Recession Of 2008

From Conservapedia

From Conservapedia The Recession of 2008 (also called the Recession of the late 2000s or the Great Recession) was a major worldwide economic downturn that began in 2008 and continued into 2010 and beyond. It was caused by the Financial Crisis of 2008; it was by far the worst recession since the Great Depression of the 1930s. The worldwide recession hit bottom in December 2009; however after five years there were few signs that the American economy started moving upward again. Five million of the 8 million jobs lost[1] did not return - despite an increase in population of 10 million over the same span of time covering President Barack Obama's first term.[2]

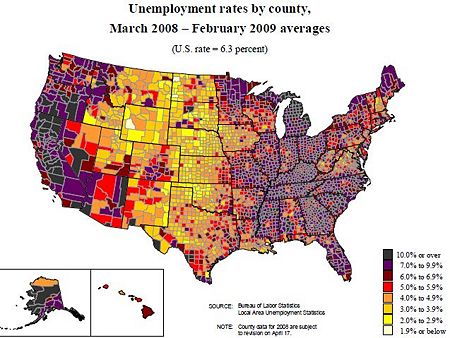

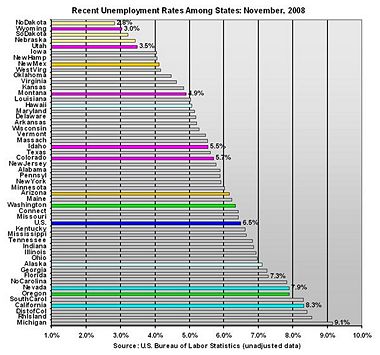

Greece, Portugal and Ireland remain in serious trouble, while China and Brazil rebounded and are growing rapidly. Concerning the United States economy, some proponents of free market capitalism declare that Federal Reserve Chairman Ben Bernanke and the United States Congress should not have bailed out failing firms and instead should have allowed free market capitalism to recover as it did in the depression of 1920, which recovered without government intervention (free market capitalists assert that government intervention can drag out recessions and depressions).[3][4] A 2005 study found that government corporate bailouts are often done for mere political considerations and the economic resources allocated exhibit significantly worse economic performance than resources allocated using purely business considerations.[5] Likewise in the U.S. the economy has stabilized but showed little signs of recovery during President Obama's first term, apart from the stock market going up. Serious weaknesses continued in housing, commercial real estate, banking, automobiles, and retail trade. Unemployment remained above 8% til October 2012 with conditions especially poor in California, Michigan and South Carolina.

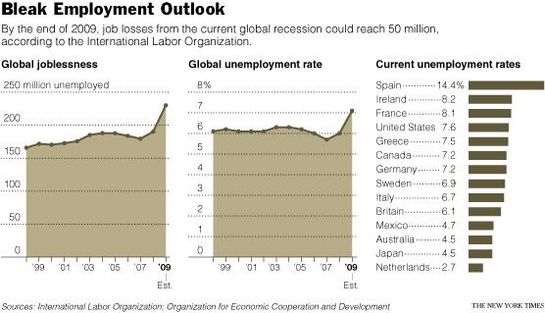

The crisis was worldwide, with major impact in Britain, Europe (that is the "European Union" or EU), Russia, Japan, the oil countries of the Middle East, and the developing world. The economy of the EU (Europe) shrank by 4% in 2009, with unemployment reaching 10%. Ireland, Iceland and parts of Eastern Europe are hardest hit. Britain was hit hard with its major banks in deep trouble. Recovery in Britain remains slow; its GDP fell 5.2% from 3Q 2008 to 3Q 2009.[6]

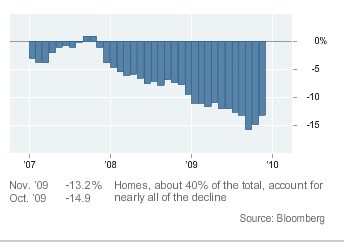

Global trade declined sharply—by 13% from August 20008 to August 2009, hurting exporters such as Germany and Japan. China has avoided most of the troubles; it continued to grow at a phenomenal rate (8.9% annual rate in 2008-9). However its exports did shrink because of falling world demand, and its ability to fund global stimulus programs are being dampened by lower growth forecasts and shifting priorities to retain capital earnings for domestic development.

Global governments spent an astonishing $17 trillion to support the world economy in the form of bailouts, guarantees, and equity market purchases. That $17 trillion represents one quarter of global GDP, but only a fraction of that sum will actually be paid out.[7] Global investment declined by 15% , and global GDP by shrank by nearly $4 trillion, or an amazing 6%. Global industrial production in the advanced economies dropped a 15%, causing unemployment to soar around the world, nearly doubling in the United States alone.[8]

Contents

- 1 Fannie Mae Origins

- 2 Indicators down

- 3 Income and Wealth

- 3.1 Money

- 4 US

- 4.1 Housing

- 4.2 Auto sector

- 4.3 Unemployment

- 5 Worldwide crisis

- 6 U.S. Politics

- 7 Economists

- 8 See also

- 9 References

Fannie Mae Origins[edit]

- Main aticle: Fannie Mae

The recession began in January 2008 in the financial sector as major banks in the U.S. and Europe got into serious trouble after a decade and a half of investing in bad mortgages. The crisis spread globally due to the fact that many banks, businesses, and pension funds worldwide had invested in these securitized debts. Trouble spread to the automobile industry, where General Motors and Chrysler went bankrupt in spring 2009, due to a decrease in US consumer demand. They remained solvent by a bailout involving a taxpayer buy out and bankruptcy reorganization was authorized by President Barack Obama and Congressional Democrats. Existing shareholders received 22 cents on the dollar for their investment, and the unions made no concessions.

Leftists have incorrectly attributed the cause of the recession to Bush Administration policies, calling it the "Bush Recession." However, many people recognize the loosening of credit guidelines in the Clinton era and government guarantees for subprime lending encouraged banks to make foolish loans which they considered had minimal risk to themselves. This, together with the threat of civil rights lawsuits under the Community Reinvestment Act were the mortgage lenders primary motivations.

In the U.S. GDP fell in the fourth quarter of 2008 (October–November–December), by 6.2% annual rate, with declines heaviest in business investment, exports, finance, autos, housing, construction, and retail sales.[9] The steep decline continued; GDP in the first quarter of 2009 (January–February–March) fell at the annualized rate of 6.1%, much worse than expected. American business slashed capital investment at an annual rate of -38%. Investment in software and computer equipment declined by an annualized 33.8%, and investment in new buildings was down 44.2%. By Spring 2009, financial markets that spiralled out of control in late 2008 stabilized, and declines in retail sales and orders by manufacturers no longer posted record declines.[10]

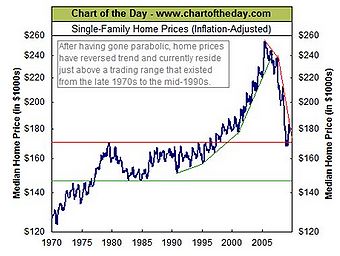

The stock market fell by 50% in 2008, wiping out trillions of dollars in assets. More trillions were lost as housing prices fell by 20%. Adding together the declines in housing and the stock market, the net worth of American households declined from $63.7 trillion in January 2008 to $51.5 trillion in January 2009, a decline of $11.2 trillion or 18%. That is, Americans owned $11 trillion less wealth, and adjusted by buying less and investing less. Meanwhile, mortgages and credit-card debt together reached $13 trillion, or 123% of after-tax income, a huge jump since 1995, when it was 83% of income.[11]

Bankruptcies among small businesses soared from 206 a day in Dec. 2007 to 357 a day in March 2009. In April, 2009, came the largest real estate bankruptcy in history, as General Growth, which owned and managed more than 200 malls, proved unable to handle its crushing $27 billion debt load. The debt was created by heavy borrowing in optimistic days to build new malls.

Wealth levels plunged worldwide. Stock markets in other major countries fell even faster than in the United States. Most companies worldwide reported reduced sales and sharply reduced profits, as banks refused to lend and consumers refused to spend, fearing the worst.

A series of emergency measures enacted by the Federal Reserve (on its own authority) and Congress after heavy prodding by presidents Bush and Obama resulted in trillions of dollars in loans, banking bailouts and guarantees, a half-trillion new stimulus spending[12][13] and a third of a trillion in tax cuts, but by mid-March 2009 the outlook remained bleak as the economy continued downward. Therefore, the Federal Reserve announced yet another trillion dollar plan on March 18, this one to buy $300 billion in Treasury bonds, and $750 billion in mortgage-backed securities. The idea was to keep mortgage rates low in the hope people will start buying houses again, but the problem was that the prices were falling, so that if a person bought a $500,000 house in 2009 it would be worth $400,000 a year later, despite the Fed's intervention.

In the first quarter of 2009 (January 1 to March 30), GDP fell sharply in major countries compared to the fourth quarter of 2008. In the US GDP was down 6.3%.

Major export countries saw their markets shrink. Exports from Japan were down 41% (quarter one 2009 versus 2008), Germany 32%, China 20% and U.S. 22%.

Major countries began experimenting again with Keynesian stimulus packages, including the US ($787 billion), Europe (EU, $634 billion), China ($586 billion), and Japan ($486 billion), but no positive results were reported[14][15] Central banks (such as the Federal Reserve in the U.S.) cut interest rates to nearly zero for half a decade, but few businesses borrowed money to expand employment or meet current operating expenses.

By September 2012 when job growth still lagged by 4 million people, economists Garett Jones and Daniel Rothschild wrote,

This suggests just how hard it is for Keynesian job creation to work in a modern, expertise-based economy. The stimulus was implemented at a time when the Keynesian model had every chance of succeeding on its own terms. The high level of unemployment and the rapid deadline for spending created both the supply of workers and the demand for workers. If the job market results are so lackluster in this setting, economists should expect even weaker stimulative results during more modest recessions.

And the Wall Street Journal observed:

The lesson of such on-the-ground knowledge is that the stimulus was a lost opportunity. In practice it became a shotgun marriage between an economic theory justified by computer models and 40 years of liberal social priorities (clean energy, Medicaid expansions and the rest). This produced the 9.1% unemployment we now have.[16]

Indicators down[edit]

Oil, metal and grain (rice, wheat, corn) prices, after hitting record levels in the summer of 2008, plunged. Crude oil went from $145 a barrel to $42.[17]

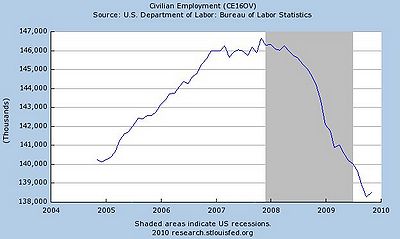

Retail sales in the U.S. and worldwide went into a major slump, with the slowest Christmas shopping season in decades. American manufacturing contracted in November 2008 at the steepest rate in 26 years. The U.S. lost some 4 million jobs in 2008,[18] the worst record since the end of World War II, Factory indexes in China, Britain, Europe, and Russia all fell to record lows.

In January 2009 the downturn worsened, as major companies and small firms announced round after round of layoffs and postponement of expansion plans. The financial sector worsened sharply in January, indicating the huge financial bailouts of 2008 were inadequate. The steep slide continued as unsold goods piled up. The GDP (gross domestic product) shrank at a -6.2% annual rate in the fourth quarter (last three months) of 2008, the sharpest contraction in 26 years.[19]

Meanwhile, at the urging of the Obama Administration, Congress passed a $789 billion stimulus package, combining new spending and tax cuts, in the hopes of Keynesian revival by mid-2009. Republicans were nearly unanimous against the proposal, as their smaller package was voted down. Canada, although not as hard hit as the U.S., prepared its own stimulus package.

- see also Economic stimulus package

Economists from all political viewpoints predicted the slide in GDP was likely to continue at an alarming pace well into summer 2009 as consumers curtailed spending and businesses reduced their capital investments and cut payrolls.

Income and Wealth[edit]

Wealth holding took a heavy blow. Incomes were down too, but not as dramatically.

Money[edit]

In terms of a monetary explanation, there is far more money around, due to the stimulus programs of the Federal Reserve, Treasury, and Congress. However the velocity (turnover rate) is down to the lowest rate since 1991. That is, people and business are saving and not spending. Banks are not lending. The nation's banks in March 2009 had reserves of $679 billion, up from only $45 billion in August 2008. Individuals are keeping their cash in the banks, or paying off credit cards and debts, and not buying new merchandise. The goal of federal stimulus spending is to get consumer spending going, to create jobs and keep businesses from slowing down.[20] If people do start spending again all the extra money will cause inflation, but in that case the Federal Reserve plans to reduce the money supply and, hopefully, restore normalcy and prosperity.[21]

US[edit]

The longest economic slumps since 1945 were the 16-month downturns that ended in March 1975 and November 1982. The Great Depression lasted 43 months, from August 1929 to March 1933.

"This may be referred to as the Great Recession," because of its length, said Norbert Ore, chairman of the Institute for Supply Management's factory survey. "It looked like we were headed for a shallow recession earlier in the year because of higher energy prices. With the meltdown in the financial sector, it has become something more serious."[22]

Housing[edit]

see Housing

The construction of new housing and commercial buildings has fallen off; many commercial buildings and shopping centers have high vacancy rates and may be hard pressed to pay their debts. Housing prices continue low—falling from an average of $255,000 to $180,000, as millions of empty houses are a drag on the market. Indeed, much of the housing activity in 2009 involved sales of foreclosed properties at distress prices.

Auto sector[edit]

The automobile industry was in desperate crisis, with General Motors and Chrysler, and numerous parts suppliers, on the verge of bankruptcy. Ford was in better shape as were the "transplants" like Toyota and Honda that have factories in the U.S. If GM were to shut down, many parts suppliers also would shut, forcing the end of most of GM's North American auto production. Autos would still be imported, though at higher than former prices. GM and Chrysler were given $17 billion TARP funds in December on condition they present a turnaround plan by Feb. 17, 2009. In its plan GM asked for access to an additional $16.6 billion in federal aid. GM also said it would close 14 U.S. plants, and cut 47,000 global hourly, salaried jobs, and revoke dealerships. Bankruptcy, GM claimed, could cost the federal government the loss of tax revenue and the loss of 1.3 million jobs across the US, as plants and dealers close down operation.[23]

In March 2009 GM reported that its auditors raised substantial doubts about its ability to continue as a going concern, citing recurring losses from operations, stockholders' deficit and an inability to generate enough cash to meet its obligations. GM received $13.4 billion in federal loans, and the company asked for a total of $30 billion from the government. Since 2006 it ran up $82 billion in losses, including $30.9 billion in 2008. Bankruptcy took place June 1, 2009. With federal help, GM ultimately escaped bankruptcy law (see Crony capitalism).

Unemployment[edit]

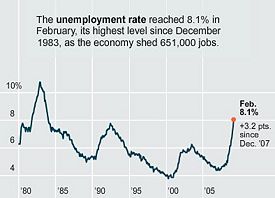

After the full implementation of the George W. Bush tax cuts, unemployment reached a low of 4.1% by October, 2006. After the Fannie Mae crash, the U.S. unemployment rate began trending upward, reaching 9.4% in May 2009. Analysts from the National Bureau of Economic research say that the current nationwide recession began in December 2007. Unemployment reached 6.5% by election day 2008, and in some parts of the country already reached 10% and higher.

Worldwide crisis[edit]

The crisis is worse in many other countries, which means they are dragging down the US economy and cannot be expected to be the engine to restore prosperity. Japan's economy, the world's second largest after the U.S., is deteriorating rapidly because of shrinking exports and weak domestic spending. Japan's GDP shrank at an annual rate of 12.7% in the fourth quarter of 2008, and the downward plunge shows no sign of reversal.

Japan's exports to the U.S. and other areas are down sharply, causing massive layoffs at companies like Nissan, Toyota, Panasonic and Sony. Capital spending on tools and factories has fallen as companies halted production lines and cut investment. Consumer spending has stalled as Japanese households reduced spending amid the large-scale layoffs. The government has promised a huge bailout package on the order of 50 trillion yen ($545 billion), but has been unable to get it passed in parliament.[24]

The economies in Europe and Russia are headed down, as are most third world countries. Eastern Europe is very hard hit, as is Ireland and Iceland. Economic growth in China continues at a much lower pace than usual, throwing tens of millions out of work there. The oil producing nations have seen their revenues plunge with the decline of oil prices.

U.S. Politics[edit]

The Obama Administration based its domestic policies on the assumption that its stimulus package passed in February, 2009, would turn around the economy. The stimulus money has been spent slowly and little impact was visible by 212. The Treasury assumed that the tax revenue would be there to fund permanent new spending programs in areas such as health care and greening the economy. It assumed that the rich will recover enough to pay new, increased taxes. Tax collections only returned to the 2007 alltime, pre-recession level in 2012. The deficit for fiscal 2009 alone was an astonishing $1.4 trillion, or 10% of GDP. To maintain the appearance of business as usual, keep Social Security and disability payments flowing and maintain defence spending, the federal government added $5 trillion to the national debt with borrowed money from abroad.

Obama delayed the recovery and kept unemployment high to permanently expand government spending, and reduce the size and increase the burdens of the private sector.[25] In the words of Rahm Emanuel, "you don't want a crisis to go to waste."

Economists[edit]

The vast majority of the world's economists and economic forecasters—whether liberal or conservative—were caught unaware by the housing bubble and the banking crisis. Nearly all misjudged the depth of the economic downturn; they were baffled by the inability of orthodox monetary policy administered by the Federal Reserve to prevent such a steep downturn. They could not agree on what, if anything, the government should do to halt it and return to recovery. By 2010, many were in general agreement with the Obama administration's Keynesian strategy. However, some say the government is not doing enough and is too cozy with the bankers, while others say that it is doing too much and warn about a lackadaisical recovery and dangerous long-term consequences. Added to that, implementation of Obamacare beginning in 2013 increases more burdens forecasted to retard job growth and lower tax collections. There is no professional consensus on the details of what should be done to end the downturn, speed recovery, or prevent a recurrence.

See also[edit]

- Recovery Summer

References[edit]

- ↑ The effectiveness of Stimulus: Job growth under President Obama's first term; Source: United States Department of Labor.

- ↑ U.S. Population growth during Obama's first four years in office. Source: U.S. Census Bureau.

- ↑ https://www.youtube.com/watch?v=zzTXaAXusiI

- ↑ https://www.youtube.com/watch?v=czcUmnsprQI

- ↑ http://papers.ssrn.com/sol3/papers.cfm?abstract_id=676905

- ↑ 3Q is the third quarter, or the months of July, August and September.

- ↑ One analyst in 2011 put the figure at $29 trillion. $29,000,000,000,000: A Detailed Look at the Fed’s Bailout by Funding Facility and Recipient, James Felkerson, University of Missouri–Kansas City, December 2011.

- ↑ David Smick, "Now What Do We Do?" November 10, 2009 online

- ↑ Three of the four engines of economic growth -- consumer spending, business investment and exports -- declined sharply. Consumer spending fell at an annualized rate of 4.3%; business investment in equipment and software sank at an astonishing annual rate of 29%; exports of goods and services plunged 24%. Washington Post Feb. 28, 2009

- ↑ An "annualized rate" is four times the actual quarterly rate. Jack Healy, "U.S. Economy in 2nd Straight Quarter of Steep Decline," New York Times April 29, 2009

- ↑ see S. Mitra Kalita, "Americans See 18% of Wealth Vanish," Wall Street Journal Mar. 13, 2009

- ↑ These supposed "temporary", "emergency" spending measures by 2013 became permanent features of the federal budget, as the $1 trillion deficit to cover its continuing costs and an accumulating national debt. The Eternal Stimulus, Wall Street Journal, February 11, 2010.

- ↑ Obama's Permanent Emergency:'Temporary' spending becomes permanent, Wall Street Journal, May 23, 2012.

- ↑ Jobless Claims Jump in New Sign Recovery Is Sputtering, Wall Street Journal, August 20, 2010.

- ↑ United States Department of Labor, Bureau of Labor Statistics. Data extracted on: July 19, 2010 (4:31:11 PM).

- ↑ Why the Stimulus Failed, Wall Street Journal, September 8, 2011.

- ↑ West Texas Intermediate Crude (WTI) 2007-01-01 to 2013-02-01

- ↑ Total Non-Farm Payrolls, U.S. Dept. of Labor.

- ↑ Jack Healy And Louis Uchitelle, "Steep Slide in U.S. Economy as Unsold Goods Pile Up," New York Times Jan. 30, 2009

- ↑ Inflation can do this -- force people to deplete cash and savings with a "spend now" mentality and damn the consequences of impoverishing themselves and heirs later. Keynes said, "In the long run we're all dead". Keynes is dead, but those alive in 2008 have to live with the consequences of decades of these economic theories elevated to public policy.

- ↑ Mark Gongloff, “Best Check on Inflation: Broken Banks,” ’’Wall Street Journal,’’ Mar. 20, 2009

- ↑ see Steve Matthews and Timothy R. Homan, "U.S. May Be in for ‘Great Recession,’" Bloomberg News Dec 2, 2008

- ↑ . For the GM plan see GM Plan of Feb 17, 2009

- ↑ Hiroku Tabuschi, "Japan’s Economy Plunges at Fastest Pace Since ’74," New York Times Feb. 15, 2009

- ↑ http://online.wsj.com/article/SB10001424052748703278604574624711732528426.html

| |||||||||||||||||

Categories: [Economic Preparedness] [Finance] [Business] [Economic History] [United States History] [Obama Administration]

↧ Download as ZWI file | Last modified: 02/18/2023 07:12:17 | 6 views

☰ Source: https://www.conservapedia.com/Recession_of_2008 | License: CC BY-SA 3.0

ZWI signed:

ZWI signed:

KSF

KSF