Media and taxes

From Wikiversity - Reading time: 11 min

From Wikiversity - Reading time: 11 min

| This is a research project at Wikiversity. |

- This essay is on Wikiversity to encourage a wide discussion of the issues it raises moderated by the Wikimedia rules that invite contributors to “be bold but not reckless,” contributing revisions written from a neutral point of view, citing credible sources -- and raising other questions and concerns on the associated '“Discuss”' page.

This essay suggests that democracy, world peace, economic development and reduced corruption might be greatly advanced if enough people support investigative journalism with two tenths of a percent of their income and ask their local and national governments to invest one percent of their budgets to subsidize qualified media organizations in proportion to the number of qualified Internet clicks for their web site.

If your annual income is $25,000 per year, this is $1 per week. For a government whose budget is 20 percent of a local economy with average income of $25,000 per year, one percent is $1 per week per person.

This can work, because it is essentially the subsidies for newspapers provided by the US for most of the nineteenth century, and is comparable to the news subsidies that the US occupiers required of the post-fascist governments in Germany and Japan after World War II, as explained below. This essay includes a discussion of evidence suggesting that these subsidies may have played a defining role in making the US, Germany and Japan the relatively free and prosperous societies they are are today. Moreover the reforms suggested herein could potentially unleash new waves of innovation that could benefit virtually everyone on the planet.

In this essay we focus primarily on the media and taxes in the US; similar analysis could be conducted of the media and other issues.[1]

If you have questions or concerns about this, please post them to the associated '“Discuss”' page. If you have evidence, please modify this Wikiversity research summary accordingly.

News threatens people with power

[edit | edit source]My research suggests that in the US progress on every substantive issue I can think of is blocked, because every plausible countermeasure threatens a major advertiser. Outside the US, progress is blocked because every plausible countermeasure threaten someone with substantial control over the media.

The mainstream media have this power for at least two reasons:

- Media organizations need money to operate and rarely bite the hands that feed them.[2]

- Humans too often accept information that supports their preconceptions and too seldom search for alternative information. The 2002 Nobel Memorial Prize in Economics was awarded to Daniel Kahneman largely for documenting how this works.[3]

Taxes

[edit | edit source]

The number of words in US federal tax code and regulations has been increasing almost linearly at very close to 150,000 words per year at least since 1955, according to the Tax Foundation: 1.4 million words in 1955 grew to 10 million in 2015 (see the accompanying figure).[4]

In 1965, when US tax code and regulations consumed 2.8 million words, Harvard Law Professor Stanley Surrey noted that “an income tax of broad coverage is inherently a quite complicated tax”.[5]

What percent of those additional words added each years since at least 1955 have actually improved the overall functioning of the US political economy, and what percent increased political corruption (called “crony capitalism” by some and “corporate welfare” by others)?

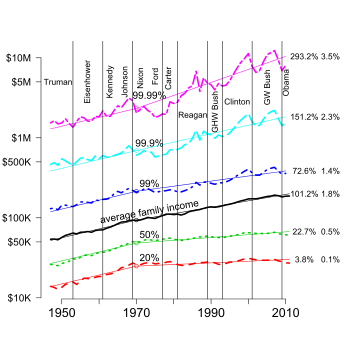

Some might suspect that nearly all the added words increase political corruption. Estimates of the cost of political corruption in the US have ranged from $100 billion per year[6] ($1,200 per family per year) to $39,000 per family per year (over $100 per day).[7] The latter number corresponds to the increase in the difference between the mean (numerical average) and the median (middle value) annual family income in the US, shown in the accompanying figure. This figure shows that the average family income has grown at close to a constant 2 percent per year for this entire period. The median grew at essentially that rate from 1947 to about 1970 and has been relatively flat since then.[8]

Scott Hodge of the Tax Foundation claims that the complexity alone of US taxes will cost the US over $400 billion in 2016.[12] This is over 2 percent of US Gross Domestic Product (GDP), forecasted to be $18.6 trillion in 2016.

We hear very little about this in the media. Why? To what extent might exposure limit the ability of major advertisers to get favors from government that do not actually increase the general welfare?

This complexity cost could be reduced almost overnight by having the Internal Revenue Service (IRS) mail each taxpayer a draft return with an estimated amount either due or to be refunded. Taxpayers could ignore this draft return and do their own taxes or paying someone else, as they do now. Or they could sign the form and pay the bill or accept the refund amount on that document. Lawrence Lessig noted that in most cases the IRS already receives all the information required to do this.[13]

This would save some substantial portion of the $400 billion in complexity cost mentioned above. On May 5, 2006 the Los Angeles Times reported that Intuit, distributors of the popular tax preparation software TurboTax, spent over $1.7 million lobbying to kill a program like this in California.[14]

Douglas Galbi estimated that advertising represents roughly two percent of the US economy.[15] From this we can estimate that roughly $8 billion (two percent of that $400 billion) goes for advertising. Much of that is controlled by a very few senior executives, who could lose a substantial portion of that $400 billion if this reform were adopted.

Media executives therefore must of necessity flinch before disseminating such information: They don't want to lose their share of that roughly $8 billion in advertising.

Even if they print one story exposing, for example, Intuit's $1.7 million effort to kill a program that would make tax preparation easier for people in California, they will not likely let that story grow into a media feeding frenzy, which would be needed to amortize the cost of any serious investigative journalism required before disseminating similar information affecting a larger portion of the major advertisers.

And this is only one relatively small industry. What percent of the senior executives of the Fortune 500 companies would be threatened by any serious coverage of the 150,000 words added this year or next year to US tax code and regulations?

The Tax Foundation and many others believe that the vast majority of US taxpayers would benefit from substantial tax simplification.

It doesn't happen, because investigative journalism threatens the profitability of commercial media organizations.

Democratizing the Media

[edit | edit source]On December 7, 2016, Donald Trump complained that the political class could not “figure out what the hell is going on”[16] regarding the refugee crisis. Elsewhere we can discuss how the current models for funding media make it hard for anyone, elites and commoners, to understand virtually any of the seemingly intractable problems facing humanity today.

Yale law professor Bruce Ackerman has suggested distributing money to qualified investigative journalism organizations based on qualified internet clicks.[17]

Qualified internet clicks could be restricted to those who have a local tax identification (ID) number. The recipients could be limited to non-commercial investigative journalism organizations with transparent funding that put everything they produce on the web in the public domain -- and who write from a neutral point of view, avoiding inflammatory language and providing comparable space to responsible alternative perspectives.

The importance of avoiding inflammatory language can be seen in the 1994 Rwandan genocide: In 1993 leading Hutus there founded “Radio Télévision Libre des Mille Collines (RTLMC), which broadcast racist propaganda, obscene jokes and music,” and almost certainly contributed to the genocide. Publicly subsidized media required to live by a fairness doctrine might help diffuse similar situations in the future -- or at least reduce their lethality.[18]

McChesney and Nichols suggested that an appropriate funding level would be 0.2 percent of GDP, which was how much they said the US government provided in newspaper subsidies under the US Postal Service Act of 1792.[19]

They noted that the US has three positive experiences in nation building. The first was the United States itself. At a time when first class postage was between 6 and 25 cents, a newspaper could be delivered in state for one cent and out of state for 1.5 cents -- and newspaper publishers could have their papers delivered to other publishers for free. This encouraged literacy and reduced political corruption, both of which contributed to economic growth.[20]

Media subsidies also seemed vital to building the current democratic traditions in Germany and Japan after World War II: Generals Eisenhower and MacArthur with muscular support from President Truman closed fascist media organizations and opened new one instructed to disseminate whatever they thought was important -- even if it involved criticizing the occupiers. Without the latter the new media would have discredited themselves in the eyes of the German and Japanese people and likely would not have attracted the audience needed to build honest democratic traditions.[21]

What can we do?

[edit | edit source]If you like the analysis of this essay, you can discuss it with others including elected officials at all levels. As noted above, the funding level suggested by McChesney and Nichols (2010, 2016) was 0.2 percent of income. This amounts to $1 per week if you make $25,000 per year -- $2 per week if you make $50,000 per year. That's less than a cup of coffee or a pack of cigarettes in the US.

People everywhere can ask governmental officials to to devote roughly 1 percent of their budget to subsidizing qualified media in proportion to qualified Internet clicks, as suggested above. This can be justified for much the same reason that organizations have Accounting departments: To help people plan better, limit unnecessary and inappropriate expenditures and increase people's confidence that their money is wisely spent.

Where government represents 20 percent of the economy,[22] one percent of the budgets of governmental organizations represents 0.2 percent of the economy, matching the postal subsidies that helped make the United States what it is today, according to the discussion above.

There are still details that must be worked out to ensure that the media subsidized by such a system are selected democratically without interference from people more interested in protecting their power than in generating the information required to improve the quality of public discourse and problem solving including conflict resolution.

References

[edit | edit source]- McChesney, Robert W.; Nichols, John (2010), The Death and Life of American Journalism, Nation Books, ISBN 9781568586052

Notes

[edit | edit source]- ↑ See, e.g., including especially, Media and corruption and Media and politics.

- ↑ Media organizations everywhere sell changes in audience behavior to its funders. A media organization that does not have an audience will not have funding for long. Many major advertisers do experiments, e.g., advertising in one market but not in others. In this way, they can quantify the changes in customer buying behavior resulting from the advertising. However, major advertisers also compete on control of the media and the political process. They have and they will shift their advertising if they consider a certain channel unfriendly, e.g., from disseminating information they consider contrary to their interests. Most of the media in the US are funded primarily by advertising. Commercial broadcasting gets 100 percent of its funding from advertising. The major media conglomerates, ABC, CBS, CNN, NBC, Fox are all major publicly traded companies or major subsidiaries of such. Some of their revenue comes from license fees and much of that comes from network affiliate broadcasters, who are themselves funded by advertising. A newspaper typically generates 70–80% of its revenue from advertising, and the remainder from sales and subscriptions (Wikipedia, “Newspaper”, “https://en.wikipedia.org/wiki/Newspaper#Advertising”; this cited Mensing, Donica (Spring 2007). "Online Revenue Business Model Has Changed Little Since 1996". Newspaper Research Journal. Accessed 2016-11-13).

- ↑ Daniel Kahneman (25 October 2011). Thinking, Fast and Slow. Macmillan. ISBN 978-1-4299-6935-2. https://books.google.com/books?id=ZuKTvERuPG8C. Retrieved 8 April 2012.

- ↑ 150,000 words per year is the slope of a least squares fit of a straight line to data published by the Tax Foundation with adjusted R-squared of 99.2 percent. The raw data are available in two Tax Foundation documents: Number of Words in Internal Revenue Code and Federal Tax Regulations, 1955-2005, Tax Foundation, retrieved 2016-11-13 and Greenberg, Scott (2015-10-08), Federal Tax Laws and Regulations are Now Over 10 Million Words Long, Tax Foundation, retrieved 2016-11-13

- ↑ Stanley Surrey (1965), "Complexity and the Internal Revenue Code: The Problem of the Management of Tax Detail", Law and Contemporary Problems: 673–710, retrieved 2016-11-13

- ↑ DeHaven, Tad (2014-07-01), Corporate Welfare in the Federal Budget, Policy Analysis, Cato Institute, retrieved 2014-09-01

- ↑ See also Wikiversity, "Media and corruption".

- ↑ A more careful analysis revealed that the average income grew at 2.2 percent per year between 1947 and 1970 and 1.8 percent since. That was true for the median as well until around 1970. Since then the median has grown at only about 0.5 percent per year.

- ↑ "Table F-1. Income Limits for Each Fifth and Top 5 Percent of Families (All Races): 1947 to 2010", Current Population Survey, Annual Social and Economic Supplements, United States Census Bureau, retrieved 2012-01-24

- ↑ Piketty, Thomas; Saez, Emmanuel, Anthony Barnes Atkinson; Thomas Piketty (eds.), Income Inequality in the United States, 1913-2002, retrieved 2012-02-08

{{citation}}: Unknown parameter|booktitle=ignored (help) - ↑ The differences between the Census and Internal Revenue Service Data can be seen most easily in the 95th percentile, present in both data sets. For more details see the help file for the "incomeInequality" data in the Ecdat package available from the Comprehensive R Archive Network (CRAN; see r-project.org).

- ↑ Hodge, Scott (2016-06-15), The Compliance Costs of IRS Regulations, Tax Foundation, retrieved 2016-11-13. Demian Brady of the National Taxpayers Union Foundation estimated this cost at $234.4 billion, just over half of Hodge's estimate. The difference hardly matters for present purposes, and neither number considers the losses to the economy that result from allocating resources to purposes that are less productive for the economy as a whole, because it seems to reduce the tax load for certain taxpayers. Brady, Demian (2016-04-06), Tax Complexity 2016: The Increasing Compliance Burdens of the Tax Code, National Taxpayers Union Foundation, retrieved 2016-11-13

- ↑ Lawrence Lessig (2011), Republic, Lost: How Money Corrupts Congress—and a Plan to Stop It, Twelve, ISBN 978-0-446-57643-7, retrieved 2016-11-13

- ↑ Halper, Evan (May 5, 2006). "Maker of Tax Software Opposes State Filing Help: The government's offer to fill out forms is a hit with poor and elderly, but not with Intuit". Los Angeles Times. Retrieved March 19, 2013.. See also Lessig (2011, p. 201) and the Wikipedia article in “Repubic, Lost”.

- ↑ Galbi, Douglas (September 14, 2008), U.S. Annual Advertising Spending Since 1919, Galbi Think!, retrieved 2016-11-13

- ↑ Johnson, Jenna (2016-12-07), "Trump calls for 'total and complete shutdown of Muslims entering the United States'", The Washington Post, retrieved 2016-11-13

- ↑ Bruce Ackerman (2010). "5. Enlightening politics". The Decline and Fall of the American Republic. Harvard U. Pr.. p. 133. ISBN 978-0-674-05703-6., Bruce Ackerman (May 6, 2013), "Reviving Democratic Citizenship?", Politics & Society, Sage, 41 (2): 309–317, doi:10.1177/0032329213483103, retrieved June 16, 2013

- ↑ Youngblood, Steven (2016), Peace journalism principles and practices, Routledge, p. 28, ISBN 978-1-138-12469-1

- ↑ They wrote, “If the United States government subsidized journalism in the second decade of the twenty-first century as a percentage of GDP to the same extent that it did in the first half of the nineteenth century, it would spend in the area of $35 billion annually.” This is just over 0.2 percent of the $18.6 trillion figure for GDP mentioned above. McChesney, Robert; Nichols, John (2016), People get ready: The fight against a jobless economy and a citizenless democracy, p. 167, ISBN 978-1-56858-522-2

- ↑ McChesney and Nichols (2010, ch. 3. Why the State, esp. pp. 118-138)

- ↑ McChesney and Nichols (2010, esp. Appendix 2, pp. 241-254)

- ↑ US "Federal Net Outlays as Percent of Gross Domestic Product" have averaged roughly 20 percent since 1952, according to the Federal Reserve Banks of St. Louis. Federal Net Outlays as Percent of Gross Domestic Product (FYONGDA188S), United States Federal Reserve Bank of St. Louis, Jul 29, 2016, retrieved 2016-11-18

KSF

KSF