Bernie Sanders Presidential Campaign, 2016#Taxes

From Ballotpedia

From Ballotpedia

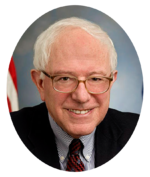

Bernie Sanders |

U.S. Senator (Assumed office: 2007) U.S. Representative (1991-2007) |

2024 • 2020 • 2016 |

This page was current as of the 2016 election.

| CANDIDATE SUMMARY | |

- According to an analysis by the Tax Policy Center that was released on May 9, 2016, Sanders’ policy proposals would add $18 trillion to the federal budget deficit over the next decade after $15.3 trillion in new taxes, most of which would come from high-income households, was factored in.[2]

- Before a rally in Appleton, Wisconsin, on March 29, 2016, Fox 6's A.J. Bayatpour asked Bernie Sanders how he would handle businesses moving out of the United States if he implements a higher corporate tax rate. Sanders replied, "We can’t succumb to blackmail. We need a new trade policy that tells corporate America, they just cannot shut down, move abroad, and bring their products back into this country. And that is certainly one of the areas we’re focusing on."[3]

- House Minority Leader Nancy Pelosi (D) told reporters January 27, 2016, that House Democrats would not embrace Bernie Sanders' single-payer health plan and the associated taxes needed to implement it. "We're not running on any platform of raising taxes," Pelosi said during a press briefing at the House Democrats' retreat in Baltimore. "We do want to have a fairer tax system, and … we hope that we can do that this year." Pelosi noted that she has supported the single-payer strategy for decades. But the nation's healthcare system has evolved in a different direction, she said, and the political conditions are simply not ripe to scrap the existing infrastructure in favor of Medicare-for-all. "He's talking about a single-payer, and that's not going to happen. I mean, does anybody in this room think that we're going to be discussing a single-payer?" she asked. "I've been for single-payer for 30 years, and it is a very popular idea in our country. But we have made a decision about where we're going on healthcare."[4]

- Sanders released a tax proposal as part of an effort to explain how he would pay for his Medicare-for-all, single-payer healthcare plan. Sanders said the plan would cost $1.38 trillion per year—a figure that has been criticized as low[5][6]— and that it would be paid for with a 6.2 percent income-based healthcare premium paid by employers, which is expected to raise $630 billion per year. Sanders' proposal also called for a 2.2 percent income-based premium paid by households, which is expected to raise $210 billion a year. The plan also would raise income tax rates on households making $250,000 and above. Under Sanders' plan, rates would rise to 37 percent on income between $250,000 and $500,000; 43 percent on income between $500,000 and $2 million; and 48 percent on income between $2 million and $10 million. The current highest income tax rate is 39.6 percent. Sanders would also raise taxes on capital gains and dividends for households making over $250,000, which would raise $92 billion per year. Limits on deductions for households making over $250,000 would raise $15 billion per year, and increases to the estate tax—focused specifically on people making more than $250,000 a year or inheriting estates larger than $3.5 million—would yield $21 billion a year. Sanders also said that $310 billion a year would be raised by eliminating several tax breaks that subsidize healthcare, which would become obsolete and disappear under a single-payer healthcare system. Currently, health insurance benefits are exempt from both income and payroll taxes, and some economists believe that, eventually, employer spending on health would translate into higher wages and salaries. Minus what would be needed to pay the 6.2 percent tax, Sanders believes that there would be $310 billion a year in new income and payroll taxes, on average over the next 10 years.[7][8][9][10]

- In an op-ed in The Des Moines Register on December 6, 2015, Sanders called on Congress to stop the merger between drug corporations Pfizer and Allergan and touted the Corporate Tax Dodging Prevention Act, a bill he introduced April 14, 2015. He wrote that Pfizer “wants to merge with a company based in Ireland so that it can dodge its tax responsibilities and pay a lower rate than many teachers and nurses do in this country. This is a phony move. The new company will still be based in New York. It will still earn huge profits in the United States, which will still be its biggest market. Pfizer shareholders will own more than half of the merged corporation. And yet, when tax time rolls around, this company will want us to believe that it is really Irish and not American.”[11]

- On December 7, 2015, Sanders unveiled a wide-ranging plan to address climate change, which is designed to reduce carbon pollution by 40 percent by 2030 and by over 80 percent by 2050. Under the proposal, Sanders would impose a tax on carbon emissions, repeal subsidies, including tax breaks, for fossil fuel production, and make investments in energy efficiency and clean, sustainable energy such as wind and solar power.[12][13]

- In a statement on November 23, 2015, Bernie Sanders denounced the merger between pharmaceutical firms Pfizer and Allergan. The move is known as a tax inversion and occurs when an American-based company merges with a foreign firm and the new combined company sets up headquarters abroad for the purposes of lowering its U.S. tax bill. Sanders said, “The Pfizer-Allergan merger would be a disaster for American consumers who already pay the highest prices in the world for prescription drugs. It also would allow another major American corporation to hide its profits overseas. The Obama administration has the authority to stop this merger, and it should exercise that authority. Congress also must pass real tax reform that demands that profitable corporations pay their fair share of taxes.”[14]

- On November 22, 2015, Michael Briggs, Sanders’ communications director, described Hillary Clinton’s recent tax proposals as “tentative half-steps that sound Republican-lite.” He added, “Given the disappearing middle class and massive income and wealth inequality in America today, we clearly have to go a lot further than what Secretary Clinton proposes. We need to raise Social Security benefits by lifting the cap on taxable income above $250,000. We need to pass excellent legislation by leading Democrats in Congress to provide paid family and medical leave. We need to join the rest of the industrialized world in guaranteeing health care to all people as a right, not a privilege.”[15]

- On the October 16, 2015, airing of HBO’s Real Time with Bill Maher, Sanders explained what he and other “democratic socialists” hope to achieve. He said, “We want to deal with grotesque level of income inequality in America. On every one of the major issues I am talking about, the American people agree.” Sanders also discussed his push for universal healthcare, saying, “The United States is the only major country on Earth that allows private insurance companies to make huge profits in the health care system. The function of health care should be to provide quality care to all people, not to make huge profits for the drug companies and insurance companies.” After Maher questioned Sanders’ proposal to pay for universal healthcare by raising taxes on the “one percent,” Sanders said, “We may have to go down a little bit lower than that, but not much lower.”[16]

- In July 2015, Sanders said that he would raise taxes on the wealthiest Americans and corporations if he were elected. Sanders said, "Yes, we have to raise individual tax rates substantially higher than they are today because almost all of the new income is going to the top 1%. And yes, those folks and large corporations will have to pay under a Sanders administration more in taxes so that we can use that revenue to rebuild our crumbling infrastructure, create the jobs we need, make sure that every kid who has the ability is able to get a college education in America because public colleges and public universities will be tuition-free."[17]

- In an interview with The Des Moines Register on July 3, 2015, Sanders expressed his preference for Scandinavian socialism and referred to himself as a democratic socialist. [18]

- In a November 2014 op-ed, Sanders wrote, "A progressive estate tax on multi-millionaires and billionaires is the fairest way to reduce wealth inequality, lower our $17 trillion national debt and raise the resources we need for investments in infrastructure, education and other neglected national priorities."[19]

- In 2013, Sanders voted against S.Amdt. 297 to S.Con.Res. 8, which proposed repealing the tax on medical devices.[20]

- In 2010, Sanders filibustered the Bush tax cuts for "more than 8 1/2 hours," according to The Los Angeles Times.[21]

- Sanders voted against H.R.3709 - the Internet Nondiscrimination Act of 2000, which proposed prohibiting "a State or political subdivision from imposing: (1) taxes on Internet access...and (2) multiple or discriminatory taxes on electronic commerce."[22]

Recent news[edit]

This section links to a Google news search for the term Bernie + Sanders + Taxes

See also[edit]

Footnotes[edit]

- ↑ VPR, "Bernie Sanders Is Streaming His Presidential Announcement On Periscope," April 30, 2015

- ↑ Tax Policy Center, "An Analysis of Senator Bernie Sanders' Tax and Transfer Proposals," May 9, 2016

- ↑ FOX6Now.com, "http://fox6now.com/2016/03/29/sanders-tells-supporters-in-appleton-to-stand-together-unify-voters-in-wisconsin/," March 30, 2016

- ↑ The Hill, "Pelosi distances Democrats from Sanders' plan to raise taxes," January 27, 2016

- ↑ The New York Times, "Weakened at Bernie’s," January 19, 2016

- ↑ Politico, "Sanders, Clinton clash over his new 'Medicare for All' plan," January 17, 2016

- ↑ The New York Times, "Sanders Makes a Rare Pitch: More Taxes for More Government," January 22, 2016

- ↑ CNN Money, "How taxes would be much higher under President Bernie Sanders," January 19, 2016

- ↑ Vox, "Here's what the tax code would look like if Bernie Sanders got everything he wanted," January 22, 2016

- ↑ The Washington Post, "Bernie Sanders’s health-care plan is the biggest attack on the rich of this campaign," January 17, 2016

- ↑ The Des Moines Register, "Sanders: Drug 'merger' must be stopped," December 6, 2015

- ↑ Bernie 2016, "Combating Climate Change to Save the Planet," accessed December 7, 2015

- ↑ NBC News, "Bernie Sanders Unveils Climate Plan," December 7, 2015

- ↑ Bernie Sanders, U.S. Senator for Vermont, "Sanders Condemns Pfizer-Allergan Merger," accessed November 24, 2015

- ↑ Bernie 2016, "Republican-lite Half Steps," November 22, 2015

- ↑ Salon, "Bill Maher just endorsed Bernie Sanders, explains how he makes GOP 'heads explode,'" October 17, 2015

- ↑ CNN, "Bernie Sanders says he'd raise taxes," July 5, 2015

- ↑ The Des Moines Register "Q&A with Bernie Sanders: What he means by socialism" July 7, 2015

- ↑ Huffington Post, "A Progressive Estate Tax," November 8, 2014

- ↑ Senate.gov, “S.Amdt. 297 to S.Con.Res. 8,” accessed December 23, 2014

- ↑ L.A. Times, “Sen. Bernie Sanders ends filibuster," December 10, 2010

- ↑ Congress.gov, "H.R.3709," accessed April 7, 2015

| |||||||||||

Categories: [Bernie Sanders] [2016 presidential election, Taxes]

↧ Download as ZWI file | Last modified: 09/06/2024 05:22:15 | 3 views

☰ Source: https://ballotpedia.org/Bernie_Sanders_presidential_campaign,_2016/Taxes | License: CC BY-SA 3.0

✘

ZWI is not signed. [what is this?]

KSF

KSF