Economics Lecture Three

From Conservapedia

From Conservapedia You can post answers here: Economics Homework 3 Answers

Economics Lectures - [1 - 2 - 3 - 4 - 5 - 6 - 7 - 8 - 9 - 10 - 11 - 12 - 13 - 14]

Recall that a "free market" is one where there is no interference by government with the price and quantity of goods sold. In a free market, government does not regulate the price or limit the quantity.

In a free market, supply equals demand for both the price and quantity sold. That is one of the beauties of free enterprise. It is efficient, it is productive and it minimizes waste. The supply and demand react almost immediately to changing needs and circumstances. Millions of transactions, or sales, occur to bring the price to its point of price equilibrium. The free market reacts much more quickly than government can. For example, government offices typically close at 4:30 or 5pm, and most government offices (other than the Post Office) are closed on Saturday, but the free market is working 24 hours a day, 6 or 7 days a week. You may be asleep, but the free market is at work to bring prices to their most efficient levels.

Prices change daily due to continual changes in supply and demand. During your next few trips to the supermarket, notice how much the prices fluctuate. This is because both supply and demand are constantly changing. Supply changes due to variations in the amount of unsold goods, problems or improvements in manufacturing, farming or shipping, or different yields in crops due to weather and other factors. Labor costs change over time, which also affects supply. Demand is constantly fluctuating also. Every day people lose or switch jobs, which affects their buying decisions. The changing of the seasons also affects demand, as do variations in personal tastes.

Two decades ago there was tremendous demand for Beanie Babies, driving up the price. Now there is far less demand, so the price has fallen. Over time, there are fluctuations in price for virtually every good and service.

This week we build on several principles introduced last week, and also introduce some entirely new concepts.

Contents

- 1 The Law of Demand and Other Key Points

- 2 The Law of Supply

- 3 What Happens When the Supplier Increases His Price?

- 4 Price Elasticity of Demand

- 5 Income Elasticity

- 6 Complements and Substitutes

- 7 Trade and the Creation of Wealth

- 8 Tariffs and Quotas

- 9 Price Controls

- 10 Minimum Wage

- 11 Price Discrimination

- 12 Assignment

The Law of Demand and Other Key Points[edit]

Building on last week's class, we can now state the three most basic principles of economics with respect to price:

- A fall in price tends to increase the quantity demanded by the public, and a rise in price tends to decrease the quantity demanded. LOWER PRICE MEANS HIGHER QUANTITY DEMANDED (and higher price means a lower quantity demanded). This is known as the Law of Demand: the quantity demanded changes inversely with price.

- When the quantity demanded exceeds the quantity supplied at a given price, the price tends to rise as sellers take advantage of the high quantity demanded. Similarly, when the quantity supplied exceeds the quantity demanded, the price tends to decrease as sellers try to sell their unsold goods.

- Price tends to move towards the amount at which the quantity in demand is equal to the quantity in supply: EQUILIBRIUM IS WHERE QUANTITY SUPPLIED EQUALS QUANTITY DEMANDED.

Many of the problems in this course, and in any economics course, can be answered just by remembering and applying the above three principles. The equilibrium price is the result of a "tug of war" between the buyers and sellers: the buyers (the public) want to pay less (a lower price), and the sellers want to receive more (a higher price). These opposing forces are constantly working to keep the price at equilibrium.

The Law of Supply[edit]

When solving a problem in economics, always take care to keep the "supply" and "demand" curves separate in your mind, even though they are superimposed on each other in one graph. The "supply" curve is from the perspective of the seller, the owner, the manufacturer, the company, etc. It is on this side that the good is produced and then sold to the public. In some ways this side is more difficult for students to understand, because in real life students are almost always on the opposite side, the demand side, where the buyers are.

Question: what does the price in a graph of the supply curve really represent? The price for a supply curve is the market price for the sale of his goods or services. When that market price increases, the supplier will produce more of his good (or provide more of his services). For example, as the salaries of professional baseball players for their services have increased in the major leagues, more and more people have tried to become professional baseball players to benefit from the higher prices paid for the services. The more profitable that the sale of a good becomes, the more of that good that people want to produce (or, in the case of baseball, the more of that service that players want to provide).

Let's take another example. If the market price of oil is low, as in only $10 a barrel, then there is no incentive to increase the production of oil. No one is going to want to drill for new oil wells. It's not worth it. It's not profitable enough. But as the market price of oil increases to $100 a barrel, then there is much more profit to be made by producing more oil. So companies will drill many new oil wells in order to sell at the high price and make more profits. The supply of oil increases as its market price increases.

This is the Law of Supply: as the market price for a good increases, the quantity supplied will increase. This is because as the market price increases, there is an incentive to supply more of the good or service to the market. This is why the supply curve is upward sloping on a graph of price and quantity.

What Happens When the Supplier Increases His Price?[edit]

Question: why doesn't a supplier repeatedly increase the price of his good or service to make more money?

The suppliers of goods and services would like to increase their prices so that they can make more money. So why don't companies repeatedly increase their prices so that they can make more money? For example, why doesn't Shop-Rite increase its price for milk and eggs by 10% every month?

Imagine yourself as president of a company that makes "widgets" (a "widget" is a term in economics for an imaginary good), and you are having a meeting to discuss your product. Inevitably an employee suggests increasing the price on the widget so that the company will make more money. People who have never studied economics think that increasing the price will always result in increased revenue from sales, because revenue is price times quantity sold. If the quantity sold is constant, then increasing the price should have the effect of increasing the revenue from sales, right?

But suppose you have an employee who had taken this economics course. He or she points out that an increase in price will reduce the demand, because of the Law of Demand: the quantity demanded by the public will decrease when the price increases. You will sell fewer goods if you raise the price: your "quantity sold" will decrease if you increase your price. Your overall revenue is price times quantity (PxQ), and a decrease in quantity sold may cause your overall revenue (PxQ) to decrease also. Think of what happens to the sales of candy bars if their price is increased to $5 per candy bar. Most people do not want to buy them anymore.

As owner, you then ask, “how much fewer sales will result if I increase the price?” If the quantity sold decreases by a smaller percentage than the price increases, then overall revenue (price times quantity sold) will increase. If, however, the quantity sold decreases by a larger percentage than the price increases, then overall revenue will decline. As owner, what matters most to you is what happens to "P times Q" as you change the price.

Price Elasticity of Demand[edit]

Here is a new concept for you: "price elasticity of demand." This concept is needed to solve the problem discussed in the prior section above: if the price of a good increases, will the revenue increase or decrease? The answer to that question is provided by the "price elasticity of demand" for the good.

Let's first try to define what "price elasticity of demand" is. Think of a rubber band. How "elastic" is the rubber band? If you pull on it, does it stretch easily or not? If you pull with a fixed force on a bunch of different rubber bands, the ones having greater elasticity will stretch more than the ones having less elasticity.

Our "force" is a change in price, and our "rubber band" is the demand by the public for the good. The "price elasticity of demand" of the good is the change in demand for the good in response to a change in price. Does an increase in price for the good cause a large decrease in demand? If so, then it has high elasticity. But if an increase in price for the good does not cause much change in demand, then it has low elasticity.

Specifically, the price elasticity of demand is the percentage change in quantity demanded divided by the percentage change in price. Because it is always negative, the sign is dropped so that price elasticity is always a positive number. For example, "-1/3" in price elasticity of demand is called "1/3" without the negative sign.

Let’s take an example. Suppose an NFL (football) team wants to make even more profit than it does already, and decides to increase its ticket prices by 20% for next season. Because attending football games is an obsession for certain fans, they are likely to pay the higher prices in order to continue attending. Perhaps only 5% of these fans will choose not to buy. The quantity demanded changes little despite a large increase in price. This means the elasticity of demand is low. To be precise, it is the percentage change in quantity demanded divided by the percentage change in price: -5%/20% = -1/4. The sign is dropped so the elasticity is expressed as “1/4”. This low elasticity encourages the supplier (the football team owner) to repeatedly increase the price. Low elasticity is described as an “inelastic demand” by economists.

How much more revenue does the team make by increasing the price? Revenue is price times quantity. If the original ticket price was P and the original quantity of tickets sold was Q, then initial revenue is P multiplied by Q (P times Q, or PxQ, or PQ). After the price increase, the revenue is (1.20 x P) x (.95 x Q) = 1.14PQ. Revenue has thus increased 14% simply by increasing the price. That explains why ticket prices for professional sports keep increasing, and why the luxury boxes are so expensive. The price elasticity of demand for professional sports (particularly football) is low. The fans still want to watch, no matter how expensive it gets. Of course, a higher price does cause some decrease in demand, but not much of a decrease.

Let’s take another example. Suppose that airlines increase the price on their flights from New York to Florida from an average of $300 per seat to $500 per seat. That is a 67% increase. What would that do to the tourist traffic to Florida from New York? It takes only a day and a half to drive to Florida, which incurs gas charges of perhaps $125 and a hotel charge of $80. Many tourists would likely drive rather than pay the higher fares. Due to the price increase, the demand for these higher-priced airline tickets could fall by 75%, assuming that many of the ticket-buyers are tourists rather than people traveling for their job.

What is the price elasticity of this demand? The percent change in quantity demanded is -75% (3/4) and the percent change in price is 67% (2/3), so the elasticity is -3/4 divided by 2/3 = -9/8. The sign is dropped so the elasticity is expressed as 9/8. It is greater than 1, and thus is described as having an “elastic demand” rather than an “inelastic demand” (inelastic demand is a value less than 1). When the price elasticity of demand equals 1, then it is called “unit elasticity of demand.”

What does it mean to a company if its goods have “elastic demand”? It means the company should be cautious in raising prices. Look at what happens to the revenue to the airlines due to the elastic demand for seats on their planes. The initial revenue was price times quantity, which is PxQ, or PQ. The revenue after the pricing change is (5/3)(P)(1/4)(Q) = (5/12)PQ. Its revenue fell to 5/12 of its initial revenue due to the price increase. The airlines lost over half of its revenue by increasing its price! Uh oh, that requires laying off many employees, reporting losses to the investors, and firing the persons responsible for that price increase.

Consider further the impact of a price increase on the same route that is due only to an increase in fuel costs. Will those price increases have the same elasticity? (No, because the alternative of traveling by car increases in cost by a similar amount. But demand will decrease a bit, because some people will simply stay at home rather than travel.)

For Honors Students Only, Concerning Calculating Elasticities[edit]

There is an ambiguity in calculating the percentage change in price or quantity. What should be used as the denominator in deriving the percentages? If $100 increases to $110, then the percent change could be described as $10/$100 x 100% or $10/$110 x 100%. Above we used the initial price and quantity as the denominator, but we could have used the final price and quantity as the denominator instead.

Economists resolve this by typically using the average overall value as the denominator in calculating the elasticities. So if the price changes from $20 to $30, the percentage change in price is $10 divided by the average of $20 and $30, which is $25. The percentage change is thus $10/$25, which is 40%. This is also known as the “arc elasticity” because it is a more accurate depiction of the “arc” or curve of demand. Use this method when doing specific calculations on homework in order to obtain the precise result.

Income Elasticity[edit]

Once you grasp the price elasticity of demand, you’ll see that you can describe the elasticity (or responsiveness) of many other variables in economics.

Someone's income, like someone’s salary at his job (only about $7.50 an hour at McDonald's), affects his demand for goods. More Mercedes-Benz luxury cars will sell when the average income increases than when it decreases. So economists find it useful to describe the “income elasticity of demand,” which is the percentage change in quantity demanded divided by the percentage change in income.

Most goods sell in greater quantities when the income of buyers increases. We all tend to go to restaurants more often, buy new clothes more often, and pay more for goods and services when we our income increases. When our income declines, we reduce our purchases.

Consider the difference between goods we need (e.g., food) and goods we want (e.g., restaurant food). The goods that we need are “necessities”; the goods we merely want are “luxury goods.” Necessities are income inelastic, because they are needed and purchased whether our income is high or low. Whether we have a good year or a bad one in terms of income, we still buy things like daily food, basic clothing, and heating at home. In contrast, luxury goods like Mercedes-Benz cars are income elastic. People do not buy as many yachts and luxury cars and homes when times are tough.

A necessity is a good that has a positive income elasticity that is less than 1. A luxury is a good that has an income elasticity greater than 1.

Here are some useful definitions. A normal good is one for which demand increases when income increases. Nearly all goods are “normal” goods. Income goes up, then more of it is purchased. But occasionally a good can be found that is “inferior”, such that demand actually decreases when income increases. Can you think of one? Margarine is an example. When income increases, people buy less margarine because they are buying a more expensive, and more desirable, substitute (butter).

So remember: when the income elasticity is positive, then the good is “normal”. When the income elasticity is negative, then it is an inferior good.

Complements and Substitutes[edit]

A complement of a good is something that is used with it. Compact disks (CDs) are complements of CD players. Hole punchers are complements to three-ring binders. Monitors are complements to desktop computers. Gasoline is a complement to cars. Bread is a complement to sandwich meat.

A substitute of a good is something that replaces it. Bicycles are substitutes for mopeds. Motorcycles are substitutes for cars. Channel 2 is a substitute for channel 4 on television. One non-fiction book is a substitute for another. Chicken is a substitute for beef.

Elasticity of demand can apply to complements and substitutes. The “cross elasticity of demand” is how the quantity demanded of one good responds to a change in price of a different good. Specifically, it is measured as the percentage change in demand for one good in response to the percentage change in price for a different good.

Note that a change in the price of a substitute or complementary good causes the entire demand curve of the other good to move left or right.

If good “A” sees a 20% drop in demand based on a 20% increase in price of good “B”, then the cross elasticity of demand is -20%/20% = -1. Do you think good A and B are complements or substitutes? They are complements. A negative cross-elasticity in demand means they are complements. Their elasticity is in the same direction as the price elasticity of demand for the good itself.

If, however, good A sees a 20% increase in demand based on a 20% increase in price of good B, then their cross-elasticity in demand is 20%/20% = 1. This positive value means that A and B are substitutes for each other.

Ponder the above for a while.

Trade and the Creation of Wealth[edit]

Do you ever wonder how wealth is created? Suppose you are good at fixing cars, but not computers. Your computer breaks, but you do not know how to fix it. You could take it to a computer store, but it will want $200 to fix it. At this point your wealth is the value of your computer minus $200.

But another homeschooler is very good at fixing computers, and offers to repair your computer for only $100. That creates wealth for you; because of your friend, now your wealth is the value of your computer minus only $100.

You then realize that your friend is having a problem with his car, which you can fix. You offer to fix your friend's car if he fixes your computer. Now your wealth is the value of your computer minus almost nothing. The "trade" between you and the homeschooler increased the wealth of both of you.

Based on the above example, most economists view "trade" (buying and selling goods and services with others) as increasing wealth. Whenever two people enter into a transaction in the free market, each side should be benefiting and increasing their wealth. When you buy milk at a grocery store, you are paying less than what the milk is really worth to you, or you would not spend time buying it. You make your purchase because it helps you. The store is making money from the milk, or it would not bother trying to sell it. So the store also becomes wealthier from the transaction. The overall wealth of society is increased by these transactions. The more transactions, the greater the wealth. It seems clear that trade within a country, like the examples just described, are to be encouraged because they increase the wealth of both the buyers and the sellers.

The term "free trade" refers to transactions between two different countries, as in trade between China and the United States. Trade with a foreign government makes it wealthier. We may also become wealthier from the transaction, but our gain is probably not as much as the foreign nation's benefit. We may actually end up spending more money defending against the foreign government that we trade with, as our military defense costs may be greater than our benefit from the trade. Or our money may be used by the foreign government to enslave its people, which we do not want. We may be losing jobs because of our trade with foreign governments, as factories are built in the foreign nations rather than in our nation. For most of the history of the United States, "free trade" with foreign nations was not popular, but it has been increasingly used in recent years. Wal-Mart, for example, imports many billions of dollars of low-cost goods directly from China, where they are produced by paying workers very little in wages.

Ask yourself: do you support "free trade" with hostile foreign countries?

Tariffs and Quotas[edit]

"Imports" are goods shipped into our country by a foreign country, for sale in our country. China imports many goods that are sold in the United States by Wal-Mart, for example.

There are valid reasons to discourage the sale of imports and encourage the sale of goods made domestically (made in the United States). The money paid for imports goes to the foreign companies, and support the foreign governments. The sale of imports do not help Americans as much as the sale of made-in-America goods do.

There are two approaches to disfavoring imports. The primary way in history was to impose a tariff on imports. A tariff is a tax on imports. A tariff raises the price of imported goods, and the supplier must then reduce its received price to attain the same level where supply meets demand. This has the effect of reducing supply. Goods made domestically (in the United States) can then increase their sales due to the decrease in sales by the imports. A tariff on a foreign-made car like the "Honda" would reduce the supply of Honda cars in the market. American car companies would benefit from that, although consumers who want to buy more Hondas might not.

The other approach to limiting imports is the use of quotas. Instead of imposing a tariff on Hondas, our government could set an upper limit (quota) on the total quantity of Hondas that may be sold in the United States each year. Quotas also reduce supply, but without generating any revenue to the government. Instead, quotas have the effect of increasing the price of the good (Hondas in this case) with the higher price going to the company that sells the Hondas. The United States government does not obtain any revenue from a quota, while it does obtain revenue from tariffs. Quotas help the foreign companies more than tariffs do, without bringing revenue to the government imposing the quota.

Prior to the passage of the Sixteenth Amendment that legalized the income tax in 1913, and even afterward, the major source of revenue for our national (federal) government in Washington, D.C. was tariffs. But tariffs have long been controversial, and divided the North (which liked them because they "protected" the northern manufacturers against competition from imports) and the South (which disliked them because it increased the prices of goods they purchase and caused foreign nations to retaliate by placing tariffs on cotton and other exports from the South). Tariffs were a major cause of the Civil War.

Today tariffs are rarely used and the government relies almost entirely on the income tax for paying for the massive government expenses.

Price Controls[edit]

So far we have been talking about transactions in the free market, in the absence of government controls. But the government does interfere in many ways in our economy. America enjoys more free enterprise than any other large country, but our government does regulate many types of markets, and even controls some of them.

During World War II, the government imposed controls to prevent companies from raising prices during the war. The needs of our military for goods increased demand that would ordinarily shift the demand curve and increase prices. But the government prohibited this from happening by limiting price increases. "Price controls" are limits on the prices at which certain goods can be sold.

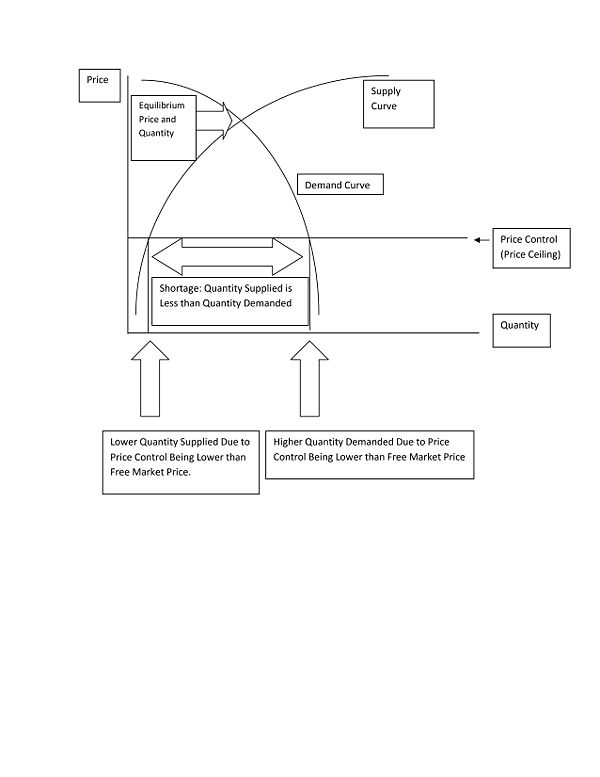

Controls on prices (and also wages) were also imposed to control inflation (increases in all prices) in the early 1970s. A war in the Middle East, and assistance in that war by the United States of Israel, caused the Arab nations to reduce their supply of oil to us. That created gasoline shortages and increased energy costs, which then drove up inflation. Price controls were designed to limit the increases. But as the following graph illustrates, price controls create shortages:

When a price control causes a difference between the supply quantity and the demand quantity, it is the lower quantity that becomes the market. The market can never be more than the lesser of the quantity in supply and the quantity in demand. Because the quantity supplied is much less than the quantity demanded in the above graph, a shortage results.

Rent control in New York City is an example of a price control that has terrible effects. The people lucky enough to be a rent-controlled apartment pay much less than the market rate, and never move out. New housing is not created as quickly as it should be, because landlords are not sure they will always be able to charge the market rate. Nearly every economist, liberal or conservative, agrees that rent control is harmful, and yet liberal politicians impose it in most big cities.

Minimum Wage[edit]

Today, the government prohibits employers from paying wages below a certain amount per hour, called the “minimum wage.” In 2013, the minimum wage rate in New Jersey and nationwide is $7.25 per hour (in some states, such as California and Nevada, state law requires a minimum wage that is higher than the federal minimum of $7.25 per hour). If you work 40 hours a week for 50 weeks, for a total of 2000 hours, then $7.25 per hour results in a yearly (annual) salary of $14,500. It is not easy to survive on so little income.

But it is even more difficult to survive without a job at all, which is what happens to more people when the minimum wage is increased. Employers who would hire someone to work at $5 per hour might not be able to hire him at $7.25 per hour. Isn’t a job at $5 an hour better than no job at all?

Also, the higher the minimum wage is in the United States, the greater the incentive for companies to move their factories to another country, such as Mexico or China, where workers are paid much less than $7.25 per hour.

There is another effect to raising the minimum wage that is also harmful. Research proves that raising the minimum wage causes teenagers to drop out of school, or not go on to college, because they can make more money working at jobs than they could before. This can be understood as follows. Suppose that "x" number of students quit school to work at jobs when the minimum wage is $6 per hour. If the minimum wage is raised from $6 per hour to $7 per hour, then jobs appear more attractive to students and even more will leave school than before. More than "x" students will quit school and go to work at $7 per hour than at $6 per hour. Therefore raising the minimum wage causes more students to leave school in order to work at jobs.

That is not good, because typically the more education someone has, the higher his income is. Studies show that going to a four-year college increases the lifetime income of an average person by about $500,000. Students who complete four-year colleges make more money on average than students who completely only two-year colleges. Students who complete two-year colleges likewise have higher average incomes than students who end their education when they graduate from high school.

In other words, increasing the minimum wage entices students to take advantage of a "short-term" benefit of the higher wage, but they are worse off in the "long-run" over the time period of their entire lives.

Price Discrimination[edit]

The term “price discrimination” sounds ugly, but it merely means selling the same good at different prices to different people. It is an attempt by a seller to capture additional money from buyers who are willing to pay more.

Airline tickets are an example. Businesses are willing to pay more for airline tickets for their employees to travel to business meetings than tourists are. Why? Because the businessmen are traveling to make more money for their company, and the airline ticket can be paid out of their profits. If they are flying to do a deal worth $100,000, then they’re willing to pay a thousand dollars for a round-trip airline ticket. Not so for tourists who are willing to pay only $200-300.

The airline wants to sell the identical seat at a price low enough for the tourist to pay, and then at a different, much higher price for the businessmen. This is price discrimination, because it distinguishes or discriminates based on who the buyer is. “Perfect price discrimination” sells each unit of a good at the maximum amount each individual buyer is willing to pay.

There are laws against price discrimination, but most sellers find clever ways to do it anyway. Airlines have distinguished between business customers and tourists by its “Saturday night stay-over” rule, or by changing the price depending on how far in advance the purchase is made (tourists can buy further in advance than businessmen can). If the traveler reserves the return flight to include staying over at least one Saturday night, or if he buys months in advance, then he is likely a tourist. If he flies out and back in the same week without staying through the weekend, or if he buys his ticket only a week before take-off, then he is likely a businessman. So the airline tickets are often priced more cheaply for those who purchase a long time in advance or stay over at least one Saturday night before returning back.

In general, price discrimination depends on the existence of obstacles to prevent buyers from reselling their goods to other buyers. If the same good is sold at $X to person A and $Y to person B, and X<Y, then person A could buy an extra good and sell it to person B at less than $Y. The price discrimination would collapse due to the resale market. Price discrimination works only when the goods cannot be resold, as in a tailored suit or dress, or an airline ticket that limits use to the person whose name is on the ticket.

Assignment[edit]

Read and, if necessary, reread the above lecture. Complete the homework assignments through the level at which you choose to enroll in this course:

1. What is a substitute for french fries, and what is a complement for them?

2. Give an example of a good that has a large price elasticity, meaning that a small decrease in price causes a big increase in demand.

3. Explain the concept of income elasticity.

4. In connection with price elasticity of demand, a nearly perfectly elastic demand curve is nearly ________ in shape, while a nearly perfectly inelastic demand curve is nearly __________ in shape.

5. Why is the name "necessity" given to a good that has an income elasticity of less than one, and the name "luxury" given to a good that has an income elasticity of more than one?

6. Give an example of a "normal" good, and an example of an "inferior" good.

7. A "price ceiling" is a type of price control that sets the maximum price allowed by law for something (like a real ceiling). A "price floor" is a type of price control that sets a minimum price allowed by law for something (like a real floor). Does a price ceiling that is set below the equilibrium (free market) price cause a surplus or a shortage? Using the graph in this lecture, explain why a surplus or a shortage is created by a price ceiling.

Honors[edit]

Write an essay of about 200-300 words total on one or more of the following topics:

8. Take a straight-line demand curve and describe the shape of the total revenue curve as a function of price.

9. Explain price discrimination, and conclude with your view of whether it should be legal or illegal.

10. Do you support "free trade" because it creates wealth, or do you oppose it for simply redistributing wealth to foreigners, some hostile to the United States?

11. What is your view of the minimum wage? Should it be increased?

12. Describe and discuss how wealth is created in society.

Categories: [Economics lectures]

↧ Download as ZWI file | Last modified: 02/27/2023 18:14:50 | 47 views

☰ Source: https://www.conservapedia.com/Economics_Lecture_Three | License: CC BY-SA 3.0

ZWI signed:

ZWI signed:

KSF

KSF