Maine Tax Code People S Veto, Question 1 (June 2010)

From Ballotpedia

From Ballotpedia ![]() This Ballotpedia article needs to be updated.

This Ballotpedia article needs to be updated.

This Ballotpedia article is currently under review by Ballotpedia staff as it may contain out-of-date information. Please email us if you would like to suggest an update.

|

|

|

The Maine Tax Code People's Veto, also known as Question 1, was on the June 8, 2010 ballot in Maine as a veto referendum, where it was approved. The measure rejected legislation enacted by the legislature and signed by the governor in 2009 that reformed the state's income tax structure, broadened the base of sales tax and amended the Circuit Breaker Program.[1][2][3][4]

Background[edit]

The petition was originally filed in June 2009 through the People's Veto provision. Originally, supporters focused on getting the measure on the 2009 November ballot, but in July 2009 they announced that they would instead collect signatures for the June 2010 election.[5][6]

In mid-June 2009, Maine lawmakers filed an application for a people's veto referendum to challenge a recently enacted tax code overhaul (LD 1495). The overhaul included an income tax rate cut, a broadening of the state sales tax to more items, and an increase in the state meals and lodging tax. The overhaul passed the Maine Legislature and was signed into law by Democratic Gov. John Baldacci. The referendum called for voters to repeal the package in its entirety.[7][8]

If the law had not been repealed by voters in June, the tax code changes would have gone into effect January 2011.[9][10][11]

Election results[edit]

| Maine Question 1 (2010) | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 193,960 | 60.82% | |||

| No | 124,928 | 39.18% | ||

Election results via: Maine Secretary of State, Elections Division, Referendum Election Tabulations, June 8, 2010

Text of measure[edit]

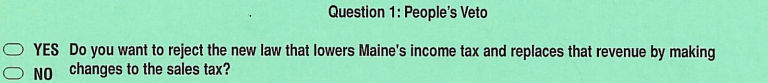

The language appeared on the ballot as:[3]

| “ | ” |

Summary[edit]

The following description of the intent and content of this ballot measure was provided in the Maine Citizen's Guide to the Referendum Election:

| “ |

This referendum question asks whether Maine voters want to reject legislation enacted by the Legislature and approved by the Governor in June 2009 that reforms the state’s income tax structure, broadens the base of the sales tax, and amends the Circuit Breaker Program as follows: Part A of the legislation replaces the four existing marginal tax rates (which range from 2% on taxable income below $4,200, up to 8.5% of taxable income over $16,700) with a flat rate of 6.5% of Maine taxable income. Taxpayers with taxable income of more than $250,000 would pay, in addition, an income tax surcharge of 0.35% on their Maine taxable income above $250,000. The legislation also replaces the current system of standard and itemized deductions with several new tax credits. Tax credits are subtracted from the amount of taxes owed, as compared to deductions, which are subtracted from the amount of taxable income to which the tax rate applies. The principal credit is a refundable household credit for individuals who are full-time Maine residents. The base amount of this credit ranges from $700 for single individuals to $1,200 for married taxpayers filing jointly, and the credit increases by $250 with each exemption that the taxpayer is allowed to claim on their federal income tax return. The legislation also provides a credit for charitable contributions of more than $250,000 claimed on a federal income tax return, and a credit for taxpayers who are 65 years or older. The existing earned income tax credit would be retained and made refundable. Refundable tax credits allow for a refund to the taxpayer (up to a maximum amount specified in the law) if the amount of the credit exceeds the amount of tax due. Both the alternative minimum tax and the alternative minimum tax credit would be repealed for individuals but maintained for corporations. Taxes on lump-sum retirement plan distributions and on early distributions from qualified retirement plans would be repealed. The retirement and disability tax credit and the low-income tax credit would also be repealed. Part B of the legislation applies the existing 5% sales tax, for the first time, to several categories of services, including many amusement, entertainment and recreational services; installation, repair and maintenance services; personal property services (such as dry cleaning, laundry services, vehicle towing, moving, house cleaning, picture framing, and pet services); transportation and courier services; and long distance telephone service. It would add an airport transportation fee of $1 per passenger for taxicab and limousine service to or from the airport. The sales tax rate on certain items would increase as follows: on meals, lodging, and liquor served in bars, restaurants and other licensed establishments, from 7% to 8.5%; on candy, from 5% to 8.5%; and on automobile rentals of less than one year, from 10% to 12.5%. Part C of the legislation makes certain changes to broaden the scope of the Maine Residents Property Tax and Rent Refund “Circuit Breaker” Program. This Program provides partial refunds of property taxes and rent paid by residents with household incomes below certain levels. This legislation repeals the 10-acre limit on the size of the homeowner’s or renter’s house lot. It also excludes from the calculation of household income (for eligibility purposes) the income of dependents in the household, cash inheritances, and the nontaxable portion of certain other types of income that do not exceed $5,000. After the legislation making the above changes was enacted in June 2009, petitioners collected enough signatures of registered voters to refer it to the people for a vote at a statewide election. The legislation has been suspended pending the outcome of this election. A “YES” vote would reject the new law and keep the current tax laws unchanged. A “NO” vote would allow the new law to take effect, including all of the above-described changes. [12] |

” |

| —Office of the Attorney General | ||

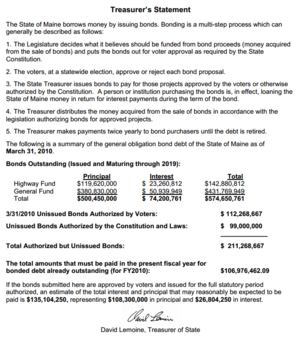

Fiscal note[edit]

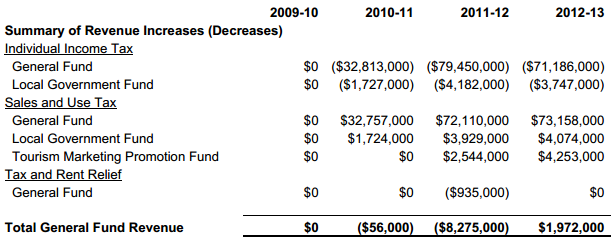

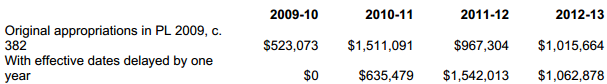

The following fiscal impact statement was provided in the Maine Citizen's Guide to the Referendum Election:

| “ |

Presented below is a summary of the revised fiscal impact of Public Law 2009, chapter 382, with all effective dates delayed by one year from the original effective dates to accommodate the delay imposed by the people’s veto process. The impact of the tax changes in the Act has also been adjusted to reflect revised economic and revenue forecasts. All of the revenues and costs presented below are contingent and would occur only if the people’s veto fails at the June 2010 referendum.

Presented below is a comparison of the original appropriations for the administrative costs compared with the revised administrative costs with a delayed effective date of one year. Subsequent legislation will be required to adjust appropriations to reflect the change in costs. |

” |

| —Maine Office of Fiscal and Program Review | ||

Support[edit]

Sponsors of the referendum included Republican Party Chairman Charles Webster, Senate Minority Leader Kevin Raye and House Minority Leader Joshua Tardy.[13] In April 2010 the Drycleaning & Laundry Institute (dead link) joined the list of organizations in support of Question 1 and asked its members to support the veto.[14] According to reports, the Greater Portland Convention and Visitors Bureau also supported Yes on 1.[15]

A group called Vote YES to Reject New Taxes launched a campaign on April 8, 2010 in support of the proposed veto.[16]

Arguments[edit]

- Referendum supporters argued that although the overhaul was designed to lower income tax, the package would also broaden the sales tax to include items like car repairs, and increase the meals and lodging tax from 7 percent to 8.5 percent. Additionally they said that it would eliminate income tax deductions and exemptions from the tax code.[7]

- At a Rockport Forum on May 18, 2010, Maine Innkeepers Association Executive Director Greg Dugal asked voters to approve the veto. "The largest industry in the state is tourism. So why would we want to alienate people who come here and support our largest industry and our largest employer," he said.[17]

- Curtis Pickard of the Maine Merchants Association argued that while the proposed reforms might cut income taxes, the state would expand sales tax and the meal-and-lodging tax in order to compensate for the lost revenue. He said he did not agree with that. "I don't like short little sound bites. I don't like having to go out there and say '100 new taxes,' but that's what you have to do to get the message across to get people to pay attention that their industry is likely on that list," said Pickard.[18]

- The Greater York Region Chamber of Commerce voted to support the repeal of the new tax laws. President Cathy Goodwin said, "It is an expansion if [sic] state sales tax, which would affect numerous new categories of small businesses and their customers." The tax, they said, was designed to impose taxes on more than 50 services not taxed by the state of Maine at the time. Such taxes included: auto repair, amusement parks, dry cleaning, vehicle towing and limousine services. The new tax law was also designed to increase sales taxes on liquor, meals and lodging and car rentals.[19]

Campaign contributions[edit]

Sen. David Trahan organized a PAC called Still Fed Up With Taxes in support of the tax code referendum. On July 20, 2009, the group announced that they collected more than $7,000 in donations and over $10,000 in pledges.[20] The main campaign PAC - Vote YES to Reject New Taxes - had an estimated $27,180 in cash contributions as of June 2, 2010. The PAC received an estimated $13,840 in in-kind contributions and spent about $8,297 in operating costs.[21]

Below is a chart that outlines major cash contributions to the Vote YES to Reject New Taxes Campaign, as of June 2, 2010:[22][23]

| Contributor | Amount |

|---|---|

| Maine Association of Realtors[24] | $222,589 |

| Maine Automobile Dealers Association[25] | $5,000 |

| Maine Restaurant Association[25] | $5,000 |

| Maine Tourism Association[25] | $5,000 |

| NFIB - Safe Trust | $2,000 |

Opposition[edit]

A group called No Higher Taxes for Maine launched a campaign on April 8, 2010 in opposition of the proposed veto.[26] "We haven't had tax relief in this state for 40 years. And this is going to bring real tax relief to Maine people," said Crystal Canney, spokeswoman for No Higher Taxes.[19] Also in opposition was the Maine State Chamber of Commerce. According to reports, the organization announced their opposition, a switch in opinion, in May 2010.[27] Previously, in 2009 the chamber asked Gov. John Baldacci to veto the tax reform because according to reports they worried about the effects on the tourism industry.[28]

Other endorsements included former Gov. Angus King and the Maine Today Media chain. Maine Today Media owns the Portland Press Herald, the Kennebec Journal and the Waterville Sentinel.[15]

Gov. Baldacci announced his opposition to Question 1 and urged voters to vote "no" on the proposed veto during his weekly radio address.[29]

Rep. John Piotti, the original sponsor of the legislation, defended his tax proposal at a Rockport Forum on May 18, 2010. Piotti argued that the current tax system was broken. Of the tax reform, which is on hold until the June vote, he said, "It is designed to take in the same amount of money we do now, just in a smarter manner."[17]

Arguments[edit]

- Opponents of the referendum said the overhaul package will reduce the tax burden on Maine residents by $55 million. Additionally, they argued that it would lower the top income tax rate from 8.5 percent to 6.5 percent for income up to $250,000, and the top income tax rate for incomes above $250,000 from 8.5 percent to 6.85 percent.[7]

- Maine State Chamber of Commerce president Dana Connors said,"Lowering the income tax rate had been something that the Maine State Chamber of Commerce had long advocated for. We hope the law is given the opportunity to work, and we are confident that it will help businesses here in Maine while attracting additional investment to this state from other parts of the country."[27] The Bangor Region Chamber of Commerce and the Greater Portland Regional Chamber of Commerce also opposed the proposed veto.[30][31]

- Rep. John Piotti argued that if the issue had not been placed on the statewide ballot Maine residents would already be paying less in taxes. This he said was a result of "misguided politics." According to Piotti by the time voters vote in June, "the delay caused by placing this issue on the ballot will have already cost Mainers over $20 million in savings and hundreds of new jobs! We can't afford to pass up that kind of opportunity anytime, but especially not now."

- In support of the state tax reform Piotti said, "The new law lowers the top income tax from 8.5% to 6.5% (on income under $250,000) and to 6.85% (on income over $250,000). But most Mainers will pay far less than 6.5%, due to a system of new household credits. Income taxes will drop for over 95% of Mainers. At the same time, the new law expands Maine's narrow sales tax base in order to stabilize revenues and export more of the tax burden to nonresidents. But in the end, the new system puts more money back in the pockets of Mainers. Nearly 90% of Mainers see an OVERALL tax cut (once both sales and income taxes are included)."[32]

- Wick Johnson, owner of Kennebec Technologies, said he liked that the tax reform cut the income tax rate for almost all Mainers by two percent. "You can't have economic development in a climate that totally discourages economic development. Nobody in their right mind who expects to be a high income person would start a business in Maine at this point in time," said Johnson.[18]

Campaign contributions[edit]

The main campaign PAC - No Higher Taxes for Maine - had an estimated $337,180 in cash contributions as of June 2, 2010. The PAC spent an estimated $303,741.97 in expenditures to oppose the proposed measure and $132.76 in operating costs.[33]

Below is a chart that outlines major cash contributions to the No Higher Taxes for Maine Campaign, as of June 2, 2010:[34][35]

| Contributor | Amount |

|---|---|

| Donald Sussman, chairman of Trust Asset Management[25] | $150,000 |

| Daniel Tishman, chairman of Tishman Construction Corp.[25] | $50,000 |

| Sheryl Crockett Tishman[25] | $50,000 |

| Leon Gorman, chairman of L.L. Bean | $25,000 |

| Iberdrola USA Corp. | $15,000 |

Media editorial positions[edit]

- Main article: Endorsements of Maine ballot measures, 2010

Support[edit]

- Foster's Daily Democrat said,

| “ |

The bottom line for voters is that the Legislature didn't do its homework on this tax package. It didn't spend the time needed to measure its true impact. It did not look hard enough at the plight of the average wage earner who will be hit hardest. The Maine Legislature needs to be sent back to the drawing board with a yes vote on Question 1 (People's Veto)... [12] |

” |

| —Foster's Daily Democrat | ||

Opposition[edit]

- The Bangor Daily News said,

| “ |

The tax reform bill is a complex piece of legislation, and it is easily demonized by those who highlight parts and ignore others. This plan makes Maine more competitive with other states for business development, and eases the burden on almost all of us. It must not be derailed. [12] |

” |

| —Bangor Daily News | ||

- The Sun Journal said,

| “ |

If Question 1, the repeal of tax reform, passes Tuesday, it will represent a victory for demagoguery over dispassionate truth. And you will likely be cheated out of paying lower taxes for years to come. The people urging a "Yes on One" vote Tuesday have, in their TV ads, desperately tried to beat a complex issue into a cynical, emotional sound bite — ordinary people getting "short-changed" by the wealthy," said the editorial board. [12] |

” |

| —Sun Journal | ||

- The Journal Tribune said,

| “ |

We can’t support a “Yes” vote on Question 1, and encourage voters to weigh the issue carefully before supporting this veto. Tax reform won’t help everyone, but if each household and business could take the time to calculate its own self-interest, this version of tax reform would become more popular." However, the board goes on to say, "Tax reform has been a hard sell. If it becomes necessary to try again, we’d like to see legislators spread the net sales tax net more broadly, rather than targeting only certain businesses to bear this new burden. [12] |

” |

| —Journal Tribune editorial board | ||

Television ads[edit]

Yes on One ad, 5-24-10 |

Support: In May 2010 the Maine Association of Realtors purchased air time for two television ads in support of repealing a tax reform law. According to reports the organization spent $197,511, through a committee called "Save the Mortgage Interest Deduction Ballot Question Committee."[40] The first television ad in support of Question 1 was released May 8, 2010. The ad's background was a wedding and highlighted all of the taxes due to the new tax reforms and their impact. It ended with "Speak now or forever pay new Maine taxes. Vote Yes on One."[41] A second ad was released May 19, 2010. Like the first ad, the second -- "Vote Yes on Blues" -- featured all the taxes due to the new tax reforms.[42] Two additional ads were released on May 24, 2010. The first ad opened with "If Question One does not pass on June 8, it means another government bailout for the wealthy and Maine people get shortchanged again. In fact, as Maine's wealthiest 1 percent get tax cuts, you will end up paying...It's just not fair."[43] The second ad released in late May featured a similar message to all previously released TV ads -- the taxes imposed by new tax reforms, as well as a focus on the notion that Maine's wealthiest would receive tax cuts while other Mainers wouldn't.[44]

No on One ad, 5-12-10 |

Opposition: In May 2010, opponents released their first television ads. One ad showed a woman trying to coax her pet lobster to move. The ad said that "Mainers know a bad idea when we see one. Like Question One, a plan to raise income taxes in a bad economy."[45] The second ad used the same statement but showed a man strapping a car seat for his young child to the back of his motorcycle.[46] Two more ads were released May 28, 2010 by No Higher Taxes for Maine. The first ad featured Wick Johnson, Kennebec Technologies president, who said he "knows how rough this economy has been." He asked voters not to be swayed by "special interests" and said, "If Question One passes and our income taxes go up it could crush any hope of recovery. But if we say no to question one we can rebuild our economy and attract new jobs. Raising income tax rates by 30 percent in a weak economy is a job killer. It's that simple."[47] The second television ad featured the same message with John Cashwell, managing director of Portage Chip Mill, as the spokesperson.[48]

Noteworthy events[edit]

Supporters and opponents of Question 1 accused each other of running misleading ads. The Yes on 1 ad described the legislatively-approved tax reforms as "another government bailout for the wealthy." But opponents said the ad made false claims about the number of people who would receive tax deductions.[49]

| “ | "It’s simply not true. Independent research from the nonpartisan office of the Maine Revenue Service shows all levels of income benefit from the tax relief bill. It’s unfortunate that during a campaign the truth is not the first rule but, in the case with the Yes on 1 campaign, it is not even an afterthought.[12] | ” |

| —Christopher St. John of the Maine Center on Economic Policy.[49] | ||

No on 1 advocates argued that the measure would raise taxes, calling it "a job killer we can't afford." But Sen. David Trahan, a leader of the campaign to repeal the tax reform law, argued that opponents' television ads are "stretching the truth." Trahan noted that according to No on 1 ads voting "yes" would increase income taxes, when in fact income taxes would remain the same, he said. The tax reforms haven't gone into effect because of the referendum, therefore the income taxes have not yet been affected, argued Trahan. He also said that opponents have "over-inflated" their numbers of who would see a decrease in taxes.[49][50]

Polls[edit]

- See also: Polls, 2010 ballot measures

|

- A poll conducted from April 28 through May 7 by Critical Insights revealed that approximately 43 percent of registered voters would not vote to overturn tax reforms, while 38 percent are would vote yes and 19 percent are undecided. According to the pollster 600 registered voters were polled during phone interviews. The poll had a margin of error of plus or minus 4 percentage points.[51]

| Date of Poll | Pollster | In favor | Opposed | Undecided | Number polled |

|---|---|---|---|---|---|

| April 28 - May 7, 2010 | Critical Insights | 38% | 43% | 19% | 600 |

Path to the ballot[edit]

The Maine Constitution allowed for a referendum to overturn a law only if opponents could collect at least 10 percent of the number of people who voted in the last governor’s election -- 55,087 signatures. The signatures were required to be submitted by mid-September 2009.[7]

Lawsuit against secretary of state[edit]

On November 2, 2009, Still Fed Up With Taxes filed a lawsuit with the Kennebec County Superior Court requesting that the court order Secretary of State Matt Dunlap to finish reviewing signatures for the referendum. The group filed petitions supporting the referendum in September 2009, but state election officials didn't verify the signatures. The verification deadline was October 13, 2009.[52]

Judge rules against secretary[edit]

Maine Superior Court Judge Donald Marden ruled in favor of state Republicans who challenged the secretary of state. According to attorney Dan Billings, who represented Maine Republican Party Chairman Charlie Webster, "The legal issue involved was concerning the Secretary of State's legal authority to continue to review and pass judgment on petitions after the 30-day deadline set by state law. And what Justice Marden said is that the statute limited the Secretary of State's authority to 30 days, and because the Maine constitution says any review of petitions has to be done in compliance with state law, after the 30 days passed the secretary of state no longer had any authority to review the petitions."[53]

- On December 21, 2009 the lower state court ruled that should an election official take longer than the allotted time to verify the signatures, the petition would be deemed valid.[54]

Sufficient signatures collected[edit]

As of November 9, 2009, supporters submitted a total of 71,035 signatures, 56,107 of which were valid signatures -- 1,020 more than the minimum requirement -- according to Secretary of State Matt Dunlap.[55]

Petitions challenged[edit]

Opponents of the referendum filed a lawsuit, Johnson v. Dunlap, with the Kennebec Superior Court, challenging the certified petitions. According to opponents, Maine's Secretary of State should not have certified the petition for the ballot because two of the notaries who notarized the petitions got married and did not notify the state that their last names had changed.[56]

Judge validates petitions[edit]

On December 23, 2009, Maine's lower state court ruled that despite the challenge, the petitions were valid. According to the judge's ruling, even if the notary who notarized the petitions wrote the incorrect information about their own qualifications, the petitions remain valid.[54]

See also[edit]

Support[edit]

Opposition[edit]

Articles[edit]

- Early results reveal approval of most Maine measures including a tax reform veto

- Mainers cast their ballots on tax reform and bond measures

- Maine tax debates increase as June 8 election nears

- Maine ballot measure order set for June 8 ballot

- Maine legislators propose stricter rules for petition circulation

- Judge chooses sides in Maine petition fight

- Maine tax veto under scrutiny, notaries didn't notify state of name change

- Maine tax code people's veto approved for June 2010 ballot

- Maine anti-tax group takes secretary of state to court

External links[edit]

- Vote Yes to Reject New Taxes - Yes on One official website

- No Higher Taxes for Maine - No on One official website

- LD 1495 Legislation

- Maine people's veto for 2010

Additional reading[edit]

- Associated Press, "Maine's Voter Turnout Appears To Be Low," June 8, 2010

- Associated Press, "Mainers vote whether to keep or overturn tax law," June 8, 2010

- The Colorado Independent, "A new path for Colorado? Maine votes on new tax structure," June 7, 2010

- Stateline of the Pew Charitable Trusts, "A tax reform test in Maine," June 7, 2010

- Sanford News, "State's primary is this Tuesday; ballot to include referendum questions and school budget validation," June 3, 2010

- The Free Press, "Lower income taxes, broaden sales taxes? Voters decide June 8," May 20, 2010

- Associated Press, "Maine Voters To Decide Bond Questions," May 16, 2010

- The Free Press, "June Statewide Ballot Questions," May 13, 2010

- Maine Public Broadcasting Network, "Battle Heats up over Maine's Tax Reform Law," May 13, 2010

- Bangor Daily News, "Tax debate comes to small communities," May 13, 2010

- Mainebiz, "Tax reform 101," May 3, 2010

- Morning Sentinel, "Tax issue on June ballot," March 22, 2010

Footnotes[edit]

- ↑ Maine Public Broadcasting Network, "Maine Voters Repeal Tax Reform Law," June 9, 2010

- ↑ Foster's Daily Democrat, "Maine repeals controversial tax law," June 9, 2010

- ↑ 3.0 3.1 3.2 3.3 Maine Secretary of State, Division of Elections, "Maine Citizen's Guide to the Referendum Election, Tuesday, June 8, 2010," accessed May 14, 2014

- ↑ Maine Secretary of State, Elections Division, "Referendum Election Tabulations, June 8, 2010," accessed May 14, 2014

- ↑ Sun Journal, "Tax repeal PAC aims for June ballot," June 21, 2009

- ↑ WABI, "Maine Tax Code People's Veto, Question 1," May 12, 2010

- ↑ 7.0 7.1 7.2 7.3 Associated Press, "Republicans attack tax overhaul," June 20, 2009

- ↑ WMTW, "Question 1 Would Change Tax Structure," May 25, 2010

- ↑ The Maine Public Broadcasting Network, "Maine Lawmakers OK Date Change for Tax Reform Law," April 7, 2010

- ↑ Maine Public Broadcasting Network, "Your Vote 2010: Question 1 and Candidate Conversations," May 20, 2010

- ↑ The Portland Press Herald, "Maine's Choice: Reform tax code, or let it be," May 30, 2010

- ↑ 12.0 12.1 12.2 12.3 12.4 12.5 12.6 12.7 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

- ↑ Associated Pres, "Top Republicans attack Maine tax overhaul," June 19, 2009

- ↑ Laundry and Cleaning News, "DLI campaigns to reject Maine drycleaning tax," April 21, 2010

- ↑ 15.0 15.1 Bangor Daily News, "Question 1 camps gather support of heavy hitters," June 6, 2010

- ↑ WCSH6, "Tax reform groups kick off campaigns," April 8, 2010

- ↑ 17.0 17.1 Bangor Daily News, "Question 1 debated at Rockport forum," May 19, 2010

- ↑ 18.0 18.1 Maine Public Broadcasting Network, "Maine Business Owners Divided on Tax Reform Repeal," May 19, 2010

- ↑ 19.0 19.1 Seacoast Online, "Heat is on for Maine tax Law," June 2, 2010

- ↑ Maine Public Broadcasting Network, "Tax Law Opponents say Donations Rolling In," July 20, 2009

- ↑ Maine Campaign Finance, "PAC Summary: Vote YES to Reject New Taxes," accessed June 2, 2010

- ↑ Maine Campaign Finance, "Vote YES to Reject New Taxes Campaign:Quarterly - April," April 2, 2010 (dead link)

- ↑ Maine Campaign Finance, "Vote YES to Reject New Taxes Campaign: 11-day Pre-Primary," May 28, 2010 (dead link)

- ↑ The Portland Press Herald, "Realtors spending big to repeal Maine tax reform," June 2, 2010

- ↑ 25.0 25.1 25.2 25.3 25.4 25.5 The Portland Press Herald, "Reports show reform effort contributors," June 3, 2010

- ↑ News 13, "Campaign Begins to Preserve Maine Tax Reform," April 9, 2010

- ↑ 27.0 27.1 The Portland Press Herald, "Maine State Chamber opposes Question 1," May 12, 2010

- ↑ The Portland Press Herald, "Maine chamber shifts stance, says it backs tax reform law," May 13, 2010

- ↑ Associated Press, "Gov Urges Mainers To Vote For Bond Proposals," June 5, 2010

- ↑ Associated Press, "Regional Chamber of Commerce endorses Maine bonds," May 20, 2010

- ↑ Bangor Daily News, "Vote no on Question 1 to lower taxes and improve the economy," May 29, 2010

- ↑ The Free Press, "Vote NO on Question 1," May 13, 2010

- ↑ Maine Campaign Finance, "PAC Summary: No Higher Taxes for Maine," accessed June 2, 2010

- ↑ Maine Campaign Finance, "No Higher Taxes for Maine - Quarterly - April," April 12, 2010 (dead link)

- ↑ Maine Campaign Finance, "No Higher Taxes for Maine - 11-day Pre-Primary," May 28, 2010 (dead link)

- ↑ Foster's Daily Democrat, "Maine tax changes overreach," May 18, 2010

- ↑ Bangor Daily News, "No on Question 1," May 26, 2010

- ↑ Sun Journal, "Vote 'No' on Question 1 to save tax reform," June 3, 2010

- ↑ The Journal Tribune, "Question 1: A chance to vote against tax reform," May 25, 2010

- ↑ Kennebec Journal, "Realtors back tax-overhaul repeal," May 27, 2010

- ↑ YouTube, "Vote YES to Reject New Taxes - Vote Yes on One," May 8, 2010

- ↑ YouTube, "Vote YES to Reject New Taxes - Vote Yes on Blues," May 19, 2010

- ↑ YouTube, "Vote YES to Reject New Taxes - YES on ONE - Reject New Taxes - TV Commercial 1 - Just Not Fair," May 24, 2010

- ↑ YouTube, "Vote YES to Reject New Taxes -Reject New Taxes - TV Commercial 2 - Auto Repair," May 24, 2010

- ↑ YouTube, "NoHigherTaxes for Maine - TV Ad," May 12, 2010

- ↑ YouTube, "NoHigherTaxes for Maine - TV Ad 2," May 12, 2010

- ↑ YouTube, "NoHigherTaxes for Maine - TV Ad 3," May 28, 2010

- ↑ YouTube, "NoHigherTaxes for Maine - TV Ad 4," May 28, 2010

- ↑ 49.0 49.1 49.2 Bangor Daily News, "Ads vex tax reform friends, foes," May 28, 2010

- ↑ Maine Public Broadcasting Network, "Question One TV Ad Under Fire," May 28, 2010

- ↑ Bangor Daily News, "Tax question may hinge on voter turnout," May 27, 2010

- ↑ Maine Public Broadcasting Network, "Anti-tax Group Taking State to Court Over Petition Delay," November 2, 2009

- ↑ Maine Public Broadcasting Network, "Judge Sides With Tax Opponents in Petition Dispute," December 23, 2009

- ↑ 54.0 54.1 Ballot Access News, "Lawsuit Victories in Maine Referendum Petition Cases," December 29, 2009

- ↑ Maine Department of State, "Maine Election Officials Certify People’s Veto Effort of “An Act To Implement Tax Relief and Tax Reform”, PL 2009 Chapter 382," November 9, 2009

- ↑ Ballot-Access, "Maine Petition is Under Attack Because Notaries Public Who Certified Petition Sheets Got Married and Didn’t Change Their Names in State Records," November 30, 2009

|

People's Veto ballot measures in Maine |

|---|---|

| Laws |

Ballot access laws • History of I&R in Maine • Signature requirements • All Maine ballot measures |

| 1990-2009 |

Sexual Orientation ('98) • Sexual Orientation ('05) • Dirigo Tax ('08) • Repeal School Consolidation ('09)• Same-Sex Marriage ('09) |

| 1970-1989 |

Weight of Commercial Vehicles ('74) • Slot Machine Ban ('80) |

| 1950-1969 |

Vehicle Registration Fee ('58) • Commercial Vehicle Registration ('58) • Sunday Liquor ('66) |

| 1930-1949 |

Government Administration ('30) • Gas Tax ('32) • Intoxicating Liquor ('34) • Fishing Licenses ('36) • Biddeford Elections ('40) • Biddeford Police Commission ('40) • Gas Tax ('41) |

| 1910-1929 |

Alcohol Percentage ('10) • Town of Gorges ('10) • Portland Bridge ('10) • Uniform Ballot Boxes ('12) • Public Utilities Commission ('14) • Hours for Working Women ('16) • Women's Suffrage • Highway Commission ('22) • Standard Time ('25) • Grades of Milk ('25) • Railroad Excise Tax ('28) • Gas Tax Increase ('29) |

|

State of Maine Augusta (capital) |

|---|---|

| Elections |

What's on my ballot? | Elections in 2025 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |

Categories: [Maine 2010 ballot measures] [Taxes, Maine] [Certified, taxes, 2010] [Veto referendum, 2010] [Historical ballots, 2015] [Historical ballots, 2014]

↧ Download as ZWI file | Last modified: 01/10/2025 02:35:48 | 4 views

☰ Source: https://ballotpedia.org/Maine_Tax_Code_People_s_Veto,_Question_1_(June_2010) | License: CC BY-SA 3.0

.png)

.jpg)

KSF

KSF