Berkshire Hathaway

From Nwe

From Nwe | Berkshire Hathaway, Inc | |

| Type | Public (NYSE: BRKA, NYSE: BRKB) |

|---|---|

| Founded | 1839 (as Valley Falls Company) |

| Founder | Oliver Chace |

| Headquarters | |

| Key people | Warren E. Buffett (Chairman & CEO) Charles T. Munger (Vice Chairman) |

| Area served | USA |

| Industry | Property and casualty insurance, Diversified investments |

| Products | Conglomerate US$13.213 Billion (2007) |

| Employees | 233,000 (mostly in subsidiaries) (2008) |

| Subsidiaries | Berkshire Hathaway Assurance, The Buffalo News, GEICO, General Re, International Dairy Queen, Fruit of the Loom, Helzberg Diamonds, NetJets, The Pampered Chef, et al.[1] |

| Website | www.berkshirehathaway.com |

Berkshire Hathaway (NYSE: BRKA and NYSE: BRKB) is a conglomerate holding company headquartered in Omaha, Nebraska, U.S., that oversees and manages a number of subsidiary companies. Berkshire Hathaway's core business is insurance, including property and casualty insurance, reinsurance and specialty nonstandard insurance. Berkshire owns a diverse range of businesses including candy production, retail, home furnishings, encyclopedias, vacuum cleaners, jewelry sales; newspaper publishing; manufacture and distribution of uniforms; manufacture, import and distribution of footwear; as well as several regional electric and gas utilities.

Berkshire Hathaway was originally founded as a conglomeration several New England textile manufacturers. In the 1960s its assets, and a sizable amount of cash on the balance sheet, caught the attention of Warren Buffett, a little-known investor from Omaha, Nebraska. Buffett began purchasing Berkshire Hathaway stock and became its Chairman and CEO in 1970. Under Buffet’s leadership the company entered the insurance business and became an investment company. Buffett is a proponent of value investing: careful evaluation of the assets and business potential of companies, and investment in businesses whose stock price is lower than the actual value of their shares. On December 31, 2008, Class A shares of Berkshire Hathaway were selling for $96,600, making them the highest-priced shares on the New York Stock Exchange. Berkshire Hathaway averaged an annual return in excess of 21 percent to its shareholders from 1965 to 2006, employing large amounts of capital and minimal debt.

History

Origins

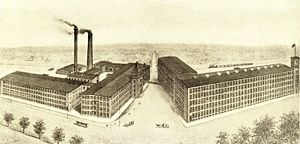

Berkshire Hathaway began as a merger of several textile manufacturing companies. In 1839, Oliver Chace (1769-1852) acquired and reorganized the Valley Falls Company in Valley Falls, Rhode Island. The Valley Falls Company eventually bought the Albion Mills, Tar-Kiln Factory in Burrillville, Manville Mills in Rhode Island, and Moodus Cotton Factory in Connecticut. Berkshire Cotton Manufacturing Company in was founded in 1889 in Adams, Massachusetts. By 1917 the company was capitalized at $2,500,000 and contained over 260,000 ring and mule spindles and 6,500 looms for the production of cotton textiles [2], making it one of the largest cotton textile companies in the world. In 1929, Berkshire merged with the Valley Falls Company and became known as Berkshire Fine Spinning Associates. [3] The company acquired the King Philip Mills in Fall River, Massachusetts in 1930, and Parker Mills of Fall River and Warren, Rhode Island in 1931. Many New England textile companies failed during the 1920s and 1930s, but Berkshire Fine Spinning Associates survived the Great Depression intact and prospered during and after World War II. At its peak in 1948, under the leadership of Malcolm Chace, Jr., Berkshire earned US$29.5 million and employed 11,000 workers at 11 mills.

Hathaway Manufacturing Co. was founded in New Bedford, Massachusetts in 1888 by Horatio Hathaway. In 1955, Chace Jr. organized a merger of Berkshire Fine Spinning Associates and Hathaway Mills to form Berkshire Hathaway Inc. After the merger, Berkshire Hathaway, headquartered in New Bedford, Massachusetts, had 15 plants employing 12,000 workers with more than $120 million in annual revenue. By the end of the decade, seven of those locations had been closed, accompanied by large layoffs.

Investment company

In the early 1960s, Berkshire Hathaway had declined to seven plants and 6,000 employees, annually producing one quarter of a billion yards of material that sold for more than $60 million. These assets, and a sizable amount of cash on the balance sheet, caught the attention of Warren Buffett, a little-known investor from Omaha, Nebraska. Buffett, who had founded Buffett Partnership Limited to make investments, started buying stock in Berkshire in 1962 at $7.60 a share. He eventually paid an average of $14.86 a share, or a total of $14 million, and took control of the company on May 10, 1965. By then, the company was operating two mills with 2,300 employees. Buffett initially maintained Berkshire's core business of textiles, but by 1967, he was expanding into the insurance industry and other investments.

In 1970, Warren Buffet became Chairman of Berkshire Hathaway.[3] Berkshire first ventured into the insurance business with the purchase of National Indemnity Company. In the late 1970s, Berkshire acquired an equity stake in the Government Employees Insurance Company (GEICO), which forms the core of its insurance operations today. Buffett used the "float" from the insurance operations (money paid in premiums by insurance policy holders and held until claims are paid out) as capital to finance numerous investments. In the early part of his career at Berkshire, Buffet made long-term investments in publicly quoted stocks; later Berkshire began acquiring entire companies. Berkshire now owns a diverse range of businesses including candy production, retail, home furnishings, encyclopedias, vacuum cleaners, jewelry sales; newspaper publishing; manufacture and distribution of uniforms; manufacture, import and distribution of footwear; as well as several regional electric and gas utilities. The last textile operations were shut down in 1985.

Warren Buffet and value investing

Warren Buffett (b. 1930), the CEO of Berkshire Hathaway, is respected for his investment prowess and his deep understanding of a wide spectrum of businesses. Often called the "Oracle of Omaha,"[4] or "the Sage of Omaha",[5] Buffett is noted for his adherence to the philosophy of value investing and for his personal frugality despite his immense wealth. While at Columbia Business School, Buffet studied under David Dodd and Benjamin Graham, author of The Intelligent Investor, and from 1954 – 1956 he worked for Graham Newman, Graham’s small investment company. Value investing involves carefully evaluating the assets and business potential of companies and buying shares in businesses whose stock price is lower than the actual value of their shares. Buffet credits Charlie Munger, who joined Buffett at Berkshire Hathaway in the 1970s and has since been Vice Chairman of the company, with encouraging him to focus on long-term sustainable growth rather than simply on the valuation of current cash flows or assets.[6]

Under Buffet’s leadership, Berkshire Hathaway invested in solid businesses offering goods and services for which demand would continue to grow over the next decades. Buffet emphasizes frugality; his salary as CEO, US$100,000 per year with no stock options, is among the lowest salaries[7] for CEOs of large companies in the United States.[8] Berkshire Hathaway averaged an annual return in excess of 21 percent to its shareholders from 1965 to 2006 while employing large amounts of capital and minimal debt[9].

Buffet’s annual letters to the shareholders of Berkshire Hathaway are widely read and quoted.

On December 31, 2008, Class A shares of Berkshire Hathaway were selling for $96,600, making them the highest-priced shares on the New York Stock Exchange. Shares closed over $100,000 for the first time on October 23, 2006, and closed at an all-time high of $150,000 on December 13, 2007. Berkshire Hathaway is notable in that it has never split its shares, reflecting its desire to attract long-term investors rather than short-term speculators. This policy has not only contributed to its high per-share price but also significantly reduced the liquidity of the stock. For this reason, Berkshire is not included in broad stock market indices such as the S&P 500, despite its size.

In 1995, to thwart the creation of UITs (Unit Investment Trusts) that would have marketed themselves as Berkshire look-alikes, Berkshire Hathaway created a Class B stock. The UITs would have pooled capital to purchase shares in Berkshire Hathaway; then sold portions of these shares to investors whose returns would have been diminished by commissions and management fees. The Class B stock has a per-share value kept (by specific management rules) close to 1⁄30 of that of the original shares (now Class A) and 1⁄200 of the per-share voting rights. Holders of Class A stock are allowed to convert their stock to Class B, though not vice versa.[10]

As of 2005, Buffett owned 38 percent of Berkshire Hathaway. Vice-Chairman Charlie Munger, also holds a stake big enough to make him a billionaire, and early investors in Berkshire David Gottesman and Franklin Otis Booth have also become billionaires. Bill Gates' Cascade Investments LLC is the second largest shareholder of Berkshire and owns more than 5 percent of class B shares.

Berkshire's annual shareholders' meetings in the Qwest Center in Omaha, Nebraska, are routinely attended by 20,000 people.[11] The 2007 meeting had an attendance of approximately 27,000. The meetings, nicknamed "Woodstock for Capitalists," are considered one of Omaha's largest annual events along with the baseball College World Series. Known for their humor and light-heartedness, the meetings typically start with a movie made for Berkshire shareholders. The meeting, scheduled to last six hours, is an opportunity for investors to ask Buffett questions.

Financials

- Cash and cash equivalents at December 31, 2007: US$44.329 billion

- Equity investments at December 31, 2007: $74.999 billion

- Total shareholders’ equity at December 31, 2007: $120.733 billion

- Revenue for 2007: $118.245 billion

- Net earnings for 2007: $13.213 billion

- Income taxes for 2007: $6.594 billion

Berkshire Hathaway businesses

Insurance and reinsurance businesses

Berkshire conducts insurance and reinsurance business activities through more than 50 domestic and foreign-based insurance companies. Berkshire’s insurance businesses provide insurance and reinsurance of property and casualty risks primarily in the United States. In addition, as a result of the General Re acquisition in December 1998, Berkshire’s insurance businesses also includes life, accident and health reinsurers, as well as internationally-based property and casualty reinsurers.

Berkshire’s insurance companies maintain capital strength at exceptionally high levels. This strength differentiates Berkshire’s insurance companies from their competitors. Collectively, the aggregate statutory surplus of Berkshire’s U.S. based insurers was approximately $48 billion at December 31, 2004. All of Berkshire’s major insurance subsidiaries are rated AAA by Standard & Poor’s Corporation, the highest Financial Strength Rating assigned by Standard & Poor’s, and are rated A++ (superior) by A. M. Best with respect to their financial condition and operating performance.

- GEICO—Berkshire acquired GEICO in January 1996. GEICO is headquartered in Chevy Chase, Maryland and its principal insurance subsidiaries include: Government Employees Insurance Company, GEICO General Insurance Company, GEICO Indemnity Company, and GEICO Casualty Company. Over the past five years, these companies have offered primarily private passenger automobile insurance to individuals in 49 states and the District of Columbia. The subsidiaries market their policies primarily through direct response methods, in which applications for insurance are submitted directly to the companies by telephone, through the mail, or via the Internet.

- General Re—Berkshire acquired General Re in December 1998. General Re held a 91 percent ownership interest in Cologne Re as of December 31, 2004. General Re subsidiaries currently conduct global reinsurance business in approximately 72 cities and provide reinsurance coverage worldwide. General Re operates the following reinsurance businesses: North American property/casualty, international property/casualty, which principally consists of Cologne Re and the Faraday operations, and life/health reinsurance. General Re’s reinsurance operations are primarily based in Stamford, Connecticut and Cologne, Germany. General Re is one of the largest reinsurers in the world based on net premiums written and capital.

- NRG (Nederlandse Reassurantie Groep)—Berkshire acquired NRG, a Dutch life reinsurance company, from ING Group in December 2007.[12].

- Berkshire Hathaway Assurance is a government bond insurance company that insures municipal and state bonds issued by local governments to finance public works projects such as schools, hospitals, roads, and sewer systems. Few companies are capable of competing in this area.[12]

Non-insurance businesses

Apparel

- Berkshire’s apparel businesses include manufacturers and distributors of a variety of clothing and footwear. Businesses engaged in the manufacture and distribution of clothing include Fruit of the Loom, Garan, Fechheimer Brothers and Russell Corporation. Berkshire’s footwear businesses include H.H. Brown Shoe Group, Acme Boots and Justin Brands.

- Berkshire acquired Fruit of the Loom on April 29, 2002 for $835 million in cash. Fruit of the Loom, headquartered in Bowling Green, Kentucky, is a vertically integrated manufacturer of basic apparel.

- Berkshire acquired Russell Corporation on August 2, 2006 for $600 million or $18.00 per share.

Building products

- Berkshire entered the building products business in August 2000 with the acquisition of Acme Building Brands. Acme, headquartered in Fort Worth, Texas, manufactures and distributes clay bricks (Acme Brick), concrete block (Featherlite) and cut limestone (Texas Quarries).

- Berkshire acquired Benjamin Moore & Co. in December 2000. Benjamin Moore, headquartered in Montvale, New Jersey, is a formulator, manufacturer and retailer of primarily architectural coatings, available principally in the United States and Canada.

- In February 2001, Berkshire acquired Johns Manville, which has been serving the building products industry since 1885 and is a manufacturer of fiber glass wool insulation products for walls, attics and floors in homes and commercial buildings, as well as pipe, duct and equipment insulation products.

- Berkshire acquired a 90 percent equity interest in MiTek Inc. in July 2001. MiTek is headquartered in Chesterfield, Missouri and makes engineered connector products, engineering software and services, and manufacturing machinery for the truss fabrication segment of the building components industry.

- Berkshire acquired Shaw Industries, Inc. in 2001. Shaw, headquartered in Dalton, Georgia, is the world’s largest carpet manufacturer based on both revenue and volume of production. Shaw designs and manufactures over 3000 styles of tufted and woven carpet and laminate flooring for residential and commercial use under about 30 brand and trade names and under certain private labels.

- On August 7, 2003, Berkshire acquired Clayton Homes, Inc. Clayton, headquartered near Knoxville, Tennessee, is a vertically integrated manufactured housing company. At year-end 2004, Clayton operated 32 manufacturing plants in 12 states. Clayton’s homes are marketed in 48 states through a network of 1,540 retailers, 391 of which are company-owned sales centers.

Flight services

- In 1996, Berkshire acquired FlightSafety International Inc. FSI’s corporate headquarters is located at LaGuardia Airport in Flushing, New York. FSI engages primarily in the business of providing high technology training to operators of aircraft and ships. FlightSafety is the world's leading provider of professional aviation training services.

- Berkshire acquired NetJets Inc. in 1998. NJ is the world’s leading provider of fractional ownership programs for general aviation aircraft. In 1986, NJ created the fractional ownership of aircraft concept and introduced its NetJets program in the United States with one aircraft type. In 2004, the NetJets program operated 15 aircraft types. In late 1996, NJ expanded its fractional ownership programs to Europe via a joint venture arrangement which is now 100% owned by NJ. The fractional ownership of aircraft concept permits customers to acquire a specific percentage of a certain aircraft type and allows them to utilize the aircraft for a specified number of flight hours per annum.

Retail businesses

- The home furnishings businesses are the Nebraska Furniture Mart, R.C. Willey Home Furnishings, Star Furniture Company, and Jordan’s Furniture, Inc.

- CORT Business Services Corporation was acquired in 2000 by an 80.1% owned subsidiary of Berkshire and is the leading national provider of rental furniture, accessories and related services in the “rent-to-rent” segment of the furniture rental industry.

Other non-insurance businesses

- Marmon Holdings Inc, acquired on December 25, 2007, was a privately held conglomerate owned by the Pritzker family for over 50 years. It owns and operates an assortment of manufacturing companies that produce railroad tank cars, plumbing pipes, metal fasteners, and wiring and water treatment products used in residential construction.[13]

- Berkshire acquired McLane Company, Inc. in May 2003 from Wal-Mart Stores, Inc. McLane provides wholesale distribution and logistics services in all 50 states and internationally in Brazil to customers that include discount retailers, convenience stores, quick service restaurants, drug stores and movie theatre complexes.

- Scott Fetzer Companies—The Scott Fetzer Companies are a diversified group of 21 businesses that manufacture and distribute a wide variety of products for residential, industrial and institutional use. The two most significant of these businesses are Kirby home cleaning systems and Campbell Hausfeld products. Scott Fetzer also manufactures Ginsu Knives.

- The Buffalo News publishes one edition daily from its headquarters in Buffalo, New York.

- Berkshire acquired XTRA in September 2001. XTRA, headquartered in St. Louis, Missouri, is a leading transportation equipment lessor. XTRA manages a diverse fleet of approximately 105,000 units, constituting a net investment of approximately $1 billion as of December 31, 2004. The fleet includes over-the-road and storage trailers, chassis, intermodal piggyback trailers and domestic containers.

- See's Candies produces boxed chocolates and other confectionery products in two large kitchens in California. See’s revenues are highly seasonal with approximately 50 percent of total annual revenues being earned in the months of November and December.

- Dairy Queen International services a system of approximately 6,000 stores operating under the names Dairy Queen, Orange Julius and Karmelkorn that offer various dairy desserts, beverages, prepared foods, blended fruit drinks, popcorn and other snack foods.

- In 2002, Berkshire acquired Albecca Inc. Albecca is headquartered in Norcross, Georgia, and primarily does business under the Larson-Juhl name. Albecca designs, manufactures and distributes custom framing products, including wood and metal moulding, matboard, foamboard, glass, equipment and other framing supplies.

- Berkshire acquired CTB International Corp. in 2002. CTB, headquartered in Milford, Indiana, is a designer, manufacturer and marketer of systems used in the grain industry and in the production of poultry, hogs, and eggs. Products are produced in the United States and Europe and are sold primarily through a global network of independent dealers and distributors, with peak sales occurring in the second and third quarters.

- In 2002 Berkshire acquired The Pampered Chef, LTD, the largest direct seller of kitchen tools in the United States. Products are researched, designed and tested by TPC, and manufactured by third party suppliers. From its Addison, Illinois headquarters, TPC utilizes a network of more than 65,000 independent sales representatives to sell its products through home-based party demonstrations, principally in the United States.

- Berkshire currently holds 83.7 percent (80.5 percent on a fully-diluted basis) of the MidAmerican Energy Holdings Company. At the time of purchase, Berkshire's voting interest was limited to 10 percent of the company's shares, but this restriction ended when the Public Utility Holding Company Act of 1935 was repealed in 2005. A major subsidiary of MidAmerican is CE Electric UK.

Holdings

Insurance and finance subsidiaries

- Duval

- GEICO

- General Re

- Kansas Bankers Surety Company

- National Indemnity Company

- Wesco Financial Corporation

- Applied Underwriters Inc.

- Medical Protective

- Nederlandse Reassurantie Groep

- Berkshire Hathaway Assurance

Other subsidiaries

- Acme Brick Company

- Ben Bridge Jeweler

- Benjamin Moore Paints

- Borsheim's Fine Jewelry

- Brooks Sports, Inc.

- Business Wire

- Clayton Homes

- Cort Furniture

- Dairy Queen

- FlightSafety International

- Forest River

- Fruit of the Loom

- Helzberg Diamonds

- HH Brown Shoe Group

- ISCAR Metalworking

- Jordan's Furniture

- Justin Brands Inc.

- Marmon Holdings Inc

- McLane Company

- Mouser Electronics

- Nebraska Furniture Mart

- NetJets

- The Pampered Chef

- Richline Group

- Russell Corporation

- See's Candies

- Shaw Industries

- Star Furniture

- R.C. Willey Home Furnishings

- TTI, Inc.

- World Book

- Xtra Lease

Common stock holdings

This includes outstanding stock as reported in the last SEC EDGAR filing (Form 13F), and the latest annual report (up to 2008).

- American Express Co. (13.1%)

- Anheuser-Busch Cos. (4.8%)

- Bank of America

- Burlington Northern Santa Fe Corporation (17.5%)

- Carmax (10%)

- The Coca-Cola Company (8.6%)

- Comcast

- Comdisco (38%)

- ConocoPhillips (5.6%)

- Costco Wholesale

- Diageo PLC

- Gannett

- General Electric

- GlaxoSmithKline

- Goldman Sachs

- The Home Depot

- H&R Block Inc. (sold out in 2007)

- Ingersoll Rand

- Iron Mountain

- Johnson & Johnson (2.2%)

- Kraft Foods (8.1%)

- Lexmark International (sold out in 2006)

- Lowe's Companies

- M&T Bank (6.1%)

- MidAmerican (83.7%)

- Moody’s Corporation (19.1%)

- Mueller Industries (sold out in 2006)

- NRG Energy

- Nike

- Norfolk Southern Corp.

- Outback Steakhouse

- PetroChina (sold out in 2007)

- Pier 1 Imports (sold out in 2007)

- Posco (4.5%)

- Procter & Gamble Co. (3.3%)

- Sanofi-Aventis (1.3%)

- Sealed Air (sold out in 2006)

- ServiceMaster

- Shaw Communications

- SunTrust Banks

- Tesco (2.9%)

- Torchmark (3.2%)

- Tyco International (sold out in 2008)

- UnitedHealth Group

- Union Pacific Railroad

- United Parcel Service

- USG (19.0%)

- U.S. Bancorp (4.4%)

- WABCO

- Wal-Mart Stores Inc. (0.5%)

- The Washington Post Company (18.2%)

- Wells Fargo (9.2%)

- Wellpoint

- Wesco Financial Corporation (80%)

- White Mountains Insurance (sold out in 2008)

Berkshire Stock Holdings

These are the holdings of Warren Buffett's Berkshire Hathaway Inc. (NYSE: BRK-A) alphabetically arranged for the quarter ended on September 30, 2008 and the corresponding shares[14]:

- American Express Co. (NYSE: AXP) 151,610,700 shares

- Anheuser Busch Cos. Inc. (NYSE: BUD) taken to 13,845,000 shares, from under under 15 million last quarter and from over 35 million in March

- Bank of America Corp. (NYSE: BAC) 5,000,000 shares; DOWN from 9.1 million shares in June

- Burlington Northern Santa Fe (NYSE: BNI) 63,785,418 shares (although higher now)

- Carmax Inc. (NYSE: KMX) 18,444,100; DOWN from 21.3 million shares in June

- Coca Cola (NYSE: KO) 200,000,000 shares (same)

- Comcast (NASDAQ: CMCSA) 12 million shares (same)

- Comdisco Holdings (NASDAQ: CDCO) over 1.5 million shares

- ConocoPhillips (NYSE: COP) 59,688,000 in one unit, but about 83.9 million total; position was known about generally last quarter, but the size had been kept confidential.

- Costco Wholesale (NASDAQ: COST) 5.254 million shares (same)

- Gannett Co. (NYSE: GCI) 3.447 million shares (same)

- General Electric Corp. (NYSE: GE) 7.777 million shares (same Sept., but now more)

- GlaxoSmithkline (NYSE: GSK) 1.51 million shares (same)

- Home Depot Inc. (NYSE: HD) 3.7 Million shares; Down from 4,181,000 in June

- Ingersoll-Rand (NYSE: IR) 5,636,600 shares (same)

- Iron Mountain (NYSE: IRM) 3,372,200 shares (same)

- Johnson & Johnson (NYSE: JNJ) listed as almost 62 million (roughly same)

- Kraft Foods (NYSE: KFT) about 148 million shares

- Lowes Companies (NYSE: LOW) 6.5 million shares; Down from 7 million in June

- M&T Bank Corp. (NYSE: MTB) 6.71 million shares (same)

- Moody's (NYSE: MCO) 48 million shares (same)

- Nike Inc. (NYSE: NKE) 7.641 million shares (same)

- Norfolk Southern (NYSE: NSC) 1.933 million shares (same)

- NRG Energy (NYSE: NRG) 5,000,000 shares; UP from 3.238 million in June

- Procter & Gamble (NYSE: PG) more than 105.8 million shares (same)

- Sanofi Aventis (NYSE: SNY) more than 3.9 million shares (same)

- Sun Trust Bank (NYSE: STI) more than 3.2 million shares (same)

- Torchmark Corp. (NYSE: TMK) 2.82 million

- US Bancorp (NYSE: USB) over 72.9 million; looks UP from June

- USG Corp. (NYSE: USG) 17.072 million shares (same)

- Union Pacific Corp. (NYSE: UNP) 8.9 million shares (same)

- United Parcel Service (NYSE: UPS) 1.429 million shares (same)

- WABCO Holdings (NYSE: WBC) 2.7 million shares (same)

- Wal-Mart Stores Inc. (NYSE: WMT) over 19.9 million shares (looks same)

- Washington Post (NYSE: WPO) over 1.72 million shares (same)

- Wells Fargo (NYSE: WFC) roughly 290.4 million shares (looks same, but likely larger now)

- Wellpoint Inc. (NYSE: WLP) 4.7773 million shares (same)

- Wesco Financial Corp. (NYSE: WSC) 5.7 million shares (same)

Companies with a "beneficial owner" relationship

This includes some of the companies where a Berkshire Hathaway stake is 5 percent or more of the outstanding stock, as reported in the last proxy statement SEC filing, and the latest annual report.

In order of percentage stake:

- Moody's Corporation (19.1 percent)

- The Washington Post Company (18.2 percent)

- Burlington Northern Santa Fe Corp. (17.5 percent)

- American Express (13.1 percent)

- Wells Fargo (9.2 percent)

- The Coca-Cola Company (8.6 percent)

Notes

- ↑ Berkshire Hathaway, Berkshire Hathaway Subsidiaries. accessdate January 30, 2009.

- ↑ Official American Textile Directory. 1917, (New York: Bragdon, Lord & Nagle Co.)

- ↑ 3.0 3.1 Rich and richer: Berkshire, Buffett and R.I.'s Chace family John Kostrzewa Providence Journal(July 10, 2006) Retrieved January 30, 2009.

- ↑ Alex Markels, July 29, 2007, How to Make Money The Buffett Way USNews.com.

- ↑ Aline Sullivan, Buffett, the Sage of Omaha, Makes Value Strategy Seem Simple: Secrets of a High Plains Investor International Herald Tribune, December 20, 1997. Retrieved January 30, 2009.

- ↑ Warren Buffett's 1989 letter to Berkshire Hathaway shareholders Retrieved January 30, 2009.

- ↑ "Warren Buffett: Value Man Through And Through", Forbes.com. (April 26, 2001) Retrieved January 30, 2009.

- ↑ Buffett on Berkshire, compensation and successors CNN, (May. 5, 2007) Retrieved January 30, 2009.

- ↑ Berkshire’s Corporate Performance vs. the S&P 500 Retrieved January 30, 2009.

- ↑ “The unit trusts that have recently surfaced fly in the face of these goals. They would be sold by brokers working for big commissions, would impose other burdensome costs on their shareholders, and would be marketed en masse to unsophisticated buyers, apt to be seduced by our past record and beguiled by the publicity Berkshire and I have received in recent years. The sure outcome: a multitude of investors destined to be disappointed.” Warren Buffet, 1995 Letter to the Shareholders of Berkshire Hathaway.

- ↑ Andrew Clark, Warren Buffet wants to make a huge difference, THE GUARDIAN, NEW YORK (July 9, 2006) Taipei Times. Retrieved January 30, 2009.

- ↑ 12.0 12.1 Berkshire Hathaway to buy reinsurer, start bond insurer MarketWatch. Retrieved January 30, 2009.

- ↑ BERKSHIRE HATHAWAY INC. TO ACQUIRE 60% OF PRITZKER FAMILY COMPANY, MARMON HOLDINGS, INC..berkshirehathaway.com. (December 25, 2007) Retrieved January 30, 2009.

- ↑ New Warren Buffett & Berkshire Hathaway Stocks A-H 247WallSt.com. (November 14, 2008) Retrieved January 30, 2009.

References

ISBN links support NWE through referral fees

- Graham, Benjamin. The Intelligent Investor: a book of practical counsel. New York, NY: Harper & Row. 1985. ISBN 978-0060155476

- Lowe, Janet. Damn right!: behind the scenes with Berkshire Hathaway billionaire Charlie Munger. New York: John Wiley, 2000. ISBN 978-0471244738

- Lowenstein, Roger. Buffett: the making of an American capitalist. New York: Random House. 1995. ISBN 978-0679415848

- Miles, Robert P. The Warren Buffett CEO: secrets from the Berkshire Hathaway managers. New York: John Wiley & Sons, 2002. ISBN 978-0471442592

External links

All links retrieved January 20, 2022.

- Berkshire Hathaway Official Website - Source for annual reports, which include Berkshire Hathaway Shareholder Letters by Warren Buffett.

- Owner’s Manual Owner Related Business Principles, written by Warren Buffet for Berkshire Hathaway shareholders

- Regulatory filings

- SEC.gov - Berkshire Hathaway, Inc. (BRK.A) - EDGAR Filings (CIK: 0001067983) the EDGAR database

- SEC.gov - Wesco Financial Corp (WSC) - EDGAR Filings (CIK: 0000105729) the EDGAR database

- SEC.gov - Warren E. Buffett - EDGAR Filings (CIK: 0000315090) the EDGAR database

- SEC.gov - Charles T. Munger - EDGAR Filings (CIK: 0001078511) the EDGAR database

Credits

New World Encyclopedia writers and editors rewrote and completed the Wikipedia article in accordance with New World Encyclopedia standards. This article abides by terms of the Creative Commons CC-by-sa 3.0 License (CC-by-sa), which may be used and disseminated with proper attribution. Credit is due under the terms of this license that can reference both the New World Encyclopedia contributors and the selfless volunteer contributors of the Wikimedia Foundation. To cite this article click here for a list of acceptable citing formats.The history of earlier contributions by wikipedians is accessible to researchers here:

- Berkshire_Hathaway history

- Berkshire_Fine_Spinning_Associates history

- Oliver_Chace history

- Hathaway_Mills history

- Warren_Buffett history

- Value_investing history

The history of this article since it was imported to New World Encyclopedia:

Note: Some restrictions may apply to use of individual images which are separately licensed.

↧ Download as ZWI file | Last modified: 02/04/2023 03:33:30 | 30 views

☰ Source: https://www.newworldencyclopedia.org/entry/Berkshire_Hathaway | License: CC BY-SA 3.0

ZWI signed:

ZWI signed:

KSF

KSF