning at present, free movement of people is limited.

- ^ When Portugal became a Community member in 1986 East Timor was considered a non-self-governing-territory under Portuguese administration by the United Nations despite Indonesian occupation of East Timor between 1975 and 1999. None of the EC laws were ever in force, but EURATOM and ECSC preferences were to apply if not for the Indonesian occupation. The de jure Portuguese administration formally ceased on 20 May 2002 when Portugal recognised East Timor's independence.

- ^ Until the unification of Germany in 1990 the de jure status of West Berlin was that of French, UK and US occupied zones with West German civilian administration. The treaties applied fully during 1952–1990 given the Federal German and French treaty responsibilities European Coal and Steel Community Treaty, Art.79, and during 1973–1990 given the British treaty responsibilities.[130][clarification needed] For the 1979, 1984 and 1989 European Parliaments, three MEPs were appointed on the nomination of the Berlin House of Representatives rather than being directly elected. From 3 October 1990 West Berlin was fully integrated in Berlin in the Federal Republic of Germany, along with the former East Germany.

References

[edit]- ^ "Overseas Countries and Territories". European Commission. Retrieved 2 August 2025.

- ^ a b The Maastricht Treaty of 1992 (Treaty on European Union): Declaration on the outermost regions of the Community

- ^ a b AFP (29 October 2010). "La collectivité de Saint-Barthélémy obtient un nouveau statut européen". Ministère de l'Outre-Mer (in French). Retrieved 8 April 2011.

- ^ a b Council Decision of 27 November 2001 on the association of the overseas countries and territories with the European Community ("Overseas Association Decision") (2001/822/EC).

- ^ Murray, Fiona (2012). The European Union and Member State Territories: A New Legal Framework Under the EU Treaties. Springer Science & Business Media. p. 172. ISBN 978-90-6704-826-2.

- ^ a b Article 349 of the Treaty on the Functioning of the European Union.

- ^ a b "Council Directive 2013/61/EU of December 2013". 17 December 2013. Retrieved 1 January 2014.

- ^ "Regional policy & outermost regions". ec.europa.eu. Retrieved 10 July 2020.

- ^ "Case search – Competition – European Commission". ec.europa.eu. Retrieved 7 February 2020.

- ^ "Case search – Competition – European Commission". ec.europa.eu. Retrieved 7 February 2020.

- ^ a b c d e f g h i Article 6 of Council Directive 2006/112/EC of 28 November 2006 (as amended) on the common system of value added tax (OJ L 347, 11 December 2006, p. 1) Eur-lex.europa.eu.

- ^ Article 3(1) of Council Regulation 2913/92/EEC of 12 October 1992 establishing the Community Customs Code (as amended) (OJ L 302, 19 October 1992, pp. 1–50)

- ^ Outermost regions, Fact Sheets on the European Union, European Parliament. Retrieved 6 November 2019.

- ^ a b Rapport d'information nombre 329 (2004–2005) de MM. Jean-Jacques Hyest, Christian Cointat et Simon Sutour, fait au nom de la commission des lois, déposé le 10 mai 2005. (in French)

- ^ a b "Guidelines on Trading with the European Community (EC)" (PDF). January 2008. Retrieved 26 July 2011.

- ^ a b See Articles 349 and 355 of the Treaty on the Functioning of the European Union.

- ^ "OCTA Presentation". www.octassociation.org. Retrieved 12 March 2018.

- ^ Article 202 [ex Article 186)]

- ^ Article 199(5) [ex Article 183(5)]

- ^ Article 200(1) [ex Article 184(1)]

- ^ Article 200(3) and 200(5) [ex Article 184(3) and (5)]

- ^ "COUNCIL DECISION 2013/755/EU of 25 November 2013: On the association of the overseas countries and territories with the European Union ('Overseas Association Decision')". Official Journal of the European Union. 19 December 2013.

- ^ "EU relations with Overseas Countries and Territories". European Commission. 4 June 2014.

- ^ a b c d e f g h i j k l m n "Overseas Countries and Territories (OCTs)". EU Directorate-General for International Cooperation and Development. Retrieved 9 January 2019.

- ^ "Overseas Countries and Territories". Trade Helpdesk. 8 December 2016. Retrieved 10 July 2020.

- ^ Future relations between the EU and the Overseas Countries and Territories (PDF). Brussels: Commission of the European Communities. 25 May 2008. p. 17.

- ^ "About the Overseas Countries and Territories Association". overseas-association.eu. Retrieved 25 July 2022.

- ^ "French Southern and Antarctic Lands". The Central Intelligence Agency. Retrieved 8 February 2010.

- ^ Art. 9, Loi n° 55-1052 du 6 août 1955 modifiée portant statut des Terres australes et antarctiques françaises et de l'île de Clipperton. Décret du 31 janvier 2008 relatif à l'administration de l'île de Clipperton.

- ^ Council Decision of 12 July 2011 on the signing and conclusion of the Monetary Agreement between the European Union and the French Republic on keeping the euro in Saint-Barthélemy following the amendment of its status with regard to the European Union (OJ L 189, 20 July 2011, pp. 1–2).

- ^ Council Decision 1999/95/EC of 31 December 1998 concerning the monetary arrangements in the French territorial communities of Saint-Pierre-et-Miquelon and Mayotte (OJ L 30, 4 February 1999, pp. 29–30).

- ^ AFP (29 October 2010). "La collectivité de Saint-Barthélémy obtient un nouveau statut européen". Ministère de l'Outre-Mer (in French). Retrieved 8 April 2011.

- ^ See Article 355(6) of the Treaty on the Functioning of the European Union. The relevant decision of the European Council was made on 29 October 2010 Decisions amending the status with regard to the European Union of the island of Saint-Barthélemy.

- ^ a b "The Kingdom of the Netherlands: One Kingdom – Four Countries; European and Caribbean)". Ministerie van Buitenlandse Zaken. April 2015.

- ^ Judgments of the Court in Cases C-145/04 and C-300/04: Kingdom of Spain v United Kingdom of Great Britain and Northern Ireland, and M.G. Eman and O.B. Sevinger v College van burgemeester en wethouders van Den Haag

- ^ "Schurende rechtsordes: Over juridische implicaties van de UPG-status voor de eilandgebieden van de Nederlandse Antillen en Aruba (Rijksuniversiteit Groningen)" (PDF) (in Dutch). Eerstekamer.nl. 19 June 2008.

- ^ "Economische gevolgen van de status van ultraperifeer gebied voor de Nederlandse Antillen en Aruba / SEOR" (PDF) (in Dutch). Eerstekamer.nl. 19 June 2008.

- ^ "Tweede Kamer, vergaderjaar 2008–2009, 31700 IV, nr. 3: Brief van de staatssecretaris van Binnenlandse Zaken en Koninkrijksrelaties met het kabinetsstandpunt over de rapporten over de UPG status voor de eilandgebieden van de Nederlandse Antillen en Aruba" (PDF) (in Dutch). Eerstekamer.nl. 21 October 2008.

- ^ "Kamerstuk 31954 nr.7: Regels met betrekking tot de openbare lichamen Bonaire, Sint Eustatius en Saba (Wet openbare lichamen Bonaire, Sint Eustatius en Saba)" (in Dutch). Overheid.nl. 14 October 2009.

- ^ "Kamerstuk 31954+31958 D: BRIEF VAN DE MINISTER VAN BINNENLANDSE ZAKEN EN KONINKRIJKSRELATIES" (in Dutch). Overheid.nl. 9 March 2012.

- ^ Pro Facto – Rijksuniversiteit Groningen (August 2015). "Vijf jaar Caribisch Nederland: De werking van wetgeving" (PDF) (in Dutch).

- ^ DSP-Groep (23 September 2015). "Vijf jaar Caribisch Nederland: Werking van de nieuwe bestuurlijke structuur" (PDF) (in Dutch).

- ^ Sociaal en Cultureel Planbureau (October 2015). "Vijf jaar Caribisch Nederland: Gevolgen voor de bevolking" (PDF) (in Dutch).

- ^ Evaluatiecommissie Caribisch Nederland (12 October 2015). "VIJFJAAR VERBONDE BONAIRE, SINT EUSTATIUS, SABA EN EUROPEES NEDERLAND (Rapport van de commissie evaluatie uitwerking van de nieuwe staatkundige structuur Caribisch Nederland)" (PDF) (in Dutch).

- ^ Treaty Establishing the EEC – Protocol on the Application of the Treaty Establishing the European Economic Community to the non-European parts of the Kingdom of the Netherlands The High Contracting Parties Anxious, at the time of signature of the Treaty establishing the European Economic Community, to define the scope of the provisions of Article 227 of this Treaty in respect of the Kingdom of the Netherlands, Have agreed upon the following provisions, which shall be annexed to this Treaty: The Government of the Kingdom of the Netherlands, by reason of the constitutional structure of the Kingdom resulting from the Statute of 29 December 1954, shall, by way of derogation from Article 227, be entitled to ratify the Treaty on behalf of the Kingdom in Europe and Netherlands New Guinea only. Done at Rome this twenty-fifth day of March in the year one thousand nine hundred and fifty-seven. Treaty establishing the EEC

- ^ "COUNCIL DECISION 2014/137/EU of 14 March 2014: On relations between the European Union on the one hand, and Greenland and the Kingdom of Denmark on the other". Official Journal of the European Union. 15 March 2014.

- ^ "Protocol: Setting out the fishing opportunities and financial contribution provided for in the Fisheries Partnership Agreement between the European Community (1) on the one hand, and the Government of Denmark and the Home Rule Government of Greenland (2), on the other hand". Official Journal of the European Union. 23 October 2012.

- ^ a b c d Anonymous (13 September 2016). "Territorial status of EU countries and certain territories". Taxation and Customs Union – European Commission. Retrieved 16 July 2020.

- ^ Annex 1 to SAD Guidelines (TAXUD/1619/08 rev. 3.4): Overview of European Union countries Archived 4 May 2014 at the Wayback Machine. Retrieved 20 August 2016.

- ^ a b "Mixed village in Cyprus buffer zone looks to offer hope". France 24. 23 January 2018. Retrieved 16 July 2020.

- ^ Murray, Fiona (2012). The European Union and Member State Territories: A New Legal Framework Under the EU Treaties. Springer Science & Business Media. p. 3. ISBN 978-90-6704-825-5.

- ^ Bahcheli, Tozun; Bartmann, Barry; Srebrnik, Henry (2004). De Facto States: The Quest for Sovereignty. Routledge. pp. 24–25. ISBN 978-1-135-77121-8.

- ^ a b "UNFICYP – Civil Affairs". United Nations Peacekeeping Force in Cyprus. 2008. Archived from the original on 15 October 2008. Retrieved 15 November 2008.

- ^ Council Regulation (EC) No 866/2004 of 29 April 2004 on a regime under Article 2 of Protocol No 10 of the Act of Accession, 30 April 2004

- ^ Chesham, Mark (2017). VAT and Financial Services (3rd ed.). Spiramus Press Ltd. p. 253. ISBN 978-1-910151-52-5.

- ^ a b "EUR-Lex – 32019R0474 – EN – EUR-Lex". eur-lex.europa.eu. Retrieved 16 July 2020.

- ^ "Live and work on Åland". Naringsliv.ax. Archived from the original on 1 December 2012. Retrieved 16 February 2013.

- ^ a b "EUR-Lex - 11994N/PRO/01 - EN - EUR-Lex". eur-lex.europa.eu.

- ^ "Åland and EU". Naringsliv.ax. Archived from the original on 11 May 2013. Retrieved 16 February 2013.

- ^ Treaty of 23 November 1964 between the Federal Republic of Germany and the Swiss Confederation on the inclusion of the municipality of Büsingen am Hochrhein in the customs territory of the Swiss Confederation, as referred to in Article 3(1) of Council Regulation 2913/92/EEC of 12 October 1992 establishing the Community Customs Code (as amended) (OJ L 302, 19 October 1992, pp. 1–50)

- ^ "UNTC". treaties.un.org.

- ^ "Germany and Switzerland" (PDF). treaties.un.org.

- ^ a b Regulation (EU) 2019/474 of the European Parliament and of the Council of 19 March 2019 amending Regulation (EU) No 952/2013 laying down the Union Customs Code, 25 March 2019, retrieved 13 January 2020

- ^ "CAMPIONE D'ITALIA – Italy in Switzerland ENCLAVES". This other world. Retrieved 21 February 2017.

- ^ Act concerning the conditions of accession of the Kingdom of Spain and the Portuguese Republic and the adjustments to the Treaties. Retrieved 20 August 2016.

- ^ a b Declaration No. 1. on Ceuta and Melilla attached to the Final Act of the Accession Treaty of the Kingdom of Spain to the Schengen Agreement (OJ L 239, 22.9.2000, p. 69)

- ^ a b Protocol 10 to the Treaty of Accession 2003 (OJ L 236, 23 September 2003, p. 955).

- ^ "COUNCIL DECISION of 10 June 2004 concerning the representation of the people of Cyprus in the European Parliament in case of a settlement of the Cyprus problem (2004/511/EC)".

- ^ Skoutaris, Nikos. "On Citizenship and Donkeys in Cyprus". Citizenship in Southern Europe. CITSEE. Retrieved 5 January 2013.

- ^ law of the Republic of Cyprus, Source: Cyprus Ministry of Justice compilation and translation (updated to June 2000).

- ^ Agency, Central Intelligence (2 June 2020). The CIA World Factbook 2020–2021. Simon and Schuster. ISBN 978-1-5107-5826-1.

- ^ See Article 299(6)(b) of the Consolidated Treaty establishing the European Community as amended by the Nice Treaty. Council Regulation (EEC) No 2913/92 of 12 October 1992 establishing the Community Customs Code

- ^ Protocol 3 to the Treaty of Accession 2003 (OJ L 236, 23 September 2003, p. 955).

- ^ "First Report on the implementation of the provisions of Protocol No 3 to the 2003 Act of Accession on the Sovereign Base Areas of the United Kingdom of Great Britain and Northern Ireland in Cyprus". Brussels: European Commission. 19 April 2010.

- ^ R H Lacey, Administrator (7 August 2007). "EURO ORDINANCE 2007 An Ordinance to provide for the adoption of the euro as legal tender in the Sovereign Base Areas and for related matters" (PDF). Government of the United Kingdom.

- ^ "Akrotiri". CIA World Factbook. Central Intelligence Agency. Retrieved 5 January 2013.

approximately 15,700 live on the Sovereign Base Areas of Akrotiri and Dhekelia including 7,700 Cypriots, 3,600 Service and UK-based contract personnel, and 4,400 dependents

- ^ "Declaration by Her Majesty's Government Regarding the Administration of the Sovereign Base Areas" (PDF). Treaty of Establishment of the Republic of Cyprus. 1960. p. 111. Archived from the original (PDF) on 23 October 2014. Retrieved 5 January 2013.

- ^ a b c d e Protocol relating to the Sovereign Base Areas of the United Kingdom of Great Britain and Northern Ireland in Cyprus, Agreement on the withdrawal of the United Kingdom of Great Britain and Northern Ireland from the European Union and the European Atomic Energy Community, EUR-Lex, 12 November 2019.

- ^ Council Regulation (EC) No 866/2004 of 29 April 2004 on a regime under Article 2 of Protocol No 10 of the Act of Accession. Council Regulation (EC) No 293/2005 of 17 February 2005 amending Regulation (EC) No 866/2004 on a regime under Article 2 of Protocol 10 to the Act of Accession as regards agriculture and facilities for persons crossing the line.

- ^ See Article 4 of the Faroe Islands Protocol, 355(5)(a) of the Treaty on the Functioning of the European Union and Article of the Treaty on European Union (as amended).

- ^ "Spørgsmål og svar". www.eu-oplysningen.dk (in Danish). Danish Parliament. Archived from the original on 12 February 2014. Retrieved 21 June 2015.

- ^ "Pas". atlantic.fo (in Danish). Atlantic Airways. Archived from the original on 21 June 2015. Retrieved 21 June 2015.

- ^ "Monks see Schengen as Devil's work". British Broadcasting Corporation. 26 October 1997. Retrieved 14 October 2007.

- ^ The Greek accession treaty does not specifically exclude Mount Athos from the Convention's territorial scope.

- ^ Joint Declaration No. 5 attached to the Final Act of the accession treaty.

- ^ a b "The Saimaa Canal – Finnish Transport Agency". www.liikennevirasto.fi.

- ^ Watch map services, especially Google Streetview, on 57°54′21″N 27°42′48″E / 57.90577°N 27.71323°E

- ^ a b c VAT act of 19 June 2009 no. 58, Norwegian Tax Administration, updated May 2014.

- ^ Immigrants warmly welcomed, Al Jazeera, 4 July 2006.

- ^ a b c Federal Act on Value Added Tax, Federal law of the Swiss Confederation. Retrieved 17 February 2016.

- ^ Brandtjen, Roland (May 2022). "The impact of Brexit on the identity of small British-European nations". Small States & Territories Journal. 5 (1): 13–30.

- ^ "- UNFICYP Buffer Zone permits". Archived from the original on 21 October 2014.

- ^ a b c d e f g h i j k l m n o p q r s "Information for Businesses/01 Customs and fiscal territories/index.jsp The customs and fiscal territories of the European Community".

- ^ "0466en01.pdf Direct Trade Regulation proposal, not yet implemented".

- ^ "Procedure File: 2006/2012(INI) – Legislative Observatory – European Parliament". www.europarl.europa.eu.

- ^ a b c d e f g h i j k l m "EUR-Lex - 12002E/TXT - EN - EUR-Lex".

- ^ a b "EURATOM Treaty Art.198d".

- ^ a b List of free trade agreements

- ^ "Agreement between the European Community, of the one part, and the Government of Denmark and the Home Government of the Faroe Islands".

- ^ Lauri Hannikainen; Frank Horn (1997). Autonomy and Demilitarisation in International Law: The Åland Islands in a Changing Europe. Martinus Nijhoff Publishers. p. 94. ISBN 978-90-411-0271-3.

- ^ a b c d e f "Treaty of Lisbon, Article 2, points 287 and 293". Retrieved 31 January 2008.

- ^ a b c d e f g h i j k l m n o p q r s Schengen Borders Code Article (21)

- ^ a b c "summaries/economic and monetary affairs/institutional and economic framework/l25042 en.htm Agreements concerning the French territorial communities".

- ^ a b c Art. 1-1-6°, Loi n°55-1052 du 6 août 1955 portant statut des Terres australes et antarctiques françaises et de l'île de Clipperton.

- ^ Article 108 of the Euratom Treaty

- ^ a b c d e f "customs/common/glossary/customs/index en.htm Customs territory of the Community". Archived from the original on 14 February 2007.

- ^ a b "Rijkswet aanpassing rijkswetten, nr. 3 MEMORIE VAN TOELICHTING" (in Dutch). Retrieved 6 November 2010.

(...) van het Verdrag tot oprichting van de Europese Gemeenschap voor Atoomenergie (Euratom) (Tr. 1957, 92). Dit verdrag geldt niet voor Curaçao en Sint Maarten.

- ^ See the PRO PRI.htm Protocol on the application of the Treaty establishing the European Atomic Energy Community to the non European parts of the Kingdom of the Netherlands and Act ratifying the EAEC Treaty in the Netherlands. The protocol on non-application of EURATOM by derogation was abrogated by Article 8 (III) of the Treaty of Amsterdam, which entered into force in 1999, but there is no evidence that the EURATOM treaty was ever extended to other countries within the Kingdom (now: Aruba, Curaçao, and Sint Maarten, formerly: the Netherlands Antilles and Suriname).

- ^ "Declaration on the towns of Ceuta and Melilla regarding Schengen".

- ^ Treaty on the Functioning of the European Union § Article 355

- ^ a b c European Economic Area agreement

- ^ a b Agreement concluded by the Council of the European Union and the Republic of Iceland and the Kingdom of Norway concerning the latters' association with the implementation, application and development of the Schengen acquis – Final Act, EUR-Lex, 10 July 1999.

- ^ Agreement on the European Economic Area – Protocol 40 on Svalbard and Declaration for activation of Protocol 40 exclusion.

- ^ The Schengen Area (Council of the European Union, 2015)

- ^ a b c Through multiple sectoral agreements

- ^ "Foreign Minister says Cyprus not to join Schengen before 2010". Embassy of the Republic of Cyprus in Berlin. Retrieved 3 February 2010.

- ^ By the third protocol to the Cyprus adhesion Treaty to EU and British local ordinance (see [1]).

- ^ a b González, María Martín, Miguel (11 January 2021). "Deal between Spain and UK plans to eliminate Gibraltar border checkpoint". EL PAÍS English.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ a b c d e f g h i "Treaty establishing the European Coal and Steel Community (Paris, 18 April 1951)". CVCE.EU by UNI.LU. 11 September 2015.

- ^ a b c d e f g h i j k l m n o p q r s t u v Annex IV: Overseas countries and territories

- ^ Up to 1 September 1962 no Community treaty applied there, besides ECSC preferences. Between that date and 16 July 1976 Suriname had OCT status.

- ^ "The provisions of Part Four of the Treaty were applied to Surinam, by virtue of a Supplementary Act of the Kingdom of the Netherlands (page29) to complete its instrument of ratification, from 1 September 1962 to 16 July 1976.", in: eur-lex.europa.eu – Treaty establishing the European Community (consolidated version) – Text of the Treaty

- ^ See the Protocol on the application of the Treaty establishing the European Atomic Energy Community to the non European parts of the Kingdom of the Netherlands and Act ratifying the EAEC Treaty in the Netherlands. The protocol on non-application of EURATOM by derogation was abrogated by Article 8 (III) of the Treaty of Amsterdam, which entered into force in 1999, but there is no evidence that the EURATOM treaty was ever extended to other countries within the Kingdom (now: Aruba, Curaçao, and Sint Maarten, formerly: the Netherlands Antilles and Suriname).

- ^ European Economic Community Treaty, Art 227

- ^ a b c d e f g h i j k l m "EUR-Lex – 11972B024 – EN". eur-lex.europa.eu.

- ^ a b According to Art.227 (EEC) and Art.198 (EURATOM) these Treaties shall not apply to those overseas countries and territories having special relations with the United Kingdom of Great Britain and Northern Ireland which are not listed in Annex IV to the EEC Treaty. Zimbabwe and Hong Kong are not listed in the annex.

- ^ New Hebrides had ECSC preferences and EURATOM application 1952–1973 stemming from the French administration in the territory, from 1973 to 1980 from both the French and British administrations, no EEC law applied 1958–1973, EEC OCT status 1973–1980

- ^ Art.198 of the EURATOM Treaty states that the treaty applies to non-European territories under jurisdiction of Member States. So far there is no reference for Macau exclusion, thus considering it included between 1986 and 1999.

- ^ "Treaty establishing the European Coal and Steel Community (Paris, 18 April 1951)". 11 September 2015.

- ^ "EUR-Lex – 11972B/AFI/DCL/06 – EN". Official Journal L 073, 27 March 1972, p. 0195.

External links

[edit]- Official website

- Information on the "Territorial status of EU countries and certain territories" from the European Commission

- Review of CARIFORUM-EU EPA – and Implications for the British and Dutch Caribbean Octs – What the CARIFORUM-EU trade deal means for current EU territories

- Regional policy & outermost regions

KSF

KSF