Black-Scholes

From Conservapedia

From Conservapedia The Black-Scholes Model[edit]

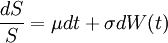

The Black-Scholes model for a stock price assumes that the stock price follows geometric Brownian motion with constant drift and volatility. More precisely, if S(t) the stock price at time t, then

where  is a standard Weiner stochastic process.

is a standard Weiner stochastic process.

Loosely speaking, this means that the return  of the stock over a very small time interval

of the stock over a very small time interval  can be viewed as a normal random variable with mean

can be viewed as a normal random variable with mean  and variance

and variance  . One can make this notion precise by invoking the concepts from the Ito calculus.

. One can make this notion precise by invoking the concepts from the Ito calculus.

The Black-Scholes Formula[edit]

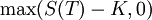

The Black-Scholes pricing formula for a European call option can be deduced from the Black-Scholes model for a stock price. A European call option on a stock with strike price  and time to maturity

and time to maturity  is a financial contract that gives the holder the option, but not the obligation, to purchase the stock for price

is a financial contract that gives the holder the option, but not the obligation, to purchase the stock for price  at time

at time  . In other words, a European call on the stock S is a contract that provides a single pay-off of

. In other words, a European call on the stock S is a contract that provides a single pay-off of

at time  . Let

. Let  denote the fair value of this contract at time

denote the fair value of this contract at time  . In deriving a formula for

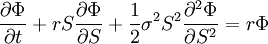

. In deriving a formula for  , Black and Scholes' key insight was that by forming a portfolio with the exact right balance of

, Black and Scholes' key insight was that by forming a portfolio with the exact right balance of  and the call option, one can completely eliminate risk associated to movements in the stock price

and the call option, one can completely eliminate risk associated to movements in the stock price  . Moreover, the resulting portfolio, being risk-free, has to grow at the risk free rate. These observations implied that the fair price of the call option had to satisfy the differential equation:

. Moreover, the resulting portfolio, being risk-free, has to grow at the risk free rate. These observations implied that the fair price of the call option had to satisfy the differential equation:

where  is the continuously compounded risk-free interest rate, and

is the continuously compounded risk-free interest rate, and  is the volatility of the stock. The solution to this differential equation, satisfying the boundary condition

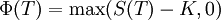

is the volatility of the stock. The solution to this differential equation, satisfying the boundary condition

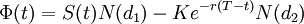

is given by:

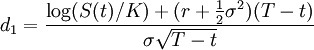

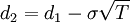

Here  is the cumulative normal distribution function,

is the cumulative normal distribution function,

and

This is the famous Black-Scholes formula for the price of a European call. Note that all the variables except for  can be observed in directly in the market at time

can be observed in directly in the market at time  . The volatility,

. The volatility,  of the stock must be estimated using either statistical data, or inferred from the price of options being sold in the market.

of the stock must be estimated using either statistical data, or inferred from the price of options being sold in the market.

Categories: [Economics]

↧ Download as ZWI file | Last modified: 02/26/2023 11:34:44 | 26 views

☰ Source: https://www.conservapedia.com/Black-Scholes | License: CC BY-SA 3.0

ZWI signed:

ZWI signed: KSF

KSF