Television licensing in the Republic of Ireland

From Wikipedia - Reading time: 23 min

From Wikipedia - Reading time: 23 min

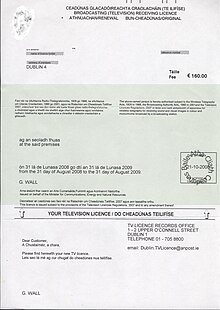

In Ireland, a television licence is required for any address at which there is a television set. Since 2016, the annual licence fee is €160.[1] Revenue is collected by An Post, the Irish postal service. The bulk of the fee is used to fund Raidió Teilifís Éireann (RTÉ), the state broadcaster. The licence must be paid for any premises that has any equipment that can potentially decode TV signals, even those that are not RTÉ's. The licence is free to anyone over the age of 70, some over 66, some Social Welfare recipients, and the blind. The fee for the licences of such beneficiaries is paid for by the state. The current governing legislation is the Broadcasting Act 2009, in particular Part 9 "Television Licence" and Chapter 5 "Allocation of Public Funding to RTÉ and TG4". Devices which stream television via internet do not need licences, nor do small portable devices such as mobile phones.[2]

The FG-Labour coalition planned to replace the television licence with a Public Service Broadcasting Charge on all primary residences and certain businesses.[3] A public consultation document on the plan was published in August 2013.[3] Asked in December 2014 about the delay in switching from the licence to the new charge, Minister of State Joe McHugh said the government would "be taking more time to work out a very complex system".[4] Implementation of the broadcasting charge was postponed in 2015 but returned to the political agenda in 2017.[5] In August 2019, Richard Bruton, the Minister for Communications, announced that from 2024 the licence fee would be replaced by "a device independent broadcasting charge", with implementation and enforcement details to be worked out in the interim.[6][7]

Collection and evasion

[edit]An Post is responsible for collection of the licence fee and commencement of prosecution proceedings in cases of non-payment. Licences can be purchased and renewed at post offices (in person or by post), or by using a credit card or debit card via a call centre or via the internet.[1] An Post receives commission to cover the cost of its collection service. In 2004, An Post had signalled its intention to withdraw from the business,[8] but was still the agent in 2017.[9][10] In 2012, 10.25% of licensees were paid by direct debit and 11.5% using savings stamps.[10] The Broadcasting (Amendment) Bill 2017 proposes to allow public tender for additional collection agents, who would not have prosecution powers.[9] A 2017 Oireachtas committee report recommends transferred responsibility for collection to the Revenue Commissioners.[11] In 2019 minister Bruton announced a public tender for all licence-fee collection for the five years to 2024.[7][12] Even if An Post loses the contract, it will still be possible to pay for television licences at post offices.[7] Nevertheless, commentators have suggested the potential loss of income may compromise the commercial viability of rural post offices, which are seen as socially important in isolated communities.[13][14]

An Post maintains a database of addresses and uses this to inspect suspected cases of non-payment. As of 2019[update] the database is 30 years old, does not contain Eircode data, and has no data mining capabilities.[13] Television dealers are required to supply details of people buying or renting televisions; this is no longer enforced as details supplied were unreliable.[15] There is no obligation on cable and satellite providers to supply details of subscribers;[16] in November 2012, a bill to change this was introduced.[17] Minister for Communications, Energy and Natural Resources Pat Rabbitte announced a planned government bill to the same effect in July 2014.[18] In April 2015, the proposal was to allow An Post to access cable and satellite subscriber databases, in tandem with cost-cutting at RTÉ;[19] in October 2015 it was reported that the plan had been shelved.[20]

More than 90 An Post employees work in licence collection, including the inspectors, who visit the premises to verify if TV receiving equipment is present.[13] If speedy payment of the licence is not made following an inspection, court proceedings are commenced by An Post.[21] In 2002, the rate of licence-fee evasion was estimated at 12%.[22] In the Dublin region in that year, approximately 21% of detected evaders were summonsed for prosecution (6,000 cases);[23] approximately one third of these cases resulted in fines, averaging €174.[24] Only 4% of fined evaders followed up three months later had purchased a licence.[25] In 2012, there were 11,500 prosecutions, up 10% over 2011.[10] Of those convicted, 242 were sent to jail, most for a few hours, six overnight.[10] This compared with 49 jailed in 2008.[10] The Irish Times reported in 2019 that the burden of proof for conviction was high, since proof of occupancy is needed before issue of a summons, which must then be personally served.[13]

In 2010, the Secretary General of the Department of Communications, Energy and Natural Resources told the Oireachtas Public Accounts Committee that the evasion rate was estimated at 12%, and the renewed contract with An Post would include provision for a 1 percentage point annual decrease in this.[26] In September 2016 the evasion rate was estimated at 13.75%, representing approximately €40m annual lost revenue.[27] The estimated evasion rate was 14.1% in 2017 and 12.83% in 2018.[12]

Disbursement

[edit]TV licence fees make up 50% of the income of RTÉ. The bulk of the rest comes from RTÉ broadcasting commercials on its radio and TV stations.[28] RTÉ also sells programming to other broadcasting. Some RTÉ services, such as RTÉ 2fm, RTÉ Aertel, RTÉ.ie, and the transmission network operate on an entirely commercial basis.

The licence fee does not entirely go to RTÉ. Expenses first deducted include the cost of collection (paid to An Post).

7% of the balance is used for Coimisiún na Meán's "Sound and Vision Scheme", which provides a fund for programme production and restoration of archive material which is open to applications from any quarter.[29] TG4 does not obtain licence fee revenue directly,[30] but does so indirectly as RTÉ is required to provide it with one hour's programming per day,[31] as well as other technical support. RTÉ's accounts express the cost of this as a percentage of its licence fee income,[32] amounting to 5.3% in 2006.[33] The remainder of TG4's funding is direct state grants[34] and commercial income.[32] The 2009 McCarthy Report, commissioned in response to a growing economic crisis, recommended that €10m of TG4's funding should in future come from licence fee revenue;[35] without increasing the fee, this would entail a matching reduction in RTÉ's funding.[36] This reduction is included in the government budget introduced in December 2010.[37] A 2017 Oireachtas committee report recommended that any increase in revenue from reduction in fee evasion should be allocated to TG4 and independent broadcasters providing public-service programming.[38]

The RTÉ Authority was replaced by the Broadcasting Authority of Ireland which regulates both private and public broadcasters. It is not directly funded from the licence fee; RTÉ, however, in common with other broadcasters, pays a levy to the Authority for its services.[39] The Broadcasting (Amendment) Bill 2019 would allow up to 50% of the BAI's funding to come directly from the television licence.[7][40]

Criticism

[edit]The licence has been criticised both in principle and as regards its implementation.

It is opposed for being outdated in a world with an increasing variety of TV channels and audio-visual technologies.[41] Commercial television companies have alleged that RTÉ unfairly uses licence fee to outbid them for broadcast rights to foreign films, TV series, and sports events. RTÉ denies this. [citation needed] European Community competition law prevents state funding of commercial activity, and RTÉ's accounts charge for non-"public service" programming out of its commercial income rather than its licence fee subsidy.

The licence is condemned as a regressive tax,[42] where the majority of prosecutions are of people on low incomes.

The high cost of collection is presented as inefficient.[43] Licence inspectors' calling to people's doors is seen as intrusive.[43] The low rate of prosecution of non-payers is seen as allowing evaders a "free ride".[42][43] The lack of an exemption (as exists in the UK) for those who can prove they don't use their equipment to receive RTÉ (or any TV) is regarded as unfair. Alternative funding methods suggested include direct funding from general exchequer revenues,[42][43] or a levy on electricity bills on the model of Cyprus.

A licence is required per address, rather than per person or per set. It has been considered unfair that the same licence fee applies to a single private dwelling as to a large commercial address, such as a hotel or a privately owned business park. In 2003, there was negative comment after a crackdown on unlicensed television sets at holiday homes,[44] and proposals for a reduced-rate licence for seldom-occupied premises.[45]

RTÉ journalists largely support the existence of the licence, and lobby for greater increases in the fee, as being a revenue stream independent of the government and thus guaranteeing freedom from political influence and associated editorial bias.[46] The opposite claim has also been made: that an annual review of the licence fee by the Government leaves RTÉ liable to political pressure.[42]

A survey of public attitudes to public-sector broadcasting was carried out by the Economic and Social Research Institute in 2004.[47] The authors noted that "public discontent at the level and inherently regressive nature of the ad rem licence fee is noticeable by its absence, particularly in contrast to the difficulties associated with the introduction of some ad rem service charges, e.g. bin and water charges."[47] The associated opinion poll recorded agree:disagree percentages of 54:29 for the statement "Public Broadcasting should be financed by the licence fee."[48] Respondents were asked what level of monthly fee they would be prepared to pay to receive RTÉ if subscription access were hypothetically to replace the licence fee: the annualised mean and median household figures were €180 and €252.60, compared to the then licence fee of €150, with those who frequently watched RTÉ programs most willing to pay.[49]

History

[edit]Television licences were introduced for the establishment of Telefís Éireann (now RTÉ) in 1962. Radio licences, abolished in 1972, had been introduced by the Parliament of the United Kingdom in 1904[50] prior to the creation of the Irish Free State in 1922. Non-compliance was widespread until the Wireless Telegraphy Act 1926 when the Minister for Posts and Telegraphs was empowered to prosecute those with no licence.[51][52]

Although before 1962 there was no television licence as such, a television set fell under the definition of "wireless receiver"; thus someone possessing a television but no radio would have needed a wireless licence at the same fee as someone with a radio.[53] Conversely between 1962 and 1972, the possessor of a television licence did not need an additional radio licence.

In 1975, members of Conradh na Gaeilge, an Irish language activist group, began campaigning for an Irish-language television station. They adopted tactics learnt from Welsh language activists of Cymdeithas yr Iaith Gymraeg, including non-payment of the television licence, and non-payment of fines imposed for not having a licence. Between 1973-1993, a total of 15 people were imprisoned for terms of between 2 and 14 days for non-payment of the licence fee and associated fine.[54] Among them were Alan Heusaff,[55] Brian Ó Baoill,[56] and Seán Mac Stíofáin.[57] This campaign of civil disobedience ended in 1996 with the establishment of Telefís na Gaeilge (now TG4).[58]

Century Radio, Ireland's first licensed national solely private-sector broadcaster, began broadcasting in 1990. Minister Ray Burke proposed allocating 25% of the television licence revenues to private-sector broadcasters. The government rejected this, but agreed instead to cap RTÉ's advertising income. A tribunal of enquiry later established that Oliver Barry, an investor in Century Radio, had given Burke a political donation of £30,000. The advertising cap was lifted in 1993.[59]

In the mid-1990s, proposals were floated to distribute funding (licence fee income or otherwise) among broadcasters based on content production, on the model of New Zealand. RTÉ successfully persuaded Minister Michael D. Higgins against such a change;[60] although the Sound & Vision scheme now operated effectively provides this, at a low level. RTÉ provide 7% (increased from 5% in 2009[61]) of the licence fee to the Sound and Vision fund which is managed by the Broadcasting Authority of Ireland (BAI). RTÉ are required by law to commission independent productions with at least 20% of their total licence and 365 hours of programming a year to TG4.

Media convergence

[edit]The definition of television in the original licensing legislation presumed a wireless radio broadcast receiver, and it was unclear whether it extended to computers, Internet devices, 3G mobile phones, or other newer technologies. In April 2007, then Minister for Communications, Energy and Natural Resources Noel Dempsey proposed modernising the definition to include newer technologies[62] The Oireachtas Joint Committee on Communications, Marine and Natural Resources cautioned against too broad a definition:[63]

The Joint Committee notes that the proposed changes to the definition and interpretation as to what constitutes a television set could have adverse effects on the perception of Ireland as a global leader in technological developments. The Joint Committee accepts that the introduction of additional forms of licence fee collection, in that regard, could negatively impact on the business sector.

In 2009, a ministerial order under the 2009 Act explicitly exempted two classes of device from the requirement to have a licence; namely, portable devices with small screens such as 3G phones or PDAs, and devices accessing streaming video services via the internet.[2] However, computers with TV tuner cards are not exempt.[2]

The 2009 Act also provides for on-the-spot fines and civil suits to be used against those not having a television licence, in response to negative views of the previous use of criminal proceedings, including imprisonment.[64][65]

The programme agreed by the Fine Gael–Labour coalition government formed after the 2011 general election states:[66]

We will examine the role, and collection of, the TV license [sic] fee in light of existing and projected convergence of broadcasting technologies, transform the TV licence into a household-based Public Broadcasting Charge applied to all households and applicable businesses, regardless of the device they use to access content and review new ways of TV licence collection, including the possibility of paying in instalments through another utility bill (electricity or telecom), collection by local authorities, Revenue or new contract with An Post.

In January 2012, minister Pat Rabbitte told the Dáil the existing licence model was inadequate both because it failed to take account of new media and because the evasion rate was 15%.[67] He said his department was studying funding methods of several foreign countries, and was considering using the database being established for the household charge to collect the broadcasting charge.[67] The department commissioned a value-for-money report, completed in April 2013, which found that evasion of the licence fee was increasing and that "the most serious threat to the future effectiveness of the current system is likely to arise from the capacity and convergence of new technology".[68] Based on the report, the department drafted a consultation document on a proposed new "Public Service Broadcasting Charge" which was published on 27 August 2013.[3] In April 2015, Rabbitte's successor as minister, Alex White, said "we cannot replace the TV licence fee with a public service broadcasting charge until we have built public understanding and support for such a move".[69] A September 2015 report by Kevin Rafter for the Independent Broadcasters of Ireland concluded that "Changing viewing habits will continue to undermine the licence fee model."[70]

In November 2017, an Oireachtas committee report recommended a "non-device dependent public service broadcasting charge" per household,[71] to fund "authoritative, impartial, indigenous, trusted and reputable public service media in Ireland".[72] A 2018 review by Crowe Horwath for the BAI, of funding for public service broadcasters, noted that moving to such a charge would raise "at least two fundamental questions": who should pay how much (individuals, households, commercial properties, hotels) and who should be eligible for funding (over-the-air broadcasters only, or cable/internet content providers as well).[73] In July 2018 the government set up a cross-departmental Working Group on the Future Funding of Public Service Broadcasting to consider the 2017 Oireachtas committee report.[7] It reported in April 2019 to Richard Bruton, the Minister for Communications, Climate Action and Environment, and in August 2019 Bruton announced that from 2024 the licence fee would be replaced by "a device independent broadcasting charge", with implementation and enforcement details to be worked out in the interim.[7][6] The media noted that the 2024 date would be after the 2024 general election, and that, depending on the collection method chosen, the charge might be "unworkable without opt-in compliance from the public".[6]

Licence fee

[edit]Increases in the licence fee have been irregular. Only one happened between 1986 and 2001. Later increases were essentially index-linked,[74] with none since the Irish financial crisis which began in 2008. Section 124 of the 2009 Act enshrines index-linking in law, although only as a recommendation. RTÉ in 2017 suggested an immediate increase to €175 to backdate annual increases forgone since 2009.[75] A 2017 Oireachtas committee recommended a review every two years based on a pure CPI formula.[76] The annual fee is set by a statutory instrument (SI) which remains in force until superseded by a later SI. Relevant fees and SIs are as follows:

| year | date | television | radio | statute | |

|---|---|---|---|---|---|

| colour | monochrome | ||||

| 2008 | 1 January | €160 | S. I. No. 851/2007 | ||

| 2006 | 1 October | €158 | S.I. No. 404/2006 | ||

| 2005 | 1 April | €155 | S.I. No. 165/2005 | ||

| 2004 | 1 January | €152 | S.I. No. 720/2003 | ||

| 2003 | 1 January | €150[a 1] | S.I. No. 608/2002 | ||

| 2002[a 2] | 1 January | €107.00 | €84.00 | S.I. No. 396/2001 | |

| 2001 | 1 September | £84.50 (€107.29) | £66.50 (€84.44) | ||

| 1996 | 1 September | £70 | £52 | S.I. No. 249/1996 | |

| 1986 | 1 March | £62 | £44 | S.I. No. 37/1986 | |

| 1984 | 1 November | £57 | £39 | S.I. No. 248/1984 | |

| 1983 | 1 April | £52 | £34 | S.I. No. 83/1983 | |

| 1980 | 1 December | £45 | £27 | S.I. No. 359/1980 | |

| 1978 | 1 December | £38 | £23 | S.I. No. 319/1978 | |

| 1977 | 1 April | £31 | £18.50 | S.I. No. 76/1977 | |

| 1974 | 1 October | £20 | £12 | S.I. No. 270/1974 | |

| 1973 | 1 October | £15[a 3] | £9[a 4] | S.I. No. 274/1973 | |

| 1972 | 1 September | £7.50[a 5] | abolished | S.I. No. 210/1972 | |

| 1971 | 1 September | £7·50[a 6] | £1.50[a 7] | S.I. No. 241/1971 | |

| 1970 | 1 July | £6 | £1 10s | S.I. No. 141/1970 | |

| 1963 | 1 November | £5 | £1 5s | S.I. No. 199/1963 | |

| 1962 | 1 January | £4[a 8] | £1[a 9] | S.I. No. 279/1961 | |

| 1961 | 1 September | £1 | S.I. No. 174/1961 | ||

| 1953 | 1 April | 17s 6d | S.I. No. 55/1953 | ||

| 1940 | 1 June | 12s 6d | S.I. No. 117/1940 | ||

| 1934 | 1 October | 10s[a 10] | S.I. No. 249/1934 | ||

| 1927 | 1 July | free (blind) | S.I. No. 54/1927 | ||

| 1927 | 3 January | 10s (ordinary); £1 (institutions[a 11]); |

S.I. No. 1/1927 | ||

| 1926 | Some time between 5 May[77] and 6 July[78] |

£1 (valve set) 10s (crystal set)[77][78] |

|||

| 1924 | Some time between 8 May[79] and 19 November[80] |

£1[79][80] | |||

| 1922 | July | All licences withdrawn owing to Irish Civil War[81] |

|||

| Until July 1922 | 10s[81] | ||||

- Notes

- ^ Price for "Television Licence": monochrome/colour distinction abolished

- ^ Prices rounded down upon the changeover to Euro currency

- ^ "Broadcasting (Television) Receiving Licence (Colour and Monochrome)"

- ^ "Broadcasting (Television) Receiving Licence (Monochrome Only)"

- ^ "Broadcasting (Television) Receiving License [sic]"

- ^ "Broadcasting (Television) Receiving Licence (including Sound Radio Broadcasts)"

- ^ Fee was unchanged from 1970 but currency had been decimalised

- ^ "Broadcasting Receiving Licence (including Television)"

- ^ "Broadcasting Receiving Licence (excluding Television)"

- ^ i.e. the higher-priced categories of 1927 were abolished; the blind exemption remained.

- ^ S.I. No. 1/1927 §1(b): "Schools and Institutions, as, for example, Colleges, Convents, Hospitals, Convalescent Homes, Boarding Houses, etc."

- ^ S.I. No. 1/1927 §1(c): "Hotels, Restaurants, Cafés, Clubs, Public Houses, etc."

- ^ S.I. No. 1/1927 §1(d): "Public Entertainments, e.g., Public Halls, Cinemas, Bazaars, etc., open to the public on payment of a charge"

- ^ S.I. No. 1/1927 §1(e): "Loud Speaker Station for outside free public reception of broadcast matter as an advertisement or demonstration"

Licences issued

[edit]| Year | Total licences | Sold licences | Welfare licences | Receipts €m[l 1] | Ref |

|---|---|---|---|---|---|

| 2014 | 213.2 | [82] | |||

| 2013 | 216.4 | [82] | |||

| 2012 | 1,411,787 | 1,003,860 | 407,927 | 215.0 | [82][83] |

| 2011 | 1,425,258 | 1,021,443 | 403,815 | 217.8 | [82][83] |

| 2010 | 1,431,716 | 1,038,665 | 393,051 | 222.4 | [82][83] |

| 2009 | 226.2 | [82] | |||

| 1988 | 62.3 | [84] | |||

| 1987 | 58.4 | [84] | |||

| 1986 | 53.8 | [84] | |||

| 1985 | 755,095 | 48.5 | [84][85] | ||

| 1984 | 720,934 | 43.4 (39.2 net) | [86] | ||

| 1970 | 429,719 | [87] | |||

| 1964 | 231,845 | [88] |

- Notes

- ^ Receipts prior to 2001 are gross and converted from Irish pounds to euros. Later receipts are net of collection cost.

See also

[edit]References

[edit]Sources

[edit]- "Broadcasting Act 2009". Irish Statute Book. Government of Ireland. 12 July 2009. Retrieved 9 December 2010.

- Corcoran, Farrel John (2004). RTÉ and the Globalisation of Irish Television. Intellect Books. ISBN 1-84150-090-9.

- Delaney, Liam; O'Toole, Francis (Winter 2004). "Irish Public Service Broadcasting: A Contingent Valuation Analysis" (PDF). The Economic and Social Review. 35 (3). ESRI: 321–350. Archived from the original (PDF) on 18 November 2007.

- Joint Committee on Communications, Climate Action and Environment (JCCCAE) (28 November 2017). "Future Funding of Public Service Broadcasting" (PDF). Oireachtas. Retrieved 28 November 2017.

- Purcell, John (22 January 2004). "Television Licence Fee Collection" (PDF). Comptroller and Auditor General. Retrieved 21 September 2007.

Citations

[edit]- ^ a b "Personal Customers / TV licence". An Post. Retrieved 2 May 2008.

- ^ a b c "S.I. No. 319/2009 – Television Licence (Exemption of Classes of Television Set) Order 2009". Irish Statute Book. 31 July 2009. Retrieved 28 October 2010.

- ^ a b c "Consultation on Public Service Broadcasting Charge". Department of Communications, Energy and Natural Resources. 27 August 2013. Retrieved 27 August 2013.

- ^ "Television Licence Fee Collection (Continued)". Dáil Éireann debates. 11 December 2014. p. 8. Retrieved 11 December 2014.

- ^ JCCCAE 2017; "'We either value journalists or we don't': TV and device fee could rise to €175". Irish Examiner. 10 November 2017. Retrieved 10 November 2017.

- ^ a b c Ó Cionnaith, Fiachra (2 August 2019). "'No way to avoid it': Everything you need to know about the new 'broadcasting charge'". Irish Examiner. Retrieved 3 August 2019.

- ^ a b c d e f "Minister Bruton Publishes Broadcasting Bill" (Press release). Department of Communications, Climate Action and Environment. 2 August 2019. Retrieved 3 August 2019.

- ^ Purcell 2004, §2.12

- ^ a b "General Scheme of Broadcasting (Amendment) Bill 2017" (PDF). 7 June 2017. p. 11; Head 5. Retrieved 15 November 2017.; "Briefing Note for the Joint Oireachtas Committee on Communications, Climate Action & Environment – Broadcasting (Amendment) Bill 2017" (PDF). 7 June 2017. pp. 3–4 Section 145 (TV Licence Issuing Agent). Retrieved 15 November 2017.

- ^ a b c d e Deegan, Gordon (6 September 2013). "Vast majority jailed for TV licence fines walk free within hours". The Irish Times. p. 8. Retrieved 6 September 2013.

- ^ JCCCAE 2017 p.6 Recommendation 3

- ^ a b Lynott, Laura (3 August 2019). "An Post defends record of licence fee collections". Irish Independent. Retrieved 4 August 2019.

- ^ a b c d Horgan-Jones, Jack (3 August 2019). "Successful bidder for collection of TV licence fee will hold five-year concession". The Irish Times. Retrieved 4 August 2019.

- ^ "'Large-scale Post Office closures inevitable' if An Post loses TV licence fee contract, say Postmasters". Breaking News. 2 August 2019. Retrieved 4 August 2019.

- ^ Purcell, §2.35

- ^ Purcell, §2.37

- ^ "Broadcasting (Television Licence Fees Recovery) Bill 2012 (PMB)". Bills 1992–2012. Oireachtas. Retrieved 27 November 2012.

- ^ Calnan, Denise (8 July 2014). "New crackdown on TV licence fee evaders to focus on cable and satellite TV subscribers". Irish Independent. Retrieved 8 July 2014.

- ^ "Communications Minister Alex White proposes to tackle TV licence evasion by allowing An Post to access Sky and UPC customer data". Irish Independent. 21 April 2015. Retrieved 6 October 2015.

- ^ Kelly, Fiach; Minihan, Mary (6 October 2015). "Plan to use Sky, UPC data to collect licence to be rejected". The Irish Times. Retrieved 6 October 2015.

- ^ Purcell, pg. 34, Figure 3.5

- ^ Purcell, §2.5

- ^ Purcell, §3.62

- ^ Purcell, §3.68

- ^ Purcell, §3.70

- ^ "12% estimated to be without TV licence – RTÉ News". RTÉ.ie. 9 December 2010. Retrieved 9 December 2010.

- ^ "Written Answer No. 1704: Television Licence Fee". Dáil Éireann Debates. Oireachtas. 16 September 2016. p. 67. Retrieved 27 September 2016.

- ^ "Licence Fee: FAQs". Raidió Teilifís Éireann. Retrieved 21 September 2007.

- ^ "Broadcasting (Funding) Act 2003". 23 December 2003. Retrieved 6 November 2007.

- ^

"Submission to the Joint Oireachtas Committee on Communications, Marine and Natural Resources on the Broadcasting Act". Screen Producers Ireland. 13 July 2005. Archived from the original on 17 July 2007. Retrieved 6 November 2007.

Operating under the statutory umbrella of RTÉ, TG4 however does not receive its funding from licence fee revenue but rather from Department of Finance discretionary spending.

- ^ "Broadcasting Act, 2001, §47". 14 March 2001. Retrieved 6 November 2007.

- ^ a b

Europe Economics; Curtin Dorgan Associates; PricewaterhouseCoopers (1 December 2004). "The effect of RTĒ's licence fee income on broadcasters and on the advertising market in Ireland" (PDF). Department of Communications, Energy and Natural Resources. pp. 10, §3.9. Retrieved 6 November 2007.

It is dependent on a combination of Government funding, commercial income (airtime sales) and support in kind rather than in cash from RTÉ. With input from TG4, RTÉ decides what content (totalling 365 hours) it will provide to TG4 – and it gives TG4 this content annually. It also gives TG4 technical support. RTÉ then costs these contributions up and expresses them as a percentage attribution to TG4 of licence fee income.

- ^ "Radio Telefís Éireann ANNUAL REPORT & GROUP FINANCIAL STATEMENTS 2006" (PDF). Raidió Teilifís Éireann. 22 March 2007. p. 25. Retrieved 6 November 2007.

- ^ "Broadcasting Act, 2001, §51". 14 March 2001. Retrieved 6 November 2007.

- ^ "Table 3.3.2 Communications, Energy & Natural Resources savings measures". Report of the Special Group on Public Service Numbers and Expenditure Programmes (PDF). Vol. 1. Dublin: Government Publications Office. 2009. p. 36. Archived from the original (PDF) on 21 July 2011. Retrieved 9 December 2010.

- ^ "TG4 paused for thought as it awaits post-budget fate". The Irish Times. 18 November 2010. Retrieved 9 December 2010.

- ^ "Budget 2011 – As It Happened". .ie. 7 December 2010. Retrieved 9 December 2010.

1753 RTÉ is to get a reduction of €10m in licence fee revenue in 2011, a reduction of 5% =PDF the 2010 figure. According to the Department of Communications, this is to replace some central funding to TG4 with licence fee funding.

- ^ JCCCAE 2017 pp.6–7 Recommendation 4

- ^ "About Us: Levy". Broadcasting Authority of Ireland. Archived from the original on 30 August 2010. Retrieved 9 December 2010.

- ^ "Broadcasting (Amendment) Bill 2019 – No. 64 of 2019". Bills. Oireachtas. 31 July 2019. Retrieved 3 August 2019.

- ^

O'Malley, Fiona (10 January 2007). "Proposed Broadcasting Bill: Hearings". JOINT COMMITTEE ON COMMUNICATIONS, MARINE AND NATURAL RESOURCES. p. 2. Retrieved 28 November 2007.

F. O'Malley: Is it not anachronistic for the Department to impose a television licence? Have we gone beyond licensing? Given that the Government is always interested in revenue, is there an alternative suggestion as to how we might raise the revenue if licensing is no longer possible?

- ^ a b c d

Government of Ireland (26 November 2003). Broadcasting (Funding) Bill 2003 [Seanad] : Second Stage (Resumed). Dáil Éireann Parliamentary Debates. pp. Volume 575, p.439. Archived from the original on 7 June 2011. Retrieved 28 November 2007.

Mr Eamon Ryan: ... Historically, 8% of the licence fee receipts have been accounted for by An Post's collection costs. It is a very expensive cost. Just 92% of the sum of over €100 that we pay for a television licence will be expended on broadcasting. It is something that we have to address seriously. I propose a much simpler system of funding which is guaranteed by the State through the general taxation system on an index-linked basis. The fund would be set in stone and would not be open to political interference in the budget each year. The moneys would be provided from central Exchequer expenditure. The fundraising and allocation aspects of such a system would be more efficient. One would not have the huge cost of collecting the licence fee and the endless television advertisements would not have to be paid for. Such advertisements remind people, for example, that they have to have a licence for their fourth television in their country home. The incredibly cumbersome present licence collecting system would no longer be needed. The system I propose would be much fairer. Under the present system, an unemployed person or a person with a very low income, for example, has to pay the exact same licence fee as their next-door neighbour who might be earning €500,000 per year. The licence fee is a regressive stealth tax.

- ^ a b c d

McDonagh, Patricia (16 November 2007). "Licence fee system should be scrapped". Irish Independent. Retrieved 28 November 2007.

Fine Gael's communications spokesman, Simon Coveney, said people are being forced to pay for the estimated 16pc of households that are not willing to pay the licence fee. ... Instead of the current intrusive and inefficient system of collecting money to finance public service broadcasting, the Government could finance it through general taxation, Mr Coveney said.

- ^

"Proposed Broadcasting Bill: Definition of Television and Collection of Licence Fee". JOINT COMMITTEE ON COMMUNICATIONS, MARINE AND NATURAL RESOURCES. 10 January 2007. Retrieved 28 November 2007.

Mr. Hayes: When I joined RTÉ I asked whether a television licence was required for a holiday home. ... Up to 2003 that is not how it was interpreted because people did not understand that was the law. ... Senator Finucane: Despite the fact these televisions may only be used for two months in the year [...] I think it is unfair.

- ^ Government of Ireland (24 April 2007). Written Answers. – Television Licence Fee. Dáil Éireann Parliamentary Debates. pp. Volume 636, p.439. Archived from the original on 7 June 2011. Retrieved 28 November 2007.

- ^ "RTÉ journalists' concern at fee". The Irish Times. 7 July 2001. Retrieved 28 November 2007.

- ^ a b Delaney & O'Toole 2004, p.323

- ^ Delaney & O'Toole, p.333

- ^ Delaney & O'Toole 2004, p.347-348

- ^ The Wireless Telegraphy Act 1904 (4 Edw. 7. c. 24); renewed by the Wireless Telegraphy Act 1906 (6 Edw. 7. c. 13); continued by the Expiring Laws Acts 5/1922, 47/1923, 60/1924, and 41/1925

- ^ Government of Ireland (16 December 1926). WIRELESS TELEGRAPHY BILL, 1926—SECOND STAGE. Seanad Éireann Parliamentary Debates. pp. Volume 8, pp.81–82. Archived from the original on 9 June 2011. Retrieved 20 September 2007.

Mr. WALSH: ... I had no alternative but to take steps to expedite the collection of licence fees, which is the main source of revenue. There are, I believe, something like 40,000 wireless users in this State. We have so calculated the number at any rate, and of these only about 4,000 have so far been good enough to pay the small licence fee of 10s.

- ^ "Wireless Telegraphy Act, 1926". 24 December 1926. Retrieved 21 September 2007.

- ^

Government of Ireland (19 June 1957). Ceisteanna—Questions. Oral Answers. – Radio Éireann Revenue. Dáil Éireann Parliamentary Debates. pp. Volume 162, p.1094. Archived from the original on 9 June 2011. Retrieved 21 September 2007.

Minister for Posts and Telegraphs (Mr. Blaney): There is no separate television licence; a television set is covered by the ordinary wireless receiving licence.

- ^ Ní Chathail, Caoimhe; Ó Maolagáin, Fearghal (26 October 2016). "TG4 ag ceiliúradh 20 bliain". Meon Eile (in Irish). Retrieved 10 November 2017.

Bhí sé tuillte go géar ag 15 acu a chaith idir 2 agus 14 lá i bpríosún idir 1973 agus 1993 as diúltú ceadúnas teilifíse a íoc le RTE.

- ^ Breathnach, Diarmuid; Ní Mhurchú, Máire. "Heusaff, Alan (1921–1999)". ainm.ie (in Irish). Cló Iar-Chonnacht. Retrieved 10 November 2017.

- ^ "Prison For TV Licence Non Payment". RTÉ News. 26 June 1985. Retrieved 26 June 2021.; Ó Cathain, Padraic (4 July 1985). "Brian Ó Baoill Welcomed Home" (in Irish). RTÉ Archives. Retrieved 26 June 2021.

- ^ Breathnach, Diarmuid; Ní Mhurchú, Máire. "Mac Stíofáin, Seán (1928–2001)". ainm.ie (in Irish). Cló Iar-Chonnacht. Retrieved 10 November 2017.

- ^ Hourigan, Niamh (2007). "The Role of Networks in Minority Language Television Campaigns". In Cormack, Michael J.; Hourigan, Niamh (eds.). Minority Language Media: Concepts, Critiques, and Case Studies. Multilingual Matters. pp. 74–77. ISBN 978-1-85359-963-7.

- ^ Corcoran 2004, p.46

- ^ Corcoran 2004, pp.47–52

- ^ Dáil debates 24 January 2012 p.270

- ^ "Proposals for Legislation in Relation to Broadcasting PART 6: Television licence 51: Interpretation". Archived from the original on 24 August 2007. Retrieved 21 September 2007.

- ^ "Houses of the Oireachtas Joint Committee on Communications, Marine and Natural Resources Tenth Report: Considerations, recommendations and conclusions on the Joint Committee's consultation on the draft General Scheme of the Broadcasting Bill" (PDF). April 2007. pp. 59–61. Retrieved 21 September 2007.

- ^ Written Answers. – Television Licence Fee Archived 22 September 2012 at the Wayback Machine Dáil debates Vol.682 cc.260–1, 12 May 2009

- ^ Broadcasting Act 2009 §§149, 150(c); Irish Statute Book

- ^ "Programme for Government 2011" (PDF). Department of the Taoiseach. 6 March 2011. Archived from the original (PDF) on 7 June 2011. Retrieved 5 February 2012.

- ^ a b Dáil debates 18 January 2012 p.21

- ^ Public Service Broadcasting Charge Policy Review Group (April 2013). "Report of the Value for Money Policy Review on the introduction of a Public Service Broadcasting Charge" (PDF). p. 6. Archived from the original (PDF) on 8 September 2013. Retrieved 27 August 2013.

{{cite web}}:|author=has generic name (help) - ^ "Minister Alex White publishes RTÉ efficiency review and report on broadcasting advertising market" (Press release). Dublin: Department of Communications, Energy and Natural Resources. 21 April 2015. Retrieved 10 November 2017.

- ^ Rafter, Kevin (30 September 2015). "Television Licence Fee" (PDF). Dublin: Independent Broadcasters of Ireland. p. 13. Retrieved 13 November 2017.

- ^ JCCCAE 2017 p.6 Recommendation 2

- ^ JCCCAE 2017 p.11

- ^ Horwath, Crowe (23 May 2013). Final report : Broadcasting Authority of Ireland review of funding for public service broadcasters (PDF). Dublin. p. 38. Retrieved 3 August 2019 – via opac.oireachtas.ie.

{{cite book}}: CS1 maint: location missing publisher (link) - ^

Department of Communications, Energy and Natural Resources (29 May 2006). "Television Licence Fee Reviews". Retrieved 8 October 2007.

As part of the Programme of Public Sector Broadcasting Reform, the Government decided that the RTÉ licence fee adjustment would be reviewed annually. A mechanism to allow for annual changes to the licence fee, using the CPI-X formula (i.e. the Consumer Price Index less a specified figure) was introduced by the Government in 2002.

- ^ JCCCAE 2017 p.43

- ^ JCCCAE 2017 p.7 Recommendation 6

- ^ a b

Government of Ireland (5 May 1926). FINANCIAL RESOLUTIONS—REPORT. – RESOLUTION No. 9. Dáil Éireann Parliamentary Debates. pp. Volume 15, p.1121. Archived from the original on 9 June 2011. Retrieved 24 September 2007.

Mr. BLYTHE: ... It is for that reason that I favour the reduction of the crystal set licence fee to ten shillings.

- ^ a b

Government of Ireland (6 July 1926). SHOP HOURS (DRAPERY TRADES, DUBLIN AND DISTRICTS) BILL, 1926. – APPROPRIATION BILL, 1926—SECOND STAGE. Seanad Éireann Parliamentary Debates. pp. Volume 7, p.742–3. Archived from the original on 9 June 2011. Retrieved 24 September 2007.

Minister for Posts and Telegraphs (Mr. Walsh): ... In the case of a licence fee the poor man who buys a set for 10/- or 12/- has to pay an annual fee of 10/-

- ^ a b

Government of Ireland (19 May 1925). CEISTEANNA—QUESTIONS. ORAL ANSWERS. – DUTY ON WIRELESS SETS. Dáil Éireann Parliamentary Debates. pp. Volume 11, p.1728. Archived from the original on 9 June 2011. Retrieved 21 September 2007.

Minister for Posts and Telegraphs (Mr. Walsh): ...The annual licence fee of one pound was sanctioned by the Minister for Finance in accordance with the recommendation of the Special Committee of the Dáil on Broadcasting, whose report was adopted by the Dáil [on 8 May 1924].

{{cite book}}: External link in|quote= - ^ a b

Government of Ireland (19 November 1924). CEISTEANNA—QUESTIONS. ORAL ANSWERS. – WIRELESS RECEIVING LICENCES. Dáil Éireann Parliamentary Debates. pp. Volume 9, p.1192. Archived from the original on 7 June 2011. Retrieved 24 September 2007.

Minister for Posts and Telegraphs (Mr. Walsh): The fee for an ordinary wireless receiving licence in the Saorstát is £1 per annum

- ^ a b

Government of Ireland (3 August 1923). INTOXICATING LIQUOR BILL. – WIRELESS BROADCASTING. Dáil Éireann Parliamentary Debates. pp. Volume 4, pp.1953–4. Archived from the original on 7 June 2011. Retrieved 21 September 2007.

The PRESIDENT: After the transfer of the Post Office Services from the British Government on 1 April 1922, permits for the installation and working of Wireless receiving apparatus were issued by the Irish Postmaster-General to experimenters and other persons who complied with the conditions laid down as regards the apparatus and aerial to be used and on payment of a fee of 10s. a year. On the outbreak of the disturbances in the country in July, 1922, these permits were withdrawn at the request of the Military Authorities and all persons in possession of wireless apparatus were required to surrender it to the Post Office for safe custody. The sale, importation or manufacture of wireless apparatus was also prohibited. This general prohibition against the use of wireless apparatus has not yet been removed. For some time past, however, special permits have been given on specified conditions with the approval of the military authorities for wireless receiving demonstrations at fetes and other entertainments organised for charitable and public objects.

- ^ a b c d e f "Written answers : Television Licence Fee Yield". Dáil Éireann proceedings. KildareStreet.com. 15 July 2015. Retrieved 10 November 2017.

- ^ a b c "Written answers 173: Television Licence Statistics". Dáil debates. 22 May 2013. Retrieved 2 September 2013.

- ^ a b c d "Written Answers. – Television Licence Revenue". Dáil debates. 12 July 1990. Retrieved 2 September 2013.

- ^ "Questions. Oral Answers. – RTE Licence Increase". Dáil Éireann Debates. 19 February 1986. Vol 363 No.14 p.8 c.3098. Retrieved 15 November 2017.

- ^ "Oral answers 6. Television Licences". Dáil debates. 20 February 1985. Retrieved 2 September 2013.

- ^ "Oral Answers 37 – Television Licences". Dáil debates. 9 June 1970. Retrieved 2 September 2013.

- ^ "Oral Answers 46 – TV Licences". Dáil debates. 1 July 1964. Retrieved 2 September 2013.

External links

[edit]- Television Licences Citizens Information Board

- Forum on Funding Public Service Broadcasting Oireachtas Joint Committee on Communications, Climate Action and Environment

KSF

KSF