United States Housing Bubble

From Nwe

From Nwe

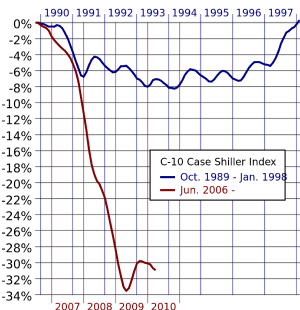

The United States housing bubble, a real estate bubble, and its subsequent bursting affected over half of the U.S. states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the home price index reported its largest price drop in its history. The credit crisis resulting from this bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.

In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to the government-sponsored Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, and to the Federal Home Loan Mortgage Corporation (FHLMC), known as Freddie Mac. Despite such massive financial rescue efforts over several years, the economic impact is considered by many economists to have been the worst financial crisis since the Great Depression of the 1930s. The Financial Crisis Inquiry Commission concluded in 2011 that the crisis was avoidable, despite being the result of a combination of factors. Unfortunately, warnings from a variety of sources were ignored and the consequences were tragic and widespread.

Prediction of the Housing Bubble Behavior

The real estate bubble that affected over half of the U.S. states in 2006, and its subsequent bursting, has generally been considered the major factor that led to the economic recession that began at the end of 2007. Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets.[1]

The burst of the housing bubble was predicted by political and economic analysts, such as G. Edward Griffin in his 1994 book, The Creature from Jekyll Island,[2] and Jeffery Robert Hunn in a March 3, 2003 editorial:

[W]e can profit from the collapse of the credit bubble and the subsequent stock market divestment [(decline)]. However, real estate has not yet joined in a decline of prices fed by selling (and foreclosing). Unless you have a very specific reason to believe that real estate will outperform all other investments for several years, you may deem this prime time to liquidate investment property (for use in more lucrative markets).[3]

However, many contested any suggestion that there could be a problem in the housing market, particularly at its peak from 2004 to 2006,[4] with some even rejecting the "house bubble" label altogether.[5]

Unfortunately, warnings from a variety of sources were ignored by those who could have taken action. For example, it was later revealed that in mid-2004 Richard F. Syron, the CEO of Freddie Mac, was warned that Freddie Mac was financing risk-laden loans that threatened its financial stability. Mr. Syron ignored the warnings.[6]

Causes

A variety of causes for the housing bubble and its subsequent bursting have now been identified, including low mortgage interest rates, low short-term interest rates, relaxed standards for mortgage loans, and irrational exuberance on the part of loan originators coupled with mania for home ownership. The combination of these factors, coupled with failure to heed warnings, led the housing bubble to be more extreme and the resulting credit crisis to be more severe, resulting in the recession.

Housing and Community Development Acts

In the years before the crisis, the behavior of lenders changed dramatically. Several administrations, both Democratic and Republican, advocated affordable housing policies in the years leading up to the crisis. In 1977 the U.S. Congress passed the Housing and Community Development Act to reduce discriminatory credit practices against low-income neighborhoods, a practice known as redlining. The law was designed to encourage commercial banks and saving associations to help meet the needs of borrowers in all segments of their communities, including low- and moderate-income neighborhoods. The Act instructs the appropriate federal financial supervisory agencies to encourage regulated financial institutions to help meet the credit needs of the local communities in which they are chartered.

The Housing and Community Development Act of 1992 established, for the first time, an affordable housing loan purchase mandate for the Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, and the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac. This mandate was to be regulated by the Department of Housing and Urban Development (HUD). Initially, the 1992 legislation required that 30 percent or more of Fannie’s and Freddie’s loan purchases be related to affordable housing. However, HUD was given the power to set future requirements, and eventually a 56 percent minimum was established.[7] To fulfill the requirements, Fannie Mae and Freddie Mac established programs to purchase $5 trillion in affordable housing loans,[8] and encouraged lenders to relax underwriting standards to produce those loans.[7]

Deregulation

Historically, the financial sector was heavily regulated by the Glass-Steagall Act which was enacted in 1933 after the Great Depression. It separated commercial and investment banks, in part to avoid potential conflicts of interest between the lending activities of the former and rating activities of the latter. It also set strict limits on banks' interest rates and loans.

Starting in the 1980s, considerable deregulation took place in banking. Banks were deregulated through:

- The Depository Institutions Deregulation and Monetary Control Act of 1980 (allowing similar banks to merge and set any interest rate).

- The Garn–St. Germain Depository Institutions Act of 1982 (allowing Adjustable-rate mortgages).

- The Gramm–Leach–Bliley Act of 1999 (allowing commercial and investment banks to merge), repealing Glass-Steagall.

Economist such as Joseph Stiglitz, Robert Kuttner, Richard D. Wolff, Robert Ekelund, and Mark Thornton among others criticized the repeal of Glass Steagall. In Stiglitz' opinion, this created a risk-taking culture of investment banking which dominated the more conservative commercial banking culture, leading to increased levels of risk-taking and leverage during the boom period.[9] However, President Bill Clinton, who signed the legislation, dismissed its connection to the subprime mortgage crisis, later stating (in 2008), "I don't see that signing that bill had anything to do with the current crisis."[10]

Economists Robert Ekelund and Mark Thornton noted:

The Financial Services Modernization Act of 1999 would make perfect sense in a world regulated by a gold standard, 100% reserve banking, and no FDIC deposit insurance; but in the world as it is, this "deregulation" amounts to corporate welfare for financial institutions and a moral hazard that will make taxpayers pay dearly.[11]

Critics have also noted defacto deregulation through a shift in mortgage securitization market share from more highly regulated Government Sponsored Enterprises to less regulated investment banks.[12]

Securitization

Securitization — the bundling of bank loans to create tradeable bonds — started in the mortgage industry in the 1970s, when Government Sponsored Enterprises (GSEs) began to pool relatively safe, conventional, "conforming" or "prime" mortgages, creating "mortgage-backed securities" (MBS). They then sold these to investors, guaranteeing these securities/bonds against default on the underlying mortgages.[13] This "originate-to-distribute" model had advantages over the old "originate-to-hold" model,[14] where a bank originated a loan to the borrower/homeowner and retained the credit (default) risk. Securitization removed the loans from a bank's books, enabling the bank to remain in compliance with capital requirement laws. More loans could be made with proceeds of the MBS sale. The liquidity of a national and even international mortgage market allowed capital to flow where mortgages were in demand and funding short.

However, securitization created a moral hazard — the bank/institution making the loan no longer had to worry if the mortgage was paid off[15] — giving them incentive to process mortgage transactions but not to ensure their credit quality.[16]

With the high down payments and credit scores of the conforming mortgages used by GSEs, this danger was minimal. Investment banks however, wanted to enter the market and avoid competing with the GSEs.[15] They did so by developing mortgage-backed securities in the riskier non-conforming subprime and Alt-A mortgage markets. Unlike the GSEs, these issuers generally did not guarantee the securities against default of the underlying mortgages.[17] By securitizing mortgages, investment bankers could now sell off these "pools" of loans to other financial institutions and investors in a secondary and, mostly unregulated, market. Instead of holding all the loans they made to home buyers on their books, lending institutions could pool several of these loans together and sell them in the secondary market to another financial institution or investor.

Securitization began to take off in the mid-1990s. The total amount of mortgage-backed securities issued almost tripled between 1996 and 2007, to $7.3 trillion. After the collapse of the dot.com bubble in 2000, the securitized share of subprime mortgages (those passed to third-party investors via mortgage-backed securities (MBS) and collateralized debt obligations (CDO)) increased from 54 percent in 2001, to 75 percent in 2006. These third-party investors were not just U.S. commercial banks but also foreign banks.[18]

A collateralized debt obligation (CDO) is a type of structured asset-backed security. Originally developed for the corporate debt markets, over time CDOs evolved to encompass the mortgage and mortgage-backed security (MBS) markets. Instead of holding all the loans in the banks' books which are subject to regulations, in the case of sub-prime mortgages the derivatives (CDOs and MBSs) magnified the effect of losses, because they allowed bankers to create an unlimited number of CDOs linked to the same mortgage-backed bonds.[18]

Regarding the role of securitization in the credit crisis, Alan Greenspan commented that "the securitization of home loans for people with poor credit — not the loans themselves — were to blame for the current global credit crisis," a statement which merely identifies the causal factors without resolving the issue of which came first. In other words, which came first: the impetus to give loans to certain segments of society with poor credit led to securitization of the loans, or the securitization allowed loans to be given to those with poor credit.[18]

Dot-com bubble collapse

The crash of the dot-com and technology sectors in 2000 led to a (approximately) 70 percent drop in the NASDAQ composite index. Several economists have argued this resulted in many people taking their money out of the stock market and purchasing real estate, believing it to be a more reliable investment. For example, Robert Shiller argued that the 2000 crash displaced "irrational exuberance" from the fallen stock market to residential real estate.[19]

In the wake of the dot-com crash and the subsequent 2001–2002 recession, the Federal Reserve (The Fed) dramatically lowered interest rates from about 6.5 per cent to just 1 per cent to avoid going into recession. As a result, liquidity (available money) increased. When interest rates are low in general it causes the economy to expand because businesses and individuals can borrow money more easily, which causes them to spend more freely and thus increases the growth of the economy.

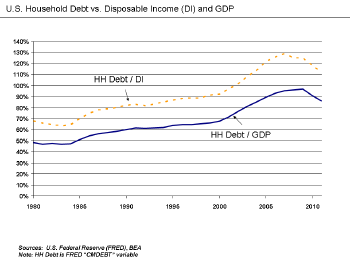

'Mania' for home ownership

Americans' love of their homes is widely known and acknowledged. However, many believe that enthusiasm for home ownership reached a level that was high even by American standards, calling the real estate market a "mania,"[1] and warning of real estate "bubble." [20] The overall U.S. homeownership rate increased from 64 percent in 1994 (about where it was since 1980) to a peak in 2004 with an all-time high of 69.2 percent.

Among Americans, home ownership is widely accepted as preferable to renting in many cases, especially when the ownership term is expected to be at least five years. However, when considered as an investment, that is, an asset that is expected to grow in value over time, as opposed to the utility of shelter that home ownership provides, housing is not a risk-free investment. The popular notion that, unlike stocks, homes do not fall in value is believed to have contributed to the mania for purchasing homes. Stock prices are reported in real time, which means investors witness the volatility. However, homes are usually valued yearly or less often, thereby smoothing out perceptions of volatility.

Fannie Mae and Freddie Mac

Fannie Mae and Freddie Mac are government sponsored enterprises (GSE) that purchase mortgages, buy and sell mortgage-backed securities (MBS), and guarantee nearly half of the mortgages in the U.S. A variety of political and competitive pressures resulted in the GSEs ramping up their purchase and guarantee of risky mortgages in 2005 and 2006, just as the housing market was peaking.

There is evidence suggesting that governmental housing policies were a motivational factor in the purchasing of substandard loans. Daniel H. Mudd, the former CEO of Fannie Mae, stated: "We were afraid that lenders would be selling products we weren't buying and Congress would feel like we weren't fulfilling our mission."[21] Another senior Fannie Mae executive stated: "Everybody understood that we were now buying loans that we would have previously rejected, and that the models were telling us that we were charging way too little, but our mandate was to stay relevant and to serve low-income borrowers. So that's what we did."[10]

The 'post-mortem' GSE commission found that these two players participated in the expansion of sub-prime and other risky mortgages, but also claimed that they followed, rather than led, Wall Street and other lenders into sub-prime lending.[14]

Mortgage fraud and predatory lending

The Federal Bureau of Investigation defines mortgage fraud as "the intentional misstatement, misrepresentation, or omission by an applicant or other interest parties, relied on by a lender or underwriter to provide funding for, to purchase, or to insure a mortgage loan."[10] Predatory lending describes unfair, deceptive, or fraudulent practices of some lenders during the loan origination process: "Lenders made loans that they knew borrowers could not afford and that could cause massive losses to investors in mortgage securities."[14]

In 2004, the FBI warned of an "epidemic" in mortgage fraud, an important credit risk of nonprime mortgage lending, which, they said, could lead to "a problem that could have as much impact as the S&L crisis".[22] Despite this, the Bush administration actually prevented states from investigating and prosecuting predatory lenders by invoking a banking law from 1863 "to issue formal opinions preempting all state predatory lending laws, thereby rendering them inoperative."[23]

In 2007, 40 per cent of all sub-prime loans resulted from automated underwriting.[24] The chairman of the Mortgage Bankers Association claimed that mortgage brokers, while profiting from the home loan boom, did not do enough to examine whether borrowers could repay.[25]

After the Federal Reserve reduced interest rates to historical lows following the dot-com bubble burst, and, under the Clinton administration that eased the banking lending standards for potential and existing home-owners (to help low-income and certain racial segments of the society), it became easier for everybody who applied to obtain a mortgage. In this climate, financial institutions offered loans to buyers with FICO scores below 620.[26] Hence, lenders offered more and more loans to higher-risk borrowers.

The Financial Crisis Inquiry Commission reported a rising incidence of "mortgage fraud which flourished in an environment of collapsing lending standards and lax regulation."[14] One example involves Citigroup, who admitted that they had approved loans for government insurance that did not qualify under Federal Housing Administration rules after being sued by a former employee.[27]

A very simplified causal chain may be sketched as follows: The Fed lowered the interest rates, due to investors taking money out of stock market, and, consequently, there was an increase in money (liquidity). Hence, financial institutions, now basically "deregulated" (from the much stricter loan protocol installed by the Glass-Steagall Act providing checks and balances against conflict of interest between commercial and investment banks) by the Gramm–Leach–Bliley Act, started offering loans to buyers with FICO scores below, and sometimes much below, the score of 620 previously considered the minimum by commercial banks.

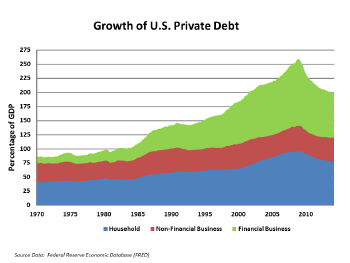

Trade Deficit

In 2005, Ben Bernanke addressed the implications of the United States' high and rising current account deficit, resulting from U.S. investment exceeding its savings, or imports exceeding exports.[28] Between 1996 and 2004, the U.S. current account deficit had increased by $650 billion, from 1.5 per cent to 5.8 per cent of GDP. The balance of payments identity requires that a country (such as the U.S.) running a current account deficit also have a capital account (investment) surplus of the same amount. The U.S. attracted a great deal of foreign investment, mainly from the emerging economies in Asia and oil-exporting nations. Foreign investors had these funds to lend, either because they had very high personal savings rates (as high as 40 per cent in China), or because of high oil prices.

Bernanke referred to this as a "saving glut"[29] that may have pushed capital into the United States, a view differing from that of some other economists, who view such capital as having been pulled into the U.S. by its high consumption levels. Regardless of the push or pull view, a "flood" of funds (capital or liquidity) reached the U.S. financial market. Foreign governments supplied funds by purchasing U.S. Treasury bonds and thus avoided much of the direct impact of the crisis. American households, on the other hand, used funds borrowed from foreigners to finance consumption or to bid up the prices of housing and financial assets.

Financial Backlash

Law Investigations, Judicial and other Responses

Significant law enforcement action and litigation resulted from the crisis. The Federal Bureau of Investigation assigned more agents to mortgage-related crimes and its caseload dramatically increased.[30] They began a probe of Countrywide Financial in March 2008 for possible fraudulent lending practices and securities fraud.[31] The FBI probed the possibility of fraud by mortgage financing companies Fannie Mae and Freddie Mac, Lehman Brothers, and insurer American International Group, among others.[32]

Several hundred civil lawsuits were filed in federal courts beginning in 2007 related to the subprime crisis. The number of filings in state courts was not quantified but was also believed to be significant.[33] In August 2014, Bank of America agreed to a near-$17 billion deal to settle claims against it relating to the sale of toxic mortgage-linked securities including subprime home loans, in what was believed to be the largest settlement in U.S. corporate history. The deal with the U.S. Justice Department topped a deal the regulator made the previous year with JPMorgan Chase over similar issues.[34] Morgan Stanley paid $2.6 billion to settle claims in February 2015.[35]

Bank Fines and Penalties

U.S. banks have paid considerable fines from legal settlements due to mortgage-related activities. The Economist estimated that from 2008 through October 2013, U.S. banks had agreed to $95 billion in mortgage-related penalties. Settlement amounts included Bank of America ($47.2B), JP Morgan Chase ($22.3B), Wells Fargo ($9.8B), Citigroup ($6.2B) and Goldman-Sachs ($0.9B).[36] Bloomberg reported that from the end of 2010 to October 2013, the six largest Wall Street banks had agreed to pay $67 billion.[37]

By April 2015 it was reported that banking fines and penalties had totaled $150 billion between 2007 and 2014, versus $700 billion in profits over that time.[38]

International Response

Financial turmoil resulting from the above-mentioned problems with subprime and other risky mortgages, resulted in a backlash against such financial instruments. The backlash was particularly sharp from countries that were surprised to find that problems with the United States housing market could be felt so keenly in their home markets. Funds and banks around the world took hits because they purchased bonds, or risk related to bonds, backed by bad home loans, often bundled into collateralized debt obligations, or CDOs.

In the United States, regulators appeared to think that such new and often unregulated investment vehicles were not all inherently flawed. As a result, foreign politicians and regulators began to seek a role in the oversight of American markets, banks and rating agencies. For example, the head of the Council of Economic Analysis in France called for complex securities to be scrutinized before banks are authorized to buy them.[39]

Regulatory proposals and long-term solutions

President Barack Obama and key advisers introduced a series of regulatory proposals in June 2009. The proposals address consumer protection, executive pay, bank financial cushions or capital requirements, expanded regulation of the shadow banking system and derivatives, and enhanced authority for the Federal Reserve to safely wind-down systemically important institutions, among others.[40] The Dodd–Frank Wall Street Reform and Consumer Protection Act was signed into law in July 2010 to address some of the causes of the crisis.

U.S. Treasury Secretary Timothy Geithner testified before Congress on October 29, 2009.[41] His testimony included five elements he stated as critical to effective reform:

- Expand the Federal Deposit Insurance Corporation bank resolution mechanism to include non-bank financial institutions;

- Ensure that a firm is allowed to fail in an orderly way and not be "rescued";

- Ensure taxpayers are not on the hook for any losses, by applying losses to the firm's investors and creating a monetary pool funded by the largest financial institutions;

- Apply appropriate checks and balances to the FDIC and Federal Reserve in this resolution process;

- Require stronger capital and liquidity positions for financial firms and related regulatory authority.

The Dodd-Frank Act addressed these elements, but stopped short of breaking up the largest banks, which grew larger due to mergers of investment banks at the core of the crisis with depository banks (for example, JP Morgan Chase acquired Bear Stearns and Bank of America acquired Merrill Lynch in 2008). Assets of five largest banks as a share of total commercial banking assets rose then stabilized in the wake of the crisis.[42] During 2013, Senators John McCain (Republican) and Elizabeth Warren (Democratic) proposed a bill to separate investment and depository banking, to insulate depository banks from higher risk activities (as they had been separated prior to the 1999 repeal of the Glass-Steagall Act).[43]

Discussion

A variety of socio-economic factors have been identified as contributing to the housing bubble and its subsequent bursting. Also, those who could have acted to prevent, or at least alleviate the negative impacts, ignored the warnings. Economic factors often combine with psychological factors to produce a cumulative behavioral effect that may appear irrational.[44] In this case, behavioral issues manifested as cultural and cognitive disparities (heterogeneity) or sharp differences in communication, understanding, and ethics in the various sectors of the society which informed their reactions to the changes in the lending environment.[18]

At the same time as Glass-Steagall was being repealed, Affordable Housing Goals were being increased with mandates to GSEs Fannie Mae and Freddie Mac, "in return for their publicly provided benefits, to extend the benefits of the secondary mortgage market to a broad range of Americans. These include low- and moderate-income families, first-time homebuyers, and residents of communities underserved by mortgage credit."[45]

Corporate greed (unrestrained by checks and balances that had been removed through deregulation) combined with mandates to the GSEs to provide loans that would make home ownership affordable and available to historically underserved segments of the population,[46] a toxic situation which resulted in a cumulative effect that was tragic and widespread in its repercussions. Most people, even fairly sophisticated investors, are not in a position to assess the quality of the assets on a financial institution’s balance sheet. When securitization muddied the waters, already confused by the risk-taking culture of investment banking dominating the more conservative commercial banking culture after deregulation of the banking industry, borrowers, often first-time homeowners, had no chance of understanding the financial picture.

The final effect of this microeconomic-macroeconomic causality will be long remembered the world over, and the changes in banking regulations will, most probably, forever change the character of this industry.

Notes

- ↑ 1.0 1.1 Bill Moyers Journal, In Washington, big business and big money are writing the rules on trade PBS, June 29, 2007. Retrieved June 24, 2020.

- ↑ G. Edward Griffin, The Creature from Jekyll Island: A Second Look at the Federal Reserve (1994, American Media, 2010, ISBN 978-0912986456).

- ↑ Jeffrey Robert Hunn, Why are my investments diving… and what can I do about it? Gold Eagle, 2003. Retrieved June 24, 2020.

- ↑ The Unofficial List of Pundits/Experts Who Were Wrong on the Housing Bubble Economics of Contempt, July 16, 2008. Retrieved June 24, 2020.

- ↑ Alex Tabarrok, Was there a Housing Bubble? Marginal Revolution, February 13, 2008. Retrieved June 24, 2020.

- ↑ Charles Duhigg, At Freddie Mac, Chief Discarded Warning Signs The New York Times, August 5, 2008. Retrieved June 24, 2020.

- ↑ 7.0 7.1 Peter J. Wallison, Dissent from the Majority Report of the Financial Crisis Inquiry Commission (AEI Press, 2011, ISBN 978-0844772301).

- ↑ Joshua Rosner, Housing in the New Millennium: A Home Without Equity is Just a Rental with Debt Graham Fisher & Co., June 29, 2001. Available at SSRN. Retrieved June 24, 2020.

- ↑ Joseph Stiglitz, Capitalist Fools Vanity Fair, January 2009. Retrieved June 24, 2020.

- ↑ 10.0 10.1 10.2 Joseph Fried, Who Really Drove the Economy Into the Ditch? (Algora Publishing, 2012, ISBN 978-0875869438).

- ↑ Robert B. Ekelund and Mark Thornton, More Awful Truths About Republicans Ludwig von Mises Institute, September 4, 2008. Retrieved June 24, 2020.

- ↑ Michael Simkovic, "Competition and Crisis in Mortgage Securitization" Indiana Law Journal, 88 (2013): 213. Retrieved June 24, 2020.

- ↑ Bruce Tuckman and Angel Serrat, Fixed Income Securities: Tools for Today's Markets (Wiley, 2011, ISBN 978-0470891698).

- ↑ 14.0 14.1 14.2 14.3 Financial Crisis Inquiry Commission, Financial Crisis Inquiry Report US Government Printing Office, 2010. Retrieved June 24, 2020.

- ↑ 15.0 15.1 Bethany McLean and Joe Nocera, All the Devils Are Here (Portfolio, 2010, ISBN 978-1591843634).

- ↑ Amiyatosh K. Purnanandam , Originate-to-Distribute Model and the Subprime Mortgage Crisis AFA 2010 Atlanta Meetings Paper. Available at SSRN. Retrieved June 24, 2020.

- ↑ Gene Walden, If Not Stocks, What? (McGraw-Hill, 2003, ISBN 978-0071421492).

- ↑ 18.0 18.1 18.2 18.3 Mirek Karasek and Jennifer P. Tanabe, The Crucial Challenge for International Aid: Making the Donor-Recipient Relationship Work to Prevent Catastrophe (Raleigh, NC: LuluPress Inc., 2014, ISBN 978-1312704282).

- ↑ Robert J. Shiller, Irrational Exuberance (Princeton University Press, 2015, ISBN 978-0691166261).

- ↑ Jason Zweig, The Oracle Speaks CNNMoney.com, May 2, 2005. Retrieved June 24, 2020.

- ↑ Charles Duhigg, Pressured to Take More Risk, Fannie Reached Tipping Point The New York Times, October 4, 2008. Retrieved June 24, 2020.

- ↑ Terry Frieden, FBI warns of mortgage fraud 'epidemic' CNN Washington Bureau, September 17, 2004. Retrieved June 24, 2020.

- ↑ Eliot Spitzer, Predatory Lenders' Partner in Crime The Washington Post, February 14, 2008. Retrieved June 24, 2020.

- ↑ Lynnley Browning, Are Computers to Blame for Bad Lending? RealtorMag, March 23, 2007. Retrieved June 24, 2020.

- ↑ Broker, bankers play subprime blame game NBCNews, May 22, 2007. Retrieved June 24, 2020.

- ↑ FICO scores lie in the interval from 350 to 850. A FICO of 620 was generally considered the minimum score for securing a loan at the prime rate.

- ↑ Bob Ivry, Woman Who Couldn’t Be Intimidated by Citigroup Wins $31 Million Bloomberg Markets Magazine, May 31, 2012. Retrieved June 24, 2020.

- ↑ Ben Bernanke, The Global Saving Glut and U.S. Current Account Deficit Homer Jones Lecture, St. Louis, Missouri, April 14, 2005. Retrieved June 24, 2020.

- ↑ Ben S. Bernanke,Global Imbalances: Recent Developments and Prospects Bundesbank Lecture, Berlin, Germany, September 11, 2007. Retrieved June 24, 2020.

- ↑ FBI Cracks Down On Mortgage Fraud CBS news, June 19, 2008. Retrieved June 24, 2020.

- ↑ FBI probes Countrywide for possible fraud CNN Money, March 10, 2008. Retrieved June 24, 2020.

- ↑ FBI Investigating Potential Fraud by Fannie Mae, Freddie Mac, Lehman, AIG, Associated Press, September 23, 2008. Retrieved June 24, 2020.

- ↑ Subprime lawsuits on pace to top S&L cases Reuters, February 15, 2008. Retrieved June 24, 2020.

- ↑ Bank of America to pay nearly $17 bn to settle mortgage claims Philadelphia Herald, August 22, 2014. Retrieved June 24, 2020.

- ↑ Ivana Kottasova, Morgan Stanley agrees $2.6 billion settlement CNN, February 26, 2015. Retrieved June 24, 2020.

- ↑ Payback Time for Subprime The Economist, October 26, 2013. Retrieved June 24, 2020.

- ↑ Nick Summers, Banks Finally Pay for Their Sins, Five Years After the Crisis Bloomberg Businessweek, October 31, 2013. Retrieved June 24, 2020.

- ↑ John W. Schoen, Seven years on from crisis, $150 billion in bank fines and penalties CNBC, April 30, 2015. Retrieved June 24, 2020.

- ↑ Jenny Anderson and Heather Timmons, Why a U.S. Subprime Mortgage Crisis Is Felt Around the World The New York Times, August 31, 2007. Retrieved June 24, 2020.

- ↑ Timothy Geithner and Lawrence Summers, A New Financial Foundation The Washington Post, June 15, 2009. Retrieved August 3, 3016.

- ↑ Final Written Testimony of Secretary Timothy F. Geithner : House Financial Services Committee, October 29, 2009 Retrieved June 24, 2020.

- ↑ World Bank, 5 Bank Asset Concentration for the United States FRED Database. Retrieved June 24, 2020.

- ↑ Carter Dougherty and Cheyenne Hopkins, Bloomberg-Warren Joins McCain to Push New Glass-Stegall bill Bloomberg, July 12, 2013. Retrieved June 24, 2020.

- ↑ Amos Tversky and Daniel Kahneman, "Prospect theory: An analysis of decision making under risk," Econometrica 47(2) (1979): 263-292.

- ↑ Cuomo Announces Action to Provide $2.4 Trillion in Mortgates for Affordable Housing for 28.1 Million Families HUD Archives: News Releases, July 29, 1999. Retrieved June 24, 2020.

- ↑ Shaheen Pasha, Banking on illegal immigrants CNN, August 8, 2005. Retrieved June 24, 2020.

References

ISBN links support NWE through referral fees

- Barth, James. The Rise and Fall of the U.S. Mortgage and Credit Markets: A Comprehensive Analysis of the Market Meltdown. Wiley, 2009. ISBN 978-0470477243

- Deflem, Mathieu (ed.). Economic Crisis and Crime (Sociology of Crime Law and Deviance, Volume 16). Emerald Group Publishing Limited, 2011. ISBN 978-0857248015

- Felsenfeld, Carl and David L. Glass. Banking Regulation in the United States. New York: Juris Publishing, Inc., 2011. ISBN 978-1578232635

- Fletcher, June. House Poor: Pumped Up Prices, Rising Rates, and Mortgages on Steroid – How to Survive the Coming Housing Crisis. New York: Collins, 2005. ISBN 978-0060873226

- Fletcher, June. Is the Party Really Over For the Housing Boom? The Wall Street Journal, February 10, 2006. Retrieved May 21, 2020.

- Fried, Joseph. Who Really Drove the Economy Into the Ditch? Algora Publishing, 2012. ISBN 978-0875869438

- Griffin, G. Edward. The Creature from Jekyll Island: A Second Look at the Federal Reserve. American Media, 2010 (original 1994). ISBN 978-0912986456

- Karasek, Mirek, and Jennifer P. Tanabe. The Crucial Challenge for International Aid: Making the Donor-Recipient Relationship Work to Prevent Catastrophe. Raleigh, NC: Lulu Press Inc., 2014. ISBN 978-1312704282

- Koller, Cynthia A. White Collar Crime in Housing: Mortgage Fraud in the United States. El Paso, TX: LFB Scholarly, 2012. ISBN 978-1593325343

- Mayer, Martin. The Bankers. New York: Weybright and Talley, 1974. ISBN 978-0679400103

- McLean, Bethany, and Joe Nocera. All the Devils Are Here: The Hidden History of the Financial Crisis. Portfolio, 2010. ISBN 978-1591843634

- Sowell, Thomas. The Housing Boom and Bust. Basic Books, 2009. ISBN 978-0465018802

- Talbott, John R. Sell Now!: The End of the Housing Bubble. New York: St. Martin's Griffin, 2006. ISBN 978-0312357887

- Talbott, John R. The Coming Crash in the Housing Market. New York: McGraw-Hill, 2003. ISBN 978-0071422208

- Tuckman, Bruce, and Angel Serrat. Fixed Income Securities: Tools for Today's Markets. Wiley, 2011. ISBN 978-0470891698

- Walden, Gene. If Not Stocks, What? McGraw-Hill, 2003. ISBN 978-0071421492

- Wallison, Peter J. Dissent from the Majority Report of the Financial Crisis Inquiry Commission. AEI Press, 2011. ISBN 978-0844772301

- Warren, Elizabeth, and Amelia Warren Tyagi. The Two-Income Trap: Why Middle Class Mothers and Fathers are Going Broke. New York: Basic Books, 2003. ISBN 978-0465090822

External links

All links retrieved May 21, 2020.

- Financial Crisis Inquiry Commission – Homepage

- Report of Financial Crisis Inquiry Commission-January 2011

- FCIC - Graphics Page

- Federal Reserve-Subprime Mortgage Crisis History Page

- PBS Frontline – Inside the Meltdown

- PBS - What You Need to Know About the Crisis

- The US sub-prime crisis in graphics BBC, November 21, 2007.

- Going through the roof The Economist, May 28, 2002.

- House of cards The Economist, May 29, 2003.

- Will the walls come falling down? The Economist, April 20, 2005.

- Still want to buy? The Economist, May 3, 2005.

- Hear that hissing sound? The Economist, December 8, 2005.

Credits

New World Encyclopedia writers and editors rewrote and completed the Wikipedia article in accordance with New World Encyclopedia standards. This article abides by terms of the Creative Commons CC-by-sa 3.0 License (CC-by-sa), which may be used and disseminated with proper attribution. Credit is due under the terms of this license that can reference both the New World Encyclopedia contributors and the selfless volunteer contributors of the Wikimedia Foundation. To cite this article click here for a list of acceptable citing formats.The history of earlier contributions by wikipedians is accessible to researchers here:

- United_States_housing_bubble history

- Subprime_mortgage_crisis history

- Glass–Steagall:_Aftermath_of_repeal history

- Causes_of_the_United_States_housing_bubble history

The history of this article since it was imported to New World Encyclopedia:

- History of "United States housing bubble"

Note: Some restrictions may apply to use of individual images which are separately licensed.

↧ Download as ZWI file | Last modified: 02/03/2023 23:27:32 | 24 views

☰ Source: https://www.newworldencyclopedia.org/entry/United_States_housing_bubble | License: CC BY-SA 3.0

ZWI signed:

ZWI signed: KSF

KSF