California Proposition 26, Supermajority Vote To Pass Certain New Taxes And Fees (2010)

From Ballotpedia

From Ballotpedia | California Proposition 26 | |

|---|---|

| |

| Election date November 2, 2010 | |

| Topic Taxes | |

| Status | |

| Type Constitutional amendment | Origin Citizens |

California Proposition 26 was on the ballot as an initiated constitutional amendment in California on November 2, 2010. It was approved.

A "yes" vote supported increasing the vote requirement needed to impose certain new taxes and fees by the state legislature and local governments from a simple majority to a two-thirds supermajority vote. |

A "no" vote opposed increasing the vote requirement needed to impose certain new taxes and fees by the state legislature and local governments from a simple majority to a two-thirds supermajority vote. |

Aftermath[edit]

Seismic Safety Commission[edit]

The California Legislative Analyst's Office determined in early 2012 that a method proposed by Jerry Brown for funding the state's Seismic Safely Commission is unconstitutional under the provisions of Proposition 26.[1]

The Seismic Safety Commission was created in 1975 and has an annual budget of about $1.3 million. It has been funded by a fee charged to insurance companies. That fee expired on July 1, 2012. Brown proposed to extend it. However, the LAO said that under the provisions of Proposition 26, that fee would be considered a tax and would have to be approved by a two-thirds (66.67 percent) supermajority vote of the California State Legislature. Furthermore, according to the LAO's analysis, a separate provision in the California Constitution says that any taxes levied on insurance companies in the state must be rolled together into one special insurance tax and cannot be assessed on a piecemeal basis, even if the state legislature does have the votes to pass a new tax on insurance companies.[1]

Election results[edit]

- See also: 2010 ballot measure election results

|

California Proposition 26 |

||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 4,923,834 | 52.41% | |||

| No | 4,470,234 | 47.59% | ||

Overview[edit]

Proposition 26 increased the vote requirement needed to impose certain new taxes and fees by the state legislature and local governments from a simple majority to a two-thirds supermajority vote.[2] Supporters of Proposition 26 referred to the initiative as the "Stop Hidden Taxes Initiative."

Proposition 26 reclassified some fees that the state levied via a simple majority vote to taxes that would require a two-thirds (66.67 percent) supermajority vote. Proposition 26 also required a supermajority vote for tax increases even if they did not increase the state's total revenue. It also required a supermajority vote by local voters for local taxes with dedicated revenue purposes.[3]

Text of measure

Ballot title

The ballot title for Proposition 26 was as follows:

| “ | Requires that certain state and local fees be approved by two-thirds vote. Fees include those that address adverse impacts on society or the environment caused by the fee-payer's business. Initiative constitutional amendment. | ” |

Ballot summary

The ballot summary for this measure was:

| “ |

• Requires that certain state fees be approved by two-thirds vote of Legislature and certain local fees be approved by two-thirds of voters. • Increases legislative vote requirement to two-thirds for certain tax measures, including those that do not result in a net increase in revenue, currently subject to majority vote. | ” |

Full Text

The full text of this measure is available here.

Estimated fiscal impact[edit]

This is a summary of the initiative's estimated fiscal impact prepared by the California Legislative Analyst's Office:

| “ |

|

” |

Constitutional changes[edit]

| California Constitution |

|---|

| Articles |

| I • II • III • IV • V • VI • VII • VIII • IX • X • XA • XB • XI • XII • XIII • XIII A • XIII B • XIII C • XIII D • XIV • XV • XVI • XVIII • XIX • XIX A • XIX B • XIX C • XX • XXI • XXII • XXXIV • XXXV |

Proposition 26 amended these parts of the state's constitution:

Support[edit]

Yes on 26 led the campaign in support of Proposition 26.

Supporters[edit]

- California Chamber of Commerce[2]

- Americans for Tax Reform[5]

- California Taxpayers Association[5]

- Howard Jarvis Taxpayers Association[5]

- The Wine Institute[5]

Arguments[edit]

- Allan Zaremberg, president of the California Chamber of Commerce, said, "The Stop Hidden Taxes initiative will prohibit politicians from using a loophole to raise even more taxes by disguising them as fees. Right now, elected officials at the state and local level pass higher taxes by labeling taxes as “fees” so they can pass or increase them with a 50% vote instead of the two-thirds required by law – and in the case of many local taxes, enact them without a public vote. We need the Stop Hidden Taxes initiative to close this loophole. Higher taxes and fees make it more difficult for businesses to stay in California – the very businesses that employ Californians, create jobs and generate revenue for our state. Increasing employment and growing the economy are crucial to California’s recovery."[6]

- Susan Shafer, a spokeswoman for the "Stop Hidden Taxes" campaign, said, "Legislators have been using the loophole of only needing 50 percent to pass a fee, but what we’re saying is that they should have a two-thirds vote, because what they are really passing are taxes, not fees."[7]

- Teresa Casazza, president of the California Taxpayers Association, said, "Instead of using gimmicks to pass or increase hidden taxes on products and services that Californians use every day, legislators will need a two-thirds vote as required by our state Constitution."[7]

Official arguments[edit]

Arguments were submitted to the official California Voter Guide on behalf of a "yes" vote on Proposition 26 by Teresa Casazza, president of the California Taxpayers' Association; Allan Zaremberg, president of the California Chamber of Commerce; and Joel Fox, president of the Small Business Action Committee:[3]

| “ |

YES ON PROPOSITION 26: STOP POLITICIANS FROM ENACTING HIDDEN TAXES State and local politicians are using a loophole to impose Hidden Taxes on many products and services by calling them 'fees' instead of taxes. Here’s how it works: At the State Level:

At the Local Level:

PROPOSITION 26 CLOSES THIS LOOPHOLE Proposition 26 requires politicians to meet the same vote requirements to pass these Hidden Taxes as they must to raise other taxes, protecting California taxpayers and consumers by requiring these Hidden Taxes to be passed by a two-thirds vote of the Legislature and, at the local level, by public vote. PROPOSITION 26 PROTECTS ENVIRONMENTAL AND CONSUMER REGULATIONS AND FEES Don’t be misled by opponents of Proposition 26. California has some of the strongest environmental and consumer protection laws in the country. Proposition 26 preserves those laws and PROTECTS LEGITIMATE FEES SUCH AS THOSE TO CLEAN UP ENVIRONMENTAL OR OCEAN DAMAGE, FUND NECESSARY CONSUMER REGULATIONS, OR PUNISH WRONGDOING, and for licenses for professional certification or driving. DON’T LET THE POLITICIANS CIRCUMVENT OUR CONSTITUTION TO TAKE EVEN MORE MONEY FROM US Politicians have proposed more than $10 billion in Hidden Taxes. Here are a few examples of things they could apply Hidden Taxes to unless we stop them:

PROPOSITION 26: HOLD POLITICIANS ACCOUNTABLE 'State politicians already raised taxes by $18 billion. Now, instead of controlling spending to address the budget deficit, they’re using this gimmick to increase taxes even more! It’s time for voters to STOP the politicians by passing Proposition 26.'— Teresa Casazza, California Taxpayers’ Association Local politicians play tricks on voters by disguising taxes as 'fees' so they don’t have to ask voters for approval. They need to control spending, not use loopholes to raise taxes! It’s time tohold them accountable for runaway spending and to stop Hidden Taxes at the local level. YES ON PROPOSITION 26: PROTECT CALIFORNIA FAMILIES California families and small businesses can’t afford new and higher Hidden Taxes that will kill jobs and hurt families. When government increases Hidden Taxes, consumers and taxpayers pay increased costs on everyday items. 'The best way out of this recession is to grow the economy and create jobs, not increase taxes. Proposition 26 will send a message to politicians that it’s time to clean up wasteful spending in Sacramento.'—John Kabateck, National Federation of Independent Business/California VOTE YES ON PROPOSITION 26 TO STOP HIDDEN TAXES—www.No25Yes26.com[4] |

” |

Opposition[edit]

No on 26 led the campaign in opposition to Proposition 26.

Opponents[edit]

- California Tax Reform Association[8]

- American Cancer Society[9]

- American Lung Association in California[9]

- California Association of Professional Scientists[9]

- California Center for Public Health Advocacy[9]

- California Nurses Association[9]

- Get The Lead Out Coalition[9]

- Marin Institute[9]

- Physicians for Social Responsibility[9]

- Prevention Institute[9]

- Public Health Institute[9]

- Public Health Law and Policy[9]

- Regional Asthma Management and Prevention[9]

- Union of Concerned Scientists[9]

- Asian Pacific Environmental Network[9]

- Bay Localize[9]

- California League of Conservation Voters[9]

- Californians Against Waste[9]

- California Coast Keeper Alliance[9]

- California Conference of Directors of Environmental Health[9]

- Center for Environmental Health[9]

- Central Valley Air Quality (CVAQ)[9]

- Communities for a Better Environment[9]

- Defenders of Wildlife[9]

- Endangered Habitats League[9]

- Environmental Defense Fund[9]

- Forests Forever[9]

- League to Save Lake Tahoe[9]

- Natural Resources Defense Council[9]

- Planning and Conservation League[9]

- Sierra Club California[9]

- Transform[9]

- Water Replenishment District of Southern California[9]

- Alliance of Californians for Community Empowerment (ACCE)[9]

- California Alliance of Retired Americans[9]

- California Common Cause[9]

- California Council of Churches IMPACT[9]

- California Democratic Party[9]

- California Green Party[9]

- California Interfaith Power & Light[9]

- California NOW[9]

- California Young Democrats[9]

- Coalition on Regional Equity[9]

- Ella Baker Center for Human Rights[9]

- Equality California[9]

- Friends Committee on Legislation of California[9]

- Greenlining Institute[9]

- Latino Voters League[9]

- League of Women Voters of California[9]

- Los Angeles County Democratic Party[9]

- Peace and Freedom Party[9]

- San Francisco Human Services Network[9]

- California Association of Highway Patrolmen[9]

- California Professional Firefighters[9]

- California Statewide Law Enforcement Association[9]

- CDF Firefighters[9]

- Peace Officers Research Association of California[9]

- AFSCME[9]

- California Labor Federation, AFL-CIO[9]

- California State Council SEIU[9]

- Professional Engineers in California Government[9]

- State Building & Construction Trades Council of California[9]

- California Faculty Association[9]

- California Federation of Teachers[9]

- California School Employees Association[9]

- California State-Los Angeles Federal Credit Union[9]

- California Teacher Association[9]

- Faculty Association of California Community Colleges(FACCC)[9]

- Consumer Federation of California[9]

- Consumers for Auto Reliability and Safety[9]

- TURN-The Utility Reform Network[9]

- Alameda County Public Health Commission[9]

- California Special Districts Association[9]

- California League of Cities[9]

- California State Association of Counties[9]

- Madera County Board of Supervisors[9]

- Marin County Board of Supervisors[9]

- Regional Council of Rural Counties[9]

- Sacramento County Board of Supervisors[9]

- San Francisco County Board of Supervisors[9]

- South Bay Cities Council of Governments[9]

Arguments[edit]

- Health Access California said, "The worst measure on the ballot is Proposition 26, which protects polluters and other corporations from having to pay for the health, environmental, and other damage they cause."[10]

Official arguments[edit]

The arguments against Proposition 26 in the state's official Voter Guide were written by Janis R. Hirohama, president of the League of Women Voters of California; Jane Warner, president of the American Lung Association in California; and Bill Magavern, director of the Sierra Club California:[3]

| “ | Should polluters be protected from paying to clean up the damage they do? Should taxpayers foot the bill instead?

The answer is NO, and that’s why voters should reject Proposition 26, the Polluter Protection Act. Who put Prop. 26 on the ballot? Oil, tobacco, and alcohol companies provided virtually all the funding for this measure, including Chevron, Exxon Mobil, and Phillip Morris. Their goal: to shift the burden of paying for the damage these companies have done onto the taxpayers. How does this work? Prop. 26 redefines payments for harm to the environment or public health as tax increases, requiring a 2/3 vote for passage. Such payments, or pollution fees on public nuisances, would become much harder to enact—leaving taxpayers to foot the bill. California has enough problems without forcing taxpayers to pay for cleaning up after polluting corporations. Companies that pollute, harm the public health, or create a public nuisance should be required to pay to cover the damage they cause. But the big oil, tobacco, and alcohol corporations want you, the taxpayer, to pay for cleaning up their messes. That’s why these corporations wrote Proposition 26 behind closed doors, with zero public input, and why they put up millions of dollars to get Proposition 26 on the ballot. Proposition 26 is just another attempt by corporations to protect themselves at the expense of ordinary citizens. The problem isn’t taxes “hidden” as fees; it’s the oil and tobacco companies hiding their true motives:

One of the so-called 'hidden taxes' identified by the Proposition 26 campaign is a fee that oil companies pay in order to cover the cost of oil spill clean-up, like the one in the Gulf. The oil companies should be responsible for the mess they create, not the taxpayers. Proposition 26 will harm local public safety and health, by requiring expensive litigation and endless elections in order for local government to provide basic services. Fees on those who do harm should cover such costs as policing public nuisances or repairing damaged roads. The funds raised by these fees are used by state and local governments for essential programs like fighting air pollution, cleaning up environmental disasters and monitoring hazardous waste. They require corporations such as tobacco companies to pay for the harm they cause. If Proposition 26 passes, these costs would have to be paid for by the taxpayers. DON’T PROTECT POLLUTERS. Join California Professional Firefighters, California Federation of Teachers, California League of Conservation Voters, California Nurses Association, Consumer Federation of California, and California Alliance for Retired Americans, and vote NO on 26. www.stoppolluterprotection.com[4] |

” |

Media editorials[edit]

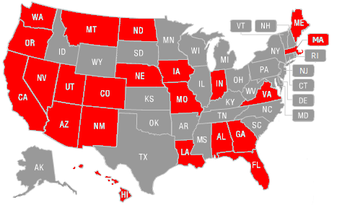

| Taxes on the ballot in 2010 |

|

Support[edit]

- Orange County Register: "This proposition accomplishes needed reforms to restrain tax-grabbing politicians who want taxpayers to bail them out for poorly managed budgets and long histories of overspending."[11]

- Long Beach Press-Telegram: "Owners of small businesses know what it's like to get saddled with "fees" that are no more than gimmicks to funnel money into political purposes, at the expense of businesses, consumers and taxpayers. Henceforth, those "fees" would take a two-thirds majority vote by the Legislature or, at the local level, by public vote."[12]

Opposition[edit]

- Bakersfield Californian: "the prospect of requiring a two-thirds vote to approve even the most routine and reasonable fees -- quite possibly in an endless parade of special elections -- is burdensome and stifling. Proposition 26 would set off a bureaucratic nightmare and bring local governments to their knees."[13]

- Contra Costa Times: "Many of the fees and charges that would become taxes under Proposition 26 are those imposed to deal with health, environmental or other societal concerns. For example, the state imposes a regulatory fee on oil manufacturers to pay for local oil-collection programs, recycling and inspections of used-oil recycling facilities. Proposition 26 goes too far in fiscally handcuffing local and state governments."[14]

- Fresno Bee: "passage of Proposition 26 could result in a two-thirds vote requirement for fees that benefit the public broadly. Examples include hazardous material fees that go to clean up toxic waste sites or promote pollution prevention, and municipal fees on alcohol retailers that go to code enforcement."[15]

- Lompoc Record: "Proponents insist passage of Proposition 26 would keep politicians from enacting hidden taxes, but what it really does is shift the burden of paying for environmental degradation from big business to individual taxpayers."[16]

- Los Angeles Daily News: "In theory, it's a fabulous idea: If fees are as difficult to pass as taxes maybe city and county and state officials would stop raising every fee known to man. In practicality, it will stop the legitimate fees such as those charged of private companies when they impact city services - services individual Angelenos must pay for. Is it right that our property taxes alone pay for the public safety response to Staples Center events? Yes, we know that governments have abused and misused fees. We know that government has gotten especially creative with new revenue-raising schemes to back-fill their general funds. We expect this will not stop them from dreaming up new ways to get around Proposition 26."[17]

- Los Angeles Times: "Proposition 26 goes much too far, making it extremely difficult to charge businesses for the damage they cause and instead sending the bill to everybody else."[18]

- Modesto Bee: "this initiative, like Proposition 25, is not a product of deliberation involving multiple stakeholders. It is a partisan power play."[19]

- Sacramento Bee: "If Proposition 26 were to pass, it would be harder to assess certain industries for the costs they pass onto society through pollution, public inebriation and other harmful side effects. Not surprisingly, Proposition 26 is supported by industries that sell alcohol or produce pollution and want to limit their exposure to new fees."[20]

- San Bernardino Sun: "Proposition 26 would only worsen the gridlock in Sacramento."[21]

- San Diego Union-Tribune: "...with a $19 billion budget deficit, now is not the time for voters to stand on principle and pass a proposition that is likely to cut billions in revenue."[22]

- San Gabriel Valley Tribune: "We don't want to see liquor, tobacco and oil companies get a break, not when taxpayers are suffering under an already heavy tax burden. That's why Proposition 26 should be defeated. The measure should be called the gang-up-on-the-taxpayers initiative."[23]

- San Jose Mercury News: "Companies that deal with hazardous waste, for instance, pay a fee that helps fund the cleanup of toxic sites. Under Proposition 26, the introduction of new programs or the expansion of existing ones like this would face an impossible hurdle in a two-thirds vote."[24]

- Santa Rosa Press Democrat: "So what would be worse than a $19 billion state budget deficit? A $20 billion budget deficit. Pardon the sophomoric humor, but an extra $1 billion in red ink is among the consequences if voters approve Proposition 26 on the Nov. 2 ballot."[25]

- Ventura County Star: "the initiative affects fees paid by chemical companies to help cover the costs for public agencies to respond to chemical accidents.Some industries chafe at such fees, which they claim are actually taxes. Proposition 26 would officially define them as taxes, not fees, and would demand a two-thirds legislative vote to impose them instead of the simple majority vote now required. However, that argument has had its day in court, and lost. In 1997, the California Supreme Court ruled — in a case involving a maker of lead-based paint — that such majority-vote fees are permissible, and aren’t taxes, because they raise revenue to deal with the effects of a particular industry."[26]

Path to the ballot[edit]

- See also: California signature requirements

In California, the number of signatures required for an initiated constitutional amendment is equal to 8 percent of the votes cast at the preceding gubernatorial election. For initiated amendments filed in 2009, at least 694,354 valid signatures were required.

Supporters of the proposal turned in 1.1 million signatures to election officials on May 7, 2010.[27] Election officials had until June 24 to inspect the signatures and announce a decision about whether the measure qualified for the state's November 2 ballot.

Signatures to qualify Proposition 26 for the ballot were collected by National Petition Management at a cost of $2,341,023.[28]

Seven versions of the proposal were filed, but signatures were only collected on one version, 09-0093.

- On December 7, 2009, Thomas W. Hiltachk filed a request with the Office of the California Attorney General for an official ballot title on an act that he is calling the "Taxpayer Protection Act of 2010."

- An earlier version was filed by Jon Coupal on behalf of the Howard Jarvis Taxpayers Association on November 20, 2009.

- Josiah Keene filed version 09-0092 on November 23, 2009 and version 09-0100 on December 21, 2009.

- Allan Zaremberg filed version 09-0093 on November 23, 2009.

See also

External links[edit]

Basic information[edit]

Supporters[edit]

- See also: 2010 ballot measure campaign websites

- No More Hidden Taxes

- Stop Hidden Taxes on Facebook

- Stop Hidden Taxes on Twitter

- Campaign finance reports for Californians Against Higher Taxes, Yes on 26

- Campaign finance reports for "Stop Hidden Taxes, No on 25, Yes on 26

Opponents[edit]

- See also: 2010 ballot measure campaign websites

- No on Proposition 26

- Stop Prop 26 on Twitter

- Campaign finance reports for Taxpayers Against Protecting Polluters, No on Proposition 26

Additional reading[edit]

- Legislative Analyst Says Prop 26 Increases Budget Deficit By $1 Billion

- Ballot Watch: Propositions 25 and 26

Footnotes[edit]

- ↑ 1.0 1.1 Huffington Post, "California Seismic Safety Commission May Lose Funding," April 7, 2012

- ↑ 2.0 2.1 San Francisco Chronicle, "Chamber of Commerce pushes anti-tax initiative," April 15, 2010

- ↑ 3.0 3.1 3.2 University of California, "2010 General Election Voter Guide," accessed February 18, 2021

- ↑ 4.0 4.1 4.2 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

- ↑ 5.0 5.1 5.2 5.3 List of organizations endorsing the "Stop Hidden Taxes" initiative

- ↑ No More Hidden Taxes, "Stop Hidden Taxes Turns in More than 1.1 Million Signatures to Qualify Ballot Initiative for November 2010 Election," May 7, 2010

- ↑ 7.0 7.1 Capitol Weekly, "Fight of the majorities: simple vs. two-thirds," June 3, 2010

- ↑ Capitol Weekly, "Fight of the majorities: simple vs. two-thirds," June 3, 2010

- ↑ 9.00 9.01 9.02 9.03 9.04 9.05 9.06 9.07 9.08 9.09 9.10 9.11 9.12 9.13 9.14 9.15 9.16 9.17 9.18 9.19 9.20 9.21 9.22 9.23 9.24 9.25 9.26 9.27 9.28 9.29 9.30 9.31 9.32 9.33 9.34 9.35 9.36 9.37 9.38 9.39 9.40 9.41 9.42 9.43 9.44 9.45 9.46 9.47 9.48 9.49 9.50 9.51 9.52 9.53 9.54 9.55 9.56 9.57 9.58 9.59 9.60 9.61 9.62 9.63 9.64 9.65 9.66 9.67 9.68 9.69 9.70 9.71 9.72 9.73 9.74 9.75 9.76 9.77 9.78 9.79 No on Proposition 26, "Coalition," accessed February 18, 2021

- ↑ California Progress Report, "Backing Ballot Measures On The Budget," July 20, 2010

- ↑ Orange County Register, "Calling fees what they are: Taxes," September 22, 2010

- ↑ Long Beach Press-Telegram, "Yes on Proposition 26," October 11, 2010

- ↑ The Bakersfield Californian, "Make Legislature fix it: No on Props. 25, 26," October 4, 2010

- ↑ The Contra Costa Times, "No on proposition 26: Measure would make it too difficult for governments to raise revenues," September 13, 2010

- ↑ The Fresno Bee, "Vote no on Props 25 and 26," October 1, 2010

- ↑ Lompoc Record, "Confronting the need for majority rule," October 5, 2010

- ↑ Los Angeles Daily News, "Power plays: Propositions 25 and 26 - they're both bad policy dressed up as reform," September 26, 2010

- ↑ Los Angeles Times, "Yes, and no," September 30, 2010

- ↑ The Modesto Bee, "Vote no on Props 25 and 26," September 30, 2010

- ↑ Sacramento Bee, "No on Props. 26 and 26 - partisan power plays," September 27, 2010 (dead link)

- ↑ San Bernardino Sun, "Bad policies posing as reform," October 14, 2010

- ↑ San Diego Union-Tribune, "Pragmatism dictates rejecting Props. 22, 26," September 22, 2010

- ↑ San Gabriel Valley Tribune, "Our View: No on Proposition 26; keep polluters accountable," October 7, 2010

- ↑ San Jose Mercury News, "One more time, vote no on Proposition 26," October 29, 2010

- ↑ The Santa Rosa Press Democrat, "No on 26: After losing in court, businesses ask voters for shield against fees," September 23rd, 2010

- ↑ The Ventura County Star, "Prop 26 deserves a no vote," September 15, 2010

- ↑ Sacramento Bee, "Measure requiring two-thirds vote to OK fees turns in signatures," May 7, 2010

- ↑ "Yes on Prop 26" campaign expenditures

|

State of California Sacramento (capital) |

|---|---|

| Elections |

What's on my ballot? | Elections in 2022 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |

Categories: [California 2010 ballot measures, certified] [Taxes, California] [Certified, taxes, 2010] [Approved, 2010]

↧ Download as ZWI file | Last modified: 11/02/2022 18:45:04 | 4 views

☰ Source: https://ballotpedia.org/California_Proposition_26,_Supermajority_Vote_to_Pass_Certain_New_Taxes_and_Fees_(2010) | License: CC BY-SA 3.0

ZWI signed:

ZWI signed:

KSF

KSF