New York Stock Exchange

From Nwe

From Nwe | New York Stock Exchange | |

|---|---|

| (U.S. National Historic Landmark) | |

|

|

|

| Location: | New York City, New York |

| Built/Founded: | 1903 |

| Architect: | Trowbridge & Livingston; George B. Post |

| Architectural style(s): | Classical Revival |

| Added to NRHP: | June 2, 1978.[1] |

| Reference #: | 78001877 |

| Governing body: | Private |

The New York Stock Exchange (NYSE) is a stock exchange based in New York City, New York. It is one of the largest facilities in the world for trading stocks and financial securities. The NYSE is operated by NYSE Euronext, which was formed in 2007 by the NYSE's merger with the fully electronic stock exchange Euronext. The NYSE building was designated a National Historic Landmark, listed in the National Register of Historic Places in 1978.

The NYSE began in 1792 when the Buttonwood Agreement was signed by 24 stock brokers outside on Wall Street. Trading on the floor was available only to members who had purchased one of the limited number of "seats." Beginning on January 24, 2007, however, most stocks could be traded via its electronic hybrid market and the NYSE became a publicly held company. The NYSE has been involved in, and contributed significantly to, many important changes in American society, changes which have impacted the world. Industrialization progressed quickly with the capital that was available through the stock exchange. On the other side, the Great Depression began with the Stock Market Crash of 1929. Recognizing the significance of stock exchanges on the economy, coupled with increasing globalization, the issue of government regulation has become paramount. As such a significant player, the effectiveness of the NYSE in its support of economic health is critical to efforts to establish a world of prosperity.

History

The origin of the New York Stock Exchange can be traced to May 17, 1792, when the Buttonwood Agreement was signed by 24 stock brokers on Wall Street in New York City under a buttonwood tree. On March 8, 1817, the organization drafted a constitution and renamed itself the "New York Stock & Exchange Board." (This name was shortened to its current form in 1863.) Anthony Stockholm was elected the Exchange's first president.

The first central location of the Exchange was a room rented for $200 a month located at 40 Wall Street. The building was destroyed in the Great Fire of New York (1835), after which the Exchange moved to a temporary headquarters. In 1863, it changed its name to the New York Stock Exchange (NYSE). In 1865, it moved to 10-12 Broad Street.

The Dow Jones Industrial Average (DJIA) was created in 1896 by Charles Dow, co-founder of Dow Jones & Company, a financial news publisher. This figure was calculated by tracking the stock prices of twelve different companies and taking their average. Published in The Wall Street Journal, the DJIA quickly became a popular indicator of stock market activity. The volume of stocks traded increased sixfold in the years between 1896 and 1901, and the NYSE needed a larger space to conduct business.[2] Eight New York City architects were invited to participate in a design competition for a new building and the Exchange selected the neoclassic design from architect George B. Post. Demolition of the existing building at 10 Broad Street and the adjacent lots started on May 10, 1901.

The New York Stock Exchange building opened on April 22, 1903, at a cost of $4 million. The trading floor was one of the largest volumes of space in the city at the time, measuring 109 feet (33 m) by 140 feet (43 m), with a skylight set into a 72-foot-high ceiling. The main façade of the building features marble sculpture by John Quincy Adams Ward in the pediment, above six tall Corinthian capitals called “Integrity Protecting the Works of Man.”

In 1922, a building designed by the architectural practice of Trowbridge & Livingston was added at 11 Broad Street for offices, and a new trading floor called "the garage." Additional trading-floor space was added in 1969 and 1988 (the "blue room"), with the latest technology for information display and communication. Another trading floor was opened at 30 Broad Street in 2000.

With the arrival of the hybrid market, whereby a stock broker may either have his order executed immediately in a fully automated electronic exchange, or have it routed to the trading floor where it is completed manually via the more traditional live auction method in the presence of a specialist broker, a greater proportion of trading was executed electronically and the NYSE decided to close the 30 Broad Street trading room in early 2006. In late 2007, the exchange closed the rooms created by the 1969 and 1988 expansions due to the declining number of traders and employees on the floor, a result of increased electronic trading.

On June 2, 1978, the NYSE building was designated a National Historic Landmark on the National Register of Historic Places.[1]

Trading

The trading floor of the New York Stock Exchange (sometimes referred to as "the Big Board") provides a means for buyers and sellers to trade shares of stock in companies registered for public trading. To be listed on the NYSE a corporation must meet specified criteria. The NYSE is open for trading Monday through Friday between 9:30 a.m. to 4:00 p.m. Eastern Time (ET), with the exception of holidays declared by the Exchange in advance.

On the trading floor, the NYSE trades in a continuous-auction format, where traders can execute stock transactions on behalf of investors. They gather around the appropriate post where a specialist broker, who is employed by a NYSE member firm (that is, he/she is not an employee of the New York Stock Exchange), acts as an auctioneer in an open-outcry, auction-market environment to bring buyers and sellers together and to manage the actual auction. They do on occasion (approximately 10 percent of the time) facilitate the trades by committing their own capital and, as a matter of course, disseminate information to the crowd that helps to bring buyers and sellers together.

Until 2007, the right to directly trade shares on the exchange was conferred upon owners of the 1366 "seats." The term comes from the fact that up until the 1870s NYSE members sat in chairs to trade. In 1868, the number of seats was fixed at 533, and this number was increased several times over the years. In 1953, the number was limited to 1366 seats. These seats were a sought-after commodity as they conferred the ability to directly trade stock on the NYSE. Seat prices varied widely over the years, generally falling during recessions and rising during economic expansions. The most expensive inflation-adjusted seat was sold in 1929 for $625,000, which, today, would be over $6 million. Seats sold for as high as $4 million in the late 1990s and $1 million in 2001. In 2005, seat prices increased to $3.25 million as the exchange was set to merge with Archipelago and become a for-profit, publicly traded company. Seat owners received $500,000 cash per seat and 77,000 shares of the newly formed corporation. The NYSE now sells one-year licenses to trade directly on the exchange.

Since January 24, 2007, all NYSE stocks can be traded via its electronic hybrid market (except for a small group of very high-priced stocks). Customers can now send orders for immediate electronic execution, or route orders to the floor for trade in the auction market.

The bell

One of the most familiar features of the NYSE is its distinctive bell that rings on the trading floor to signal the start and end of trading each business day. It is considered an honor to be invited to ring the bell to open or close trading for the day.

Originally trading times were signaled by a Chinese gong, but brass bells were introduced when the NYSE moved to its current location in 1903. There is one large bell, measuring 18 inches (460 mm) in diameter, in each of the four trading areas of the NYSE. They are operated synchronously from a single control.[3]

Trading landmarks

The First Stock Ticker was employed in 1867.[4]

In 1915, the market price was given in dollars.

In 1943, the trading floor was opened to women.[5]

In the mid-1960s, the NYSE Composite Index was created, with a base value of 50 points equal to the 1965 yearly close. This index reflects the value of all stocks trading at the exchange instead of just the 30 stocks included in the Dow Jones Industrial Average.

The NYSE created the Common Stock Index in 1966, and floor data were fully automated.[6]

Foreign brokers were admitted to NYSE in 1977.

The New York Futures Exchange began in 1979.

A real-time ticker was introduced at the Market in 1996.[7]

Trading in fractions (n/16) ended in 2001, and was replaced by decimals (increments of $.01).

In 2003, the NYSE Composite Index was relaunched using revised methodology and a new base value of 5,000 points equal to the 2002 yearly close.

In 2005, NYSE Hybrid Market was launched, creating a blend of auction and electronic trading. On December 30, 2005, in anticipation of the NYSE’s transformation into a publicly held company, member seat sales officially ended, replaced by the sale of annual trading licenses.[8]

Notable events

The Dow Jones Industrial Average (DJIA) exceeded 100 on January 12, 1906, followed by the Panic of 1907.

The exchange was closed shortly after the beginning of World War I (July 31, 1914), but it partially re-opened on November 28 of that year in order to help the war effort by trading bonds, and completely reopened for stock trading in mid-December.

On September 16, 1920, a bomb exploded on Wall Street close to the NYSE building, killing 33 people and injuring more than 400. The NYSE building and some buildings nearby, such as the JPMorgan Chase building, still have marks on their facades caused by the bombing.

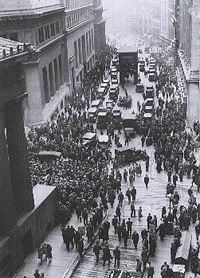

The Black Thursday crash of the Exchange on October 24, 1929, and the sell-off panic which started on Black Tuesday, October 29, are often blamed for precipitating the Great Depression of 1929. In an effort to try to restore investor confidence, the Exchange unveiled a 15-point program aimed to upgrade protection for the investing public on October 31, 1938.

On October 1, 1934, the exchange was registered as a national-securities exchange with the U.S. Securities and Exchange Commission, with a president and a 33-member board.

On August 24, 1967, Abbie Hoffman led members of the Yippie movement to the Exchange gallery in a protest. The protesters threw fistfuls of dollars down to the traders below. Since that incident, the Exchange spent $20,000 to enclose the gallery with bulletproof glass.

In 1970, the Securities Investor Protection Corporation was established.

On February 18, 1971 the NYSE was recognized as not-for-profit organization, and the number of board members was reduced to 25.[6]

On October 19, 1987, the DJIA dropped 508 points, a 22.6 percent loss in a single day, prompting officials at the exchange to invoke the "circuit breaker" rule to halt all trading. This was a controversial move and led to a quick change in the rule; with trading now halting for an hour, two hours, or the rest of the day when the DJIA drops 10, 20, or 30 percent, respectively. In the afternoon, the 10-percent and 20-percent drops halt trading for a shorter period of time, but a 30-percent drop always closes the exchange for the day. The rationale behind the trading halt was to give investors a chance to reevaluate their positions and stabilize trading.

There was a panic on October 27, 1997 with a fall of 7.2 percent in value (554.26 points) prompted by falls in Asian markets, from which the NYSE recovered quickly.

The NYSE was closed from September 11 until September 17, 2001, as a result of the September 11 attacks.

On September 17, 2003, NYSE chairman and chief executive Richard Grasso stepped down as a result of controversy concerning the size of his deferred-compensation package. He was replaced as CEO by John S. Reed, the former chairman of Citigroup.

The NYSE announced plans to acquire Archipelago in 2005, in a deal that reorganized the NYSE as a publicly traded, for-profit company. It began trading under the name NYSE Group on March 8, 2006.

On April 4, 2007, the NYSE Group completed a merger with Euronext, the European combined stock market, thus forming the NYSE Euronext, the first transatlantic stock exchange.

In January, 2008 NYSE Euronext announced it would acquire the American Stock Exchange. This acquisition was completed on October 1, 2008.[9]

On September 15, 2008, also known as "Ugly Monday," the DJIA lost more than 500 points amid fears of bank failures, resulting in a permanent prohibition of naked short-selling and a three-week temporary ban on all short selling of financial stocks.[10] As the global financial crisis erupted, trading on the NYSE experienced some of the greatest volatility in its history.[11] Monday, September 29 brought a point drop on the Dow of 777.68, almost seven percent. On Friday, October 10 stock markets crashed across Europe and Asia. Within the first five minutes of the trading session on Wall Street, the DJIA plunged 697 points, falling below 7900 to its lowest level since March 17, 2003, and continuing to make violent swings throughout the day. Trading on the NYSE closed with the Dow at 8,451, down 1,874 points, or 18 percent for the week, and after eight days of losses, 40 percent down from its record high on October 9, 2007.

On February 15, 2011 it was announced that Deutsche Boerse and NYSE Euronext would combine to create the world’s premier global exchange group. According to Reto Francioni, Chief Executive Officer of Deutsche Boerse,

This transaction brings together two of the most respected and successful exchange operators in the world to lead the way in global capital markets and set the standard for growth, quality and market reach. ... Clients will have unparalleled access to markets, products, information, world-class technology, clearing services and settlement – globally and around the clock. From a regulatory perspective, we are committed to remaining the world’s most transparent and best regulated platform.”[12]

Future of the NYSE

The NYSE is a symbol of Wall Street, its first permanent home, and Wall Street itself represents American financial and economic power. Wall Street can sometimes represent elitism and cut-throat capitalism, but it also stirs feelings of pride about the market economy. Wall Street became the symbol of a country and economic system that many Americans see as having developed not through colonialism and plunder, but through trade, capitalism, and innovation.[13] As the epitome of Wall Street, the NYSE has great significance, not just as a historical building and part of the development of the United States, but also as a measure of the power and influence of the United States in the world.

The future of the NYSE may be affected by three major factors: the continuing globalization of markets, the tumultuous economy, and the effect of technology on the market. The merger of the NYSE and Euronext, and the later merger with Deutsche Boerse, provides a trans-Atlantic connection of the stock and derivatives markets that should encourage more investors to purchase stocks in both the U.S. and Europe, more cheaply and efficiently. Since the NYSE has been losing listings, especially initial preferred offerings IPOs to European exchanges, the merging with European exchanges may regain the fees and trading profits. Also, in an increasingly challenging economy, when exchanges combine they can become more efficient by cutting staff and sharing technology. Such a global exchange will permit investors to operate from a common trading platform, which may help to stabilize international markets in times of economic crisis.

With the global economic problems that emerged in the latter part of 2008, the NYSE may find itself undergoing increasing regulation. Lack of effective regulation, particularly related to risky loans in the sub-prime mortgage market, has been blamed for the instability in the economy. Greater regulation will inevitably impact the successful operation of the NYSE.

Provided the technology in the NYSE remains state of the art, it will increasingly play a controlling role in the marketplace. This could act as a counterbalance to the conflicting emotions of human greed and fear, which have contributed to the roller-coaster ride the NYSE often takes when market forces go awry. Technology properly utilized in the future might offset emotion-driven swings in the markets and encourage confidence in difficult economic times. The NYSE's pioneering efforts in the hybrid market may offer the best scenario in which computerized trading, which has the potential to inspire greater confidence, is still balanced by the human factor in the traditional face to face auction trading environment.

Notes

- ↑ 1.0 1.1 National Park Service, New York Stock Exchange, National Historic Landmark summary listing, September 17, 2007. Retrieved February 4, 2009.

- ↑ NYSE, The New York Stock Exchange Building, NYSE Euronext. Retrieved February 4, 2009.

- ↑ NYSE, The Bell, NYSE Euronext. Retrieved February 4, 2009.

- ↑ Timeline: 1860-1899, NYSE Euronext. Retrieved February 4, 2009.

- ↑ NYSE, Timeline 1940-1959, NYSE Euronext. Retrieved February 4, 2009.

- ↑ 6.0 6.1 NYSE, Timeline 1960-1079, NYSE Euronext. Retrieved February 4, 2009.

- ↑ NYSE, Timeline 1980-1999, NYSE Euronext. Retrieved February 4, 2009.

- ↑ NYSE, Timeline 2000-Today, NYSE Euronext. Retrieved February 4, 2009.

- ↑ NYSE Euronext Completes Acquisition of American Stock Exchange, NYSE Euronext. Retrieved February 4, 2009.

- ↑ Jim Martin, "Behind Wall Street's ugly Monday," Erie Times-News, GoErie.com, September 16. 2008. Retrieved February 4, 2009.

- ↑ Vikas Bajaj, "Stocks Are Hurt by Latest Fear: Declining Prices," New York Times, November 19, 2008. Retrieved February 4, 2009.

- ↑ News Releases, Deutsche Boerse AG And NYSE Euronext Agree To Combine To Create The Premier Global Exchange Group NYSE Euronext (February 15, 2011). Retrieved February 17, 2011.

- ↑ Steve Fraser, Every Man a Speculator: A History of Wall Street in American Life (Harper Perennial, 2006, ISBN 006662049X).

References

ISBN links support NWE through referral fees

- Buck, James E. The New York Stock Exchange: The First 200 Years. Greenwich Pub. Group, 1992. ISBN 0944641024.

- Fraser, Steve. Every Man a Speculator: A History of Wall Street in American Life. Harper Perennial, 2006. ISBN 006662049X.

- Geisst, Charles R. Wall Street: A History - From its Beginnings to the Fall of Enron. Oxford University Press, 2004. ISBN 0195170601.

- Kent, Zachary. The Story of the New York Stock Exchange. Scholastic Library Pub., 1990. ISBN 0516047485.

- Sloane, Leonard. The Anatomy of the Floor. Doubleday, 1980. ISBN 0385122497.

- Sobel, Robert. N.Y.S.E.: A History of the New York Stock Exchange, 1935-1975. Weybright and Talley, 1975. ISBN 0679401245.

External links

All links retrieved November 14, 2022.

Credits

New World Encyclopedia writers and editors rewrote and completed the Wikipedia article in accordance with New World Encyclopedia standards. This article abides by terms of the Creative Commons CC-by-sa 3.0 License (CC-by-sa), which may be used and disseminated with proper attribution. Credit is due under the terms of this license that can reference both the New World Encyclopedia contributors and the selfless volunteer contributors of the Wikimedia Foundation. To cite this article click here for a list of acceptable citing formats.The history of earlier contributions by wikipedians is accessible to researchers here:

The history of this article since it was imported to New World Encyclopedia:

Note: Some restrictions may apply to use of individual images which are separately licensed.

↧ Download as ZWI file | Last modified: 02/04/2023 00:07:06 | 38 views

☰ Source: https://www.newworldencyclopedia.org/entry/New_York_Stock_Exchange | License: CC BY-SA 3.0

ZWI signed:

ZWI signed:

KSF

KSF